Meta Pay is the rebranded version of Facebook Pay, offering a secure and convenient way to shop, send money, and donate across Meta technologies. At WHAT.EDU.VN, we simplify complex topics to provide you with clear answers. Explore Meta Pay benefits, setup, and security measures, and discover digital wallet options and payment solutions.

1. What Exactly Is Meta Pay?

Meta Pay is Meta’s unified payment system, designed to facilitate secure transactions across its platforms like Facebook, Instagram, WhatsApp, and Messenger, as well as on other online platforms where the Meta Pay button is available. It allows users to store payment methods and make transactions without re-entering their details each time. Meta Pay aims to simplify and streamline the payment process within the Meta ecosystem and beyond.

Essentially, Meta Pay is a digital wallet service that securely stores your payment information and allows you to make purchases, send money, and donate to causes across Meta’s platforms. It simplifies online transactions and provides a secure way to manage your finances within the Meta environment.

1.1 How Does Meta Pay Differ From Traditional Payment Methods?

Meta Pay differs from traditional payment methods in several key ways:

- Integration: Meta Pay is deeply integrated into the Meta ecosystem, allowing for seamless transactions across Facebook, Instagram, WhatsApp, and Messenger. Traditional methods like credit cards or bank transfers don’t offer this level of integration.

- Convenience: Users can store their payment information once and use it across various platforms without re-entering details. This is more convenient than traditional methods that require you to enter your information each time you make a purchase.

- Security: Meta Pay offers enhanced security features such as encryption, anti-fraud monitoring, and the option to use a PIN or biometric authentication.

- Speed: Transactions via Meta Pay are generally faster than traditional online payments, making it a more efficient option.

- Accessibility: Meta Pay is designed to be accessible on mobile devices, making it easy to use on the go.

- Versatility: Beyond just making purchases, Meta Pay also allows you to send money to friends and family, donate to causes, and pay for services.

- Cross-Platform Use: Meta Pay can be used anywhere you see the Meta Pay button online, extending its utility beyond Meta’s own platforms.

- User Experience: Meta Pay provides a unified and consistent user experience across different platforms, reducing the learning curve for users.

1.2 Why Did Facebook Pay Transition to Meta Pay?

The transition from Facebook Pay to Meta Pay was part of a larger rebranding effort by Meta to align its products and services with its vision for the metaverse. Meta wants to create a cohesive digital environment, and Meta Pay is a key component of this vision.

- Rebranding: The primary reason for the transition was to align the payment system with Meta’s broader brand identity, emphasizing its commitment to the metaverse and future digital experiences.

- Unified Ecosystem: Meta Pay is intended to be a universal payment method across all Meta platforms, creating a seamless and integrated experience for users.

- Future-Proofing: The rebranding signals Meta’s intention to expand its payment services into new areas, including the metaverse, and to offer more innovative financial products.

- Clarity: The name “Meta Pay” more clearly communicates that the service is part of the Meta ecosystem, helping users understand its purpose and functionality.

- Expansion: The transition allows Meta to position its payment system as more than just a feature of Facebook, opening up opportunities for broader adoption and partnerships.

- Marketing: The rebranding provides an opportunity to market the payment system with a fresh identity, attracting new users and reinforcing the benefits of using Meta Pay.

- User Experience: Meta aims to provide a consistent payment experience across its platforms, and the rebranding helps to unify this experience under a single banner.

- Strategic Vision: Meta Pay is a strategic component of Meta’s overall plan to develop a comprehensive digital economy within its ecosystem, supporting creators, businesses, and users alike.

2. What Are the Key Features of Meta Pay?

Meta Pay comes with a host of features designed to make online transactions easier and more secure.

- Unified Payment Method: Use a single payment method across Facebook, Instagram, WhatsApp, Messenger, and other online platforms.

- Secure Storage: Encrypts and securely stores your payment card numbers.

- Anti-Fraud Monitoring: Monitors systems to detect unauthorized activity.

- Customer Care: Provides 24/7 customer support via email or chat where available.

- PIN or Biometric Authentication: Secure payments with a PIN, facial recognition, or fingerprint recognition.

- Payment History: Easily view your payment history, manage payment methods, and update settings in one place.

- Cross-Platform Compatibility: Use Meta Pay anywhere you see the Meta Pay button while shopping online.

- Peer-to-Peer Payments: Send money to friends and family directly through Messenger and other Meta platforms.

- Donations: Easily donate to causes you care about across Meta technologies.

