In today’s fast-paced digital world, managing finances online has become increasingly streamlined. Many are already familiar with digital wallets like Apple Wallet and Google Pay, simplifying transactions both online and in stores. Now, a new contender is entering the arena: Paze. You might have even received an email from your bank alerting you to its arrival and your card’s eligibility. But what exactly is Paze, and how does it differentiate itself from other digital payment methods?

Understanding Paze: Simplifying Online Checkouts

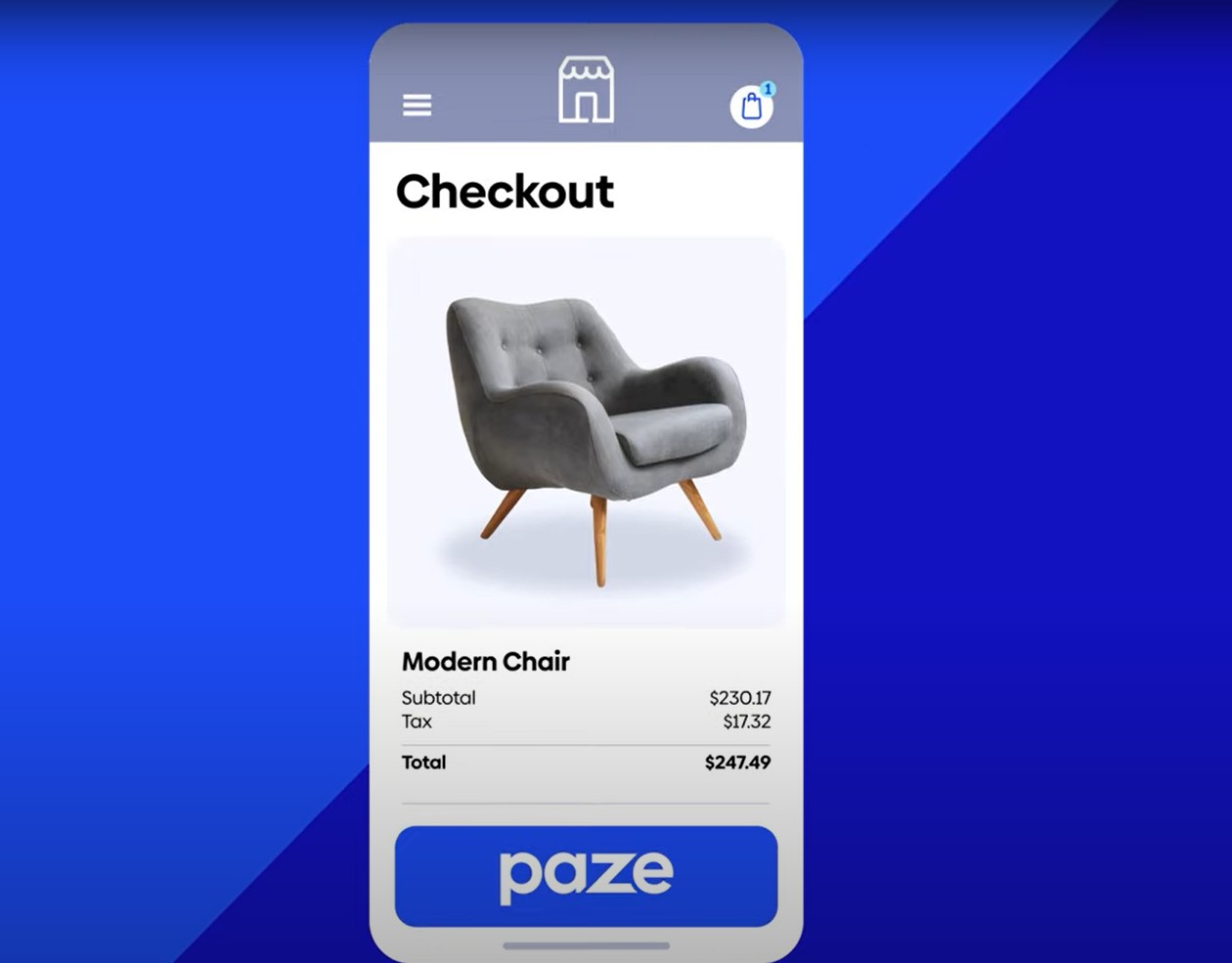

Paze is a digital payment option designed to make online checkout processes more convenient and secure. It works by consolidating your eligible credit and debit cards from participating banks and credit unions into a single, easily accessible digital wallet. This means you can say goodbye to juggling multiple cards or repeatedly entering your details online.

According to Melissa Lambarena, a financial expert at NerdWallet, Paze offers a user-friendly approach: “You don’t have to create a new user name or password, or download a new app to make online transactions.” This ease of use is a key advantage, eliminating the friction often associated with setting up and managing new payment platforms.

How Does Paze Work? A Streamlined Transaction Process

Using Paze for online purchases is designed to be straightforward. The process revolves around your email address, simplifying the checkout experience. Here’s a step-by-step look at how Paze transactions work:

- Checkout Online: When you’re ready to make a purchase on a website that supports Paze, select Paze as your payment method.

- Enter Your Email: Use the email address associated with your credit or debit card at checkout.

- Verification Code: A security code is immediately sent to your phone, adding an extra layer of protection.

- Verify and Pay: Enter the security code to verify the transaction. Once verified, your payment is securely processed.

This streamlined process not only speeds up online shopping but also enhances security. As Lambarena points out, “Paze suggests it’s safer because it doesn’t share your card number with merchants.” This reduced exposure of your sensitive card details is a significant benefit in today’s digital landscape.

Paze vs. Existing Digital Wallets: Key Differences

While Paze shares similarities with popular digital wallets like Apple Pay and Google Wallet, there are crucial distinctions. Notably, Paze is specifically designed for online transactions. Unlike Apple Pay and Google Wallet, which can be used for both online and in-store purchases, Paze focuses solely on simplifying online checkouts.

Another key difference lies in how Paze is set up. Instead of requiring you to manually enter your card details into a separate third-party app, Paze operates directly through participating banks. This integration means you likely already have access to Paze if your bank is participating, often without needing to sign up or download anything new. You may simply need to activate it through your bank.

However, Paze is still in its early stages. Currently, only a limited number of retailers, approximately 20, are offering Paze as a payment option. This limited availability means that while promising, Paze’s widespread utility is still developing.

Security and Privacy Considerations with Paze

While Paze emphasizes security by not sharing your card number with merchants, users still need to maintain robust email security. Lambarena advises, “you want to make sure you’re keeping your email secure and up to date, and whatever password you use for the emails is hard to crack down, and no one else has access to that email.” Ensuring your email account’s security is paramount when using Paze, as your email address is the key identifier for transactions.

Getting Started with Paze: Activation and Availability

One of the convenient aspects of Paze is that you generally don’t need to register separately. Instead, Paze is offered directly by participating banks and credit unions. If your bank is part of the Paze network, you will likely receive a notification, possibly via email, informing you about the new service and your eligibility.

Activation is typically straightforward, often requiring you to simply confirm your interest through your bank’s platform. If, for any reason, you prefer not to have your account connected to Paze, you should contact your bank directly to opt-out.

In conclusion, Paze presents itself as a streamlined and potentially more secure method for online payments. By integrating directly with banks and utilizing your email for transactions, it aims to simplify the online checkout experience. While still in its early rollout phase with limited retailer adoption, Paze is a digital wallet option worth watching as it expands and evolves in the digital payment landscape.