What Is Salt Deduction? The State and Local Tax (SALT) deduction allows taxpayers who itemize on their federal income tax return to deduct specific taxes paid to state and local governments. Understanding the SALT deduction is crucial, and WHAT.EDU.VN is here to provide clarity. This guide delves into the specifics, history, and implications of this deduction, offering a comprehensive understanding of property tax deductions, local tax deductions, and more.

1. Understanding the Basics of SALT Deduction

The SALT deduction, or State and Local Tax deduction, allows taxpayers who itemize when filing their federal income taxes to deduct certain taxes paid to state and local governments. This provision has been a part of the U.S. tax code for over a century and is intended to alleviate some of the burden of double taxation, where income is taxed at both the state/local and federal levels.

1.1. How the SALT Deduction Works

Taxpayers who choose to itemize their deductions can deduct up to $10,000 of state and local taxes paid. These taxes typically include property taxes, state income taxes, or state sales taxes. Before the Tax Cuts and Jobs Act (TCJA) of 2017, there was no limit to the amount of SALT that could be deducted. However, the TCJA introduced a cap of $10,000 per household, which significantly changed the landscape of this deduction. The $10,000 cap applies regardless of filing status, meaning single filers, married couples filing jointly, and heads of household are all subject to the same limit. This has led to considerable debate and discussion, particularly in states with high state and local taxes.

1.2. Types of Taxes Included in the SALT Deduction

The SALT deduction encompasses several types of taxes, each with its own set of rules and considerations. The most common types of taxes that can be included in the SALT deduction are:

- Property Taxes: These are taxes levied on real property, such as homes, land, and commercial buildings. The amount of property tax you can deduct is based on the assessed value of your property and the local tax rate.

- State Income Taxes: These are taxes imposed by state governments on the income earned by residents. If you pay state income taxes, you can deduct the amount you paid during the tax year.

- State Sales Taxes: In states without income taxes, taxpayers can elect to deduct state and local sales taxes instead of income taxes. This is particularly beneficial for residents of states like Washington, Texas, and Florida, which do not have state income taxes.

1.3. Who Can Claim the SALT Deduction?

The SALT deduction is available to taxpayers who itemize their deductions on their federal income tax return. Itemizing involves listing out individual deductions, such as the SALT deduction, mortgage interest, charitable contributions, and medical expenses, rather than taking the standard deduction. Whether you should itemize or take the standard deduction depends on whether your total itemized deductions exceed the standard deduction amount for your filing status. The standard deduction amounts are adjusted annually for inflation and vary based on your filing status (e.g., single, married filing jointly, head of household).

1.4. Impact of the $10,000 Cap

The introduction of the $10,000 cap on the SALT deduction by the TCJA had a significant impact on taxpayers, particularly those in high-tax states. Before the TCJA, taxpayers in these states could deduct the full amount of their state and local taxes, which often exceeded $10,000. With the new cap in place, many taxpayers found that they could no longer deduct the full amount of their SALT, leading to higher federal tax liabilities. The impact of the cap is most pronounced in states with high property taxes, high income taxes, or both. States like New York, New Jersey, California, and Massachusetts have seen the largest effects, as many residents in these states have state and local tax burdens well above the $10,000 limit.

2. The History and Evolution of the SALT Deduction

The SALT deduction has a long and complex history, dating back to the inception of the federal income tax in 1913. Over the years, the deduction has undergone numerous changes and has been the subject of ongoing debate and political maneuvering.

2.1. Early Origins of the SALT Deduction

The SALT deduction was originally established as part of the Revenue Act of 1913, which introduced the modern federal income tax. At the time, the deduction was intended to address concerns about double taxation and to promote fiscal federalism by allowing states and localities to raise revenue without unduly burdening their residents. The deduction was relatively uncontroversial in its early years, as income tax rates were low and only a small percentage of the population was subject to the tax.

