Square: What Is It and How Can It Benefit You? At WHAT.EDU.VN, we simplify complex topics, and today, we’re demystifying Square. This comprehensive guide explores the multifaceted functionalities of Square, including its payment processing prowess, POS systems, and various business solutions, empowering you with the knowledge to leverage its capabilities effectively. Discover how this financial technology platform can streamline transactions and business management with POS solutions, payment processing, and small business tools.

1. Understanding Square

Square is a financial technology company that provides various payment processing and point-of-sale (POS) solutions to businesses of all sizes. Renowned for its distinctive “square” card reader, Square offers a comprehensive suite of tools designed to streamline transactions, manage operations, and foster growth. Its ecosystem encompasses hardware, software, and services tailored to meet the evolving needs of modern businesses.

1.1. The Core Functionality of Square

At its core, Square functions as an all-in-one POS solution, integrating payment processing, e-commerce platforms, marketing tools, and various business management features. The app-based software allows users to initiate sales by creating an account and downloading the free POS software on any mobile device. This unified platform facilitates both in-person and online sales, providing flexibility and convenience for businesses and customers alike.

1.2. Square’s Appeal to Small Businesses

Square’s popularity among small and new businesses stems from its feature-rich free plan, which offers essential tools without upfront costs. However, Square also caters to larger enterprises by providing custom POS solutions tailored to their specific requirements. With millions of downloads and high ratings, the Square POS software has solidified its position as a trusted and reliable solution for businesses worldwide.

Alt: Square mobile credit card reader attached to an iPhone.

2. Square’s Comprehensive Product Suite

Square offers a diverse range of products and services designed to address various aspects of business management. From standard POS software to advanced hardware and add-ons, Square’s offerings cater to businesses of all sizes and industries.

2.1. Key Components of a Free Square Account

Every free Square account includes:

- Standard POS software

- Payment processing

- Payment gateway

- Waived chargeback fees

- Mobile POS app

- Basic website builder and online store

- Online ordering

- Basic invoicing

- Virtual terminal

- Customer Relationship Management (CRM)

- Starter team management plan

- First magstripe mobile card reader

2.2. Additional Products and Add-ons

In addition to the free offerings, Square provides a range of additional products and add-ons, including:

- Advanced card readers, POS terminals, and registers

- SMS and email marketing

- Customer loyalty programs

- Customer contract creation and management

- Employee shift scheduling

- Team communication

- Payroll

- Checking and savings accounts

- Small business loans

- And more

3. The Payment Processing Powerhouse: Square Payments

Payment processing services form the cornerstone of Square’s offerings, providing businesses with a seamless and efficient way to accept payments from customers. As a payment facilitator, Square simplifies the complexities of traditional merchant accounts, allowing businesses to focus on their core operations.

3.1. Square as a Payment Facilitator

Square Payments operates as a payment facilitator, partnering with acquiring banks to establish a central merchant account. Each business owner who creates a Square account gains access to a sub or aggregate merchant account, streamlining the payment processing process.

3.2. How Square Handles Funds

As a payment facilitator, Square manages funds on behalf of its business customers, holding, receiving, and disbursing payments as needed. Square’s merchant account connects to various payment networks, enabling the processing of transactions and transfer of funds for its business customers.

3.3. Benefits for New Businesses

Square eliminates the challenges of lengthy and complicated approvals, allowing new businesses to immediately accept various payment methods with competitive terms, zero monthly fees, and no long-term contracts. This accessibility and convenience make Square an attractive option for entrepreneurs and startups.

Alt: A small business owner uses a Square Terminal for card payment.

4. Payment Methods Supported by Square

Square supports a wide array of payment methods, catering to the diverse preferences of customers and businesses alike.

4.1. Accepted Payment Methods

Square accepts the following payment methods:

- Cash, check, vouchers, and other tenders

- Credit & debit card payments (Visa, Mastercard, American Express, Discover)

- Digital wallets

- HSA and FSA debit cards

- ACH

- Gift cards

- Buy Now, Pay Later (BNPL) with Afterpay

- Peer-to-peer payments with CashApp

4.2. Supported Payment Services

Square supports the following payment services:

- Mobile POS

- In-store POS

- Online payment gateway

- Invoicing

- Subscription management

- Virtual terminal

- CBD program

5. Understanding Square’s Payment Processing Fees

Square’s payment processing fees are designed to be transparent and easy to understand, catering to the needs of small and new businesses.

5.1. Flat Rate Pricing

Square employs flat rate pricing, which simplifies fee management for small and new businesses. While not the lowest rates available, flat rate pricing offers predictability and ease of budgeting.

5.2. Custom Rates for Larger Businesses

Businesses processing over $250,000 annually can negotiate custom rates with Square, potentially securing volume discounts and more favorable pricing models.

