What Is Sox controls? Delve into the critical aspects of the Sarbanes-Oxley Act and its controls with WHAT.EDU.VN. Discover how SOX compliance ensures financial accuracy, safeguards investor trust, and mitigates risk. Explore the key components of SOX, including IT controls, testing methodologies, and reporting requirements. Learn about regulatory compliance, internal control, and financial reporting best practices.

1. Understanding SOX Compliance Requirements

The Sarbanes-Oxley Act of 2002 (SOX) mandates that publicly traded companies registered with the Securities and Exchange Commission (SEC) implement internal controls for processes and systems that impact financial reporting. These SOX requirements aim to ensure the accuracy and reliability of financial reporting, fostering trust among investors and the public. This legislation came about after several high-profile fraud scandals, such as Enron and WorldCom, shook the markets. Understanding the scope of SOX—knowing where it ends and regular management internal controls begin—is crucial.

1.1 Key Sections of the Sarbanes-Oxley Act

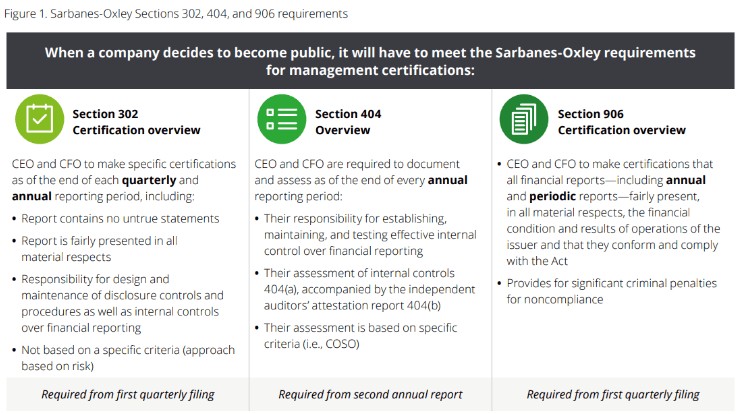

The Sarbanes-Oxley Act has eleven titles, with three in particular significantly impacting financial reporting and the responsibilities of a company’s CEO and CFO:

-

Section 302: Mandates that CEOs and CFOs certify the financial records of their companies. This certification indicates that:

- Reports are accurate.

- Reports are fairly presented in all material aspects.

- There is acknowledgment of responsibility for disclosure controls, procedures, and internal controls over financial reporting.

- Reports are risk-based.

This section holds CEOs and CFOs accountable for their organization’s financial statements, a measure that wasn’t codified until SOX was enacted.

-

Section 404: Requires publicly traded companies and companies pursuing an IPO to engage accounting firms to independently assess and sign off on management’s assessment of internal controls. Additionally, this section requires external auditors to report on the adequacy of the company’s internal control over financial reporting. It involves annual assessments to ensure controls are effective and reliable.

-

Section 906: Explicitly opens the way for criminal penalties to be issued in the event of non-compliance.

The Sarbanes-Oxley Act also led to the creation of the Public Company Accounting Oversight Board (PCAOB), which oversees auditors and accounting firms that sign off on organizations’ financial statements and internal control reports. The PCAOB is responsible for ensuring these auditors are doing their jobs properly, adding an extra layer of oversight.

Section 302, Section 404, and Section 906 Summary from Deloitte

Section 302, Section 404, and Section 906 Summary from Deloitte

1.2 The Role of SOX in Financial Integrity

SOX compliance plays a vital role in maintaining financial integrity by requiring companies to establish and maintain effective internal controls over financial reporting. These controls help to prevent errors, fraud, and misstatements in financial statements, ensuring that investors and other stakeholders receive accurate and reliable information. By adhering to SOX regulations, companies can enhance transparency, accountability, and investor confidence, ultimately contributing to the stability and integrity of the financial markets. WHAT.EDU.VN supports understanding these regulations for informed financial practices.