2.2. Changes and Modifications Over the Years

Over the decades, the SALT deduction has been modified and adjusted in response to changing economic conditions and political priorities. One significant change occurred in the 1980s, when Congress considered eliminating the deduction as part of broader tax reform efforts. Ultimately, the deduction was retained, but its scope was narrowed. Another notable change occurred with the passage of the Tax Reform Act of 1986, which eliminated the deduction for state sales taxes. However, this provision was later reinstated as an itemized deduction, allowing taxpayers to choose between deducting state income taxes or state sales taxes.

2.3. The Tax Cuts and Jobs Act (TCJA) and the $10,000 Cap

The most significant recent change to the SALT deduction came with the passage of the Tax Cuts and Jobs Act (TCJA) in 2017. The TCJA introduced a temporary cap of $10,000 on the amount of state and local taxes that taxpayers could deduct. This change was highly controversial, particularly in high-tax states, where many residents faced significant increases in their federal tax liabilities as a result of the cap. The TCJA also made several other changes to the tax code, including reducing individual income tax rates, increasing the standard deduction, and eliminating or modifying various other deductions and credits.

2.4. Current Status and Future Outlook

As of now, the $10,000 cap on the SALT deduction remains in effect. The cap is scheduled to expire after 2025, at which point the SALT deduction will revert to its pre-TCJA status, with no limit on the amount that can be deducted. However, there is ongoing debate about whether to make the cap permanent, modify it, or repeal it altogether. The future of the SALT deduction will likely depend on the outcome of these debates and the broader political and economic landscape. Stay informed with WHAT.EDU.VN for updates.

3. Arguments For and Against the SALT Deduction

The SALT deduction has been a source of ongoing debate and controversy, with strong arguments both for and against its existence. Proponents of the deduction argue that it is necessary to prevent double taxation and to promote fiscal federalism, while opponents contend that it disproportionately benefits high-income taxpayers and distorts economic decision-making.

3.1. Arguments in Favor of the SALT Deduction

- Prevents Double Taxation: One of the primary arguments in favor of the SALT deduction is that it prevents double taxation. Without the deduction, taxpayers would be forced to pay taxes on income that has already been taxed at the state and local levels.

- Promotes Fiscal Federalism: Proponents also argue that the SALT deduction promotes fiscal federalism by allowing states and localities to raise revenue without unduly burdening their residents. By allowing taxpayers to deduct state and local taxes, the federal government effectively subsidizes state and local government spending.

- Supports State and Local Services: The SALT deduction helps support state and local services by making it easier for states and localities to raise revenue. This can lead to better schools, infrastructure, and other essential services.

3.2. Arguments Against the SALT Deduction

- Disproportionately Benefits High-Income Taxpayers: One of the main criticisms of the SALT deduction is that it disproportionately benefits high-income taxpayers. Because high-income taxpayers are more likely to itemize and tend to live in high-tax states, they receive a larger share of the benefits from the deduction.

- Distorts Economic Decision-Making: Opponents also argue that the SALT deduction distorts economic decision-making by encouraging states and localities to raise taxes more than they otherwise would. This can lead to inefficient allocation of resources and higher overall tax burdens.

- Subsidizes High-Tax States: The SALT deduction effectively subsidizes high-tax states, which can lead to inequities between states. Taxpayers in low-tax states may feel that they are unfairly subsidizing the high spending habits of states with more generous social programs and higher taxes.

3.3. The Debate Over Repeal or Modification

The debate over whether to repeal or modify the SALT deduction has intensified in recent years, particularly in light of the $10,000 cap imposed by the TCJA. Some policymakers and economists have called for the complete repeal of the deduction, arguing that it is inefficient and inequitable. Others have proposed various modifications, such as raising the cap, eliminating it for high-income taxpayers, or converting it into a tax credit.

4. Who Benefits Most from the SALT Deduction?

The SALT deduction’s benefits are not evenly distributed across the population. Certain income groups and geographic regions benefit more than others, leading to debates about the fairness and equity of the deduction.

