Airbnb has become a household name for travelers and those interested in the burgeoning short-term rental market. You’ve likely encountered the term while planning a vacation or exploring real estate investment opportunities. But what exactly does “Airbnb” mean? Many people find themselves puzzled by the name, and understandably so.

The current understanding of Airbnb and its original meaning have diverged over time. This article will delve into the question, “What Does Airbnb Stand For?” by exploring the origins of the term and its evolution into the name of a leading tech giant in the real estate and travel industry.

Decoding Airbnb: Air Bed and Breakfast Explained

To directly answer the question: what does Airbnb stand for?

Simply put, Airbnb is an abbreviation for Air Bed and Breakfast.

To truly grasp the Airbnb meaning, it’s essential to understand the story of how this term came into existence.

The term “Airbnb” was coined in 2007 by Joe Gebbia and Brian Chesky, the entrepreneurial minds behind the Airbnb company. Back then, living in a San Francisco apartment, they conceived the idea of renting out space in their living room to designers attending the International Design Conference in the city.

Their initial offering was quite basic: a lounge room furnished with a few air mattresses for sleeping and breakfast provided in the morning.

This humble beginning is precisely how they arrived at the name Airbnb – Air Bed and Breakfast.

So, the next time someone asks, “What does Airbnb stand for?”, you can share this interesting origin story. And the story of Airbnb’s growth from this simple concept is even more compelling.

The Genesis of Airbnb: From Airbeds to a Global Platform

This part of the narrative marks the transformation of the term Airbnb from a description to the name of a groundbreaking company.

After successfully renting out their room for $80 a night, Gebbia and Chesky took their idea further by creating the first version of their website. Initially named AirBedAndBreakfast.com, the website served as a platform to advertise their rental space, manage reservations, and process payments.

Word quickly spread, and the website gained traction as other homeowners recognized its potential for advertising their own “Airbnb-style” rentals.

In 2009, the fledgling startup secured $7 million in venture capital, and the website name was streamlined to Airbnb.com.

Over the ensuing years, Airbnb experienced explosive growth, expanding its reach to countries worldwide and establishing international headquarters in cities like Sydney and Dublin.

So, what does Airbnb stand for in the modern context?

Today, if you ask someone “what is Airbnb?”, many might not even be aware of the literal meaning behind the name. For most, Airbnb is simply recognized as the name of a massive online platform, valued at approximately $31 billion, boasting around 6 million listings for short-term rentals across the globe.

The platform conceived by Joe and Brian has become a primary resource for travelers seeking short-term accommodations during their trips.

However, the Airbnb platform of today offers far more than just an “air bed and breakfast.” The platform evolved to allow any property owner to list their space for rent, regardless of the property type.

This expansion meant that while Airbnb originated with the concept of an airbed, it now encompasses listings ranging from single rooms to entire houses and even unique properties like castles and boats, all available for short-term rentals.

Crucially, Airbnb doesn’t own any of the properties listed on its platform. So, how does Airbnb generate revenue?

To understand that, let’s examine the operational mechanics of Airbnb.

How Airbnb Operates: Connecting Hosts and Guests

Now that we’ve explored what Airbnb stands for and the company’s origins, let’s delve into how Airbnb functions as a business.

As previously mentioned, Airbnb operates as a marketplace and does not own the properties featured on its website. Instead, Airbnb provides a platform for homeowners to list their properties and connects them with potential guests. Airbnb’s revenue model is based on charging a service fee, a percentage of the booking value, whenever a guest reserves a property and pays the host.

With millions of properties listed worldwide and hundreds of millions of bookings facilitated, Airbnb generates substantial revenue through these service fees.

Beyond just listing properties, Airbnb offers a range of services to both hosts and guests to streamline the short-term rental process and facilitate successful matches between travelers and suitable accommodations.

One of Airbnb’s key features is its review system. Guests can rate and review the properties where they stay, and these reviews are publicly available on the platform. These reviews significantly influence a property’s reputation and performance.