2. What Are SOX Controls Defined?

SOX controls are the specific measures that an organization implements to comply with the Sarbanes-Oxley Act. These controls are relevant because they govern how internal control structures should support accurate, honest, and trustworthy financial information reporting. Therefore, SOX controls are those that address, mitigate, or otherwise manage risks to the accuracy and integrity of financial reporting.

2.1 Determining Relevance of a Control

Not all controls in an organization’s environment will be in-scope for SOX, but many will. To determine if a control should be considered relevant for SOX purposes, ask these questions:

- Does this control relate to or input into the financial information used for financial disclosures?

- Does this control affect financial material accounts or financial statement reporting?

- Does this control affect any systems or processes that feed into financial statement reporting?

If the answer is yes to any of these questions, the organization may want to include that control in the scope of their SOX procedures and internal controls reporting. WHAT.EDU.VN provides resources for identifying relevant SOX controls tailored to your business needs.

2.2 Examples of SOX Controls

SOX controls can include a variety of measures, such as:

- Segregation of duties: Ensuring that no single individual has control over multiple conflicting responsibilities, such as authorizing payments and reconciling bank statements.

- Access controls: Limiting access to financial systems and data to authorized personnel only.

- Reconciliations: Regularly comparing financial data from different sources to ensure accuracy and completeness.

- Approval processes: Requiring multiple levels of approval for significant financial transactions.

- Documentation: Maintaining detailed records of all financial transactions and internal control procedures.

- IT General Controls (ITGCs): Controls over IT systems that support financial reporting, such as change management, access security, and data backup.

These controls, when effectively implemented, help to prevent errors and fraud, ensure compliance with SOX regulations, and provide assurance to investors and stakeholders that the company’s financial reporting is reliable and accurate.

3. Is SOX Compliance Mandatory?

SOX compliance is mandatory for publicly traded companies and is in the best interest of companies that may soon be pursuing an IPO. However, SOX compliance is not required for nonprofit organizations and private companies. It ensures transparency and accountability in financial reporting for these entities.

3.1 Benefits for Nonprofits and Private Companies

Even though they may not be subject to SOX, nonprofits and private companies may still want to leverage some of the internal controls frameworks available, such as COSO’s Internal Control – Integrated Framework (ICIF) and COBIT, to apply risk management and internal controls best practices to their organizations. These frameworks help improve operational efficiency, reduce risk, and enhance overall governance, all of which are crucial for long-term success, whether you’re publicly traded or not.

3.2 SOX Compliance for IPO Aspirants

For companies considering an IPO, achieving SOX compliance is a critical step. It not only demonstrates a commitment to financial integrity but also prepares the organization for the increased scrutiny and regulatory requirements that come with being a public company. Implementing SOX controls early can streamline the IPO process and build confidence among potential investors. WHAT.EDU.VN provides resources to guide companies through SOX compliance in preparation for an IPO.

4. Understanding the Number of SOX Controls

An organization is not required to implement a set number of SOX controls. Taking a risk-based approach to internal controls (recommended) means that each business will have a different set of risks and controls that address them. The number of SOX controls a company operates can vary greatly and does not directly correlate to the success or effectiveness of a SOX program — a higher number of controls is not always the best risk-mitigation strategy. That said, there are many controls that companies will have in common with SOX, such as access controls, segregation of duties, change management, various business processes, data backup, and even corporate governance controls.

4.1 Risk-Based Approach to Internal Controls

The risk-based approach to internal controls is highly recommended because it allows each business to tailor its SOX controls to its specific risks. By identifying and assessing the risks that are most relevant to their financial reporting, companies can focus their resources on implementing the controls that will be most effective in mitigating those risks. This targeted approach ensures that the SOX program is both efficient and effective, providing reasonable assurance that financial statements are accurate and reliable. WHAT.EDU.VN offers insights into adopting a risk-based approach for optimal SOX compliance.

