What Is Considered Good Credit? It’s a question many people ask, and at WHAT.EDU.VN, we’re here to provide you with a clear and concise answer. A favorable credit standing, often reflected in your credit score, can unlock numerous financial opportunities and advantages. Maintaining healthy credit habits is essential for long-term financial well-being. Let’s explore the nuances of credit scores, creditworthiness, and how to achieve and maintain a good credit rating. If you have any questions, remember you can always ask for free on WHAT.EDU.VN.

1. Understanding Credit Scores: An Overview

Credit scores are numerical representations of your creditworthiness, reflecting your history of borrowing and repaying debt. These scores are used by lenders to assess the risk of extending credit to you. Generally, a higher credit score indicates a lower risk, leading to better loan terms and interest rates. Let’s dive into what makes up a good credit score and its importance.

2. What Is a Good FICO® Score?

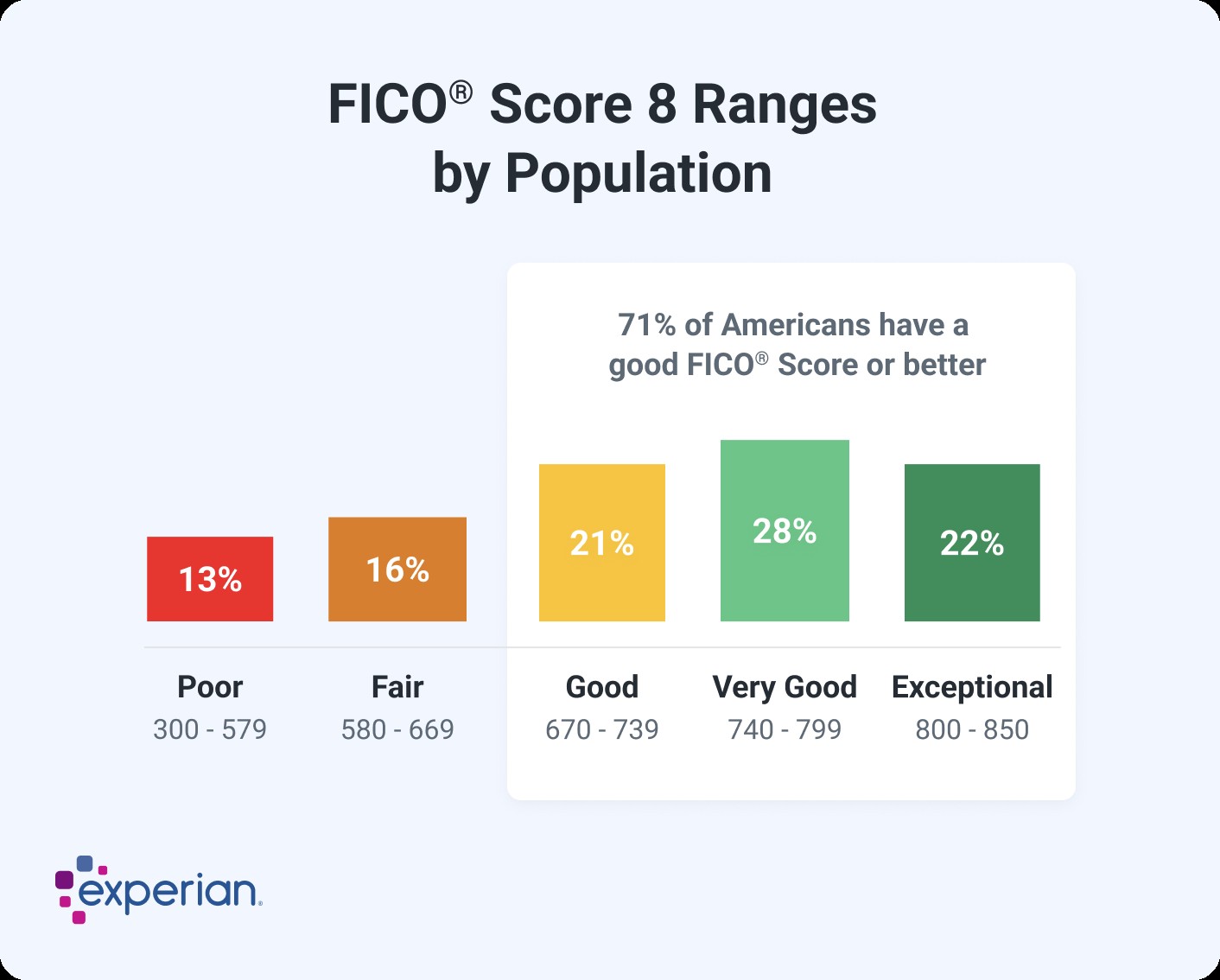

FICO® Scores are among the most widely used credit scores in the United States. They range from 300 to 850, with different ranges indicating different levels of creditworthiness.

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

A FICO® Score between 670 and 739 is generally considered good, while a score above 740 is considered very good or exceptional. Achieving a good FICO® Score can significantly improve your chances of getting approved for loans, credit cards, and other financial products with favorable terms.

Alt: Credit score ranges based on FICO Score 8 showing distribution of Americans in each range.