These features make Meta Pay a comprehensive payment solution for both personal and business use, streamlining transactions and enhancing security.

2.1 How Secure Is Meta Pay?

Meta Pay employs robust security measures to protect your financial information.

- Encryption: Meta Pay encrypts your payment card numbers and securely stores them to prevent unauthorized access.

- Anti-Fraud Monitoring: The system continuously monitors for any unusual activity to detect and prevent fraud.

- Payment Protection: If unauthorized activity is detected, Meta Pay will notify you immediately and take steps to secure your account.

- PIN and Biometric Authentication: You can add an extra layer of security by creating a Meta Pay PIN or using your device’s fingerprint or facial recognition.

- Secure Data Centers: Meta Pay uses secure data centers to store your information, with multiple layers of physical and digital security.

- Compliance: Meta Pay complies with industry standards and regulations to ensure the highest level of security.

- Data Privacy: Meta Pay is committed to protecting your privacy and does not share your payment information with unauthorized parties.

- Regular Audits: Meta conducts regular security audits to identify and address any potential vulnerabilities.

- Two-Factor Authentication: Enable two-factor authentication for added security when accessing your Meta Pay account.

2.2 What Payment Methods Are Supported by Meta Pay?

Meta Pay supports a variety of payment methods to provide flexibility for users.

- Major Credit Cards: Visa, Mastercard, American Express, and Discover are widely accepted.

- Debit Cards: Most major debit cards are also supported.

- PayPal: You can link your PayPal account to Meta Pay for added convenience.

- Shop Pay: Users can also use Shop Pay if they have an account.

- Bank Accounts: In some regions, you may be able to link your bank account directly to Meta Pay.

- Gift Cards: Meta may occasionally offer the option to use gift cards for purchases through Meta Pay.

- Prepaid Cards: Some prepaid cards are supported, but acceptance may vary.

- Digital Wallets: Meta Pay can be used in conjunction with other digital wallets for added flexibility.

- Local Payment Methods: In certain countries, Meta Pay may support local payment methods popular in those regions.

3. How Do You Set Up Meta Pay?

Setting up Meta Pay is straightforward and can be done in a few simple steps.

- Go to Payment Settings: Navigate to the payment settings within Facebook, Instagram, or Messenger.

- Enter Payment Method: Add your preferred payment method, such as a credit card, debit card, PayPal, or Shop Pay account.

- Enter Account Information: Provide the necessary account details for your chosen payment method.

- Verify Information: Verify that all the information you entered is correct.

- Set Up Security: Create a Meta Pay PIN or enable biometric authentication for added security.

- Start Using Meta Pay: Use Meta Pay the next time you make a purchase, donate, or send money across Meta technologies or anywhere you see the Meta Pay button online.

3.1 What If I Already Use Facebook Pay?

If you were already using Facebook Pay, the transition to Meta Pay is seamless.

- No Action Required: All your existing Facebook Pay information, including account details, payment methods, and settings, will automatically transfer to Meta Pay.

- Automatic Update: The Facebook Pay button will be updated to the Meta Pay button.

- Same Functionality: The features and user experience you were familiar with in Facebook Pay will remain the same in Meta Pay.

- Continued Access: You can continue to access your payment history and manage your settings in the same way as before.

- Seamless Transition: The transition is designed to be smooth and hassle-free, ensuring uninterrupted access to your payment information.