4.2 Common SOX Controls

Despite the variability in the number of SOX controls, there are several controls that companies commonly implement:

- Access Controls: Restricting access to financial systems and data to authorized personnel to prevent unauthorized modifications or disclosures.

- Segregation of Duties: Dividing responsibilities among different individuals to prevent fraud and errors.

- Change Management: Implementing procedures to ensure that changes to financial systems and processes are properly authorized, tested, and documented.

- Business Processes: Establishing standardized procedures for key financial processes, such as revenue recognition, accounts payable, and inventory management.

- Data Backup: Regularly backing up financial data to prevent data loss in the event of a system failure or disaster.

- Corporate Governance Controls: Implementing policies and procedures to ensure that the company is governed ethically and in compliance with applicable laws and regulations.

These common controls form the foundation of an effective SOX program, providing a baseline level of protection against financial misstatements and fraud.

5. Deep Dive into SOX 404 Controls

SOX 404 refers to a section of the SOX Act (Section 404) that spells out the SOX requirement for management to implement internal controls over financial reporting. Specifically, SOX Section 404 mandates:

(Sec. 404) Directs the SEC to require by rule that annual reports include an internal control report which (1) avers management responsibility for maintaining adequate internal control mechanisms for financial reporting and (2) evaluates the efficacy of such mechanisms. It also requires the public accounting firm to attest in their annual audit report on the effectiveness of the issuer’s internal controls over financial reporting (ICFR). Section 404(b) is the section that explicitly requires an independent public accounting to perform an audit on a company’s ICFR. When used as shorthand, SOX 404 controls can refer to those controls that will be audited by a public accounting firm for compliance with the Act.

5.1 Management’s Responsibility

SOX 404 places significant responsibility on management to establish and maintain effective internal controls over financial reporting (ICFR). This includes documenting the controls, assessing their design and operating effectiveness, and reporting on their effectiveness to the SEC. Management must also disclose any material weaknesses in ICFR to the SEC and take steps to remediate them.

5.2 External Auditor Attestation

In addition to management’s responsibility, SOX 404 also requires the company’s external auditor to attest to the effectiveness of the company’s ICFR. This attestation provides an independent assessment of the company’s internal controls, giving investors and other stakeholders greater confidence in the accuracy and reliability of the company’s financial reporting. The external auditor’s attestation is a critical component of SOX 404 compliance. WHAT.EDU.VN offers detailed explanations of external auditor attestation requirements under SOX 404.

6. Navigating SOX IT Controls and Cybersecurity

SOX requirements generally include business process controls and SOX IT controls. On the business side, the controls in-scope are those around the accuracy of the data feeding into financial reporting, along with reconciliations, and financial data processing. From the IT perspective, there are IT general controls (ITGCs) and application controls. SOX IT controls aim to ensure the systems are well-controlled, accurate, complete, and free of errors that could potentially impact financial reporting.

6.1 Critical IT Systems vs. SOX IT Systems

The key to defining your SOX scope is understanding which processes and systems impact financial reporting. Where most need clarification is in differentiating between critical IT systems versus SOX IT systems. You may have a system holding all of your customers’ information, an essential component to the success of your organization, but if that system does not capture financial data feeding into your financial reporting, it is not a SOX application. It should still be well-controlled, but it is not within the scope of SOX testing. In contrast, a data center hosting SOX-sensitive (i.e. financial) systems, data, or information would be considered in-scope, and might even require a physical audit.

6.2 Cybersecurity and SOX Compliance

When it was originally issued, the Sarbanes-Oxley Act did not account for the emerging cybersecurity threat landscape. Still, implementing and maintaining a strong internal controls program typically calls for strong security controls, especially around sensitive data that may impact financial reporting. Controls under SOX that also impact a company’s cybersecurity posture include incident response and remediation, business continuity planning, and data security (in relation to financial data).