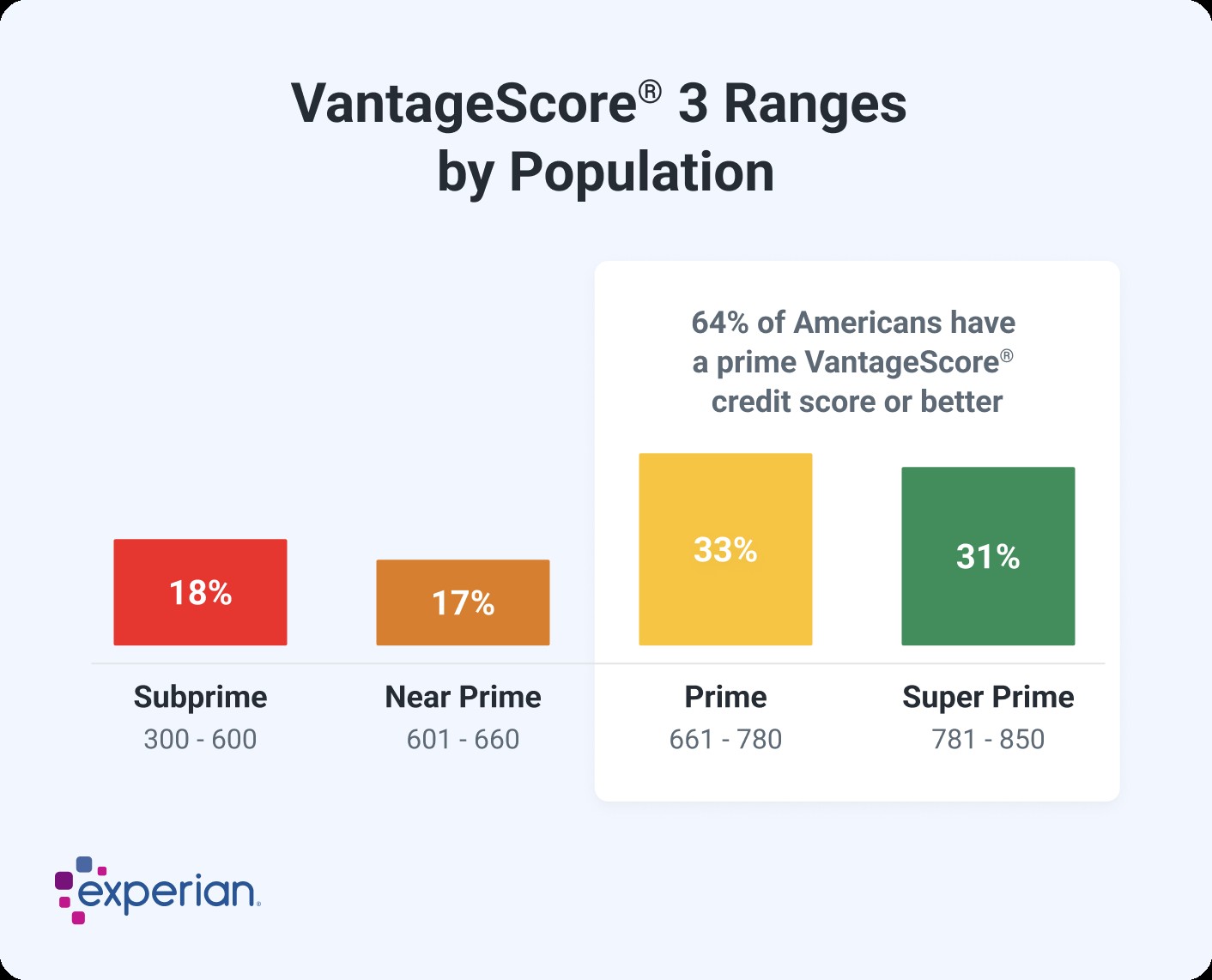

3. What Is a Good VantageScore Credit Score?

VantageScore is another popular credit scoring model, also ranging from 300 to 850. While the ranges are similar to FICO®, the specific cutoffs for each category differ slightly.

- Poor: 300-600

- Fair: 601-660

- Good: 661-780

- Excellent: 781-850

According to the VantageScore model, a score between 661 and 780 is considered good. Like FICO® Scores, a higher VantageScore can lead to better financial opportunities.

Alt: Credit score ranges based on VantageScore 3 showing distribution of Americans in each range.

4. Factors Affecting Your Credit Scores

Several factors influence your credit scores. Understanding these factors can help you take proactive steps to improve and maintain a good credit rating.

4.1. Payment History

Your payment history is one of the most critical factors in determining your credit score. Making on-time payments consistently demonstrates your reliability as a borrower. Late or missed payments can negatively impact your credit score.

4.2. Amounts Owed (Credit Utilization)

The amount of debt you owe relative to your available credit, known as credit utilization, is another significant factor. Keeping your credit utilization low (ideally below 30%) indicates that you are managing your credit responsibly.

4.3. Length of Credit History

The length of time you have been using credit also plays a role in your credit score. A longer credit history generally indicates a more established track record of responsible credit management.

4.4. Credit Mix

Having a mix of different types of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact your credit score. It demonstrates your ability to manage various types of credit.

4.5. New Credit

Opening too many new credit accounts in a short period can lower your credit score. Each credit application results in a hard inquiry, which can temporarily lower your score.

