What Is Fit On My Paycheck? FIT, or Federal Income Tax, taxable wages, is the portion of your earnings subject to federal income tax withholding. Understanding this figure is crucial for managing your finances effectively. This comprehensive guide from WHAT.EDU.VN breaks down the concept, its practical implications, and how it differs from your gross wages. Learn about tax liability, financial planning, tax optimization, avoiding surprises, and retirement planning.

Table Of Contents

- Understanding FIT Taxable Wages

- Practical Meaning of FIT Taxable Wages

- FIT Taxable Wages vs. Gross Wages

- Factors Influencing FIT Taxable Wages

- Calculating FIT Taxable Wages

- Impact of Pre-Tax Deductions on FIT

- How Non-Taxable Benefits Affect FIT

- The Role of Tax Credits in FIT Calculations

- Strategies to Optimize Your FIT Taxable Wages

- Common Mistakes to Avoid with FIT

- Resources for Understanding FIT Taxable Wages

- Frequently Asked Questions (FAQs) about FIT Taxable Wages

- The Future of FIT Taxable Wages

- Seeking Professional Advice on FIT

- Conclusion: Mastering Your Paycheck

1. Understanding FIT Taxable Wages

FIT taxable wages are the part of your income that the federal government taxes. It’s the amount used to calculate your federal income tax withholding. Essentially, it’s the earnings base upon which your federal income tax liability is determined. This figure is found on your pay stub and is critical for understanding how much of your paycheck goes towards federal taxes. Accurately understanding these wages can empower you to manage your financial life better.

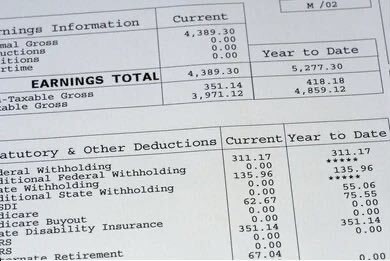

Paycheck Example with FIT Highlighted

Paycheck Example with FIT Highlighted

1.1 What Does FIT Stand For?

FIT stands for Federal Income Tax. It represents the tax levied by the U.S. federal government on an individual’s taxable income. This tax is used to fund various federal programs and services, such as national defense, infrastructure, and social security.

1.2 How Are FIT Taxable Wages Determined?

FIT taxable wages are determined by starting with your gross wages and then subtracting certain deductions and exemptions. These deductions can include contributions to retirement accounts, health insurance premiums, and other pre-tax benefits. The resulting figure is your FIT taxable wage.

1.3 Why Is It Important to Understand FIT?

Understanding FIT taxable wages is important for several reasons. First, it helps you understand how much of your income is subject to federal income tax. Second, it allows you to plan your finances more effectively. Third, it empowers you to make informed decisions about your benefits and deductions. Understanding your federal tax liability can contribute to informed financial decisions.

2. Practical Meaning of FIT Taxable Wages

FIT taxable wages have significant practical implications for employees. These wages directly affect your take-home pay, tax liability, and financial planning. Knowing how these wages are calculated and what factors influence them allows you to make informed decisions to optimize your financial well-being.

2.1 Impact on Take-Home Pay

The amount of federal income tax withheld from your paycheck is directly related to your FIT taxable wages. Higher taxable wages generally result in higher tax withholdings and lower take-home pay.

2.2 Determining Tax Liability

Your FIT taxable wages are used to calculate your federal income tax liability at the end of the year. This figure, along with any tax credits or deductions you claim, determines whether you owe additional taxes or receive a refund.

2.3 Aiding Financial Planning

Knowing your approximate FIT taxable wages can help you create a more accurate budget and financial plan. This allows you to anticipate your tax obligations and plan accordingly.

2.4 Strategic Decision Making

Understanding which factors influence your taxable wages puts you in a better position to make strategic decisions. These decisions include those regarding pre-tax deductions and benefits, potentially minimizing the impact of these taxes.