4.1. High-Income vs. Low-Income Taxpayers

Historically, the SALT deduction has disproportionately benefited high-income taxpayers. These taxpayers are more likely to itemize deductions rather than take the standard deduction, and they often reside in states with higher property and income taxes. Before the TCJA, a significant portion of the SALT deduction’s benefits went to the wealthiest taxpayers. The $10,000 cap has somewhat reduced this disparity, but high-income taxpayers still tend to benefit more due to their higher tax liabilities.

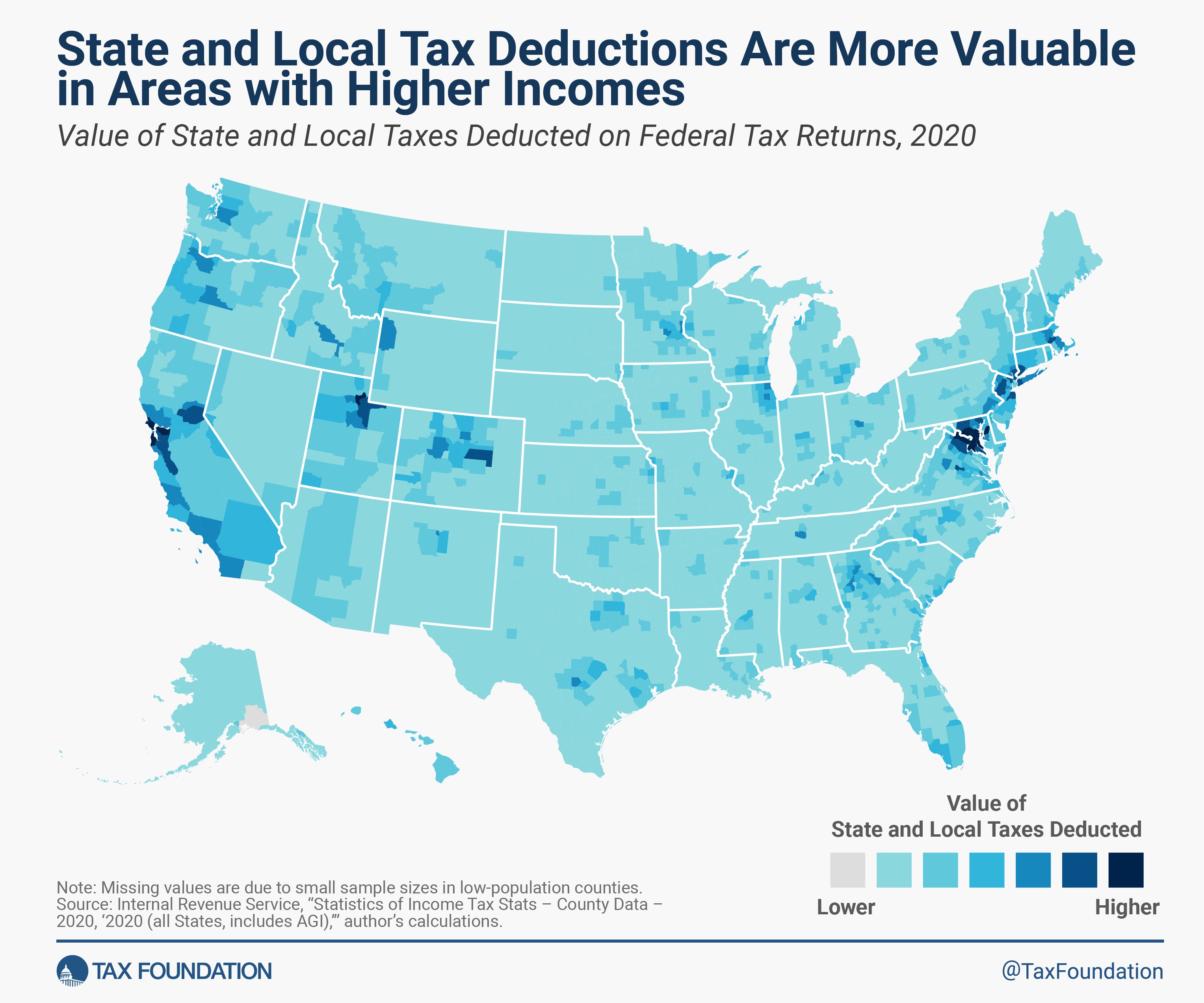

4.2. Geographic Distribution of Benefits

The benefits of the SALT deduction are concentrated in a few high-tax states. States like New York, New Jersey, California, Massachusetts, and Maryland have a large percentage of taxpayers who itemize and deduct significant amounts of state and local taxes. These states often have high property values, high income levels, and generous public services, leading to higher tax burdens for their residents. The cap on the SALT deduction has had a particularly significant impact on these states, leading to calls for its repeal or modification.

4.3. Impact on Different States

The impact of the SALT deduction and the $10,000 cap varies significantly from state to state. States with low taxes and a high percentage of taxpayers taking the standard deduction have been less affected by the cap. On the other hand, states with high taxes and a large number of itemizers have seen a greater impact, with many residents facing higher federal tax liabilities. This has led to political tensions and debates about the fairness of the federal tax system.

5. How to Calculate Your SALT Deduction

Calculating your SALT deduction involves several steps, including gathering the necessary documentation, determining which taxes are deductible, and understanding any limitations or restrictions.

5.1. Gathering Necessary Documentation

To calculate your SALT deduction, you will need to gather documentation of the state and local taxes you paid during the tax year. This includes:

- Property Tax Bills: These show the amount of property taxes you paid on your home, land, or other real property.

- State Income Tax Returns: These show the amount of state income taxes you paid during the year.

