Generational labels like Gen X, Millennials, and Baby Boomers are thrown around constantly, but understanding exactly who falls into each group can be surprisingly confusing. If you’ve ever wondered, “What age is Gen X, anyway?” you’re definitely not alone. Sorting through this “alphabet soup” of generations can feel overwhelming, especially when you realize the significant economic power these cohorts wield.

Millennials, for example, represented the highest-spending generation in 2020, with expenditures projected to reach a staggering $1.4 trillion. Despite facing economic headwinds early in their careers, Millennials are poised to inherit over $68 trillion from their Baby Boomer and early Gen X parents by 2030, potentially making them the wealthiest generation in U.S. history. Generation Z isn’t far behind, projected to command $33 trillion in income by 2030, surpassing Millennials in spending power shortly after. And then there’s Generation Alpha, the youngest cohort, rapidly growing in numbers globally.

The bottom line is this: younger generations are critical to the future of any business, especially financial institutions. To effectively connect with these groups and capture their attention (and their dollars), understanding who they are is paramount.

Generations are Defined by Birth Year, Not Current Age

One common point of confusion is thinking of generations in terms of current age. Generational cohorts are defined by birth year ranges, not by a specific age bracket at any given moment. The reason is simple: generations age collectively. Thinking of Millennials as just “college kids” is outdated and inaccurate. Millennials have moved far beyond college age; that life stage is now dominated by Gen Z.

Consider someone from Generation X who turned 18 in 1998. They are now well into their 40s. Their priorities, concerns, and the marketing messages they respond to are vastly different than when they were teenagers. Regardless of the current year, individuals remain part of the generation they were born into.

Here’s a breakdown of generational cohorts by birth year and their approximate current age:

- Baby Boomers: Born 1946-1964, currently 57-75 years old (approximately 71.6 million in the U.S.)

- Generation X: Born 1965-1979/80, currently 41-56 years old (approximately 65.2 million people in the U.S.)

- Millennials (Gen Y): Born 1981-1994/6, currently 25-40 years old (approximately 72.1 million in the U.S.)

- Gen Y.1: 25-29 years old (around 31 million people in the U.S.)

- Gen Y.2: 30-40 years old (around 42 million people in the U.S.)

- Generation Z: Born 1997-2012, currently 9-24 years old (nearly 68 million in the U.S.)

- Generation Alpha: Born 2012-2025 (and potentially beyond), currently 0-9 years old (approximately 48 million people in the U.S.)

The term “Millennial” is broadly used to encompass both segments of Gen Y (Y.1 and Y.2). The term “Zillennials” sometimes describes those born at the cusp of the Millennial and Gen Z generations, roughly between 1994 and 2000. Initially, “Generation Z” was a placeholder name, but like “Gen Y” evolved into “Millennials,” Gen Z and Gen Alpha may also adopt new names as they mature. While “Gen Alpha” is convenient now, it might not be the final label.

The Alphabet Soup of Generation Names: Why Letters?

The trend of naming generations after letters began with Generation X, those born between 1965 and 1980. The preceding generation, Baby Boomers (1946-1964), got their name from the post-World War II “baby boom” in America, a period of prosperity and increased birth rates.

However, the generation following the Boomers lacked such a clear cultural identifier. This lack of a defining characteristic is, ironically, the anecdotal origin of the term “Gen X”. It was meant to represent the unknown and undetermined nature of this generation. Sources vary, but the popularization of “Gen X” is attributed to sociologists, novelists, or even the musician Billy Idol.

Following “Gen X,” the next logical step was “Gen Y” (1981-1996). The term “Millennials,” now synonymous with Gen Y, is largely credited to Neil Howe and William Strauss, who coined it in 1989 as the upcoming millennium gained cultural prominence.

Generation Z followed, referring to those born from the late 1990s onward. Various alternative names emerged, including Gen Tech, post-Millennials, iGeneration, Gen Y-Fi, and Zoomers. Generation Alpha, named after the first letter of the Greek alphabet, may simply signify the start of a new cycle of alphabetical naming conventions.

Understanding Gen Y Subgroups: Why Splitting Generations Matters

Javelin Research highlighted that Millennials, despite being born within a relatively close timeframe, are not all in the same life stage. Older Millennials are establishing families and careers, while younger Millennials are navigating early adulthood and career beginnings. These different life phases translate into different priorities and consumer behaviors, making it useful for marketers to segment this generation further into Gen Y.1 and Gen Y.2.

The financial lives of these subgroups also differ significantly. Younger Gen Y.1 is just beginning to exert their buying power, whereas older Gen Y.2 has a more established financial history and may be dealing with mortgages and raising families. These distinct priorities and needs necessitate tailored marketing approaches.

This principle of segmentation applies to younger generations in general. As people age, they tend to converge in terms of life experiences and challenges. However, younger generations experience more dramatic shifts between life stages. Consider the vast differences between elementary school and high school students, even though they may belong to the same generation.

Marketing to entire generations as monolithic groups is less effective than segmenting strategies and messaging to resonate with specific life stages and priorities within those generations.

