What Is A Normal Credit Score? Credit scores are essential for financial health, impacting loan eligibility and interest rates. At WHAT.EDU.VN, we help you understand credit scores and how to achieve financial goals. Discover factors influencing credit scores and strategies for improvement. Learn about creditworthiness and financial planning today.

1. Defining a Normal Credit Score

Credit scores, typically ranging from 300 to 850, are crucial for assessing creditworthiness. But what is a normal credit score, and how does it affect your financial opportunities? Understanding this range is the first step toward managing your credit effectively. This section will delve into the various credit score ranges and what they signify, giving you a clear picture of where you stand. Credit reports influence loan approvals and interest rates.

A “normal” credit score is subjective and can vary based on the scoring model used. However, understanding the general ranges can provide a useful benchmark.

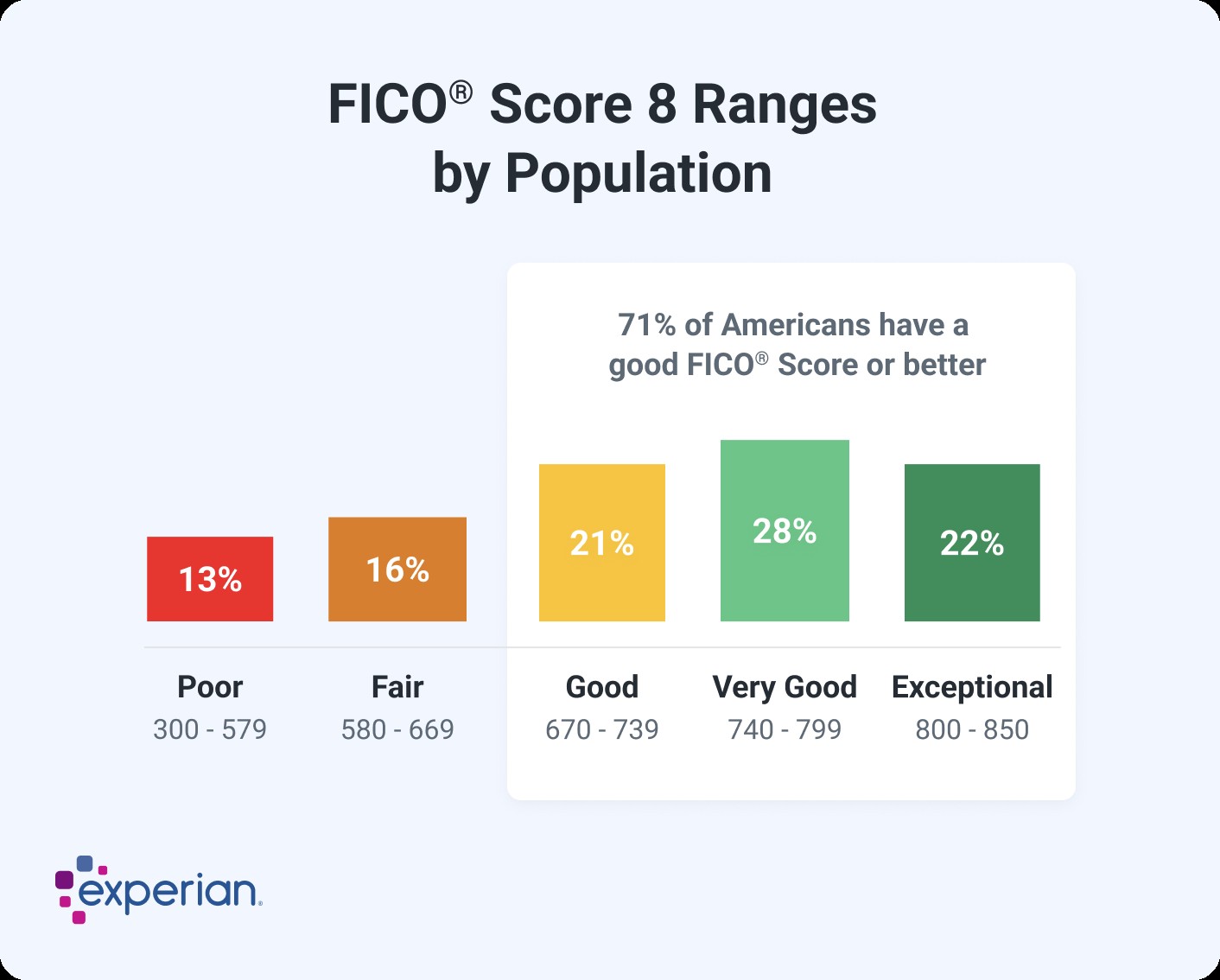

1.1. FICO Score Ranges

FICO (Fair Isaac Corporation) scores are widely used by lenders. Here’s a breakdown of FICO score ranges:

- Exceptional (800-850): Indicates excellent credit management.

