At first glance, accounting might appear to be a profession centered solely around numbers—simply crunching figures, right? While it’s true that manipulating financial data is a significant aspect of the role, accounting is a vital business function that involves far more problem-solving and strategic thinking than you might initially imagine. From effectively leveraging assets and meticulously managing budgets to achieving financial efficiencies and maximizing investments, the operations of accounting and finance management extend well beyond the common perception of the profession.

So, What Does An Accountant Do on a daily basis? This article will delve into the everyday tasks, diverse roles and responsibilities, essential skills, and career prospects for accountants, while also exploring the emerging trends shaping the future of this dynamic field.

Defining the Accountant: More Than Just Numbers

An accountant is a highly skilled professional entrusted with the critical tasks of maintaining and interpreting financial records. The scope of an accountant’s responsibilities is broad, encompassing a wide array of finance-related duties, whether they are working directly with individual clients or contributing to larger businesses and organizations.

The term “accountant” is often used alongside other related terms, sometimes causing confusion about the precise nature of this career. For instance, “accountant” and “bookkeeper” are phrases that are occasionally used interchangeably, yet significant distinctions exist between these two job titles.

Typically, bookkeepers often hold at least an associate degree and primarily concentrate on the meticulous recording of financial transactions. Accountants, conversely, usually possess at least a bachelor’s degree in accounting and are tasked with the more complex role of interpreting financial information, moving beyond simple data collection.

In essence, while accountants possess the skills of bookkeepers, not all bookkeepers are qualified accountants.

Furthermore, the designation of Certified Public Accountant (CPA) denotes an accountant who has successfully passed the rigorous CPA exam and fulfilled specific state licensing requirements. Therefore, all CPAs are accountants, but it’s important to remember that not every accountant is a CPA.

Accounting is a vast and multifaceted field, encompassing numerous distinct job titles and roles within organizations. The profession is broadly categorized into three primary types of accountants—public accountants, management accountants, and government accountants—each specializing in different facets of financial management. Internal and external auditors are also closely related and crucial roles within the broader accounting landscape.

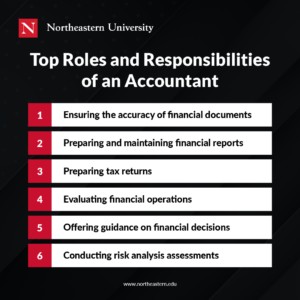

Decoding the Roles and Responsibilities of an Accountant

While the specific daily duties of an accountant will naturally vary depending on their specific position and the organization they serve, several core tasks and responsibilities are commonly associated with the accounting profession:

Analyzing financial information and preparing financial reports to summarize and forecast financial position. Accountants are responsible for dissecting complex financial data, identifying trends, and creating clear, concise reports that provide insights into an organization’s financial health and future projections.

Preparing tax returns and ensuring compliance with tax regulations. Navigating the intricate world of tax law is a key responsibility. Accountants prepare accurate tax returns for individuals and businesses, ensuring adherence to all relevant regulations and minimizing tax liabilities.

Auditing financial statements to ensure accuracy and compliance. Accountants often act as auditors, meticulously examining financial records to verify their accuracy and ensure they comply with established accounting principles and legal requirements. This role is crucial for maintaining financial integrity and trust.

Developing and implementing accounting systems and procedures. Designing and implementing efficient accounting systems is vital for smooth financial operations. Accountants develop procedures to streamline financial processes, improve accuracy, and enhance overall efficiency.

Providing financial advice and guidance to clients or management. Accountants are trusted advisors, offering expert financial counsel to individuals, businesses, and management teams. This advice can range from investment strategies to budgeting and financial planning.

Beyond these core duties, accountants are bound by a legal and ethical obligation to operate with honesty and diligence, avoiding any negligence in their professional conduct. They bear the responsibility of ensuring that their clients’ or employers’ financial records are not only accurate but also fully compliant with all applicable laws and regulations. This commitment to ethical practice and regulatory adherence is fundamental to the integrity of the accounting profession.

Essential Skills for Accountants: A Blend of Technical and Soft Skills

To thrive in the dynamic field of accounting, professionals need to cultivate a diverse range of skills, encompassing both technical expertise and crucial soft skills. These skills are essential for navigating the complexities of the profession and achieving long-term success.

Soft Skills: The Cornerstones of Professional Success

Common soft skills are particularly vital when considering long-term career advancement and overall effectiveness in accounting. Analyzing data from current job postings reveals the top soft skills that employers actively seek in accounting professionals.