- Sales Tax Receipts: If you choose to deduct state sales taxes instead of state income taxes, you will need to keep track of your sales tax receipts throughout the year.

- Form 1099-G: This form reports any state or local tax refunds you received, which may reduce the amount of your SALT deduction.

5.2. Determining Deductible Taxes

Once you have gathered your documentation, you need to determine which taxes are deductible. You can deduct property taxes and either state income taxes or state sales taxes, but not both. If you choose to deduct state sales taxes, you can either use your actual receipts or use the IRS’s sales tax calculator to estimate the amount of sales tax you paid.

5.3. Limitations and Restrictions

Keep in mind that the SALT deduction is subject to a $10,000 cap per household. This means that if your total state and local taxes exceed $10,000, you can only deduct up to that amount. Additionally, if you received a state or local tax refund, you may need to reduce your SALT deduction by the amount of the refund.

6. Common Misconceptions About the SALT Deduction

There are several common misconceptions about the SALT deduction that can lead to confusion and errors when filing your taxes. Understanding these misconceptions can help you avoid mistakes and ensure that you are taking the correct deduction.

6.1. “Everyone Can Deduct the Full Amount of Their State and Local Taxes”

One common misconception is that everyone can deduct the full amount of their state and local taxes. While this was true before the TCJA, the $10,000 cap now limits the amount that many taxpayers can deduct. As a result, many taxpayers in high-tax states are unable to deduct the full amount of their SALT.

6.2. “You Can Deduct Both State Income Taxes and State Sales Taxes”

Another misconception is that you can deduct both state income taxes and state sales taxes. In reality, you can only deduct one or the other. If you choose to deduct state sales taxes, you cannot also deduct state income taxes, and vice versa.

6.3. “The SALT Deduction Only Benefits the Wealthy”

While it is true that the SALT deduction disproportionately benefits high-income taxpayers, it is not exclusively for the wealthy. Many middle-class taxpayers in high-tax states also benefit from the deduction, particularly those who itemize and have significant property tax liabilities.

