In today’s complex and ever-evolving business landscape, leaders are constantly seeking clarity and direction, especially when navigating economic uncertainties. As businesses gear up for 2025 planning, recent U.S. jobs and inflation reports offer a glimpse into the stabilization and resilience of labor markets. To effectively strategize in this environment, understanding the insights provided by expert organizations becomes paramount. This article delves into the implications of these market factors, drawing upon the expertise of WTW – a leading global advisory, broking, and solutions company – to decipher what these trends mean for businesses and their talent strategies. So, What Does Wtw Mean for your 2025 planning? Let’s explore their analysis of the latest economic indicators and guidance for effective leadership.

Key Findings from WTW Analysis of the US Labor Market

WTW, formerly known as Willis Towers Watson, is a prominent global entity that provides data-driven, insight-led solutions in the areas of people, risk and capital. Their analyses of economic reports offer valuable perspectives for businesses worldwide. Here are some key takeaways from their interpretation of recent U.S. labor market data:

Stable Job Gains Indicate Continued Market Strength

According to WTW’s analysis of the latest Bureau of Labor Statistics (BLS) reports, the U.S. job market continues to demonstrate surprising strength. Nonfarm payroll employment saw a robust increase of 254,000 jobs in September. This figure not only surpasses the average monthly gain of 203,000 over the preceding year but also outpaces job creation in previous months. This consistent job growth signals a resilient economy, even amidst broader global uncertainties.

Job Openings and Hiring Rates Show Signs of Moderation

While job gains remain strong, WTW points to other indicators suggesting a cooling in the previously overheated labor market. Job openings, while still substantial at 8.0 million in August, have seen a decrease from 9.3 million the previous year and a significant drop from the high of 12.0 million in March 2022. Hires and hire rates remained relatively stable at 5.3 million and 3.3% respectively. The layoff rate, at 1.0%, is slightly lower than both the previous month and the rate from a year prior, indicating a degree of job security for current employees.

Unemployment Rate Remains Low but Shows Slight Increase Year-Over-Year

The unemployment rate in the U.S. experienced a slight decrease in September, falling to 4.1% from 4.2% the previous month. However, WTW highlights that this figure is modestly higher than the 3.8% recorded a year ago. It’s crucial to note that the current unemployment rate is significantly lower than the 7.8% peak observed during the pandemic in September 2020. This suggests a labor market that is still tight by historical standards, but no longer at the extreme lows seen in the immediate post-pandemic recovery.

Labor Force Participation Rate Stabilizes

WTW’s analysis also considers the labor force participation rate, which remained steady at 62.7% in September for the third consecutive month, consistent with the rate from a year prior. While long-term trends show a decline in labor participation over decades, the pandemic caused a significant temporary dip. The current rate is gradually closing this gap, aligning with the longer-term downward trend. Notably, the labor force participation rate for individuals aged 25 to 54, a critical segment of the workforce, has rebounded to pre-pandemic levels. This stabilization, according to WTW, signals a more balanced labor market compared to the acute talent shortages experienced in the recent past.

Quit Rates Decline, Indicating Greater Labor Market Stability

A significant indicator of labor market dynamics, the quit rate, has decreased to 1.9% in August, as noted by WTW. This is considerably lower than the pre-pandemic rate of 2.3% and a sharp decline from the peak of 3.0% during the “Great Resignation.” This sustained decrease in quit rates, falling below 2.0% for the first time since before the pandemic, suggests that employees are now more inclined to remain with their current employers. WTW interprets this as a sign of reduced labor market volatility and increased stability in employee retention.

Inflation Shows Downward Trend, Easing Financial Pressures

WTW’s examination of the Consumer Price Index (CPI) reveals a positive trend in the fight against inflation. The CPI increased by 2.4% over the 12 months leading up to September, continuing a downward trajectory from the 6.4% rate in December 2022. This represents the smallest 12-month increase since February 2021. While still above pre-pandemic levels of around 2.0%, the trend is moving towards that target. WTW emphasizes that this moderation in inflation provides greater market stability and improves the buying power for employees.