SOX controls can help an organization recover from data breaches and security breaches by encouraging a healthy and effective internal control environment. To this end, automation of controls has become increasingly important, especially in information technology, as automated controls reduce the manual, human effort needed to mitigate risks and address the potential for user error when executing controls. WHAT.EDU.VN provides insights into aligning cybersecurity measures with SOX IT controls for enhanced compliance.

Even though SOX is not explicitly framed to encourage cybersecurity best practices, stakeholders should keep security in mind as cyber threats can now cost companies and organizations massively in dollars and reputation.

7. Examining Key SOX Controls

Within the SOX controls, we designate the primary controls for mitigating risk as key controls. Considerable reliance is put on the key controls, so these should be monitored and tested more frequently. Organizations may also want to set up compensating controls to support key controls if they fail to operate. Compensating controls can provide additional assurance that financial information is being accurately reported. Since controls identified as “key” can have a massive impact on internal controls related to financial reporting, SOX teams should stay on top of these processes and understand their ins and outs.

7.1 The Role of Management Review Controls (MRCs)

Management Review Controls (MRCs) also play a critical part in SOX controls. MRCs are typically used in key controls, such as the monthly close process, budget vs. actual analysis, and quarterly and annual financial reviews: This allows management to conduct a thorough review of its financial statements to ensure accuracy and completeness prior to reporting to investors and users of the financials. MRCs are also used in account reconciliations and the approval process for significant financial transactions to ensure multiple levels of management review before a transaction is executed (i.e. wiring funds). MRCs are essential because they provide an additional layer of oversight and help ensure that financial information is accurate and reliable; thereby, enhancing the overall effectiveness of SOX controls.

7.2 Examples of Key SOX Controls

Key SOX controls typically include:

- Revenue Recognition: Controls to ensure that revenue is recognized in accordance with accounting standards and company policies.

- Inventory Management: Controls to ensure that inventory is accurately tracked and valued.

- Financial Close Process: Controls to ensure that the company’s financial statements are complete, accurate, and fairly presented.

- IT General Controls (ITGCs): Controls over IT systems that support financial reporting, such as change management, access security, and data backup.

These key controls are essential for preventing material misstatements in the company’s financial statements and ensuring compliance with SOX regulations. WHAT.EDU.VN explains the importance of key SOX controls in maintaining financial integrity.

8. Effective SOX Controls Testing

SOX control testing is a function performed by either management or internal audit or both, as well as by external auditors from a public accounting firm. SOX control testing is performed to determine if the controls are working as intended or if there are any gaps in the internal control process.

8.1 Internal Audit’s Role in Testing

External auditors will perform tests of controls to vet management’s assertions and validate that controls are operating as designed and intended. An organization’s internal audit teams and their external auditors can test SOX controls by first understanding the control and what risks it is designed to mitigate, then designing a test around the control’s key attributes or gates, and finally obtaining the evidence and reasonable assurance they need to determine if the control is working as intended or if there are any findings.

8.2 Essential Steps in SOX Testing

Essential steps in SOX testing include:

- Planning the Test: Defining the scope of the test, identifying the controls to be tested, and developing a testing plan.

- Performing the Test: Gathering evidence to determine whether the controls are operating effectively, such as reviewing documentation, observing processes, and interviewing personnel.

- Evaluating the Results: Assessing the evidence gathered and determining whether the controls are operating as intended.

- Reporting the Findings: Documenting the results of the test and reporting any deficiencies or weaknesses in internal controls to management.

By following these steps, organizations can ensure that their SOX controls are operating effectively and that any deficiencies are promptly identified and remediated. WHAT.EDU.VN provides detailed guidance on conducting effective SOX control testing.

9. Understanding SOX Reporting

SOX reporting is usually done both internally and externally. Internal SOX reporting includes SOX testing status updates created by management, or the company’s internal audit department, with any issues found and remediation plans to address any control failures or deficiencies.