7. Strategies for Minimizing the Impact of the SALT Cap

Given the limitations imposed by the $10,000 cap on the SALT deduction, many taxpayers are looking for strategies to minimize its impact on their federal tax liabilities. While there are no easy solutions, there are several steps you can take to potentially reduce the impact of the cap.

7.1. Bunching Deductions

One strategy is to bunch your deductions into a single tax year. This involves accelerating or deferring deductible expenses so that you can exceed the standard deduction amount in one year and itemize, while taking the standard deduction in other years. For example, you could make larger charitable contributions in one year and smaller contributions in other years to maximize your itemized deductions.

7.2. Maximizing Other Itemized Deductions

Another strategy is to maximize other itemized deductions, such as mortgage interest, charitable contributions, and medical expenses. By increasing these deductions, you may be able to itemize even if your SALT deduction is limited by the cap.

7.3. Considering Tax-Advantaged Accounts

You can also consider using tax-advantaged accounts, such as 401(k)s, IRAs, and health savings accounts (HSAs), to reduce your taxable income. By contributing to these accounts, you can lower your overall tax liability and potentially offset the impact of the SALT cap.

8. The SALT Deduction and Real Estate

The SALT deduction has significant implications for the real estate market, particularly in high-tax states. The deduction can affect property values, home sales, and investment decisions.

8.1. Impact on Property Values

The SALT deduction can influence property values by making homeownership more affordable. In states with high property taxes, the deduction can help offset some of the cost of owning a home, making it more attractive to potential buyers. However, the $10,000 cap has reduced this benefit, particularly in high-tax areas, potentially dampening demand and property values.

8.2. Effect on Home Sales

The SALT deduction can also affect home sales by influencing demand. In areas where property taxes are high and the SALT deduction is significant, the cap can make it more difficult to sell homes, as potential buyers may be less willing to pay high prices if they cannot deduct the full amount of their property taxes.

8.3. Investment Decisions

Investors also consider the SALT deduction when making real estate investment decisions. The deduction can affect the after-tax return on investment properties, particularly in high-tax areas. The cap can make real estate investments less attractive in these areas, potentially shifting investment activity to lower-tax states.

9. Frequently Asked Questions (FAQs) About the SALT Deduction

To further clarify the complexities of the SALT deduction, here are some frequently asked questions:

| Question | Answer |

|---|---|

| What is the SALT deduction? | The State and Local Tax (SALT) deduction allows taxpayers who itemize to deduct certain taxes paid to state and local governments, such as property taxes and either state income or sales taxes. |

| What taxes are included in the SALT deduction? | The SALT deduction includes property taxes, state income taxes, or state sales taxes. You can deduct property taxes and either state income taxes or state sales taxes, but not both. |

| Who can claim the SALT deduction? | Taxpayers who itemize deductions on their federal income tax return can claim the SALT deduction. |

| What is the limit on the SALT deduction? | The Tax Cuts and Jobs Act (TCJA) of 2017 set a limit of $10,000 per household for the SALT deduction. This cap applies regardless of filing status. |

| How do I calculate my SALT deduction? | Gather documentation of state and local taxes paid, determine which taxes are deductible, and be aware of the $10,000 cap. Use Schedule A (Form 1040) to calculate and report your itemized deductions. |

| What if my state and local taxes exceed $10,000? | If your state and local taxes exceed $10,000, you can only deduct up to the $10,000 limit. The excess amount is not deductible. |

| Can I deduct both state income taxes and state sales taxes? | No, you can only deduct either state income taxes or state sales taxes, but not both. Choose the one that results in a higher deduction for you. |

| How does the SALT deduction affect my federal tax liability? | The SALT deduction reduces your taxable income, which can lower your federal tax liability. However, the impact is limited by the $10,000 cap. |

| Will the SALT cap expire? | As of now, the $10,000 cap on the SALT deduction is scheduled to expire after 2025. After that, the SALT deduction will revert to its pre-TCJA status, with no limit on the amount that can be deducted. |

| Where can I find more information about the SALT deduction? | You can find more information about the SALT deduction on the IRS website (www.irs.gov) or consult with a tax professional. Additionally, WHAT.EDU.VN provides valuable resources and updates on tax-related topics. |

10. The Future of the SALT Deduction: Potential Changes and Reforms

The future of the SALT deduction remains uncertain, with ongoing debates and discussions about potential changes and reforms. Several proposals have been put forth, ranging from repealing the cap to modifying it in various ways.