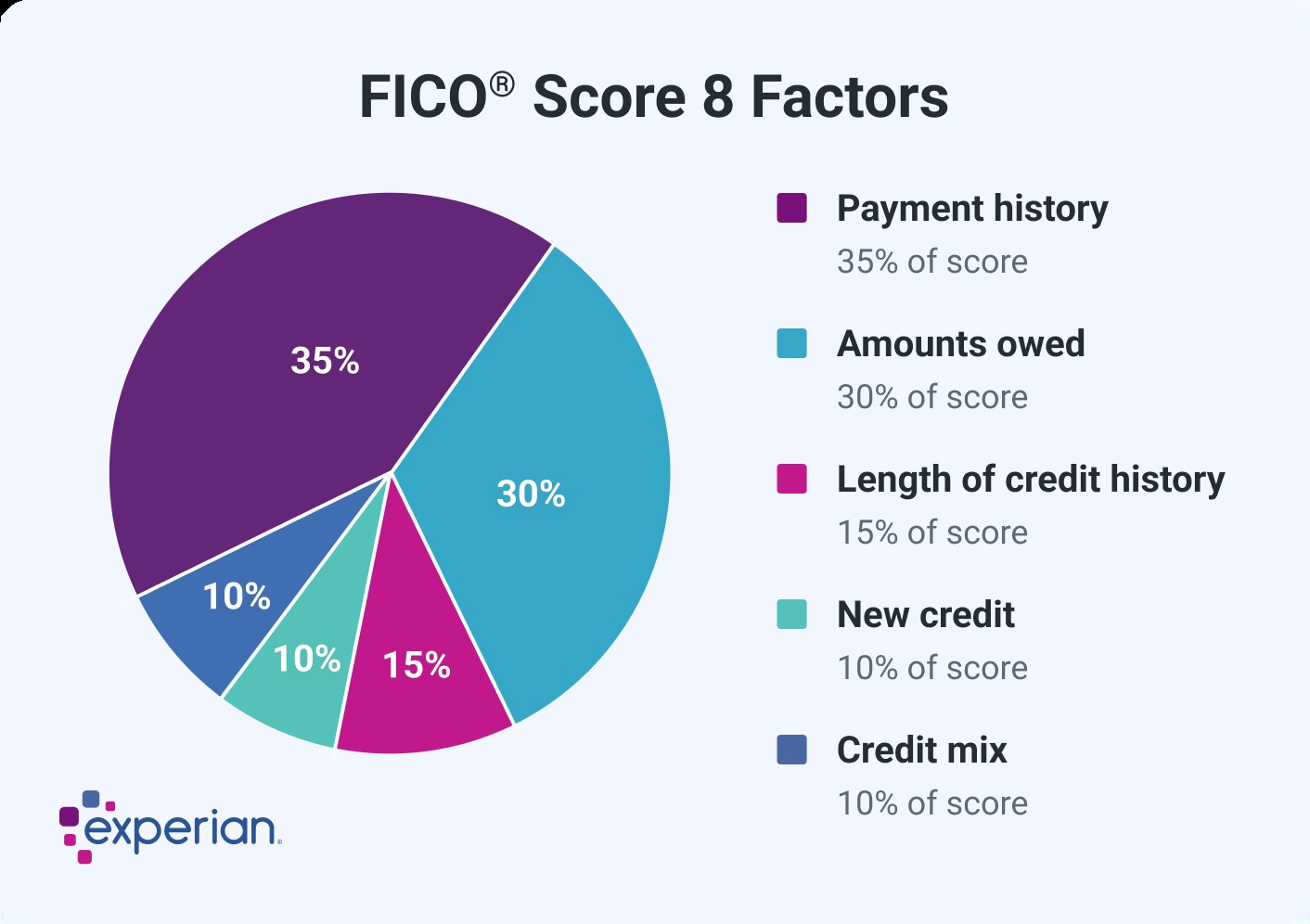

5. FICO® Score Factors in Detail

FICO® provides a breakdown of how each factor contributes to your credit score. While the exact percentages may vary based on your credit profile, the general breakdown is as follows:

- Payment History: 35%

- Amounts Owed: 30%

- Length of Credit History: 15%

- Credit Mix: 10%

- New Credit: 10%

Alt: Pie chart showing FICO Score 8 factors and their influence on credit scores.

6. VantageScore Credit Score Factors in Detail

VantageScore also considers similar factors, but it ranks them by influence rather than assigning specific percentages.

| VantageScore Credit Scoring Factor | Importance |

|---|---|

| Payment History | Extremely Influential |

| Total Credit Usage | Highly Influential |

| Credit Mix and Experience | Highly Influential |

| New Accounts Opened | Moderately Influential |

| Balances and Available Credit | Less Influential |

7. Factors Not Considered in Credit Scores

It’s important to note that certain factors are not considered when calculating credit scores. These include:

- Race

- Religion

- National origin

- Gender

- Marital status

- Income

- Employment history

Credit scores are solely based on your credit behavior and history.

8. What Is a Good Credit Score to Buy a House?

A good credit score is crucial when applying for a mortgage to buy a house. Lenders use your credit score to determine your eligibility for a loan and the interest rate you will receive. Aiming for a credit score in the good range or higher can increase your chances of approval and secure a lower interest rate.

Generally, a FICO® Score of at least 670 is considered good for buying a house. However, the specific requirements may vary depending on the lender and the type of mortgage you are seeking.

8.1. Minimum Credit Scores for Different Mortgages

| Mortgage Type | Minimum Credit Score |

|---|---|

| Conventional Mortgage | 620 |

| FHA Loan | 500-579 (with 10% down payment), 580+ (with 3.5% down payment) |

| USDA Loan | 580-620 (may be required by lenders) |

| VA Loan | 620+ (generally required by lenders) |

It’s also important to remember that even if you meet the minimum credit score requirement, a higher score can result in better loan terms and lower interest rates, saving you a significant amount of money over the life of the loan.

9. What Is a Good Credit Score to Buy a Car?

Similar to buying a house, having a good credit score can significantly benefit you when purchasing a car. A higher credit score can help you qualify for lower interest rates on auto loans, reducing your monthly payments and the total cost of the vehicle.