- Very Good (740-799): Above average, suggesting responsible credit behavior.

- Good (670-739): Considered a solid score, likely to be approved for loans.

- Fair (580-669): Below average, may face higher interest rates or denials.

- Poor (300-579): Significant credit issues, likely to face difficulty obtaining credit.

1.2. VantageScore Ranges

VantageScore is another popular credit scoring model. Here are the VantageScore ranges:

- Excellent (781-850): Top-tier creditworthiness.

- Good (661-780): Solid credit management.

- Fair (601-660): Near prime, indicating some credit challenges.

- Poor (300-600): Subprime, suggesting significant credit risks.

1.3. Average Credit Score in the US

In 2023, the average FICO score in the United States was 715. This places the average American in the “good” credit score range. However, this doesn’t mean a score around 715 is necessarily “normal” for everyone, as it can vary based on age, location, and financial habits.

2. Factors Influencing Credit Scores

Many elements influence your credit score. Understanding these factors can help you take steps to improve your credit health.

2.1. Payment History

Description: Payment history is the most significant factor in determining your credit score. It reflects your ability to pay bills on time.

Impact: Late payments, defaults, and bankruptcies can significantly lower your credit score.

Improvement: Always pay your bills on time. Set up automatic payments or reminders to avoid missing due dates.

2.2. Credit Utilization

Description: Credit utilization refers to the amount of credit you are using compared to your total available credit.

Impact: High credit utilization can negatively impact your score, signaling that you are overextended.

Improvement: Keep your credit utilization below 30%. For example, if you have a credit card with a $10,000 limit, aim to keep your balance below $3,000.

2.3. Length of Credit History

Description: The length of time you’ve had credit accounts open also affects your score.

Impact: A longer credit history generally leads to a higher score, as it provides more data for lenders to assess.

Improvement: Maintain older credit accounts in good standing, even if you don’t use them often.

2.4. Credit Mix

Description: Having a mix of different types of credit accounts (e.g., credit cards, installment loans, mortgages) can positively influence your score.

Impact: A diverse credit mix demonstrates that you can manage various types of credit responsibly.

Improvement: If appropriate, consider diversifying your credit accounts. However, don’t open new accounts solely for the sake of improving your credit mix.

2.5. New Credit

Description: Opening multiple new credit accounts in a short period can lower your credit score.

Impact: Each new account results in a hard inquiry on your credit report, which can temporarily lower your score.

Improvement: Avoid opening too many new accounts at once. Space out credit applications to minimize the impact on your credit score.

2.6. Public Records and Collections

Description: Public records such as bankruptcies and collection accounts can severely damage your credit score.

Impact: These negative marks stay on your credit report for several years and can significantly hinder your ability to obtain credit.

Improvement: Address any outstanding debts and try to negotiate with creditors to remove collection accounts from your report.

2.7. Credit Inquiries

Description: Credit inquiries occur when a lender checks your credit report to assess your creditworthiness.

Impact: Hard inquiries (resulting from credit applications) can slightly lower your score, while soft inquiries (like checking your own credit) do not.

Improvement: Limit the number of credit applications you make, and be strategic about when you apply for new credit.

3. Why a Good Credit Score Matters

Having a good credit score opens doors to numerous financial benefits and opportunities. Understanding these advantages can motivate you to maintain and improve your credit health.

3.1. Lower Interest Rates

A higher credit score typically qualifies you for lower interest rates on loans and credit cards. This can save you a significant amount of money over the life of a loan.

3.2. Higher Approval Odds

Lenders are more likely to approve your applications for loans, mortgages, and credit cards if you have a good credit score.

3.3. Better Loan Terms

With a good credit score, you may qualify for better loan terms, such as longer repayment periods or more flexible payment options.

3.4. Increased Credit Limits

Credit card issuers are more likely to offer higher credit limits to individuals with good credit scores, providing greater purchasing power and flexibility.

3.5. Easier Approval for Rentals

Landlords often check credit scores when evaluating rental applications. A good credit score can increase your chances of being approved for an apartment or house.

3.6. Lower Insurance Premiums

In some states, insurance companies use credit-based insurance scores to determine premiums for auto, home, and life insurance. A good credit score can result in lower insurance costs.

3.7. Employment Opportunities

Some employers may review credit reports (but not credit scores) as part of the hiring process. Maintaining good credit can give you an edge in the job market.

