A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. While a score in the mid-600s is generally considered good, an excellent credit score typically falls in the high 700s or 800s. Achieving an excellent credit score can unlock numerous financial benefits, including lower interest rates on loans and credit cards, and better terms on mortgages and other financial products. Understanding What Is An Excellent Credit Score and how to reach it is crucial for financial well-being.

Understanding Credit Score Ranges

Both FICO® Score and VantageScore® are widely used credit scoring models. While their ranges and specific scoring factors vary slightly, the underlying principles remain the same.

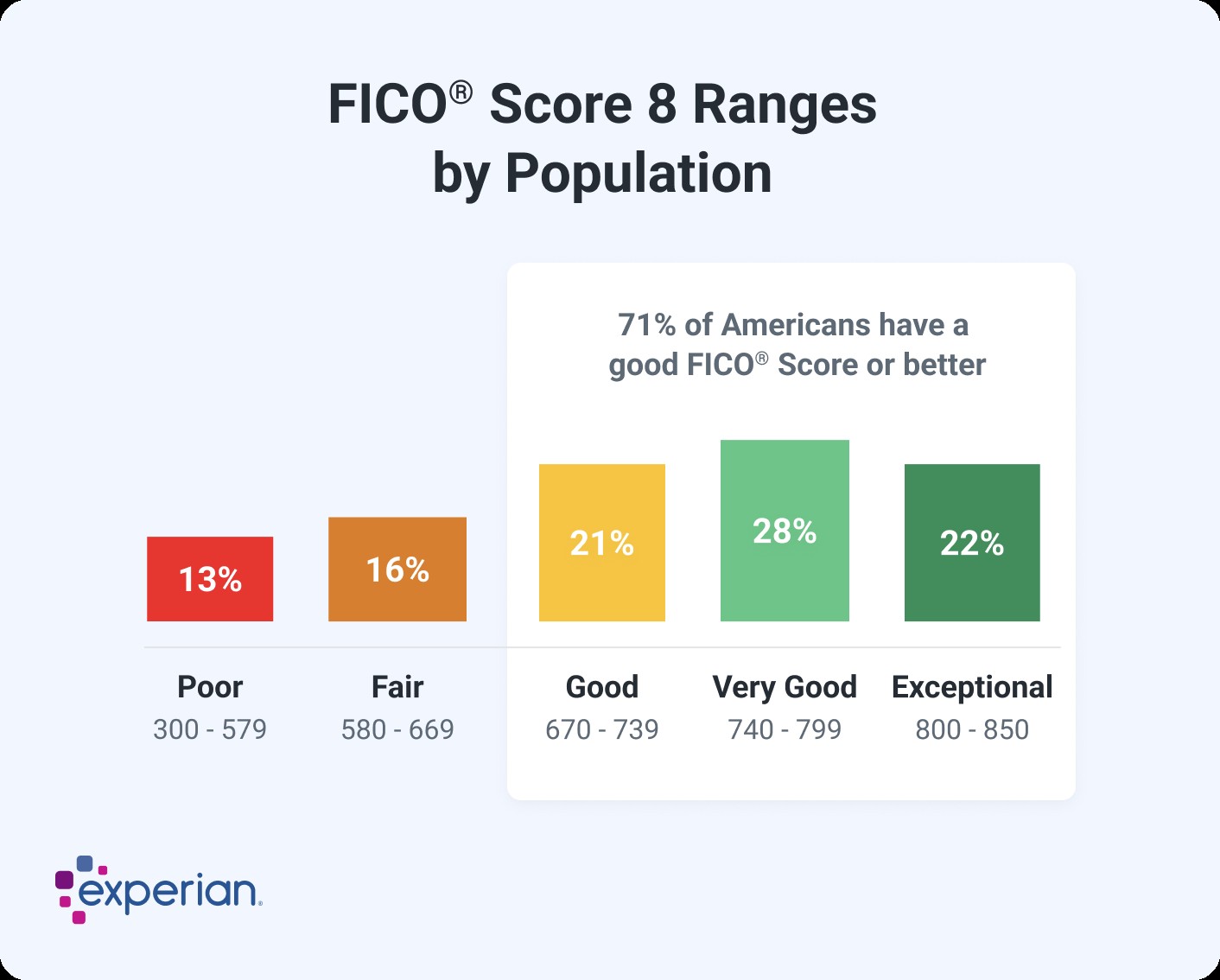

- FICO® Score: A good FICO® Score ranges from 670 to 739. A score of 740 to 799 is considered Very Good, and 800 to 850 is considered Exceptional or Excellent.