9.1 Mandatory Components of External SOX Reporting

External SOX reporting is a combination of reports submitted by the company to the SEC and an audit report from the company’s external auditor. The auditor’s report expresses an opinion on the accuracy of the financial statements and the effectiveness of management’s internal controls over financial reporting. Below are some mandatory components of external SOX reporting:

- Quarterly and Annual Reports: Under SOX, public companies are required to submit quarterly (10-Q) and annual (10-K) reports to the SEC. These reports must include certified financial statements and disclosures about the company’s financial health and internal controls.

- Internal Control Reports: Section 404 requires management to include an internal control report in the annual 10-K. This report must state management’s responsibility for establishing and maintaining adequate internal control over financial reporting, as well as an assessment of the effectiveness of these controls.

- Material Changes Disclosure: Section 409 requires companies to disclose material changes in their financial condition or operations on a rapid and current basis, usually through an 8-K filing.

- Record Retention Requirements: Section 802 imposes stringent record retention requirements. Companies must retain all audit or review work papers for five years. Destruction, alteration, or falsification of records is subject to severe penalties.

- Enhanced Financial Disclosures: SOX requires enhanced financial disclosures, including off-balance-sheet transactions, pro forma figures, and the use of special purpose entities (SPEs). This ensures greater transparency and accuracy in financial reporting.

9.2 Role of the SEC

The SEC plays a crucial role in SOX reporting by overseeing compliance with the Act’s requirements and enforcing penalties for non-compliance. The SEC reviews companies’ financial statements and internal control reports to ensure that they are accurate and reliable. The SEC also investigates potential violations of SOX and brings enforcement actions against companies and individuals who violate the Act. WHAT.EDU.VN offers resources on navigating SEC requirements for SOX compliance.

10. Initiating SOX Controls Testing Today

Due to the scope and complexity of maintaining audit programs to meet SOX requirements, The Institute of Internal Auditors (IIA) recommends that management start testing SOX controls early each year and consider the program an ongoing, year-round internal control testing process.

10.1 Benefits of Early and Continuous Testing

Early and continuous testing of SOX controls offers several benefits, including:

- Early Detection of Deficiencies: Testing controls early in the year allows organizations to identify and remediate any deficiencies or weaknesses in internal controls before the end of the fiscal year.

- Improved Compliance: Continuous testing helps ensure that controls are operating effectively throughout the year, reducing the risk of non-compliance with SOX requirements.

- Increased Efficiency: By testing controls on an ongoing basis, organizations can streamline the testing process and reduce the burden on resources.

- Better Decision-Making: Continuous monitoring of controls provides management with timely and accurate information about the effectiveness of internal controls, enabling them to make better decisions about risk management and resource allocation.

By starting SOX controls testing early and making it an ongoing process, organizations can improve their compliance with SOX requirements and enhance the effectiveness of their internal controls.

10.2 Steps to Begin SOX Controls Testing

To begin SOX controls testing, organizations should follow these steps:

- Define the Scope: Determine which controls will be tested and the scope of the testing.

- Develop a Testing Plan: Create a plan that outlines the testing procedures, timeline, and resources needed.

- Gather Evidence: Collect evidence to determine whether the controls are operating effectively, such as reviewing documentation, observing processes, and interviewing personnel.

- Evaluate the Results: Assess the evidence gathered and determine whether the controls are operating as intended.

- Report the Findings: Document the results of the test and report any deficiencies or weaknesses in internal controls to management.

- Remediate Deficiencies: Take steps to remediate any deficiencies or weaknesses identified during testing.

By following these steps, organizations can begin SOX controls testing and ensure that their internal controls are operating effectively. WHAT.EDU.VN provides practical guidance on implementing SOX controls testing in your organization.