10.1. Proposals to Repeal the SALT Cap

Some policymakers and advocacy groups have called for the complete repeal of the $10,000 cap on the SALT deduction. Proponents of repeal argue that the cap is unfair to taxpayers in high-tax states and that it distorts economic decision-making. They contend that repealing the cap would restore fairness and equity to the federal tax system.

10.2. Proposals to Modify the SALT Cap

Other proposals involve modifying the SALT cap in various ways. Some have suggested raising the cap to a higher level, such as $20,000 or $25,000, while others have proposed eliminating the cap for certain income groups or for certain types of taxes, such as property taxes. These proposals aim to strike a balance between the goals of preventing double taxation and limiting the deduction’s benefits for high-income taxpayers.

10.3. Potential Impact of Changes

The potential impact of any changes to the SALT deduction would depend on the specific nature of the changes. Repealing the cap would likely benefit taxpayers in high-tax states, particularly those with high property tax liabilities. Raising the cap or modifying it in other ways would have a more targeted impact, depending on the specific details of the changes. Stay tuned to WHAT.EDU.VN for the latest updates.

11. How the SALT Deduction Interacts with Other Tax Provisions

The SALT deduction does not exist in isolation; it interacts with other provisions of the tax code, and these interactions can affect your overall tax liability. Understanding these interactions is crucial for effective tax planning.

11.1. Standard Deduction vs. Itemized Deductions

The decision to take the standard deduction or itemize depends on whether your total itemized deductions, including the SALT deduction, exceed the standard deduction amount for your filing status. If your itemized deductions are greater than the standard deduction, you should itemize to reduce your taxable income.

11.2. Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) is a separate tax system designed to ensure that high-income taxpayers pay a minimum amount of tax. The SALT deduction can affect your AMT liability, as certain itemized deductions are not allowed under the AMT. If you are subject to the AMT, you may need to adjust your tax planning strategies accordingly.

11.3. Qualified Business Income (QBI) Deduction

The Qualified Business Income (QBI) deduction allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income. The SALT deduction can affect the QBI deduction, as it reduces your taxable income, which can impact the amount of your QBI deduction.

12. Seeking Professional Advice on SALT Deduction

Navigating the complexities of the SALT deduction can be challenging, particularly with the $10,000 cap and the ongoing debates about potential changes. Consulting with a tax professional can provide valuable guidance and help you optimize your tax planning strategies.

12.1. When to Consult a Tax Professional

You should consider consulting a tax professional if you have complex tax situations, such as significant state and local tax liabilities, multiple sources of income, or investments in real estate. A tax professional can help you understand the implications of the SALT deduction and develop strategies to minimize your tax liability.

12.2. How a Tax Professional Can Help

A tax professional can help you calculate your SALT deduction, determine whether you should itemize or take the standard deduction, and identify strategies to minimize the impact of the $10,000 cap. They can also provide guidance on other tax-related issues, such as retirement planning, estate planning, and business taxes.

12.3. Finding a Qualified Tax Advisor

When seeking a tax professional, it is important to find someone who is qualified and experienced. Look for a Certified Public Accountant (CPA) or an Enrolled Agent (EA) who specializes in tax planning and has a strong understanding of the SALT deduction and other relevant tax provisions.