- VantageScore®: VantageScore 3.0 and 4.0 also use a range of 300 to 850. A good score is 661 to 780, while 781 to 850 is considered Super Prime or Excellent.

In 2023, the average FICO® Score in the U.S. was 715, indicating that many consumers have achieved good or excellent credit.

Factors Influencing Your Credit Score

Several factors influence your credit scores, and understanding these can help you improve your creditworthiness.

FICO® Score Factors

FICO® Score considers the following factors, with varying degrees of importance:

- Payment History (35%): This is the most important factor. Consistently paying your bills on time is crucial.

- Amounts Owed (30%): The amount of debt you owe relative to your available credit is a significant factor. Keeping your credit utilization low (below 30%) is ideal.

- Length of Credit History (15%): A longer credit history generally indicates lower risk.

- Credit Mix (10%): Having a mix of different types of credit accounts (e.g., credit cards, loans) can be beneficial.

- New Credit (10%): Opening too many new accounts in a short period can negatively impact your score.

VantageScore Factors

VantageScore also considers similar factors, although their relative importance is categorized differently:

- Payment History: Extremely influential.

- Total Credit Usage: Highly influential.

- Credit Mix and Experience: Highly influential.

- New Accounts Opened: Moderately influential.

- Balances and Available Credit: Less influential.

Benefits of an Excellent Credit Score

Achieving an excellent credit score unlocks many financial advantages:

- Lower Interest Rates: You’ll qualify for lower interest rates on credit cards, loans, and mortgages, saving you significant money over time.

- Better Loan Terms: Lenders are more likely to offer favorable loan terms, such as longer repayment periods and lower fees.

- Increased Approval Odds: You’ll have a higher chance of being approved for credit cards and loans.

- Higher Credit Limits: You may be offered higher credit limits on your credit cards, providing more financial flexibility.

- Better Insurance Rates: In some states, insurance companies use credit-based insurance scores to determine premiums, so an excellent credit score can lead to lower insurance costs.

Steps to Achieve an Excellent Credit Score

Improving your credit score takes time and effort, but it’s achievable with consistent, responsible financial habits:

- Pay Bills on Time: This is the most crucial step. Set up automatic payments to avoid missing deadlines.

- Keep Credit Utilization Low: Aim to use no more than 30% of your available credit on each credit card.

- Monitor Your Credit Reports: Regularly check your credit reports for errors and dispute any inaccuracies. You can obtain free credit reports from Experian, Equifax, and TransUnion.

- Avoid Opening Too Many New Accounts: Opening several new accounts in a short period can lower your average account age and potentially lower your score.

- Maintain a Mix of Credit Accounts: Having a mix of credit cards and installment loans (like auto loans or mortgages) can demonstrate responsible credit management.

- Become an Authorized User: If you have limited credit history, becoming an authorized user on a credit card account with a long history of on-time payments can help boost your score.

What an Excellent Credit Score Doesn’t Consider

It’s important to note that credit scores do not consider factors like:

- Race

- Religion

- National origin

- Gender

- Marital status

- Income

- Employment history

These factors are legally protected and cannot be used in credit scoring.

Conclusion

What is an excellent credit score? It’s a score that typically falls in the high 700s or 800s and opens doors to significant financial benefits. By understanding the factors that influence your credit scores and adopting responsible financial habits, you can work towards achieving and maintaining an excellent credit score, securing better financial opportunities and long-term stability. Regularly monitor your credit and take proactive steps to improve your creditworthiness, paving the way for a brighter financial future.