Customer Acquisition Cost, or CAC, reveals the total expenses an organization incurs to attract new clients and potential customers. At WHAT.EDU.VN, we believe understanding CAC is vital for businesses. This crucial metric encompasses sales, marketing investments, and resources spent persuading a prospect to purchase your offerings. Improve efficiency and optimize spending using effective customer acquisition strategies and marketing ROI.

1. Defining Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) represents the total cost a company incurs to acquire a new customer. It’s a critical business metric that helps organizations understand the efficiency and profitability of their marketing and sales efforts. Analyzing CAC is essential for optimizing marketing spend, improving ROI, and ensuring long-term business sustainability.

1.1. What Does CAC Include?

CAC typically includes all expenses related to acquiring new customers, such as:

- Marketing and advertising costs

- Sales salaries and commissions

- Marketing and sales software costs

- Professional services (e.g., consultants, agencies)

- Overhead expenses associated with marketing and sales activities

1.2. Why is CAC Important?

Understanding your CAC is vital for several reasons:

- Measuring Profitability: CAC helps determine if the cost of acquiring a customer is justified by the revenue they generate over their lifetime (Customer Lifetime Value – CLTV).

- Optimizing Marketing Spend: By analyzing CAC across different marketing channels, you can identify the most cost-effective strategies and allocate your budget accordingly.

- Improving ROI: Reducing CAC while maintaining or increasing customer acquisition rates directly improves your return on investment.

- Attracting Investors: A low and well-managed CAC is attractive to investors, as it indicates efficient and sustainable growth.

A bar graph showing the CAC of different customer acquisition strategies

A bar graph showing the CAC of different customer acquisition strategies

Alt Text: Visual representation showcasing Customer Acquisition Cost analysis across various marketing channels.

1.3. CAC vs. Other Metrics

CAC is often used in conjunction with other metrics to provide a comprehensive view of business performance:

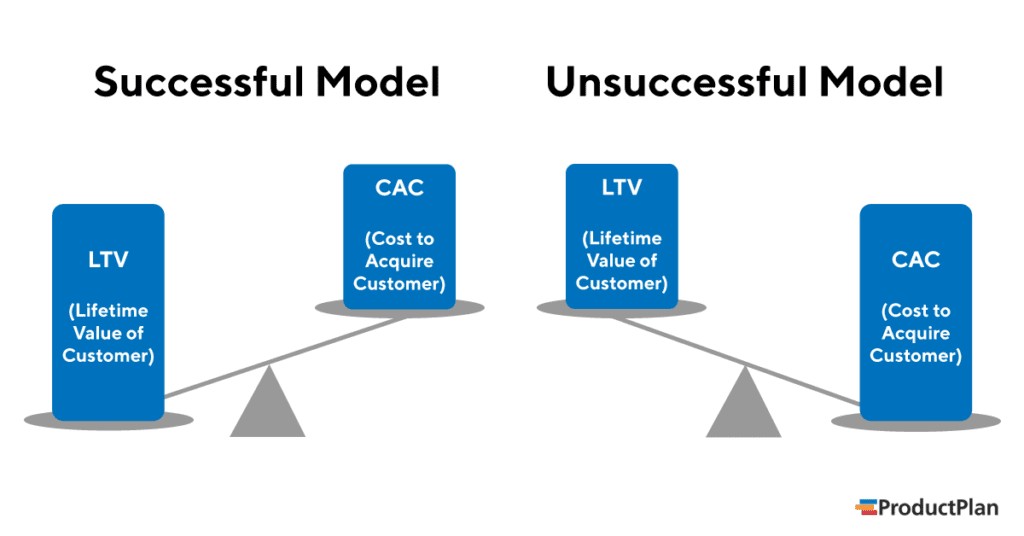

- Customer Lifetime Value (CLTV): CLTV predicts the total revenue a customer will generate throughout their relationship with your company. A healthy business typically has a CLTV that is significantly higher than its CAC.