5.3. Standard Payment Processing Fees

Square’s standard payment processing fees are as follows:

- Monthly payment processing account fee: $0

- Cash, cheque, vouchers, and other tenders: $0

- Credit cards:

- In-person transaction: 2.6% + 10 cents

- Online: 2.9% + 30 cents per transaction

- Keyed-in & card-on-file transactions: 3.5% + 15 cents per transaction

- Chargeback fee: Waived up to $250/month

- Invoicing: 3.30% + 15 cents to 3.5% + 10 cents per transaction

- ACH Payments: 1%, minimum $1

- Afterpay: 6% + 30 cents per transaction

- CBD program transactions: From 3.5% + 10 cents per transaction

- Same-day funding: + 1.5%

- Volume discounts: Available with a paid POS plan, or more than $250,000 in annual sales volume and over $15 in average ticket size

5.4. Included Features

All Square payments processing includes free dispute management, active fraud prevention, end-to-end encrypted payments, live phone support, and PCI compliance, ensuring the security and reliability of transactions.

6. Exploring Square’s Hardware Offerings

While Square’s software is app-based, the company offers a range of proprietary hardware designed for scalability and versatility.

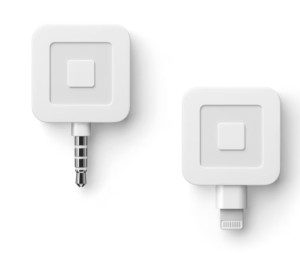

6.1. Mobile Credit Card Readers

Square’s hardware lineup begins with mobile credit card readers, including separate magstripe and contactless devices, allowing businesses to accept payments on the go.

Alt: A Square magnetic stripe credit card reader.

Alt: A Square contactless credit card reader.

6.2. Versatile iPad Stand

The versatile iPad stand features a built-in card terminal and can be configured as a countertop or kiosk, providing flexibility for various business settings.

Alt: A Square Stand for iPad with a 2-in-1 card reader.

6.3. Stand-Alone Checkout Terminal

Square offers mobile and countertop versions of a stand-alone checkout terminal, complete with a built-in touchscreen, customer display, and swipe, chip, and contactless card readers, providing a comprehensive POS solution.

Alt: A Square Terminal, a stand-alone POS with a 3-in-1 card reader.

6.4. Square Register

The Square Register is equipped with a 3-in-1 card reader and offers a seamless checkout experience for both businesses and customers.

Alt: A Square Register, complete with a 3-in-1 card reader.

7. Diving into Square’s Point-of-Sale (POS) System

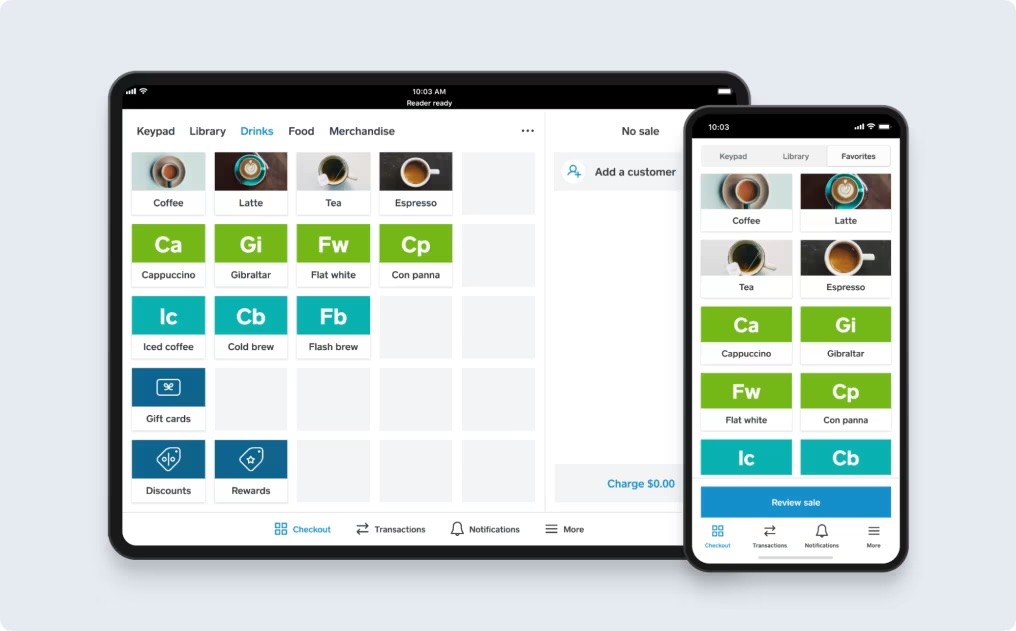

Square offers basic and industry-specific POS software accessible on iPads, Android devices, iPhones, and Square’s proprietary hardware. Each software version includes inventory, ordering, sales, customer management, and reporting tools, providing businesses with the resources needed to manage their operations effectively.

7.1. Core Features of the Basic Free POS Software

The basic free POS software includes the following features:

- Inventory management

- Cash, mobile, debit, credit, and gift card payments processing

- Invoicing

- Website builder

- Virtual terminal

- CRM

- Offline credit card payment processing

- Returns and refunds processing

- Tip management

- Digital and printed receipts

Alt: Square POS systems on an iPad and a smartphone.