2.5 Avoiding Financial Surprises

Tracking your taxable wages for the year allows you to avoid tax-related surprises, such as unexpected tax bills. Regular tracking is a sound financial habit.

3. FIT Taxable Wages vs. Gross Wages

It’s common to confuse FIT taxable wages with gross wages. While related, they are not the same. Gross wages represent your total earnings before any deductions, while FIT taxable wages are the portion of your gross wages subject to federal income tax.

3.1 Definition of Gross Wages

Gross wages include your base salary or hourly rate, overtime pay, bonuses, commissions, and other forms of compensation paid by your employer. It’s the total amount you earn before any deductions or taxes are taken out.

3.2 Definition of FIT Taxable Wages

FIT taxable wages are the portion of your gross wages subject to federal income tax. This amount is generally lower than your gross wages due to deductions and exemptions.

3.3 Key Differences Explained

The main differences between gross wages and FIT taxable wages lie in the deductions and exemptions applied. Common pre-tax deductions, such as contributions to retirement accounts and health insurance premiums, are subtracted from your gross wages to arrive at your FIT taxable wages. Non-taxable benefits, such as certain types of educational assistance or life insurance coverage, are also excluded from taxable wages.

| Feature | Gross Wages | FIT Taxable Wages |

|---|---|---|

| Definition | Total earnings before deductions | Portion of gross wages subject to federal income tax |

| Includes | Salary, hourly rate, overtime, bonuses | Gross wages minus deductions and exemptions |

| Impact on Taxes | Used to calculate total income | Used to calculate federal income tax withholding |

| Key Differences | Before deductions | After deductions |

3.4 Example Illustrating the Difference

Let’s say Sarah’s gross salary is $5,000 per month. She contributes $500 to her 401(k) and pays $300 in health insurance premiums. In this case, her gross wages are $5,000, while her FIT taxable wages are $4,200 ($5,000 – $500 – $300).

4. Factors Influencing FIT Taxable Wages

Several factors can influence your FIT taxable wages, including your income level, filing status, deductions, and exemptions. Understanding these factors can help you manage your tax liability more effectively.

4.1 Income Level

The higher your income, the higher your FIT taxable wages will generally be. As your income increases, you may also move into higher tax brackets, resulting in a larger percentage of your income being subject to federal income tax.

4.2 Filing Status

Your filing status (e.g., single, married filing jointly, head of household) can also affect your FIT taxable wages. Different filing statuses have different standard deductions and tax brackets, which can impact your overall tax liability.

4.3 Deductions

Deductions, such as contributions to retirement accounts, health savings accounts (HSAs), and itemized deductions, can reduce your FIT taxable wages. By claiming these deductions, you can lower your tax liability.

4.4 Exemptions

Exemptions, such as personal exemptions and dependent exemptions, can also reduce your FIT taxable wages. However, personal and dependent exemptions have been suspended for tax years 2018 through 2025.

4.5 Tax Law Changes

Changes in tax laws can also impact your FIT taxable wages. Tax laws are subject to change, and these changes can affect the amount of income that is subject to federal income tax.

5. Calculating FIT Taxable Wages

Calculating your FIT taxable wages involves starting with your gross wages and subtracting any applicable deductions and exemptions. Here’s a step-by-step guide to calculating your FIT taxable wages:

5.1 Step-by-Step Guide

- Determine Your Gross Wages: Calculate your total earnings for the pay period, including salary, hourly rate, overtime, bonuses, and commissions.

- Identify Pre-Tax Deductions: Identify any pre-tax deductions, such as contributions to retirement accounts, health insurance premiums, and flexible spending accounts (FSAs).

- Subtract Pre-Tax Deductions: Subtract the total amount of pre-tax deductions from your gross wages.

- Calculate Taxable Wages: The resulting figure is your FIT taxable wages.