- Return on Investment (ROI): ROI measures the profitability of an investment. By calculating the ROI of your marketing and sales efforts, you can assess the effectiveness of your customer acquisition strategies.

- Churn Rate: Churn rate is the percentage of customers who stop doing business with your company over a given period. High churn rates can offset the benefits of a low CAC.

2. Calculating Customer Acquisition Cost: Formulas and Methods

Calculating CAC accurately is crucial for making informed business decisions. There are two primary methods for calculating CAC: the simple method and the complex method. Both methods provide valuable insights, but the complex method offers a more comprehensive view of all associated costs.

2.1. Simple CAC Calculation

The simple method is a straightforward way to estimate your CAC. It involves dividing your total marketing campaign costs by the number of customers acquired during that campaign.

Formula:

CAC = MCC ÷ CA

Where:

- MCC (Marketing Campaign Costs): Total costs spent on marketing campaigns related to customer acquisition.

- CA (Customers Acquired): Total number of new customers acquired through those marketing campaigns.

Example:

If you spent $5,000 on a Facebook advertising campaign and acquired 50 new customers, your CAC would be:

$5,000 ÷ 50 = $100

This means it cost you $100 to acquire each new customer through the Facebook campaign.

2.2. Complex CAC Calculation

The complex method provides a more accurate representation of your CAC by including all relevant expenses associated with acquiring new customers.

Formula:

CAC = (MCC + W + S + PS + O) ÷ CA

Where:

- MCC (Marketing Campaign Costs): Total costs spent on marketing campaigns related to customer acquisition.

- W (Wages): Wages and salaries associated with marketing and sales personnel.

- S (Software Costs): Costs of all marketing and sales software (e.g., CRM, marketing automation tools).

- PS (Professional Services): Costs of any additional professional services used in marketing/sales (e.g., consultants, agencies).

- O (Overhead): Overhead expenses attributable to marketing and sales activities (e.g., rent, utilities).

- CA (Customers Acquired): Total number of new customers acquired.

Example:

Let’s say you have the following expenses:

- Marketing Campaign Costs (MCC): $10,000

- Wages (W): $20,000

- Software Costs (S): $5,000

- Professional Services (PS): $2,000

- Overhead (O): $3,000

- Customers Acquired (CA): 200

Your CAC would be:

($10,000 + $20,000 + $5,000 + $2,000 + $3,000) ÷ 200 = $200

This indicates that your true cost to acquire each new customer is $200 when considering all associated expenses.

2.3. Choosing the Right Method

The simple method is useful for a quick estimate and for comparing the performance of specific marketing campaigns. However, the complex method is recommended for a more accurate and comprehensive understanding of your overall CAC. The complex method ensures you account for all relevant expenses, providing a clearer picture of your customer acquisition costs.

3. Strategies to Reduce Customer Acquisition Cost (CAC)

Reducing CAC is a critical goal for businesses looking to improve profitability and achieve sustainable growth. Several strategies can be employed to lower CAC, focusing on optimizing marketing efforts, improving customer experience, and leveraging organic growth.

3.1. Optimize Your Marketing Funnel

A well-optimized marketing funnel can significantly reduce your CAC by guiding potential customers through the buying process more efficiently.

- Attract: Focus on attracting the right audience through targeted content marketing, SEO, and social media strategies.

- Engage: Engage potential customers with valuable and relevant content that addresses their needs and interests.

- Convert: Optimize your landing pages, calls-to-action, and sales process to convert leads into paying customers.

- Retain: Focus on customer retention to increase customer lifetime value and reduce the need for constant customer acquisition.

3.2. Improve Customer Onboarding

A smooth and effective customer onboarding process can increase customer satisfaction, reduce churn, and ultimately lower your CAC.

- Personalized Onboarding: Tailor the onboarding experience to meet the specific needs and goals of each customer.

- Educational Resources: Provide clear and concise educational resources that help customers understand how to use your product or service effectively.

- Proactive Support: Offer proactive support to address any questions or issues customers may encounter during the onboarding process.