13. The SALT Deduction and Tax Planning for 2024

As you plan for the 2024 tax year, it’s important to consider the SALT deduction and how it may impact your overall tax strategy. With the $10,000 cap still in place, careful planning is essential to minimize your tax liability.

13.1. Reviewing Your 2023 Tax Situation

Start by reviewing your 2023 tax situation to understand how the SALT deduction affected your tax liability. This will help you identify areas where you can make adjustments to your tax planning strategies for 2024.

13.2. Estimating Your 2024 State and Local Taxes

Estimate your state and local taxes for 2024 to determine whether you will be affected by the $10,000 cap. Consider factors such as changes in property values, income levels, and state tax rates.

13.3. Adjusting Your Withholding and Estimated Tax Payments

If you expect to owe taxes due to the SALT cap, consider adjusting your withholding or making estimated tax payments throughout the year. This can help you avoid penalties and ensure that you are meeting your tax obligations.

14. Resources for Staying Informed About the SALT Deduction

Staying informed about the SALT deduction is crucial, particularly with the ongoing debates and potential changes. There are several resources available to help you stay up-to-date on the latest developments.

14.1. IRS Website

The IRS website (www.irs.gov) is a valuable resource for information about the SALT deduction and other tax-related topics. You can find publications, forms, and FAQs that provide detailed guidance on various tax issues.

14.2. Tax Foundation

The Tax Foundation (www.taxfoundation.org) is a non-profit organization that provides analysis and commentary on tax policy issues. They offer valuable insights into the SALT deduction and its potential impact on taxpayers and the economy.

14.3. WHAT.EDU.VN

WHAT.EDU.VN provides educational resources and updates on tax-related topics, including the SALT deduction. Our platform offers easy-to-understand explanations and practical advice to help you navigate the complexities of the tax code.

Alt text: Map showing the impact of the SALT cap repeal by county, illustrating the state and local tax deduction deducted on federal tax returns.

15. Case Studies: Real-Life Examples of SALT Deduction Impact

To illustrate the real-world impact of the SALT deduction, let’s examine a few case studies of taxpayers in different situations.

15.1. Case Study 1: High-Income Family in New York

A high-income family in New York has significant property taxes, state income taxes, and other deductible expenses. Their total state and local taxes exceed $25,000. With the $10,000 cap, they can only deduct $10,000, resulting in a higher federal tax liability.

15.2. Case Study 2: Middle-Class Homeowner in California

A middle-class homeowner in California has property taxes and state income taxes totaling $12,000. They can only deduct $10,000, reducing their overall tax savings. They explore strategies such as bunching deductions to maximize their tax benefits.

15.3. Case Study 3: Retiree in Florida

A retiree in Florida has low property taxes and no state income taxes. They choose to deduct state sales taxes instead, but the total amount is less than $10,000. They take the standard deduction instead, as it provides a greater tax benefit.

16. Understanding State-Specific Rules for SALT Deduction

While the federal SALT deduction has a $10,000 cap, some states have enacted their own rules and provisions related to state and local taxes. Understanding these state-specific rules is important for maximizing your tax benefits.

16.1. State Tax Credits for Property Taxes

Some states offer tax credits for property taxes, which can help offset some of the cost of homeownership. These credits may be available to certain income groups or for specific types of properties.

16.2. State Tax Deductions for Certain Expenses

Other states offer tax deductions for certain expenses, such as medical expenses, charitable contributions, and education expenses. These deductions can help reduce your state tax liability and potentially increase your overall tax savings.

16.3. State Rules for Itemizing Deductions

States may have different rules for itemizing deductions than the federal government. Some states may allow you to itemize even if you take the standard deduction on your federal return, while others may have stricter requirements for itemizing.

17. How to Plan for Future Changes in SALT Deduction Laws

Given the ongoing debates and potential changes to the SALT deduction, it’s important to plan for future changes in the law. This involves staying informed about the latest developments and adjusting your tax planning strategies accordingly.