Positive reviews can be a major asset for hosts, encouraging more bookings as guests seek out highly-rated properties. Conversely, the review system discourages hosts from misrepresenting their properties or providing subpar experiences, as negative reviews can deter future bookings.

Further enhancing its offerings, Airbnb acquired Luxury Retreats in 2017 and launched Airbnb Plus in 2018, expanding its reach into different segments of the accommodation market.

Exploring Airbnb Plus: Premium Quality and Verified Comfort

Airbnb Plus is designed to highlight a curated selection of homes known for their exceptional quality and outstanding hosts. These hosts have consistently received positive guest reviews and are recognized for their attention to detail and commitment to providing excellent guest experiences.

Airbnb Plus listings offer an added layer of assurance beyond guest reviews. To achieve Airbnb Plus status, properties typically undergo an in-person quality inspection conducted by an Airbnb representative to verify the property’s quality, design standards, and amenities.

Properties that meet the rigorous Airbnb Plus criteria are distinguished by a special “Plus” badge displayed on their listing page, signaling their premium status to potential guests.

Airbnb Plus is particularly valuable when booking higher-end rentals. Luxury Airbnb rentals often command premium prices, and Airbnb Plus provides guests with greater confidence that the property will live up to its price point and offer a superior experience.

The luxury vacation rental market on Airbnb has become a lucrative avenue for real estate investment, leading us to the topic of leveraging Airbnb to build a real estate business and generate income.

Building an Airbnb Business: Real Estate in the Short-Term Rental Era

One of the traditional and enduring methods of generating income from real estate is renting out owned property. Historically, this typically involved long-term rentals. However, Airbnb popularized a different approach – short-term rentals, a concept previously more common in the hotel industry.

Short-term rentals involve renting out properties for brief stays, ranging from a single night to a few weeks or a month. Airbnb’s platform democratized access to short-term renting, enabling homeowners to tap into this market and generate supplemental income.

Real estate investors recognized the significant potential in this shift. While short-term rental performance can be seasonal and fluctuate, it often offers a higher potential for profitability compared to traditional long-term rentals in certain markets.

This realization spurred savvy investors to purchase properties specifically to operate them as Airbnb rentals.

The popularity of this approach led to some pushback from residential communities, local authorities, and the hotel industry in various cities and regions worldwide. Concerns about housing affordability, neighborhood character, and fair competition led to the implementation of regulations and restrictions on short-term rentals in many locations, sometimes even outright bans.

Today, operating an Airbnb rental often requires obtaining a permit or license, depending on local regulations.

Despite these regulations, opportunities still exist to start an Airbnb business and generate substantial income in locations where short-term rentals are permitted and in demand.

Similar to traditional rental property investment, launching an Airbnb business begins with identifying an investment property with the potential to generate profitable rental income. This necessitates conducting thorough real estate market analysis, comparing properties, and carefully evaluating financial projections, just as with any other real estate investment venture.

Find a Profitable Airbnb Investment Property

Before delving into the specific steps of investing in an Airbnb rental property, it’s crucial to address the legal landscape surrounding Airbnb operations.

Navigating Airbnb Legality: Understanding Local Regulations

When considering launching an Airbnb business, understanding the local legal framework in your target city is paramount.

As mentioned earlier, numerous cities have implemented laws and regulations that may restrict or govern short-term rental activities.

In many jurisdictions, obtaining a permit or license is a prerequisite before listing a property on Airbnb or accepting paying guests for short-term stays.

However, the specifics of these regulations and the level of enforcement vary significantly across different local governments.

Therefore, the only way to determine the viability of starting an Airbnb business in a specific city is to thoroughly research and understand the applicable local laws and regulations.

Airbnb provides some resources to help hosts navigate these legal complexities. While not exhaustive, the Airbnb legal resources page can be a helpful starting point for gathering relevant information.