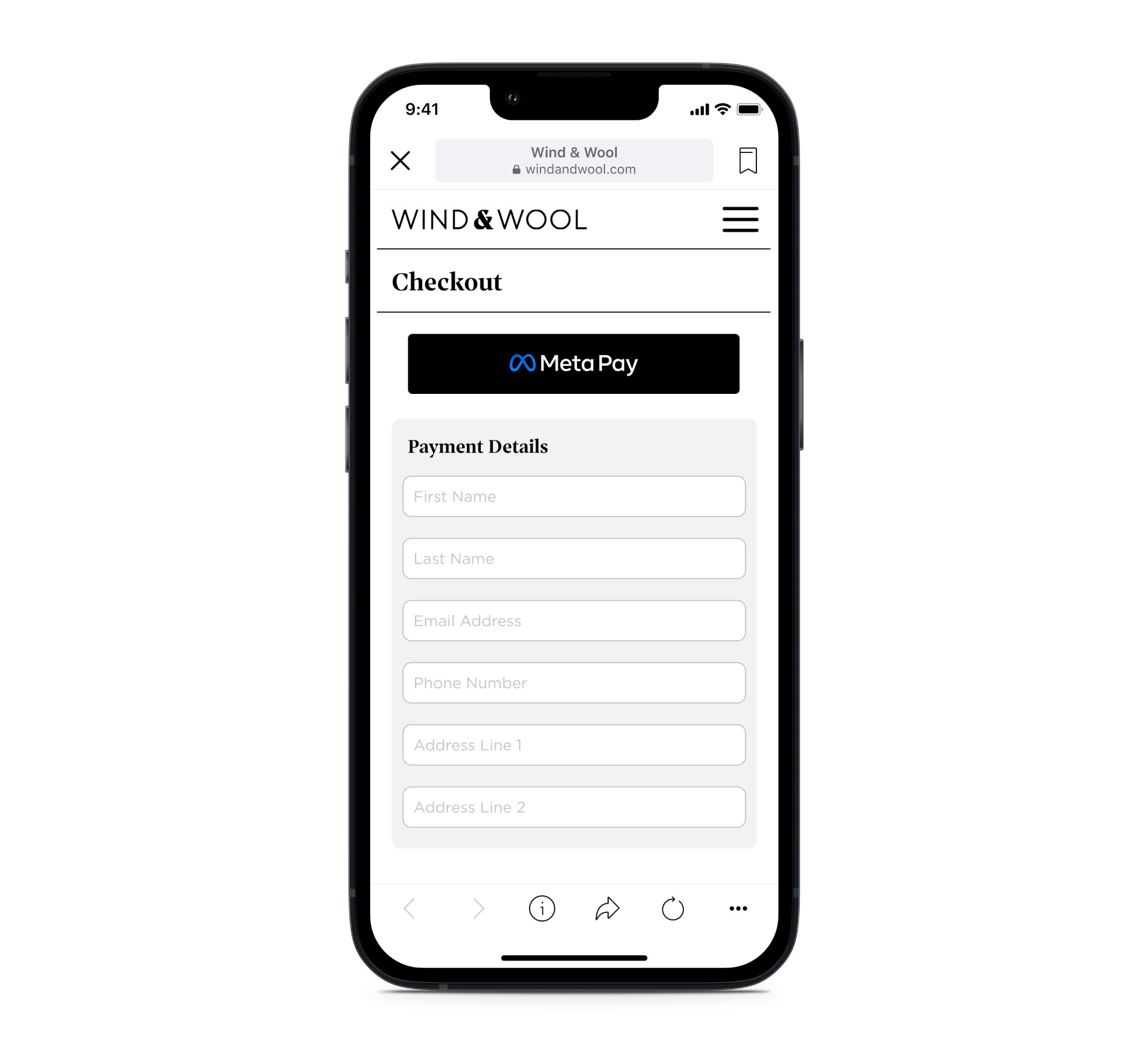

3.2 Can I Use Meta Pay for Online Shopping Outside of Meta Platforms?

Yes, Meta Pay can be used for online shopping outside of Meta platforms.

- Meta Pay Button: Look for the Meta Pay button on participating online stores.

- Secure Checkout: When you see the Meta Pay button, you can use your stored payment information to complete your purchase securely.

- Convenience: This eliminates the need to enter your payment details each time you shop on different websites.

- Wide Acceptance: Meta is working to expand the number of online stores that accept Meta Pay, making it a convenient option for a wide range of purchases.

- Unified Experience: Using Meta Pay outside of Meta platforms provides a consistent and secure payment experience.

4. What Are the Benefits of Using Meta Pay?

There are numerous benefits to using Meta Pay for your online transactions.

- Convenience: Store your payment information once and use it across multiple platforms and websites.

- Security: Benefit from encryption, anti-fraud monitoring, and optional PIN or biometric authentication.

- Speed: Make quick and easy payments without having to re-enter your details each time.

- Unified Experience: Enjoy a consistent payment experience across Facebook, Instagram, WhatsApp, Messenger, and other online stores.

- Versatility: Use Meta Pay for purchases, sending money to friends and family, and donating to causes.

- 24/7 Customer Care: Get assistance via email or chat whenever you need it.

- Easy Management: View your payment history, manage payment methods, and update your settings in one place.

- Accessibility: Access Meta Pay on your mobile device for easy use on the go.

- Integration: Seamlessly integrated into the Meta ecosystem for a streamlined experience.

4.1 How Does Meta Pay Simplify Online Transactions?

Meta Pay simplifies online transactions in several ways:

- One-Time Setup: You only need to enter your payment information once.