5.2 Common Deductions

Common deductions that can reduce your FIT taxable wages include:

- 401(k) contributions

- Health insurance premiums

- Health savings account (HSA) contributions

- Flexible spending account (FSA) contributions

- Traditional IRA contributions (if deductible)

- Student loan interest (up to a certain limit)

5.3 Utilizing Online Calculators

Several online calculators can help you estimate your FIT taxable wages. These calculators typically require you to enter your gross wages, filing status, and deductions. While these tools provide an estimate, consult a tax professional for precise calculations.

6. Impact of Pre-Tax Deductions on FIT

Pre-tax deductions are a valuable tool for reducing your FIT taxable wages. These deductions are subtracted from your gross wages before taxes are calculated, lowering your tax liability.

6.1 What Are Pre-Tax Deductions?

Pre-tax deductions are deductions that are taken from your gross wages before federal income tax is calculated. This means that you don’t pay federal income tax on the amount you contribute to these accounts.

6.2 Common Pre-Tax Deductions Explained

Common pre-tax deductions include contributions to:

- 401(k) or other Retirement Plans: Contributions to these plans are typically made before taxes, reducing your current taxable income.

- Health Insurance Premiums: Many employers offer pre-tax health insurance premiums, which can significantly lower your taxable wages.

- Flexible Spending Accounts (FSAs): Contributions to FSAs for medical or dependent care expenses are also pre-tax.

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, contributions to an HSA are also pre-tax.

6.3 Benefits of Utilizing Pre-Tax Deductions

Utilizing pre-tax deductions offers several benefits, including:

- Lowering your FIT taxable wages

- Reducing your federal income tax liability

- Saving money on taxes

- Saving for retirement or other financial goals

6.4 Maximizing Your Pre-Tax Deductions

To maximize your pre-tax deductions, consider contributing the maximum amount allowed to your retirement accounts, health savings accounts, and flexible spending accounts.

Alt: Illustration showing money flowing into pre-tax deduction accounts, reducing the taxable income.

7. How Non-Taxable Benefits Affect FIT

Non-taxable benefits are another way to reduce your FIT taxable wages. These benefits are excluded from your taxable income, lowering your tax liability.

7.1 What Are Non-Taxable Benefits?

Non-taxable benefits are benefits that are not subject to federal income tax. This means that you don’t pay federal income tax on the value of these benefits.

7.2 Common Non-Taxable Benefits Explained

Common non-taxable benefits include:

- Employer-Provided Health Insurance: The value of employer-provided health insurance coverage is generally not taxable to employees.

- Life Insurance Coverage: Up to a certain amount, employer-provided life insurance coverage is not taxable.

- Dependent Care Assistance: Employer-provided dependent care assistance, such as childcare benefits, may be non-taxable up to a certain limit.

- Educational Assistance: Certain types of employer-provided educational assistance may be non-taxable.

7.3 Benefits of Utilizing Non-Taxable Benefits

Utilizing non-taxable benefits offers several advantages, including:

- Lowering your FIT taxable wages

- Reducing your federal income tax liability

- Receiving valuable benefits tax-free

7.4 Maximizing Your Non-Taxable Benefits

To maximize your non-taxable benefits, take advantage of any employer-provided benefits that are offered, such as health insurance, life insurance, and dependent care assistance.

8. The Role of Tax Credits in FIT Calculations

Tax credits can play a significant role in reducing your overall tax liability, although they don’t directly affect your FIT taxable wages. Tax credits are dollar-for-dollar reductions in your tax liability.

8.1 What Are Tax Credits?

Tax credits are credits that directly reduce the amount of tax you owe. They are different from deductions, which reduce your taxable income.

8.2 Common Tax Credits Explained

Common tax credits include:

- Child Tax Credit: This credit is available for qualifying children under the age of 17.

- Earned Income Tax Credit (EITC): This credit is available for low- to moderate-income individuals and families.

- Child and Dependent Care Credit: This credit is available for expenses related to childcare or dependent care that allows you to work or look for work.

- Education Credits: These credits are available for qualified education expenses.