11. Essential SOX Compliance Checklist

An effective SOX compliance program requires careful planning and execution. Here’s a checklist to guide your organization through the process:

11.1 Defining the SOX Audit Scope

PCAOB AS 2201 states, “A top-down approach begins at the financial statement level and with the auditor’s understanding of the overall risks to internal controls over financial reporting. The auditor then focuses on entity-level controls and works down to significant accounts, disclosures, and their relevant assertions.”

This step in a SOX compliance audit process should not result in a list of compliance procedures but should instead help the auditor identify potential risks and sources, how they might impact the business, and whether the internal controls qualify as SOX controls — i.e. whether they will provide reasonable assurance that a material error will be avoided, prevented, or detected.

11.2 Determining Materiality in SOX

- Step 1. Determine what items are considered material to financial statements and financial disclosures reported to investors. Financial statement items and disclosures are considered “material” if they can influence the economic decisions of users. Auditors can typically determine what is material by calculating a certain percentage of key financial statement accounts. For example, 5% of total assets, 3-5% of operating income, or some analysis of multiple key P&L and BS accounts.

- Step 2 – Determine all locations holding material account balances. Analyze the financials for all the locations where you do business. If any of the financial statement account balances at these locations exceed what was determined as material (in Step 1), chances are they will be considered material and in-scope for SOX testing in the coming year.

- Step 3 – Identify transactions populating material account balances. Meet with your Controller and the specific process owners to determine the transactions (both debits and credits) that cause the financial statement account to increase or decrease. Document how these transactions occur and how they are recorded in a narrative, flowchart, or both.

- Step 4 – Identify financial reporting risks for material accounts. Seek to understand what could prevent the transaction from being correctly recorded, or the specific risk event. Then, document the effect the risk event could have on the account balance being incorrectly recorded, or the breakdown of the financial statement assertion.

11.3 Identifying SOX Controls

During your materiality analysis, auditors will identify and document SOX controls that may prevent or detect transactions from being incorrectly recorded. They will seek to identify the checks and balances in the financial reporting workflow that ensure the transactions are recorded correctly, and account balances are calculated accurately.

Often material accounts need multiple controls in place to prevent a material misstatement from occurring. However, audit teams are cautioned from applying a brute-force approach and creating a new SOX control whenever a new risk is identified. Inadvertently, each new control is often classified as “key” without performing a true risk assessment, contributing to the ever-increasing control count. By understanding the differences between key and non-key controls, internal audit teams can effectively combat rising control counts. WHAT.EDU.VN helps differentiate between key and non-key controls in your SOX compliance efforts.

To keep things simple, the quickest method to differentiate a non-key vs. key control is to refer to the level of risk being addressed. Is the control mitigating a low or high risk? By understanding the risks affecting the SOX compliance process, audit teams can better prioritize and focus their efforts on key controls.

12. Finalizing an Effective System of Internal Controls Plan

Lastly, to finalize and plan for an effective system of internal controls, your audit team must identify manual and automated SOX IT controls. For the automated controls identified, you should evaluate whether the underlying system is in scope for ITGC testing, which will impact your overall testing strategy of the control. If you have ITGC comfort over the underlying system, you can substantially reduce the amount of SOX IT control testing needed.

12.1 Building a Well-Rounded SOX Testing Program

Once you have defined your scope and identified your SOX controls using these best practices, you will be on track to developing a well-rounded SOX testing program. Meeting SOX requirements does not need to be overly complicated. WHAT.EDU.VN provides insights into building a well-rounded SOX testing program.

12.2 Streamlining Your SOX Program

Implementing SOX compliance software such as AuditBoard’s SOXHUB can help you eliminate version control issues in your SOX documentation process, centralize SOX control testing, facilitate SOX reporting, and streamline your SOX program from end to end.