3.3. Enhance Customer Experience

A positive customer experience can lead to increased customer loyalty, positive word-of-mouth referrals, and a lower CAC.

- Gather Feedback: Regularly solicit feedback from customers to identify areas for improvement.

- Act on Feedback: Implement changes based on customer feedback to improve the overall customer experience.

- Personalize Interactions: Personalize customer interactions to make customers feel valued and appreciated.

3.4. Leverage Content Marketing

Content marketing is a cost-effective way to attract and engage potential customers, build brand awareness, and drive organic traffic to your website.

- Create Valuable Content: Develop high-quality, informative, and engaging content that addresses the needs and interests of your target audience.

- Optimize for SEO: Optimize your content for search engines to improve your organic search rankings and attract more qualified leads.

- Promote Your Content: Promote your content through social media, email marketing, and other channels to reach a wider audience.

3.5. Implement Customer Referral Programs

Customer referral programs incentivize existing customers to refer new customers to your business, providing a cost-effective way to acquire new customers.

- Offer Incentives: Provide attractive incentives to both the referrer and the referred customer.

- Make it Easy to Refer: Simplify the referral process to encourage more customers to participate.

- Promote Your Referral Program: Promote your referral program through email, social media, and other channels.

3.6. Utilize Social Media Marketing

Social media marketing can be a powerful tool for reaching a large audience, building brand awareness, and driving traffic to your website.

- Identify Your Target Audience: Determine which social media platforms your target audience frequents.

- Create Engaging Content: Develop engaging content that resonates with your target audience.

- Run Targeted Ads: Use social media advertising to reach a specific audience with targeted messages.

3.7. Optimize Pricing Strategy

An effective pricing strategy can attract more customers, increase revenue, and improve your overall CAC.

- Conduct Market Research: Research your competitors’ pricing and identify opportunities to differentiate your pricing.

- Offer Value-Based Pricing: Price your product or service based on the value it provides to customers.

- Consider Freemium Models: Offer a free version of your product or service to attract new users and encourage them to upgrade to a paid plan.

3.8. Enhance Website Conversion Rates

Optimizing your website for conversions can increase the number of visitors who become paying customers, ultimately lowering your CAC.

- Improve Website Design: Ensure your website is visually appealing, easy to navigate, and mobile-friendly.

- Optimize Landing Pages: Create dedicated landing pages for specific marketing campaigns with clear calls-to-action.

- A/B Test: A/B test different elements of your website to identify what works best for converting visitors into customers.

4. The Relationship Between CAC and Customer Lifetime Value (CLTV)

The relationship between Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLTV) is a critical indicator of a business’s long-term profitability and sustainability. CLTV represents the total revenue a customer is expected to generate throughout their relationship with your company. Comparing CLTV to CAC helps you understand whether your customer acquisition efforts are financially viable.

4.1. Understanding Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) is a prediction of the net profit attributed to the entire future relationship with a customer. It helps businesses understand the long-term value of acquiring and retaining customers.

Formula:

There are several ways to calculate CLTV, but a common formula is:

CLTV = (Average Purchase Value x Purchase Frequency) x Customer Lifespan

Where:

- Average Purchase Value: The average amount a customer spends per purchase.

- Purchase Frequency: The number of times a customer makes a purchase within a given period.

- Customer Lifespan: The estimated length of time a customer will continue doing business with your company.

Example:

Let’s say a customer spends an average of $50 per purchase, makes 4 purchases per year, and remains a customer for 5 years.

CLTV = ($50 x 4) x 5 = $1,000

This means that each customer is expected to generate $1,000 in revenue over their lifetime.

4.2. The Ideal CLTV:CAC Ratio

The ideal CLTV:CAC ratio is generally considered to be 3:1 or higher. This means that for every dollar you spend acquiring a customer, you should expect to generate at least three dollars in revenue over their lifetime.

- CLTV:CAC < 1:1: This indicates that you are spending more to acquire a customer than they are worth, which is not sustainable.