8.3 How Tax Credits Affect Your Tax Liability

Tax credits directly reduce the amount of tax you owe. For example, if you owe $5,000 in federal income tax and you are eligible for a $1,000 tax credit, your tax liability would be reduced to $4,000.

8.4 Claiming Tax Credits

To claim tax credits, you must meet the eligibility requirements and file the appropriate tax forms with your tax return. Consult a tax professional to ensure you are claiming all the credits you are entitled to.

9. Strategies to Optimize Your FIT Taxable Wages

Several strategies can help you optimize your FIT taxable wages and reduce your overall tax liability. These strategies include maximizing pre-tax deductions, utilizing non-taxable benefits, and claiming tax credits.

9.1 Maximizing Pre-Tax Deductions

Contribute the maximum amount allowed to your retirement accounts, health savings accounts, and flexible spending accounts to reduce your FIT taxable wages.

9.2 Utilizing Non-Taxable Benefits

Take advantage of any employer-provided benefits that are offered, such as health insurance, life insurance, and dependent care assistance, to reduce your taxable income.

9.3 Claiming All Eligible Tax Credits

Research and claim all the tax credits you are eligible for, such as the Child Tax Credit, Earned Income Tax Credit, and Child and Dependent Care Credit, to reduce your overall tax liability.

9.4 Adjusting Your Withholding

Review your W-4 form (Employee’s Withholding Certificate) and adjust your withholding to ensure that you are not overpaying or underpaying your taxes.

9.5 Seeking Professional Tax Advice

Consult a tax professional to get personalized advice on how to optimize your FIT taxable wages and reduce your overall tax liability.

10. Common Mistakes to Avoid with FIT

Several common mistakes can lead to errors in calculating your FIT taxable wages and filing your tax return. Avoiding these mistakes can help you avoid penalties and ensure that you are paying the correct amount of taxes.

10.1 Incorrectly Calculating Gross Wages

Ensure that you are accurately calculating your gross wages, including all sources of income.

10.2 Overlooking Deductions

Don’t overlook any deductions that you are eligible for, such as contributions to retirement accounts, health insurance premiums, and student loan interest.

10.3 Not Adjusting Withholding

Review your W-4 form and adjust your withholding as needed to reflect changes in your income, filing status, or deductions.

10.4 Failing to Keep Records

Keep accurate records of your income, deductions, and credits to support your tax return.

10.5 Missing Tax Deadlines

File your tax return by the deadline to avoid penalties and interest.

11. Resources for Understanding FIT Taxable Wages

Numerous resources are available to help you understand FIT taxable wages and navigate the tax system.

11.1 IRS Website

The IRS website (www.irs.gov) provides a wealth of information on federal income tax, including publications, forms, and FAQs.

11.2 Tax Professionals

Consult a tax professional for personalized advice and assistance with your tax return.

11.3 Online Tax Software

Online tax software programs can help you calculate your FIT taxable wages and file your tax return.

11.4 Financial Advisors

Financial advisors can provide guidance on tax planning and investment strategies.

11.5 WHAT.EDU.VN

WHAT.EDU.VN offers a platform for asking questions and receiving free answers from experts and community members, providing valuable insights on various financial topics, including FIT taxable wages.

12. Frequently Asked Questions (FAQs) about FIT Taxable Wages

Here are some frequently asked questions about FIT taxable wages:

| Question | Answer |

|---|---|

| What is the difference between FIT and FICA? | FIT refers to federal income tax, while FICA refers to Federal Insurance Contributions Act taxes, which include Social Security and Medicare taxes. |

| How do I adjust my FIT withholding? | You can adjust your FIT withholding by completing a new W-4 form and submitting it to your employer. |

| What happens if I overpay or underpay my FIT taxes? | If you overpay your FIT taxes, you will receive a refund. If you underpay your FIT taxes, you may owe penalties and interest. |