Why Generational Cohort Names Are Important for Businesses

Generational labels serve as convenient shorthand for roughly two decades’ worth of shared attitudes, motivations, and historical experiences. While individuals rarely self-identify solely by their generational label, these terms are valuable tools for marketers and have permeated popular culture.

It’s crucial to remember that generational age ranges are not rigid scientific boundaries; they are approximations that evolve over time. The purpose of using generational cohorts is to better understand consumers and tailor marketing messages to their current phase of life. Regardless of the specific terminology used, the goal is to connect with consumers in a way that is relevant to their experiences and needs.

What Makes Each Generation Distinct?

Keep in mind that the exact birth years defining each generation are debated, especially for generations after the Baby Boomers. There are no universally definitive cutoffs. However, the provided ranges offer a useful framework for understanding generational distinctions.

Another key factor differentiating generations is technology adoption. Younger generations are typically early adopters of new technologies, which then gradually spread to older generations. For instance, while smartphone penetration is high across all age groups, Gen Z, the youngest generation, are the heaviest users.

Baby Boomer Generation: Key Traits

- Boomer Birth Years: 1946 to 1964

- Current Age: 57 to 75

- Generation Size: 71.6 million

- Media Consumption: Baby Boomers are heavy consumers of traditional media like TV, radio, magazines, and newspapers. However, a significant 90% are also on Facebook, using technology to connect with family and friends.

- Banking Habits: Boomers often prefer in-person banking transactions and still use cash frequently, especially for smaller purchases.

- Shaping Events: Post-WWII optimism, the Cold War, and the hippie movement.

- Financial Horizon: Boomers face concerns about funding retirement, especially with rising student loan debt (often incurred to support their children), declining pensions, and social security uncertainties.

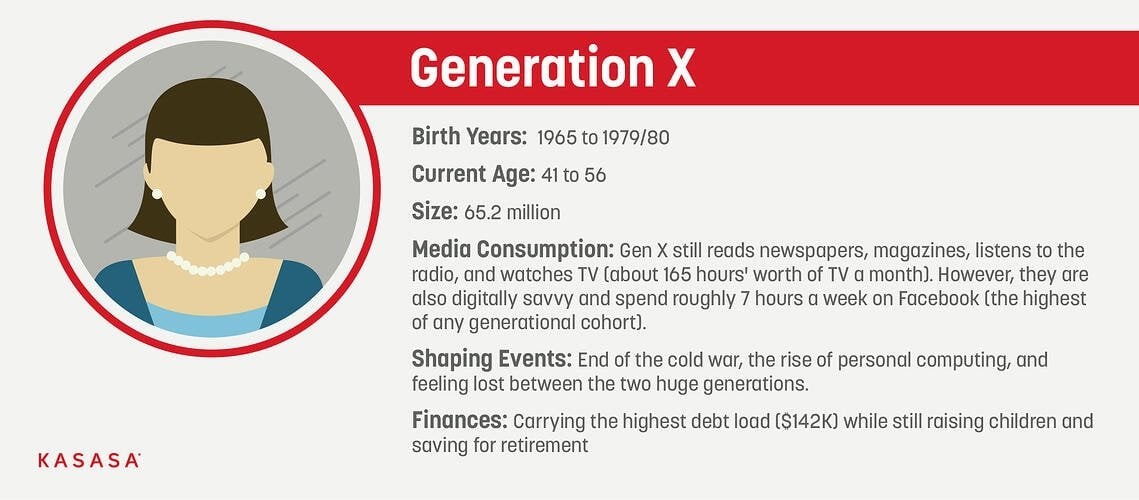

Generation X: Key Traits

- Gen X Birth Years: 1965 to 1979/80

- Current Age: 41 to 56

- Nicknames: “Latchkey Generation,” “MTV Generation”

- Generation Size: 65.2 million

- Media Consumption: Gen X consumes traditional media (newspapers, magazines, radio, TV – about 165 hours/month) but are also digitally comfortable, spending around 7 hours weekly on Facebook (more than any other generation).

- Banking Habits: Gen X is digitally savvy for research and online financial management but often prefers in-person transactions. They value personal banking relationships and brand loyalty.

- Shaping Events: End of the Cold War, the rise of personal computing, feeling overshadowed by larger generations.

- Financial Horizon: Gen X faces the challenge of raising families, paying off student debt, and caring for aging parents, straining their finances. They carry significant debt (average $142,000, mostly mortgage) and seek to reduce debt while building stable savings.

Millennials (Gen Y): Key Traits

- Millennial Birth Years: 1981 to 1994/6

- Current Age: 25 to 40

- Nicknames: Gen Y, Gen Me, Gen We, Echo Boomers

- Generation Size: 72.1 million

- Media Consumption: While 95% still watch TV, streaming services like Netflix are favored over traditional cable. Cord-cutting is common. They are highly comfortable with mobile devices but still use computers for some purchases (32%). Multiple social media accounts are typical.