A VantageScore of 661 or higher is generally considered a good credit score for an auto loan. However, as with mortgages, lenders may have different requirements, and a higher score can lead to more favorable terms.

9.1. Impact of Credit Score on Auto Loan Interest Rates

| Credit Score Range | Average Interest Rate |

|---|---|

| 720-850 | Lowest |

| 690-719 | Lower |

| 661-689 | Moderate |

| 620-660 | Higher |

| 300-619 | Highest |

As the table illustrates, a higher credit score can result in significantly lower interest rates on auto loans.

10. Why There Are Different Credit Scores

You might be wondering why there are multiple credit scoring models and why your credit scores may vary across different agencies. The reason is that credit scoring companies continually update and refine their models to better assess risk.

10.1. FICO® and VantageScore

FICO® and VantageScore are the two main credit scoring companies, each offering different versions of their scoring models. Lenders can choose which model they want to use when evaluating credit applications. This can result in different credit scores for the same individual.

10.2. Different Versions of Credit Scores

Both FICO® and VantageScore periodically release new versions of their credit scores to incorporate technological advances and changes in consumer behavior. Lenders can then decide whether to upgrade to a newer model or stick with an older version that is already integrated into their systems.

11. VantageScore’s Different Credit Scores: A Comparison

| Feature | VantageScore 3.0 | VantageScore 4.0 | VantageScore 4plus |

|---|---|---|---|

| Considers Credit Report Data Only | Yes | Yes | No |

| Considers Trended Data | No | Yes | Yes |

| Considers Banking Data | No | No | Yes |

VantageScore 4plus is the newest model and can consider banking data to provide a more comprehensive credit assessment.

12. FICO’s Different Credit Scores: An Overview

FICO® offers various types of credit scores tailored to different industries and purposes. These include:

- Base FICO® Scores: Used by any type of lender to predict the likelihood of falling behind on any type of credit obligation.

- Industry-Specific FICO® Scores: Tailored for auto lenders and credit card issuers, predicting the likelihood of falling behind on those specific types of accounts.

- FICO® Scores Using Alternative Data: Incorporate alternative credit data, such as deposit account information or telecom and utility payments, to score individuals with limited credit histories.

13. How Creditors Choose Which Credit Scores to Use

Lenders have the flexibility to choose which credit reports and scores to use when evaluating credit applications. They may consider various factors when making this decision, such as the type of loan, their internal risk assessment policies, and their experience with different scoring models.

14. The Importance of Having a Good Credit Score

Having a good credit score can make achieving your financial goals easier. It can be the difference between qualifying or being denied for a loan, securing a lower interest rate, and accessing better financial opportunities.

14.1. Impact on Mortgage Rates

| FICO® Score | Interest Rate (30-Year Fixed) | Monthly Payment | Total Interest Cost |

|---|---|---|---|

| 620 | 7.71% | $2,806.11 | $549,199 |

| 700 | 7.13% | $2,667.53 | $499,310 |

| 840 | 6.69% | $2,564.49 | $462,214 |

As the table illustrates, a better credit score can save you tens of thousands of dollars in interest payments over the life of a mortgage.

14.2. Non-Lending Decisions

Credit scores can also impact non-lending decisions, such as whether a landlord will rent you an apartment or whether an employer will hire you.

14.3. Insurance Premiums

In some states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home, and life insurance.