1. Communication: Clarity is Key

Effective communication is paramount for accountants. They must possess exceptional listening skills to accurately gather financial facts and figures from clients, managers, and other stakeholders. Equally important is the ability to clearly and concisely articulate their findings, presenting complex financial information in understandable written reports and verbal explanations. Strong communication bridges the gap between technical data and practical understanding.

2. Computer Proficiency: Navigating the Digital Landscape

In today’s technologically driven world, computer proficiency is non-negotiable for accounting professionals. They must be adept at utilizing advanced accounting software, such as QuickBooks or SAP, and other computer-based tools to perform their tasks efficiently and effectively. Staying updated with the latest technological advancements in accounting software is crucial for maintaining a competitive edge.

3. Detail Orientation: Precision and Accuracy

A meticulous attention to detail is a hallmark of successful accountants. They must possess an unwavering commitment to accuracy and organization when handling vast amounts of financial information. While working with complex data, even seemingly minor errors can have significant repercussions if not identified and corrected promptly. Detail orientation minimizes risks and ensures the reliability of financial data.

4. Management Skills: Guiding and Leading

Accountants often play a role in management, providing financial insights that guide decision-making. To be effective in this capacity, an accountant needs to understand fundamental management principles. This knowledge allows them to offer accurate direction and valuable guidance to colleagues and clients seeking financial advice. Management skills empower accountants to contribute strategically to organizational success.

5. Budgeting Acumen: Beyond Basic Math

A common misconception is that advanced mathematical prowess is the primary requirement for accountants. While basic math skills are undoubtedly important, the budgeting functions of an accountant typically do not demand highly complex mathematical skills. Instead, a strong understanding of budgeting principles, financial planning, and analytical thinking are more crucial for effectively managing budgets and providing sound financial forecasts.

Specialized Skills: Technical Expertise for Professional Excellence

While soft skills are essential for overall career success, specialized skills are what make accountants highly effective and proficient in their specific areas of expertise. Data from current job postings highlights the top specialized skills that employers prioritize when hiring accounting professionals.

1. Accounting Principles: The Foundation of Sound Practice

A deep understanding of generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the region, is fundamental. These principles serve as the bedrock of ethical and accurate accounting practice. Without a solid grasp of these principles, accountants risk providing flawed guidance or presenting misleading financial statements, jeopardizing their professional standing and client trust.

2. Finance Expertise: Navigating the Financial Landscape

Since accountants frequently provide financial advice, a strong foundation in finance is indispensable. They must be comfortable with financial terminology, understand financial markets, and confidently engage in conversations about diverse financial topics. Finance expertise equips accountants to offer informed and strategic financial counsel.

3. Auditing Proficiency: Ensuring Financial Integrity

While not every accounting role necessitates auditing skills, proficiency in auditing is a highly valuable asset. Auditing skills enable accountants to rigorously assess financial data, ensuring its accurate representation and adherence to contemporary accounting standards. This skill is particularly crucial for roles focused on compliance and financial oversight.

4. Financial Statement Literacy: Deciphering Financial Documents

Accountants work with financial documents daily, creating, maintaining, and referencing them. Therefore, comprehensive financial statement literacy is essential. They need to thoroughly understand all aspects of common financial statements, including balance sheets, income statements, and cash flow statements, to effectively analyze financial performance and position.

5. Financial Analysis: Uncovering Insights from Data

Collecting and analyzing financial data forms a significant part of the accounting profession. Financial analysis skills are crucial for identifying trends, detecting potential issues, and providing data-driven insights. The application of data analytics in accounting is a rapidly growing trend, with data analysis becoming increasingly central to modern accounting practices.

Accounting Jobs: High Demand and Promising Career Growth

Accounting is a career field characterized by strong demand, offering impressive salaries and robust job growth prospects. The need for skilled accounting professionals is consistently on the rise across various industries.

Data from the Bureau of Labor Statistics (BLS) projects a 6 percent growth in employment for accountants and auditors by 2031. Industry trend analysis further confirms this positive outlook, revealing substantial growth in unique accounting job postings. From May 2020 to May 2022, the number of unique accounting-related job postings per month surged by nearly 20,000, demonstrating the escalating demand for accounting expertise.

Compensation plays a significant role in the growing appeal of the accounting profession. Job posting analysis indicates that while the average median salary for accountants with a bachelor’s degree is approximately $64,900 per year, gaining experience in the field leads to substantial salary increases. For instance, accountants with one to three years of experience can earn between $57,000 and $70,000 annually. Those with five to seven years of experience can expect an average median salary of $73,100. Finally, seasoned accounting professionals with ten or more years of experience can command salaries up to $121,200 per year, highlighting the lucrative long-term earning potential in this field.