17.1. Monitor Legislative Updates

Monitor legislative updates and news reports to stay informed about potential changes to the SALT deduction. Pay attention to proposed bills, committee hearings, and floor debates in Congress and state legislatures.

17.2. Adjust Tax Planning Strategies

Adjust your tax planning strategies as needed to reflect any changes in the SALT deduction. This may involve reevaluating your itemized deductions, adjusting your withholding or estimated tax payments, and exploring other tax-saving opportunities.

17.3. Consult with a Tax Professional

Consult with a tax professional to get personalized advice on how to plan for future changes in the SALT deduction. A tax professional can help you understand the implications of potential changes and develop strategies to minimize your tax liability.

18. The Impact of SALT Deduction on Small Businesses

The SALT deduction isn’t just for individuals; it also affects small businesses, especially those structured as pass-through entities. These businesses can deduct state and local taxes paid, which can impact their overall profitability and tax liability.

18.1. SALT Deduction for Pass-Through Entities

Pass-through entities, such as S corporations, partnerships, and sole proprietorships, pass their income and expenses through to their owners’ individual tax returns. The owners can then deduct their share of the business’s state and local taxes on their personal returns, subject to the $10,000 cap.

18.2. Impact on Business Investment Decisions

The SALT deduction can influence business investment decisions, particularly in high-tax states. Businesses may be less likely to invest in states with high taxes if they cannot deduct the full amount of their state and local taxes. This can lead to shifts in economic activity and job creation.

18.3. Strategies for Small Businesses

Small businesses can use various strategies to minimize the impact of the SALT cap. This includes carefully planning their business expenses, maximizing other deductible expenses, and considering alternative business structures.

19. The Importance of Accurate Record Keeping for SALT Deduction

Accurate record keeping is essential for claiming the SALT deduction. You need to keep detailed records of all state and local taxes paid, including property tax bills, state income tax returns, and sales tax receipts.

19.1. Types of Records to Keep

Keep records of property tax bills, state income tax returns, sales tax receipts, and any other documentation related to state and local taxes. These records should be kept for at least three years from the date you filed your tax return.

19.2. Using Technology for Record Keeping

Use technology to streamline your record keeping. There are many software programs and apps available that can help you track your expenses, organize your receipts, and prepare your tax return.

19.3. Consult with a Tax Professional

Consult with a tax professional to ensure that you are keeping accurate records and claiming the correct amount of the SALT deduction. A tax professional can provide guidance on record keeping best practices and help you avoid errors.

20. Take Action: Get Your Tax Questions Answered for Free at WHAT.EDU.VN

Are you still puzzled about the SALT deduction? Do you have more tax-related questions? Don’t worry! WHAT.EDU.VN is here to help. We understand that navigating the complexities of the tax code can be overwhelming, and finding reliable answers can be challenging.

20.1. Free Question-Answering Platform

At WHAT.EDU.VN, we offer a free question-answering platform where you can ask any tax-related question and receive prompt and accurate answers from knowledgeable experts. Whether you’re a student, a professional, or simply someone who wants to learn more about taxes, our platform is designed to provide you with the information you need.

20.2. Convenient and Accessible Service

Our service is convenient and accessible. You can ask your questions anytime, from anywhere, using your computer or mobile device. We strive to provide clear, concise, and easy-to-understand answers that address your specific concerns.

20.3. Get Your Questions Answered Today

Don’t let tax questions keep you up at night. Visit WHAT.EDU.VN today and get the answers you need. Our team of experts is ready to assist you with any tax-related inquiry.

Contact Us:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- WhatsApp: +1 (206) 555-7890

- Website: WHAT.EDU.VN

We look forward to helping you navigate the world of taxes with confidence.

The SALT deduction is a complex and ever-evolving aspect of the U.S. tax system. Staying informed and seeking professional advice can help you navigate its intricacies and optimize your tax planning strategies. Remember, what.edu.vn is here to assist you with any tax-related questions you may have.