- CLTV:CAC = 1:1: This means you are breaking even, but not generating a profit from your customer acquisition efforts.

- CLTV:CAC = 2:1: This is a good starting point, but there is still room for improvement.

- CLTV:CAC = 3:1 or Higher: This is considered a healthy ratio, indicating that your customer acquisition efforts are profitable and sustainable.

4.3. Improving the CLTV:CAC Ratio

If your CLTV:CAC ratio is not ideal, there are several strategies you can employ to improve it:

- Increase Customer Lifetime Value: Focus on customer retention, upselling, and cross-selling to increase the revenue generated by each customer.

- Reduce Customer Acquisition Cost: Implement the strategies discussed earlier to lower the cost of acquiring new customers.

- Target High-Value Customers: Focus your marketing efforts on attracting customers who are likely to have a higher CLTV.

4.4. CLTV:CAC as a Strategic Tool

The CLTV:CAC ratio is not just a metric; it’s a strategic tool that can guide your business decisions. By monitoring and analyzing this ratio, you can:

- Identify Profitable Marketing Channels: Determine which marketing channels are generating the highest-value customers.

- Optimize Customer Acquisition Strategies: Refine your customer acquisition strategies to attract more high-value customers at a lower cost.

- Make Informed Investment Decisions: Make informed decisions about investing in customer acquisition and retention initiatives.

5. Common Mistakes in Calculating and Interpreting CAC

Calculating and interpreting Customer Acquisition Cost (CAC) accurately is essential for making informed business decisions. However, many companies make common mistakes that can lead to inaccurate results and misguided strategies.

5.1. Not Including All Relevant Costs

One of the most common mistakes is failing to include all relevant costs associated with customer acquisition. This can result in an artificially low CAC, leading to overspending on inefficient marketing channels.

Solution:

- Use the complex CAC calculation method to ensure you account for all expenses, including marketing and advertising costs, sales salaries and commissions, software costs, professional services, and overhead expenses.

5.2. Ignoring the Time Factor

CAC is often calculated without considering the time it takes to acquire a customer. This can be misleading, especially for businesses with long sales cycles.

Solution:

- Track the time it takes to convert a lead into a customer and factor this into your CAC calculation.

- Analyze CAC on a cohort basis to understand how acquisition costs vary over time.

5.3. Not Segmenting CAC by Channel

Calculating an overall CAC without segmenting it by channel can mask significant differences in the cost-effectiveness of different marketing strategies.

Solution:

- Calculate CAC separately for each marketing channel (e.g., social media, email marketing, paid advertising) to identify the most efficient channels.

- Allocate your marketing budget based on the performance of each channel.

5.4. Confusing CAC with Cost Per Lead (CPL)

CAC and Cost Per Lead (CPL) are related but distinct metrics. CPL measures the cost of generating a lead, while CAC measures the cost of acquiring a paying customer.

Solution:

- Track both CAC and CPL to understand the entire customer acquisition process.

- Optimize your lead generation and conversion strategies to improve both CPL and CAC.

5.5. Not Accounting for Customer Churn

High customer churn rates can significantly impact your CAC. If you are losing customers quickly, you will need to acquire new customers to replace them, driving up your acquisition costs.

Solution:

- Monitor your customer churn rate and identify the reasons why customers are leaving.

- Implement strategies to improve customer retention and reduce churn.

5.6. Ignoring the Impact of Seasonality

Seasonality can affect both customer acquisition costs and customer acquisition rates. Ignoring these seasonal fluctuations can lead to inaccurate CAC calculations.

Solution:

- Analyze CAC on a monthly or quarterly basis to identify seasonal trends.

- Adjust your marketing strategies to account for seasonal fluctuations.

5.7. Not Considering the Impact of Discounts and Promotions

Discounts and promotions can attract new customers, but they can also reduce the revenue generated by each customer, impacting your overall profitability.

Solution:

- Factor the impact of discounts and promotions into your CAC calculation.

- Analyze the long-term impact of discounts and promotions on customer lifetime value.