| Can I claim my dependents on my tax return? | You may be able to claim your dependents on your tax return if they meet certain requirements. However, personal and dependent exemptions have been suspended for tax years 2018 through 2025. |

| How do I find out if I am eligible for tax credits? | You can find out if you are eligible for tax credits by reviewing the IRS guidelines and consulting a tax professional. |

| What if I have multiple jobs? | Withholding rules vary depending on income and filing status. Form W-4 has been updated to be more accurate. For more information, please consult a professional. |

| Are unemployment benefits taxable? | Yes, unemployment benefits are generally considered taxable income and are subject to federal income tax. You may need to have taxes withheld from your unemployment benefits or make estimated tax payments. |

| How does self-employment affect FIT Taxable Wages? | If you are self-employed, you are responsible for paying both the employer and employee portions of Social Security and Medicare taxes through self-employment tax. Your FIT taxable wages will include your net earnings from self-employment, which is your gross income minus business expenses. You will also need to make estimated tax payments throughout the year. |

| How do state taxes impact FIT Taxable Wages? | State taxes do not directly impact your federal income tax (FIT) taxable wages. FIT taxable wages are determined based on your gross income and deductions allowed under federal tax law. However, state income taxes can be a deduction on your federal return if you itemize deductions, which can indirectly affect your overall tax liability. |

| Where can I find reliable tax advice? | You can find reliable tax advice from qualified tax professionals, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs). Additionally, the IRS provides numerous resources and publications on their website (www.irs.gov) to help taxpayers understand their obligations and navigate the tax system. |

13. The Future of FIT Taxable Wages

The future of FIT taxable wages is subject to change as tax laws evolve. Stay informed about potential changes and how they may impact your tax liability.

13.1 Potential Tax Law Changes

Tax laws are subject to change, and these changes can affect the amount of income that is subject to federal income tax.

13.2 Impact of Economic Factors

Economic factors, such as inflation and unemployment, can also impact tax laws and FIT taxable wages.

13.3 Staying Informed

Stay informed about potential changes in tax laws and how they may impact your tax liability by following reputable news sources and consulting a tax professional.

14. Seeking Professional Advice on FIT

Consulting a tax professional can provide personalized advice and guidance on how to optimize your FIT taxable wages and reduce your overall tax liability.

14.1 Benefits of Professional Advice

A tax professional can help you:

- Understand complex tax laws

- Identify deductions and credits you are eligible for

- Adjust your withholding to avoid overpaying or underpaying your taxes

- File your tax return accurately and on time

- Resolve tax issues with the IRS

14.2 Finding a Qualified Tax Professional

To find a qualified tax professional, consider:

- Asking for referrals from friends, family, or colleagues

- Checking the credentials and experience of the tax professional

- Ensuring the tax professional is licensed and in good standing

- Discussing your specific tax needs and goals with the tax professional

14.3 Questions to Ask a Tax Professional

When consulting a tax professional, ask questions such as:

- What are your qualifications and experience?

- What are your fees?

- How often will we communicate?

- What is your approach to tax planning?

- How do you handle tax audits?

15. Conclusion: Mastering Your Paycheck

Understanding FIT taxable wages is crucial for managing your finances effectively. By understanding how these wages are calculated, what factors influence them, and what strategies you can use to optimize them, you can take control of your financial well-being.

Remember, at WHAT.EDU.VN, we’re dedicated to making complex topics like this easier to understand. Don’t hesitate to ask your questions on our platform, where experts and community members are ready to provide free answers.

Alt: A person confidently holding a paycheck, symbolizing financial understanding and control.

Do you have more questions about your paycheck or taxes? Are you struggling to find reliable answers? Don’t worry. WHAT.EDU.VN is here to help. We offer a free platform where you can ask any question and receive answers from our community of experts.

Visit WHAT.EDU.VN today and get the answers you need to master your paycheck.

Contact Us:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- Whatsapp: +1 (206) 555-7890

- Website: what.edu.vn