13. Frequently Asked Questions About SOX Controls

To further clarify the intricacies of SOX controls, here are some frequently asked questions:

| Question | Answer |

|---|---|

| What are SOX controls and why are they important? | SOX controls are internal measures established to ensure the accuracy and integrity of a company’s financial reporting. They are crucial for maintaining investor confidence, ensuring regulatory compliance, and preventing fraud by establishing clear procedures and accountability for financial operations. |

| How often should SOX controls be tested and reviewed? | SOX controls should be tested and reviewed at least annually. However, more frequent testing may be necessary if there are significant changes in processes, systems, or personnel to ensure ongoing compliance and effectiveness. |

| What are the penalties for non-compliance with SOX controls? | Non-compliance with SOX controls can result in severe penalties, including fines, imprisonment, and reputational damage. Senior executives, particularly the CEO and CFO, can be held personally liable for failing to ensure the accuracy and reliability of financial reports and internal controls. |

| How do SOX controls relate to cybersecurity? | SOX controls indirectly relate to cybersecurity by encouraging strong security measures around sensitive data that impacts financial reporting. Implementing and maintaining a robust internal controls program necessitates strong security controls, especially concerning sensitive data. |

| What is the role of Management Review Controls (MRCs) in SOX compliance? | Management Review Controls (MRCs) play a critical role in SOX compliance by providing an additional layer of oversight. MRCs are typically used in key controls to ensure accuracy and completeness prior to reporting to investors and users of the financials. They enhance the overall effectiveness of SOX controls. |

| How can automation improve SOX compliance? | Automation can improve SOX compliance by reducing the manual effort needed to mitigate risks and address the potential for user error when executing controls. Automated controls are especially important in information technology for ensuring accuracy and efficiency. |

| What steps should organizations take to prepare for SOX compliance? | Organizations should define the scope of their SOX audit, determine materiality in financial statements, identify SOX controls (both key and non-key), and finalize an effective system of internal controls. Regular testing, documentation, and continuous improvement are essential for maintaining compliance. |

| What are IT General Controls (ITGCs) and why are they important? | IT General Controls (ITGCs) are controls over IT systems that support financial reporting. They ensure that systems are well-controlled, accurate, complete, and free of errors that could potentially impact financial reporting. ITGCs include change management, access security, and data backup processes. |

| What is the top-down approach in SOX auditing? | The top-down approach begins at the financial statement level with an understanding of the overall risks to internal controls over financial reporting. Auditors then focus on entity-level controls and work down to significant accounts, disclosures, and their relevant assertions, helping identify potential risks and sources of impact. |

| What is the role of external auditors in SOX compliance? | External auditors play a critical role in SOX compliance by independently assessing and attesting to the effectiveness of a company’s internal controls over financial reporting. Their attestation provides assurance to investors and stakeholders regarding the accuracy and reliability of the company’s financial statements. |

Need More Answers? Ask WHAT.EDU.VN!

Navigating SOX controls can be complex, but you don’t have to do it alone. At WHAT.EDU.VN, we provide a platform where you can ask any question and receive free, accurate, and timely answers from experts. Whether you’re a student, a professional, or simply curious, our community is here to help.

Facing challenges in finding quick and free answers? Unsure where to turn for reliable information? Worried about the cost of professional advice? WHAT.EDU.VN offers a user-friendly platform where you can ask questions and get insightful responses from knowledgeable individuals.

Get Your Questions Answered for Free

- Ask Any Question: No matter the topic, our platform is designed to handle all your inquiries.

- Quick and Accurate Responses: Receive timely and precise answers from our community of experts.

- Easy-to-Understand Information: We break down complex topics into simple, digestible explanations.

- Connect with a Community: Exchange knowledge and insights with other users.

- Free Consultation: Get free advice on simple issues.

Don’t let your questions go unanswered. Visit WHAT.EDU.VN today and experience the convenience of getting the information you need, absolutely free. Our mission is to provide a trusted resource for anyone seeking knowledge and clarity.

Contact Us

For further assistance, please reach out to us:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- WhatsApp: +1 (206) 555-7890

- Website: WHAT.EDU.VN

Join the what.edu.vn community now and unlock a world of answers at your fingertips!