15. How to Improve Your Credit Scores

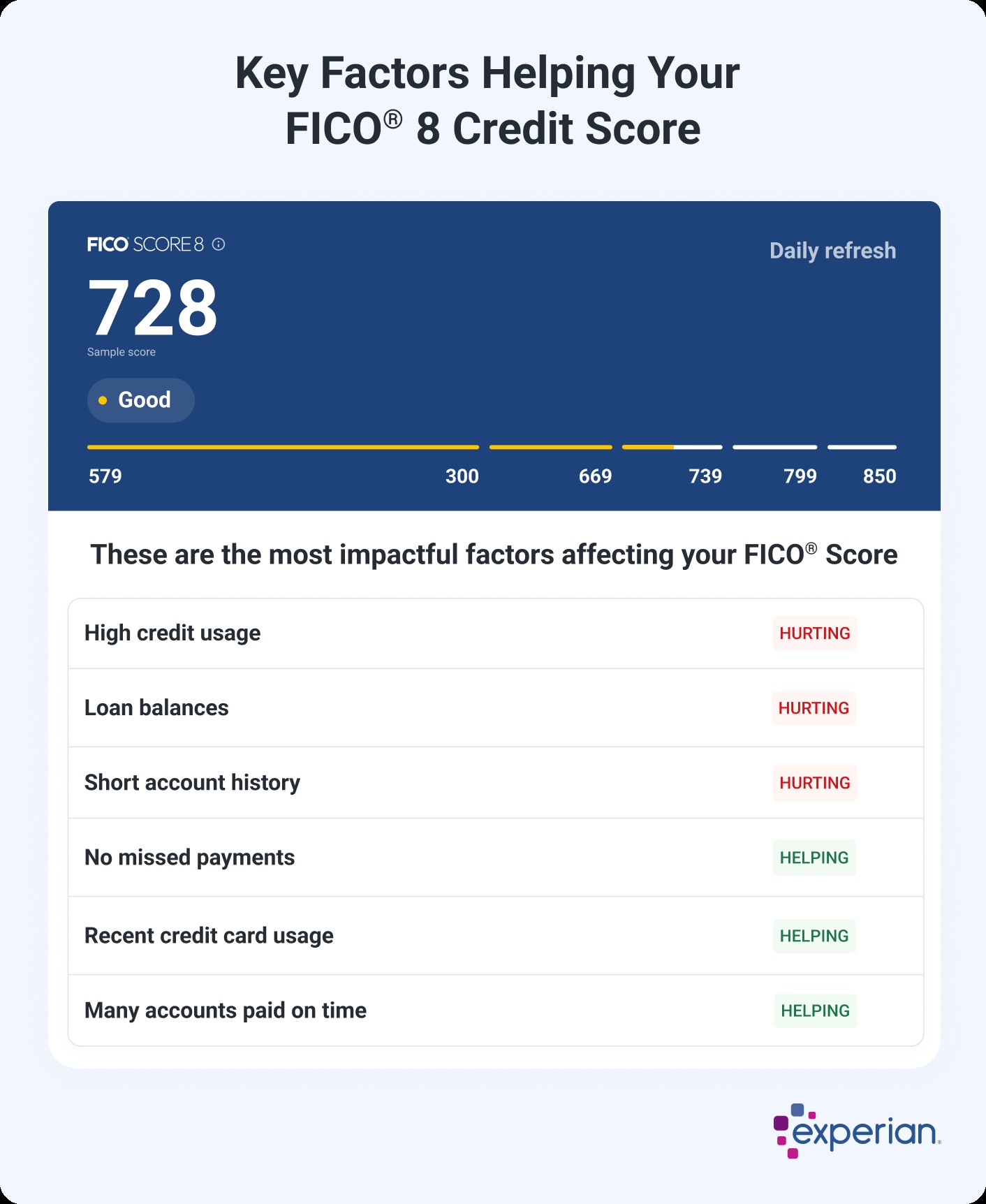

Improving your credit score requires a strategic approach focused on addressing the underlying factors that affect your score.

15.1. Pay Bills on Time

Consistently paying your bills on time is the most important step you can take to improve your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

15.2. Lower Your Credit Utilization

Keeping your credit utilization low can significantly boost your credit score. Aim to use no more than 30% of your available credit.

15.3. Check Your Credit Report for Errors

Regularly review your credit report for errors or inaccuracies. If you find any mistakes, dispute them with the credit bureau to have them corrected.

15.4. Avoid Opening Too Many New Accounts

Opening too many new credit accounts in a short period can lower your credit score. Be selective about applying for new credit.

15.5. Maintain a Mix of Credit Accounts

Having a mix of different types of credit accounts can improve your credit score. However, don’t open new accounts solely for the purpose of diversifying your credit mix.

Alt: Graphic showing factors that influence a FICO Score 8, highlighting the importance of payment history.

16. What to Do if You Don’t Have a Credit Score

If you have no credit history, you may not have a credit score. This can make it difficult to get approved for loans or credit cards.