Airbnb Investment Strategies: Tailoring Your Approach

Once you’ve confirmed the legal permissibility of operating short-term rentals in your chosen city, the next step is to develop a strategic approach for your Airbnb rental business.

Investing in Airbnb rentals offers a range of strategies to suit different investment goals and market conditions.

For instance, you could focus on weekend rentals in locations with strong weekend tourism, or you could explore the potential of Airbnb monthly rentals.

Airbnb monthly rentals, accommodating guests for up to 30 days, bridge the gap between short-term vacation rentals and traditional long-term rentals. They offer greater flexibility in adjusting rental rates to market fluctuations while providing a more consistent income stream compared to nightly rentals. This strategy has emerged as a viable alternative to traditional rentals for some investors.

Vacation rentals, on the other hand, appeal to investors seeking flexibility and personal use. You can utilize the property as your own vacation home during periods when it’s not rented out, combining personal enjoyment with income generation.

Generally, the core strategy involves acquiring properties primarily for listing as short-term rentals and leveraging the Airbnb platform to generate passive income.

Similar to traditional rental property investment, a systematic approach is essential for success:

Location Selection: The Cornerstone of Airbnb Profitability

Choosing a lucrative location is the initial and critical step in establishing a profitable Airbnb rental business.

Location selection is heavily influenced by your investment criteria and objectives, considering factors such as:

- Proximity to your own residence, if you plan to manage the property closely.

- The location’s inherent appeal and attractiveness to tourists and travelers.

- Seasonality of tourism demand and its impact on Airbnb occupancy rates.

- Insights into future developments or projects that could influence short-term rental demand and performance.

- The specific local laws and regulations governing short-term rentals in the area.

Numerous other factors can contribute to identifying a favorable location for vacation rental investments.

Once you’ve narrowed down a location, the next step involves assessing the performance of existing short-term rentals in that market and identifying properties for sale that offer attractive projected returns. This requires access to reliable Airbnb market data and comparable property analysis.

Leveraging Airbnb Comps: Data-Driven Insights

Airbnb comps, or comparable properties, involve analyzing data from similar Airbnb listings in a specific area to benchmark performance and identify investment opportunities.

For example, if you’re interested in investing in a particular neighborhood, you can determine the average rental rate in that area by analyzing data from comparable Airbnb listings.

Beyond rental rates, you can use Airbnb comps to compare and filter properties based on various criteria, including:

- Guest reviews and ratings.

- Listing history and time on the market.

- Past performance metrics (occupancy rate, revenue).

- Property size and features.

- Property type (apartment, house, etc.).

Analyzing Airbnb comps can yield valuable insights, such as identifying property types with high demand or seasonal income trends. For example, you might discover that single-family homes are highly sought after, while beachfront properties command premium rental rates during peak seasons. This data can inform your investment strategy and property selection.

Finding Investment Properties for Sale: Bridging Data and Acquisition

Armed with insights from Airbnb comps and market analysis, the next crucial step is to locate suitable investment properties for sale that align with your criteria and offer strong potential returns.

This property search phase can be demanding depending on the resources and tools at your disposal.

While Airbnb’s platform is invaluable for market research and competitive analysis, it doesn’t directly facilitate finding properties for sale.

However, specialized platforms like Mashvisor can bridge this gap.

When evaluating properties for sale, you’ll gather key data points, including property characteristics and listing prices. By combining this data with your Airbnb comp analysis, you can estimate the potential rental income a property could generate and compare it to the asking price of similar properties.

This comparative analysis enables you to calculate key return on investment metrics, such as cap rate and cash-on-cash return, for each property under consideration. These metrics help you objectively assess the financial viability of different investment opportunities.

Ultimately, the process involves selecting the properties that best align with your investment goals and risk tolerance, contacting listing agents or owners, and negotiating to close a purchase deal.