3.8. Access to Rewards and Perks

Many credit cards offer rewards programs and other perks to attract customers with good credit. These can include cash back, travel miles, and other valuable benefits.

4. How to Improve Your Credit Score

Improving your credit score requires a strategic approach and consistent effort. Here are some effective strategies to boost your creditworthiness.

4.1. Make Timely Payments

Always pay your bills on time, every time. Set up automatic payments or reminders to ensure you never miss a due date.

4.2. Reduce Credit Utilization

Keep your credit utilization below 30%. Pay down balances on credit cards to lower your credit utilization ratio.

4.3. Review Your Credit Report

Regularly check your credit report for errors or inaccuracies. Dispute any mistakes with the credit bureaus to have them corrected.

4.4. Avoid Opening Too Many New Accounts

Opening multiple new credit accounts in a short period can negatively impact your score. Be selective about when you apply for new credit.

4.5. Keep Old Accounts Open

Maintain older credit accounts in good standing, even if you don’t use them often. This can help improve your credit history.

4.6. Use a Mix of Credit Accounts

If appropriate, diversify your credit accounts by having a mix of credit cards, installment loans, and other types of credit.

4.7. Become an Authorized User

If you have limited credit history, consider becoming an authorized user on someone else’s credit card account. This can help you build credit.

4.8. Consider a Secured Credit Card

A secured credit card requires a security deposit, which typically becomes your credit limit. Using a secured card responsibly can help you build or rebuild credit.

5. Credit Scores and Major Purchases

Your credit score plays a pivotal role in major financial decisions, such as buying a house or a car. Understanding how your credit score impacts these purchases can help you prepare and make informed choices.

5.1. Buying a House

A good credit score is essential for securing a mortgage with favorable terms. Here’s how credit scores affect your ability to buy a home:

- Higher Approval Odds: A higher credit score increases your chances of being approved for a mortgage.

- Lower Interest Rates: With a good credit score, you’ll likely qualify for a lower interest rate, saving you thousands of dollars over the life of the loan.

- Better Loan Options: A good credit score can open the door to a wider range of mortgage options, including conventional loans and government-backed loans.

The minimum credit score required to buy a house can vary depending on the type of mortgage you’re applying for:

- Conventional Mortgage: Many lenders require a minimum credit score of 620.

- FHA Home Loans: The Federal Housing Administration (FHA) offers loans with lower credit score requirements. You may be eligible for an FHA loan with a credit score as low as 500 if you make a 10% down payment. A credit score of 580 or higher typically requires a 3.5% down payment.

- USDA Loans: USDA loans are available to eligible rural homebuyers. Lenders may require a minimum credit score of 620, but there is no set minimum.

- VA Loans: VA loans are available to eligible veterans and active-duty service members. Lenders generally require a credit score of 620 or higher.

5.2. Buying a Car

Your credit score also affects your ability to secure an auto loan with favorable terms. Here’s how credit scores influence your car-buying experience:

- Higher Approval Odds: A good credit score increases your chances of being approved for an auto loan.

- Lower Interest Rates: With a good credit score, you’ll likely qualify for a lower interest rate, saving you money on your car payments.

- Better Loan Terms: A good credit score can help you negotiate better loan terms, such as a longer repayment period or a lower down payment.

While there isn’t a set minimum credit score to buy a car, a VantageScore credit score of 661 or higher is generally considered good. As your credit score increases, you’ll typically qualify for better auto loan terms.

6. Credit Score Myths and Misconceptions

There are many myths and misconceptions surrounding credit scores. Debunking these can help you make informed decisions and avoid common pitfalls.

6.1. Checking Your Credit Score Will Lower It

Fact: Checking your own credit score is a soft inquiry and does not affect your credit score.

6.2. Closing Credit Card Accounts Improves Your Score

Fact: Closing credit card accounts can actually lower your score, especially if they are older accounts or have high credit limits.

6.3. Carrying a Balance Improves Your Score

Fact: Carrying a balance on your credit card does not improve your score. It’s better to pay off your balance in full each month to avoid interest charges and maintain a low credit utilization ratio.

6.4. Credit Scores Are Only for Loans and Credit Cards

Fact: Credit scores can also affect your ability to rent an apartment, secure insurance, and even get a job.

6.5. All Credit Scores Are the Same

Fact: There are different credit scoring models (e.g., FICO and VantageScore), and each model may calculate your score differently.

7. Monitoring Your Credit Score and Report

Regularly monitoring your credit score and report is essential for maintaining good credit health. Here’s why and how to do it effectively.