16.1. Establishing Credit

To establish credit, you can:

- Apply for a secured credit card

- Become an authorized user on someone else’s credit card

- Take out a credit-builder loan

16.2. Requirements for FICO® Scores

To generate a FICO® Score, you need:

- An account that is at least six months old

- An account that has been active in the past six months

16.3. Requirements for VantageScore

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

17. Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to fluctuate over time.

17.1. Reasons for an Increase

- Negative items fall off your credit report

- You lower your credit utilization rate

- You pay off or settle collection accounts

- You add new on-time payments to your credit report

17.2. Reasons for a Decrease

- A credit card or loan payment becomes 30 days past due

- Your credit utilization rate increases

- You apply for or open a new credit account

- You file for bankruptcy

Alt: Graphic showing key factors helping and hurting a FICO 8 credit score.

18. Monitoring Your Credit Report and Score

Regularly monitoring your credit report and score is essential for maintaining good credit. It allows you to track your progress, identify potential problems, and take corrective action as needed.

18.1. Free Credit Monitoring

You can check and monitor your FICO® Score and credit report for free from Experian, with daily updates and real-time alerts for suspicious changes in your report.

19. Frequently Asked Questions (FAQ)

Here are some frequently asked questions about credit scores and what is considered good credit:

| Question | Answer |

|---|---|

| What is the difference between a FICO® Score and a VantageScore? | FICO® and VantageScore are two different credit scoring models. While they both use a range of 300 to 850, the specific factors and weightings they use to calculate your score may differ. |

| How often should I check my credit score? | It’s a good idea to check your credit score at least once a year. However, you may want to check it more frequently if you are planning to apply for a loan or credit card. |

| What is a good credit utilization rate? | A good credit utilization rate is generally below 30%. This means you should aim to use no more than 30% of your available credit on each credit card. |

| How long does it take to improve my credit score? | The time it takes to improve your credit score can vary depending on your individual circumstances. However, by following the steps outlined above, you can start to see improvements within a few months. |

| Can I get a loan with bad credit? | It may be possible to get a loan with bad credit, but you will likely pay a higher interest rate and have less favorable terms. It’s generally better to improve your credit score before applying for a loan. |

| What is a secured credit card? | A secured credit card is a type of credit card that requires you to put down a security deposit. The deposit typically serves as your credit limit. Secured credit cards can be a good way to establish credit. |

| How do I dispute an error on my credit report? | To dispute an error on your credit report, you will need to contact the credit bureau that issued the report. You can typically do this online or by mail. |

| Does closing a credit card account hurt my credit score? | Closing a credit card account can potentially hurt your credit score, especially if it reduces your overall available credit or shortens your credit history. |

| Can I remove negative items from my credit report? | Negative items can stay on your credit report for up to seven years (or ten years for bankruptcies). However, if an item is inaccurate, you can dispute it with the credit bureau. |

| What is the impact of a hard inquiry on my credit score? | A hard inquiry can temporarily lower your credit score. However, the impact is usually minimal and will typically disappear within a few months. |

20. Call to Action

Do you have more questions about what is considered good credit? Are you struggling to understand your credit score and how to improve it? Don’t worry! WHAT.EDU.VN is here to help. We offer a free platform where you can ask any question and receive prompt, accurate answers from knowledgeable experts.

20.1. Why Choose WHAT.EDU.VN?

- Free Service: Ask any question without incurring any fees.

- Quick Answers: Get timely responses to your queries.

- Expert Advice: Receive guidance from experienced professionals.

- Easy to Use: Our platform is user-friendly and accessible to everyone.

- Community Support: Connect with a community of users to share knowledge and insights.

20.2. Contact Us

Address: 888 Question City Plaza, Seattle, WA 98101, United States

WhatsApp: +1 (206) 555-7890

Website: WHAT.EDU.VN

Don’t let credit score confusion hold you back. Visit WHAT.EDU.VN today and get the answers you need to achieve your financial goals. Whether you’re planning to buy a home, purchase a car, or simply want to improve your financial health, we’re here to support you every step of the way. Start asking questions and unlock the power of knowledge with what.edu.vn.