Geographic location also influences an accountant’s earning potential. Factors such as the local cost of living and the demand for talent in a specific region can significantly impact salary expectations. For example, data from Robert Half shows that professionals in cities like Boston, New York City, and San Francisco can earn significantly more than the national average, with salary premiums of 34 percent, 40.5 percent, and 41 percent respectively.

For entry into the accounting profession, most employers require candidates to hold at least a bachelor’s degree in accounting or a closely related field, such as Finance and Accounting Management. Additional certifications are often highly valued, enhancing a job seeker’s prospects. Many accounting professionals pursue the Certified Public Accountant (CPA) designation, completing the rigorous licensing process administered by the Association of International Certified Professional Accountants.

However, the accounting field offers diverse career paths beyond becoming a CPA. The industry encompasses a wide array of in-demand finance and accounting careers. Regardless of the specific accounting path chosen, the field offers substantial job growth opportunities and a promising career trajectory.

Key Accounting Trends Shaping the Future

To thrive in the evolving accounting landscape, both aspiring and current accounting professionals must stay informed about emerging trends. Keeping skills relevant and maintaining a competitive advantage requires continuous learning and adaptation to industry developments.

1. The Rise of Accounting Automation

Automated accounting software solutions, such as QuickBooks and other popular applications, are increasingly transforming the industry. A recent survey revealed that bookkeepers and accountants spend approximately 86 percent of their time on tasks that have the potential for automation.

However, automation is not about replacing accountants with machines. Instead, the increasing adoption of automation means that accountants can shift their focus from routine manual tasks like data entry to more strategic and analytical activities.

Implementing accounting automation empowers accountants to streamline workflows, enhance efficiency, and become more effective in their roles. Emerging technologies enable the automation of labor-intensive tasks such as tax preparation, payroll processing, and audits, freeing up valuable time and resources for higher-level responsibilities.

2. Emphasizing Transparency and Data Security

Heightened standards of transparency in accounting and an intensified focus on data security are among the most critical trends in the field. These trends reflect a growing emphasis on accountability and trust in the financial sector.

In the wake of accounting scandals and increased scrutiny following the 2008 financial crisis, restoring trust and credibility to the accounting profession became paramount. This led to an industry-wide push for transparent financial reporting, influencing financial reporting processes and standards.

Public expectations for accurate reporting have expanded beyond basic honesty. Companies are now increasingly expected to publicly disclose comprehensive financial statements, providing a complete and transparent picture of their financial standing to reduce market uncertainty and foster greater investor confidence.

Furthermore, as custodians of sensitive financial data, accountants bear a significant responsibility for maintaining robust data security practices. Numerous high-profile data breaches in recent years have underscored the critical need for advanced protection measures. Accountants must remain vigilant and continuously update their security knowledge to safeguard sensitive information effectively.

3. Data Analysis Takes Center Stage

Today’s accountants and CPAs are increasingly engaging in tasks that demand strong analytical skills, largely driven by the exponential growth of data across industries. The ability to analyze and interpret data is becoming a core competency for accounting professionals.

Data analytics has numerous applications within accounting. For example, auditors are leveraging analytics to enhance processes like continuous monitoring and auditing, enabling more proactive risk assessment and fraud detection. Similarly, accountants in advisory roles can harness the power of big data to identify patterns in consumer behavior and market trends, uncovering potential investment opportunities and driving profitability.

To remain competitive and adapt to industry advancements, modern accountants must cultivate an analytical mindset and develop strong data analysis skills. This shift towards data-driven decision-making is transforming the role of accountants, positioning them as strategic business partners.

Charting Your Path: How to Become an Accountant

Accounting is clearly a profession that extends far beyond mere number crunching. It is a dynamic and in-demand field offering diverse opportunities and significant career potential. The sustained growth of the accounting and finance industry underscores the value of pursuing an accounting degree.

If becoming an accountant aligns with your career aspirations, numerous resources are available to guide your journey. Exploring accounting programs is a crucial step in preparing for this rewarding role. Prioritizing a high-quality education, such as pursuing a Bachelor of Science in Finance and Accounting Management, can significantly enhance your prospects of meeting employer expectations and achieving your professional goals in the field of accounting.

To explore this and other bachelor’s degree programs that can propel your accounting career, visit our program pages.