- Auto-Fill: Meta Pay automatically fills in your payment details at checkout.

- No More Manual Entry: No need to manually enter your credit card or bank details each time you make a purchase.

- Quick Payments: Transactions are processed quickly, saving you time and effort.

- Reduced Friction: Meta Pay reduces the friction associated with online payments, making it easier to complete your purchases.

- Consistent Experience: Provides a consistent payment experience across different platforms and websites.

- Mobile-Friendly: Designed to work seamlessly on mobile devices.

- Secure Payments: Offers enhanced security features to protect your financial information.

- Streamlined Process: The overall payment process is streamlined, making it more efficient and user-friendly.

4.2 Can Meta Pay Be Used for International Transactions?

Meta Pay supports international transactions, making it convenient for users to make purchases and send money across borders.

- Global Availability: Meta Pay is available in nearly 200 countries worldwide.

- Multiple Currencies: Supports payments in 55 different currencies.

- Cross-Border Payments: Allows you to send money to friends and family in other countries.

- International Shopping: Use Meta Pay to make purchases from online stores in different countries.

- Currency Conversion: Automatically converts currencies for international transactions.

- Localized Experience: Provides a localized payment experience based on your location.

- Secure Transactions: Ensures secure transactions for international payments.

- Convenient Transfers: Simplifies the process of sending and receiving money internationally.

- Reduced Fees: May offer lower fees compared to traditional international money transfer services.

5. What Is the Future of Meta Pay?

Meta envisions Meta Pay playing a crucial role in the development of the metaverse and the broader digital economy.

- Metaverse Integration: Meta Pay will be deeply integrated into the metaverse, allowing users to make purchases, participate in virtual economies, and interact with digital assets.

- Financial Products: Meta plans to develop new financial products that connect people to the digital economy through Meta Pay.

- Creator Economy: Meta Pay will support creators by providing them with tools to monetize their content and engage with their fans.

- Business Growth: Meta Pay will help businesses grow by providing them with a seamless and secure payment solution for online transactions.

- Digital Economy: Meta Pay is a key component of Meta’s vision for a thriving digital economy, supporting commerce, innovation, and economic opportunity.

- Expansion: Meta plans to expand the reach of Meta Pay to more countries and platforms.

- Innovation: Meta will continue to innovate and add new features to Meta Pay to improve the user experience and enhance its capabilities.

- Partnerships: Meta is partnering with other companies to integrate Meta Pay into their services and expand its ecosystem.

- Mobile Payments: Meta will continue to focus on mobile payments, making it easy for users to make transactions on the go.

5.1 How Does Meta Pay Fit Into the Metaverse Vision?

Meta Pay is an integral part of Meta’s metaverse vision, serving as the primary payment method for virtual transactions.

- Virtual Commerce: Meta Pay will facilitate commerce within the metaverse, allowing users to buy and sell virtual goods and services.

- Digital Assets: Meta Pay will support the purchase and management of digital assets such as NFTs and cryptocurrencies.

- Virtual Experiences: Meta Pay will enable users to pay for virtual experiences such as concerts, events, and games.

- Creator Monetization: Creators will use Meta Pay to monetize their content and interact with their fans in the metaverse.

- Seamless Transactions: Meta Pay will provide a seamless and secure payment experience within the metaverse.

- Economic Opportunities: The metaverse will offer new economic opportunities, and Meta Pay will be essential for facilitating these transactions.

- Digital Identity: Meta Pay will be linked to users’ digital identities in the metaverse, providing a secure and convenient way to manage their finances.

- Interoperability: Meta is working to ensure that Meta Pay is interoperable with other payment systems in the metaverse.

- Virtual Wallets: Meta Pay will function as a virtual wallet, allowing users to store and manage their digital assets in the metaverse.

5.2 What New Features Can We Expect From Meta Pay in the Future?

Meta is continuously working to improve Meta Pay and add new features to enhance the user experience.

- Cryptocurrency Support: Expect Meta Pay to support cryptocurrency payments in the future, allowing users to buy and sell digital currencies.

- NFT Integration: Meta Pay will likely integrate with NFT marketplaces, allowing users to buy, sell, and manage NFTs.

- Loyalty Programs: Meta may introduce loyalty programs that reward users for using Meta Pay.

- Expanded Payment Options: Meta may add support for additional payment methods such as digital wallets and local payment systems.

- Improved Security: Meta will continue to enhance the security of Meta Pay to protect users from fraud and unauthorized access.

- Personalized Recommendations: Meta Pay may offer personalized recommendations based on users’ purchase history and preferences.