Mashvisor: Your Comprehensive Airbnb Investment Toolkit

Mashvisor is a specialized Airbnb analytics platform designed to empower real estate investors in identifying and evaluating properties for sale based on their projected returns and Airbnb market potential.

The platform offers a suite of tools and features to streamline the Airbnb investment process:

- Property search tools to find investment properties for sale in specific markets.

- Market analysis dashboards to assess the performance and trends of rental markets.

- Property analysis calculators to project rental income, expenses, and profitability metrics.

- Airbnb analysis tools to compare properties and optimize rental strategies.

By aggregating data from diverse sources, including Airbnb and the MLS (Multiple Listing Service), Mashvisor automates much of the analysis process, eliminating the need for manual spreadsheet calculations and data compilation.

Mashvisor enables users to efficiently explore investment opportunities across US markets and access comprehensive data analytics in a centralized platform.

The platform incorporates filters and customization options to refine property searches and enhance the accuracy of investment projections.

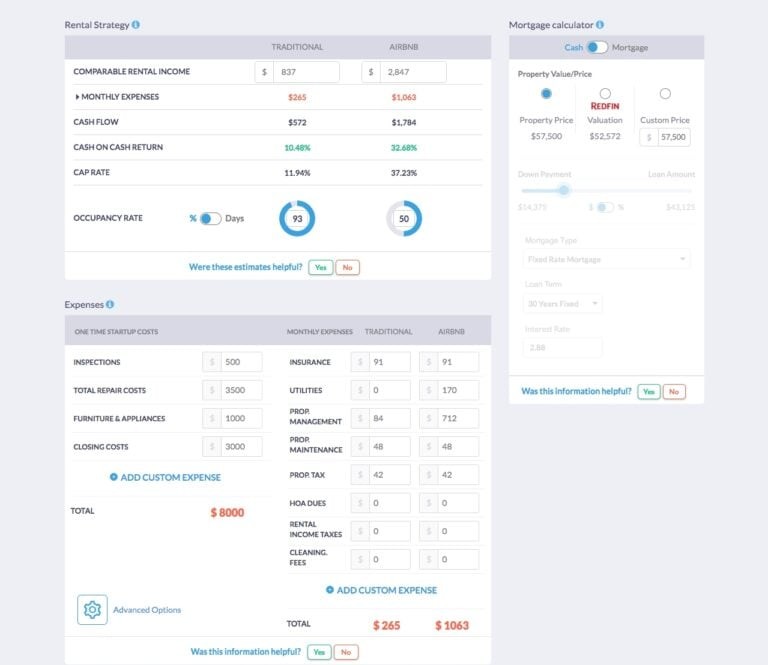

Furthermore, Mashvisor’s integrated Airbnb calculator provides projected cap rate estimates for individual properties based on local market data. It also allows users to adjust variables and assumptions to conduct sensitivity analysis and refine their projections.

What Does Airbnb Stand For? Mashvisor Airbnb Investment Tool

What Does Airbnb Stand For? Mashvisor Airbnb Investment Tool

Mashvisor’s Airbnb calculator leverages Airbnb comps to estimate key performance indicators for a listing, including rental income, monthly expenses, cash flow, cash on cash return, cap rate, and occupancy rate.

Conclusion: Airbnb – From Humble Beginnings to Global Success

In conclusion, we’ve uncovered the answer to the question: what does Airbnb stand for? It’s a story rooted in the simple beginnings of “Air Bed and Breakfast,” a concept that has blossomed into one of the world’s largest and most influential companies in the real estate and travel sectors.

So, what does Airbnb stand for now, beyond its literal meaning?

Airbnb stands for innovation, disruption, and opportunity.

And for many investors, it stands for success in the dynamic world of short-term rental real estate.

If you’re ready to embark on your journey into the Airbnb business, you’re in the right place to start exploring the possibilities.

Sign up for Mashvisor and gain a competitive edge in your investment endeavors with our powerful suite of tools.

Start Your Investment Property Search!