5.8. Relying on Inaccurate Data

Inaccurate data can lead to flawed CAC calculations and misguided business decisions.

Solution:

- Ensure your data is accurate and up-to-date.

- Use reliable data sources and tracking tools.

- Regularly audit your data to identify and correct any errors.

6. CAC in Different Industries

Customer Acquisition Cost (CAC) can vary significantly across different industries due to factors such as competition, market maturity, product complexity, and customer behavior. Understanding how CAC differs in various industries can provide valuable insights for benchmarking your own performance and developing effective acquisition strategies.

6.1. E-commerce

In the e-commerce industry, CAC is often driven by online advertising, social media marketing, and search engine optimization. The industry is highly competitive, with numerous players vying for customer attention.

- Factors Affecting CAC: High competition, reliance on online advertising, and the need for effective customer retention strategies.

- Common Strategies: Paid advertising, social media marketing, email marketing, and content marketing.

6.2. SaaS (Software as a Service)

SaaS companies typically have higher CACs than e-commerce businesses due to longer sales cycles and the need for extensive customer onboarding and support.

- Factors Affecting CAC: Longer sales cycles, high customer acquisition cost because sales processes are longer and more complex, and the need for ongoing customer support.

- Common Strategies: Content marketing, inbound marketing, free trials, and partner programs.

6.3. Healthcare

The healthcare industry faces unique challenges in customer acquisition due to regulatory constraints and the need for trust and credibility.

- Factors Affecting CAC: Regulatory constraints, need for trust and credibility, and longer sales cycles.

- Common Strategies: Content marketing, patient referrals, and community outreach.

6.4. Finance

The finance industry is highly competitive, with numerous players offering similar products and services. Building trust and credibility is essential for attracting new customers.

- Factors Affecting CAC: High competition, the need for trust and credibility, and regulatory requirements.

- Common Strategies: Content marketing, referral programs, and partnerships.

6.5. Real Estate

The real estate industry relies heavily on personal relationships and local marketing efforts to acquire new customers.

- Factors Affecting CAC: Reliance on personal relationships, local market conditions, and longer sales cycles.

- Common Strategies: Referral programs, local advertising, and community involvement.

6.6. Education

The education sector utilizes diverse strategies to attract students, from digital marketing to traditional outreach.

- Factors Affecting CAC: The reputation of the institution, quality of programs, and career prospects.

- Common Strategies: Digital marketing, participation in educational fairs, and alumni referrals.

6.7. Benchmarking Your CAC

Benchmarking your CAC against industry averages can provide valuable insights into your performance. However, it is important to consider the specific characteristics of your business and target market when comparing your CAC to industry benchmarks.

7. The Future of Customer Acquisition Cost

The landscape of customer acquisition is constantly evolving, driven by technological advancements, changing consumer behavior, and increased competition. Understanding the future trends in customer acquisition can help businesses prepare for the challenges and opportunities ahead.

7.1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming customer acquisition by enabling businesses to personalize marketing messages, predict customer behavior, and automate marketing tasks.

- Personalized Marketing: AI can analyze customer data to create highly personalized marketing messages that resonate with individual customers.

- Predictive Analytics: ML can predict which leads are most likely to convert into customers, allowing businesses to focus their efforts on the most promising prospects.

- Automated Marketing: AI can automate marketing tasks such as email marketing, social media marketing, and lead nurturing, freeing up marketers to focus on more strategic initiatives.

7.2. Augmented Reality (AR) and Virtual Reality (VR)

AR and VR are creating new opportunities for businesses to engage with customers and showcase their products in immersive and interactive ways.

- Interactive Product Demos: AR and VR can allow customers to experience products in a virtual environment, providing a more engaging and informative product demonstration.

- Virtual Storefronts: AR and VR can create virtual storefronts that allow customers to browse and purchase products from the comfort of their own homes.

7.3. Voice Search Optimization

With the increasing popularity of voice assistants like Siri and Alexa, optimizing your content for voice search is becoming increasingly important.