- Banking Habits: Millennials show less brand loyalty, prioritizing products and features and demanding efficient, high-quality service. They trust brands with strong track records (like Apple and Google) and prefer digital tools for debt management. Banking is seen as transactional rather than relational.

- Shaping Events: The Great Recession, the internet and social media explosion, and 9/11.

- Financial Horizon: Millennials are a major workforce segment, but burdened by student debt, delaying major life purchases like homes and weddings. Financial instability leads to a preference for access over ownership and on-demand services. They seek financial partners to guide them towards major purchases.

Gen Z: Key Traits

- Gen Z Birth Years: 1997 to 2012

- Current Age: 9 to 24

- Nicknames: iGeneration, Post-Millennials, Homeland Generation

- Generation Size: 68 million

- Media Consumption: Gen Z received their first mobile phone around age 10. They are digital natives, growing up in a hyper-connected world where smartphones are the primary communication tool. They spend an average of 3 hours daily on mobile devices.

- Banking Habits: Having witnessed Millennial financial struggles, Gen Z is more fiscally conservative, prioritizing debt avoidance. Debit cards and mobile banking are preferred.

- Shaping Events: Smartphones, social media, constant war, and observing the financial difficulties of their Gen X parents.

- Financial Horizon: Gen Z is actively learning about personal finance and opening savings accounts earlier than previous generations, showing a strong interest in financial education.

Generation Alpha: Key Traits

- Generation Alpha Birth Years: 2012 to 2025+

- Current Age: 0 to 9

- Nicknames: None widely adopted yet.

- Generation Size: 48 million and growing

- Media Consumption: Alphas are raised in tech-saturated homes with smart devices everywhere. Many experienced virtual schooling due to the pandemic and gravitate towards online learning platforms. Many have had a digital presence since infancy through their Millennial parents’ social media.

- Banking Habits: While some older Alphas may have accounts like Greenlight, their banking habits are still developing. As true digital natives, they will expect seamless, personalized digital experiences. Current trends suggest they will be highly educated and wealthy.

- Shaping Events: Global pandemic, social justice movements, Trump-era politics, and Brexit.

- Financial Horizon: As digital natives, Alphas will likely be even more detached from physical cash, viewing money as digital numbers and transacting primarily through apps and e-commerce.

Technology Use Across Generations

Younger generations generally adopt and use technology more readily than older generations, and this pattern continues today. While Baby Boomers may lag behind Gen X and Millennials in native technology use, their adoption rate is accelerating. Boomer smartphone ownership, for example, has significantly increased from 25% in 2011 to 68% in 2019.

Are Generations the Best Way to Understand Consumers?

Understanding generational trends provides valuable insights into shared attitudes and behaviors shaped by common experiences during similar life stages. Generational data is also often incorporated into marketing tools and audience segmentation.

However, generations are not the complete picture, and their behaviors are not always easily defined. Generations are dynamic and evolve over time. Relying solely on age ranges has limitations.

Do Generations Bank Differently? Absolutely.

Several factors contribute to generational differences in banking:

- Wealth Accumulation: Each generation has spent different lengths of time in the workforce, resulting in varying levels of wealth. Baby Boomers hold the highest average and median net worth, followed by Gen X, then Millennials. Gen Z’s net worth is still emerging.

- Life Stage Priorities: Generations are in different life stages, focusing on different financial goals like retirement (Boomers), children’s education (Gen X, older Millennials), or first car purchases (younger Millennials, Gen Z).

- Technological Context: Each generation grew up in different technological landscapes, shaping their preferences for managing finances and interacting with financial institutions.

- Financial Climate: Generations have experienced different economic conditions, influencing their financial attitudes and trust in institutions. The COVID-19 pandemic, however, has acted as a “great equalizer,” forcing all generations to adapt to new ways of banking and living.

Generational Banking Differences in the Marketplace

Ease of Use vs. Personal Service:

Younger generations, particularly Millennials and Gen Z, are increasingly comfortable with and even prefer digital tools like chatbots for banking inquiries. Studies show a significant portion of Gen Z and Millennials have used banking chatbots, and over half of those users found the experience better than interacting with a human. However, for complex banking tasks, human assistance is still valued, even by younger generations.

Security and Priorities:

Security remains the top concern when choosing a bank across all generations. Reputation is also a high priority for Gen Z and Millennials. Branch locations are still important for Gen Z and Boomers, ranking similarly to digital and app services. Gen X prioritizes in-person support over digital services, while Baby Boomers value local banking.

Technology is Expanding Beyond Younger Generations:

While younger generations were early adopters of digital banking, the COVID-19 pandemic has spurred wider digital adoption across older generations. Surveys show a significant increase in online and mobile banking usage among seniors (55+), indicating a broader shift towards digital channels across all age groups.

The trend is clear: older generations are increasingly behaving more like younger, digitally-native generations in their banking preferences. To succeed in the evolving market, financial institutions must cater to the digital expectations of younger generations while also recognizing the increasing digital engagement of older demographics. Extending excellent service beyond physical branches and into the digital realm is now essential.