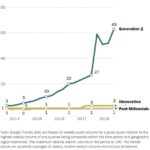

Wage Growth Continues, but at a More Moderate Pace

Average hourly earnings in the U.S. have risen by 4.0% over the 12-month period ending in September. WTW’s own surveys indicate that the median pay raise in the U.S. for 2024 was 4.1%, down from 4.5% in 2023. Looking ahead to 2025, salary budget increases are projected to be 3.9%. While these figures represent a decrease from the highs of recent years, WTW points out that they remain elevated compared to the average of the past two decades. Notably, 2023 marked the first year since 2020 where U.S. pay increases outpaced inflation, signaling a return to a pattern observed from 2008 to 2020. This shift suggests a stabilization in labor markets and potentially less pressure for employers to continually escalate wages.

WTW’s Guidance for Effective Leadership and Talent Management in 2025

Based on their analysis, WTW provides crucial guidance for leaders as they plan for 2025 and beyond. They emphasize that while talent pressures may have eased somewhat, talent shortages remain a persistent challenge. Effective leaders are advised to incorporate human capital governance into their strategic planning at the highest levels of their organizations.

WTW stresses that successful leadership in the current environment requires moving beyond reactive approaches to talent management, such as simply responding to the “Great Resignation” or “quiet quitting.” Instead, leaders must proactively cultivate workplaces where individuals genuinely desire to be, regardless of external circumstances. This involves:

- Differentiating Culture and Employee Experiences: Creating unique and positive employee experiences is paramount. This goes beyond basic compensation and benefits to encompass aspects like work environment, development opportunities, and a sense of belonging. WTW’s research consistently shows that superior employee experiences drive superior financial performance.

- Maintaining Competitive Total Rewards: While employee experience is crucial, competitive pay and bonus structures remain essential. WTW advises organizations to regularly benchmark their compensation packages to ensure they attract and retain top talent.

- Embracing Flexibility and Skill Development: Offering flexibility in work arrangements, coupled with robust skill development programs, is increasingly important to meet the evolving needs of the modern workforce. Employees value opportunities for growth and work-life balance.

- Fostering Purpose-Driven Cultures: Creating a strong sense of purpose and aligning employees with the company’s mission are key drivers of engagement and retention. WTW underscores the importance of culture in enabling organizations and their people to thrive amidst continuous disruption.

Conclusion: Leveraging WTW Insights for Strategic 2025 Planning

In conclusion, WTW’s analysis of the latest U.S. jobs and inflation reports paints a picture of a stabilizing labor market with moderating inflation. While challenges remain, particularly in talent acquisition and retention, the insights provided by WTW offer a valuable roadmap for leaders as they plan for 2025. By understanding what WTW means through their expert analysis, businesses can make informed decisions about their talent strategies, compensation, and overall approach to navigating the evolving world of work. Embracing a proactive, employee-centric approach, as advocated by WTW, will be critical for organizations seeking sustained success in the years ahead.

References:

- Bremen, John M. “What Do October Jobs And Inflation Reports Mean For 2025 Planning?” Forbes, 18 Oct. 2024, https://www.forbes.com/sites/johnbremen/2024/10/18/what-do-october-jobs-and-inflation-reports-mean-for-2025-planning/.

- U.S. Bureau of Labor Statistics. “Employment Situation Summary.” Bureau of Labor Statistics, 3 Nov. 2024, https://www.bls.gov/news.release/empsit.nr0.htm.

- U.S. Bureau of Labor Statistics. “Job Openings and Labor Turnover Summary.” Bureau of Labor Statistics, 1 Nov. 2024, https://www.bls.gov/news.release/jolts.nr0.htm.

- WTW. “Employers More Conservative with Salary Budgets as Employee Base Stabilizes.” WTW, July 2024, https://www.wtwco.com/en-us/news/2024/07/employers-more-conservative-with-salary-budgets-as-employee-base-stabilizes.