- Conversational Keywords: Focus on using conversational keywords that people are likely to use when speaking to a voice assistant.

- Long-Tail Keywords: Target long-tail keywords that answer specific questions.

- Local SEO: Optimize your local SEO to ensure your business appears in local voice search results.

7.4. Increased Focus on Customer Retention

As customer acquisition costs continue to rise, businesses are increasingly focusing on customer retention as a more cost-effective way to grow their business.

- Personalized Customer Experience: Provide a personalized customer experience that makes customers feel valued and appreciated.

- Proactive Customer Support: Offer proactive customer support to address any questions or issues customers may encounter.

- Loyalty Programs: Implement loyalty programs to reward customers for their continued business.

7.5. Data Privacy and Security

With increasing concerns about data privacy and security, businesses need to be transparent about how they collect and use customer data.

- Obtain Consent: Obtain explicit consent from customers before collecting their data.

- Be Transparent: Be transparent about how you use customer data.

- Protect Customer Data: Implement security measures to protect customer data from unauthorized access.

8. Customer Acquisition Cost FAQs

Here are some frequently asked questions about Customer Acquisition Cost (CAC):

| Question | Answer |

|---|---|

| What is a good CAC? | A good CAC depends on the industry and business model, but generally, a CLTV:CAC ratio of 3:1 or higher is considered healthy. |

| How can I reduce my CAC? | Optimize your marketing funnel, improve customer onboarding, enhance customer experience, leverage content marketing, implement customer referral programs, utilize social media marketing, and optimize your pricing strategy. |

| What is the difference between CAC and CPL? | CPL (Cost Per Lead) measures the cost of generating a lead, while CAC (Customer Acquisition Cost) measures the cost of acquiring a paying customer. |

| How do I calculate CAC for different channels? | Calculate the total cost spent on each marketing channel and divide it by the number of customers acquired through that channel. |

| Why is it important to track CAC? | Tracking CAC helps you understand the efficiency and profitability of your marketing efforts, optimize your marketing spend, and make informed business decisions. |

| What is CLTV and how does it relate to CAC? | CLTV (Customer Lifetime Value) is a prediction of the net profit attributed to the entire future relationship with a customer. A healthy business typically has a CLTV that is significantly higher than its CAC, ideally a ratio of 3:1 or higher. |

| What are some common mistakes in CAC calculation? | Not including all relevant costs, ignoring the time factor, not segmenting CAC by channel, confusing CAC with CPL, not accounting for customer churn, ignoring the impact of seasonality, not considering the impact of discounts and promotions, and relying on inaccurate data. |

| How can AI and ML impact CAC? | AI and ML can personalize marketing messages, predict customer behavior, and automate marketing tasks, improving customer acquisition efficiency and reducing CAC. |

| How do changing data privacy regulations affect CAC? | Stricter data privacy regulations require businesses to obtain explicit consent from customers before collecting their data and to be transparent about how they use customer data, which can impact the effectiveness of certain marketing strategies and increase CAC. |

| What are some emerging trends in customer acquisition? | Increased focus on personalization, automation, AI, voice search optimization, and customer retention. |

9. Need Help Understanding Your Customer Acquisition Cost?

Navigating the complexities of Customer Acquisition Cost can be challenging. At WHAT.EDU.VN, we understand the importance of having a clear understanding of your CAC. If you’re struggling to calculate, interpret, or reduce your CAC, we’re here to help.

We offer a free consultation service where our experts can answer your questions and provide personalized guidance. Whether you’re unsure about which costs to include in your calculation, need help optimizing your marketing funnel, or want to explore strategies for improving your CLTV:CAC ratio, we’ve got you covered.

Don’t let a high CAC hold you back from achieving your business goals.

Contact us today to schedule your free consultation:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- WhatsApp: +1 (206) 555-7890

- Website: WHAT.EDU.VN

We’re committed to providing you with the knowledge and support you need to succeed. Ask your questions now on what.edu.vn and get the answers you need to optimize your customer acquisition efforts and drive sustainable growth.