7.1. Why Monitor Your Credit

- Detect Errors and Fraud: Monitoring your credit report allows you to identify any errors or fraudulent activity that could negatively impact your score.

- Track Your Progress: Monitoring your credit score helps you track your progress as you take steps to improve your credit health.

- Understand Your Credit Profile: Monitoring your credit provides insights into your credit history, including the factors that are helping and hurting your score.

7.2. How to Monitor Your Credit

- Check Your Credit Report: You are entitled to a free credit report from each of the three major credit bureaus (Experian, TransUnion, and Equifax) once a year. Visit AnnualCreditReport.com to request your free reports.

- Use Credit Monitoring Services: Consider using a credit monitoring service that provides regular updates on your credit score and alerts you to any changes in your credit report.

- Check Your Credit Score for Free: Many credit card issuers and financial institutions offer free credit score monitoring as a benefit to their customers.

8. Understanding Different Credit Scoring Models

Familiarizing yourself with the main credit scoring models can provide a clearer understanding of how lenders assess your creditworthiness.

8.1. FICO Scores

FICO scores are the most widely used credit scores by lenders. FICO scores range from 300 to 850 and are based on five main factors:

- Payment History (35%): The most important factor, reflecting your ability to pay bills on time.

- Amounts Owed (30%): Also known as credit utilization, it measures the amount of credit you’re using compared to your available credit.

- Length of Credit History (15%): A longer credit history generally leads to a higher score.

- Credit Mix (10%): Having a mix of different types of credit accounts can positively influence your score.

- New Credit (10%): Opening too many new accounts in a short period can lower your score.

8.2. VantageScore

VantageScore is another popular credit scoring model that is used by many lenders. VantageScore also ranges from 300 to 850 and considers similar factors as FICO, but with slightly different weights:

- Payment History: Extremely influential.

- Total Credit Usage: Highly influential.

- Credit Mix and Experience: Highly influential.

- New Accounts Opened: Moderately influential.

- Balances and Available Credit: Less influential.

9. Building Credit from Scratch

If you don’t have a credit history, building credit from scratch can seem daunting. However, there are several strategies you can use to establish credit and start building a positive credit score.

9.1. Secured Credit Card

A secured credit card requires a security deposit, which typically becomes your credit limit. Using a secured card responsibly and making timely payments can help you build credit.

9.2. Credit-Builder Loan

A credit-builder loan is a small loan that is designed to help you build credit. The loan proceeds are typically held in a savings account, and you make monthly payments to repay the loan.

9.3. Become an Authorized User

Ask a family member or friend to add you as an authorized user on their credit card account. This can help you build credit, as the account’s payment history will be reported to your credit report.

9.4. Report Rent and Utility Payments

Some credit reporting agencies allow you to report your rent and utility payments to your credit report. This can help you build credit, especially if you have limited credit history.

9.5. Apply for a Retail Credit Card

Retail credit cards are often easier to obtain than general-purpose credit cards. Using a retail card responsibly can help you build credit.

10. Addressing Negative Items on Your Credit Report

Negative items on your credit report can significantly lower your credit score. Addressing these issues is crucial for improving your credit health.

10.1. Review Your Credit Report

Regularly review your credit report to identify any negative items, such as late payments, collections, or charge-offs.

10.2. Dispute Errors

If you find any errors on your credit report, dispute them with the credit bureaus. Provide supporting documentation to substantiate your claims.

10.3. Negotiate with Creditors

Contact creditors to negotiate payment plans or settlements for outstanding debts. In some cases, you may be able to negotiate the removal of negative items from your credit report.

10.4. Pay Off Collections

Pay off outstanding collection accounts to improve your credit score. In some cases, you may be able to negotiate a “pay-for-delete” agreement, where the creditor agrees to remove the collection account from your credit report once you pay the debt.

10.5. Wait for Items to Age Off

Negative items generally stay on your credit report for several years. Late payments typically remain for seven years, while bankruptcies can stay for up to ten years. Over time, the impact of these items on your credit score will diminish.

Navigating the world of credit scores can be complex, but understanding what is a normal credit score and how to improve it is essential for financial well-being. At WHAT.EDU.VN, we are dedicated to providing you with the knowledge and resources you need to make informed financial decisions.

Do you have more questions about credit scores or need personalized advice? Visit what.edu.vn today and ask your question for free. Our community of experts is here to help you navigate your financial journey with ease. Contact us at 888 Question City Plaza, Seattle, WA 98101, United States, or reach out via WhatsApp at +1 (206) 555-7890. We are committed to providing you with the answers you need, quickly and easily. Let us help you achieve your financial goals.