- Augmented Reality: Meta may integrate Meta Pay with augmented reality experiences, allowing users to make purchases in the real world using their mobile devices.

- Virtual Reality: Meta Pay will be essential for facilitating transactions in virtual reality environments.

- Cross-Platform Compatibility: Meta will work to ensure that Meta Pay is compatible with a wide range of devices and platforms.

6. Meta Pay vs. Other Digital Payment Systems

Meta Pay competes with other digital payment systems like PayPal, Apple Pay, Google Pay, and Square. Each has its own strengths and weaknesses.

- PayPal: Widely accepted but not as deeply integrated into a specific ecosystem.

- Apple Pay: Seamless for Apple users but limited to Apple devices.

- Google Pay: Versatile but may not be as widely adopted as other systems.

- Square: Primarily for business transactions, though it also offers personal payment features.

6.1 How Does Meta Pay Compare to PayPal?

Meta Pay and PayPal are both popular digital payment systems, but they have some key differences.

| Feature | Meta Pay | PayPal |

|---|---|---|

| Ecosystem | Deeply integrated into Meta platforms | Independent, widely accepted online |

| Integration | Seamless within Facebook, Instagram, etc. | Requires linking to bank or card |

| Security | Encryption, anti-fraud monitoring | Encryption, dispute resolution |

| Fees | Varies | Varies, especially for business transactions |

| User Base | Primarily Meta users | Global user base |

| Primary Use Cases | Social commerce, personal payments | Online shopping, business transactions |

| Metaverse Focus | Strong focus on metaverse transactions | Limited metaverse focus |

| Ease of Use | Simple setup and integration | User-friendly interface |

| Mobile Experience | Optimized for mobile use | Optimized for mobile use |

| Customer Support | 24/7 customer care where available | Customer support via phone, email, chat |

6.2 What Advantages Does Meta Pay Have Over Apple Pay and Google Pay?

Meta Pay has several advantages over Apple Pay and Google Pay, particularly within the Meta ecosystem.

- Ecosystem Integration: Meta Pay is deeply integrated into Facebook, Instagram, WhatsApp, and Messenger, providing a seamless experience for users within these platforms.

- Cross-Platform Use: Meta Pay can be used on both iOS and Android devices, whereas Apple Pay is limited to Apple devices.

- Social Commerce: Meta Pay is well-suited for social commerce, allowing users to make purchases directly within social media apps.

- Metaverse Focus: Meta Pay is positioned to be a key payment method in the metaverse, giving it an advantage as virtual worlds become more prevalent.

- User Base: Meta has a massive user base across its platforms, giving Meta Pay a large potential audience.

- Convenience: Meta Pay simplifies the payment process by allowing users to store their payment information once and use it across multiple platforms.

- Versatility: Meta Pay can be used for a variety of purposes, including purchases, sending money, and donating to causes.

- Customization: Meta Pay can be customized to meet the needs of different users and businesses.

- Innovation: Meta is committed to innovating and adding new features to Meta Pay to enhance its capabilities.

7. Security Best Practices for Meta Pay Users

To ensure the security of your Meta Pay account, follow these best practices:

- Use a Strong PIN: Create a strong, unique PIN for your Meta Pay account.

- Enable Biometric Authentication: Use fingerprint or facial recognition for added security.

- Monitor Your Account: Regularly check your payment history for any unauthorized transactions.

- Be Wary of Phishing: Be cautious of phishing emails or messages asking for your Meta Pay login information.

- Keep Your Device Secure: Use a strong password or PIN to protect your mobile device.

- Update Your Software: Keep your device’s operating system and apps up to date to protect against security vulnerabilities.

- Use a Secure Network: Avoid using public Wi-Fi networks for sensitive transactions.

- Report Suspicious Activity: If you notice any suspicious activity on your Meta Pay account, report it immediately.

- Review Privacy Settings: Regularly review and update your privacy settings to control who can see your payment information.

7.1 What to Do If You Suspect Fraudulent Activity on Your Meta Pay Account

If you suspect fraudulent activity on your Meta Pay account, take these steps immediately:

- Change Your Password: Change your Meta Pay password immediately to prevent further unauthorized access.

- Report the Incident: Report the fraudulent activity to Meta Pay customer support as soon as possible.

- Contact Your Bank: Contact your bank or credit card company to report the fraudulent charges and request a chargeback.

- Monitor Your Accounts: Monitor your bank and credit card accounts for any additional unauthorized transactions.

- File a Police Report: If the fraudulent activity is significant, consider filing a police report.

- Review Security Settings: Review your security settings on Meta Pay and enable two-factor authentication if it is not already enabled.

- Update Payment Information: If your payment information has been compromised, update it with new card details.

- Be Alert for Phishing: Be extra cautious of phishing attempts that may try to obtain your login information.

- Secure Your Devices: Ensure that your devices are secure and free from malware.

7.2 How to Protect Your Personal Information While Using Meta Pay

Protecting your personal information while using Meta Pay is crucial. Here are some tips:

- Use Strong Passwords: Use strong, unique passwords for your Meta Pay account and other online accounts.

- Enable Two-Factor Authentication: Enable two-factor authentication for added security.

- Be Cautious of Phishing: Be wary of phishing emails or messages that may try to trick you into providing your personal information.

- Review Privacy Settings: Regularly review and update your privacy settings on Meta Pay and other social media platforms.

- Limit Sharing: Limit the amount of personal information you share online.

- Use a Secure Network: Avoid using public Wi-Fi networks for sensitive transactions.

- Keep Software Updated: Keep your device’s operating system and apps up to date.

- Monitor Your Accounts: Regularly monitor your accounts for any unauthorized activity.

- Use a VPN: Consider using a virtual private network (VPN) to encrypt your internet traffic and protect your privacy.

8. Frequently Asked Questions About Meta Pay

Here are some frequently asked questions about Meta Pay to provide you with more clarity.

8.1 Is Meta Pay Free to Use?

Yes, Meta Pay is generally free to use for personal transactions. However, there may be fees associated with certain business transactions or currency conversions. Always review the terms and conditions for any potential fees.

8.2 Can I Use Meta Pay to Send Money to Friends and Family?

Yes, Meta Pay allows you to send money to friends and family directly through Messenger and other Meta platforms. This feature makes it easy to split bills, send gifts, or provide financial support.

8.3 What Happens If My Meta Pay Account Is Hacked?

If your Meta Pay account is hacked, take immediate action. Change your password, report the incident to Meta Pay customer support, and contact your bank or credit card company. Monitor your accounts for any unauthorized transactions and file a police report if necessary.

8.4 How Do I Cancel a Payment Made Through Meta Pay?

Canceling a payment made through Meta Pay depends on the situation. If the payment is still pending, you may be able to cancel it. If the payment has already been processed, you may need to contact the recipient to request a refund.

8.5 What Should I Do If I Have Trouble Setting Up Meta Pay?

If you have trouble setting up Meta Pay, refer to the Meta Pay help center for detailed instructions and troubleshooting tips. You can also contact Meta Pay customer support for assistance.

8.6 Does Meta Pay Offer Purchase Protection?

Meta Pay may offer purchase protection for certain transactions. Review the terms and conditions to see if your purchase is covered and what steps you need to take to file a claim.

8.7 Can I Use Meta Pay on Multiple Devices?

Yes, you can use Meta Pay on multiple devices. Simply log in to your Meta Pay account on each device and follow the setup instructions.

8.8 How Does Meta Pay Handle Refunds?

Refunds through Meta Pay are typically processed back to your original payment method. The timeframe for receiving a refund may vary depending on the merchant and your bank.

8.9 Is Meta Pay Available in My Country?

Meta Pay is available in nearly 200 countries worldwide. To check if Meta Pay is available in your country, visit the Meta Pay website or app.

8.10 How Do I Contact Meta Pay Customer Support?

You can contact Meta Pay customer support via email or chat where available. Refer to the Meta Pay help center for contact information and hours of operation.

9. Meta Pay: A Step Towards the Future of Digital Payments

Meta Pay is more than just a payment system; it’s a step towards a future where digital transactions are seamless, secure, and integrated into our daily lives. As Meta continues to develop the metaverse and expand its digital economy, Meta Pay will play a crucial role in connecting people and businesses.

Do you have more questions or need further clarification? Don’t hesitate to ask the experts at WHAT.EDU.VN for free answers. We’re here to help you navigate the complexities of digital payments and technology. Contact us at 888 Question City Plaza, Seattle, WA 98101, United States, Whatsapp: +1 (206) 555-7890, or visit our website at WHAT.EDU.VN for more information. Your questions are welcome, and our answers are always free.

If you’re still struggling to grasp Meta Pay or have other burning questions, why not ask them on what.edu.vn? Get fast, free answers from experts and a supportive community ready to help you understand the ever-evolving world of digital payments and beyond.