7.2. Industry-Specific POS Software

Square offers industry-specific POS software tailored to retail, restaurants, and professional services. These alternatives provide unique features such as advanced inventory management, seat management, kitchen display systems, and scheduling tools. Upgrading to a paid POS plan may also unlock discounted transaction rates.

8. Exploring Additional Features and Products

Square’s ecosystem extends beyond payment processing and POS systems, encompassing a range of business tools across commerce, customer management, employee management, and banking.

8.1. Square Commerce Products

Square offers a suite of commerce products designed to facilitate online sales and streamline business operations.

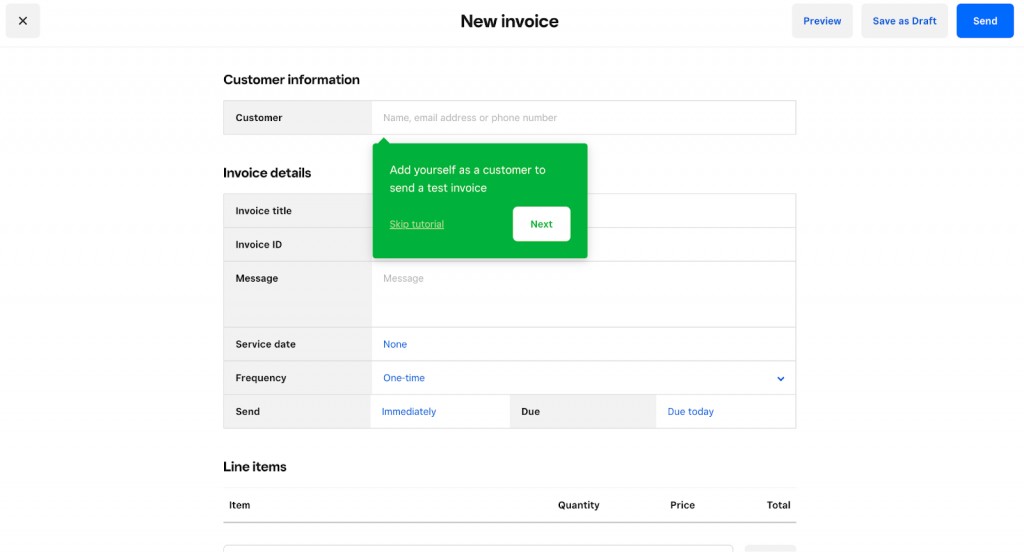

8.1.1. Invoicing

Square’s invoicing feature is customizable and offers automated tools for alerts and follow-ups, simplifying the billing process for businesses.

Alt: A Square invoicing feature shows alerts and follow-up options.

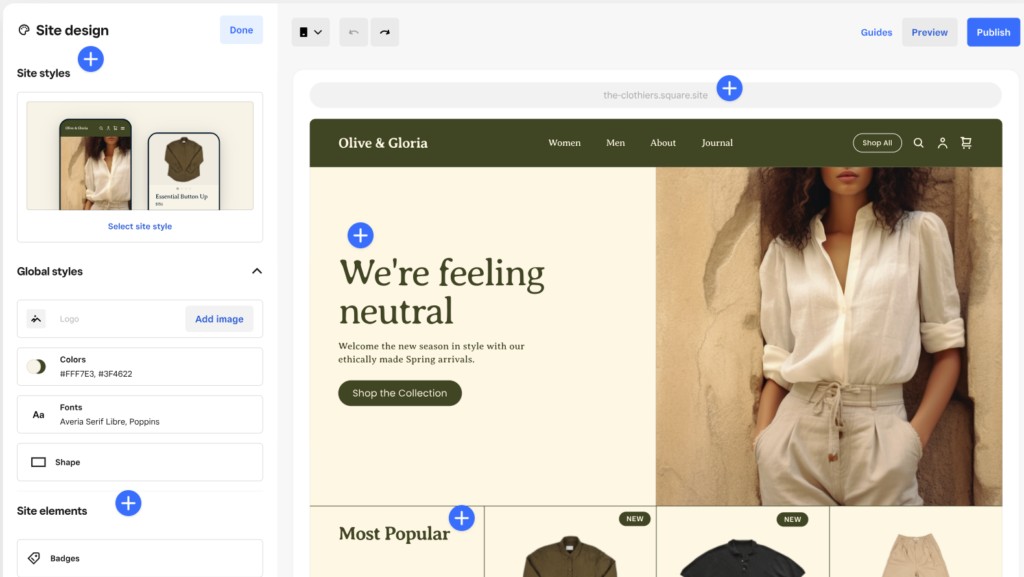

8.1.2. Online Site Builder

Square’s online site builder comes with a drag-and-drop functionality, enabling users to easily set up their website, even without prior experience.

Alt: Square online site builder provides easy drag-and-drop functionality.

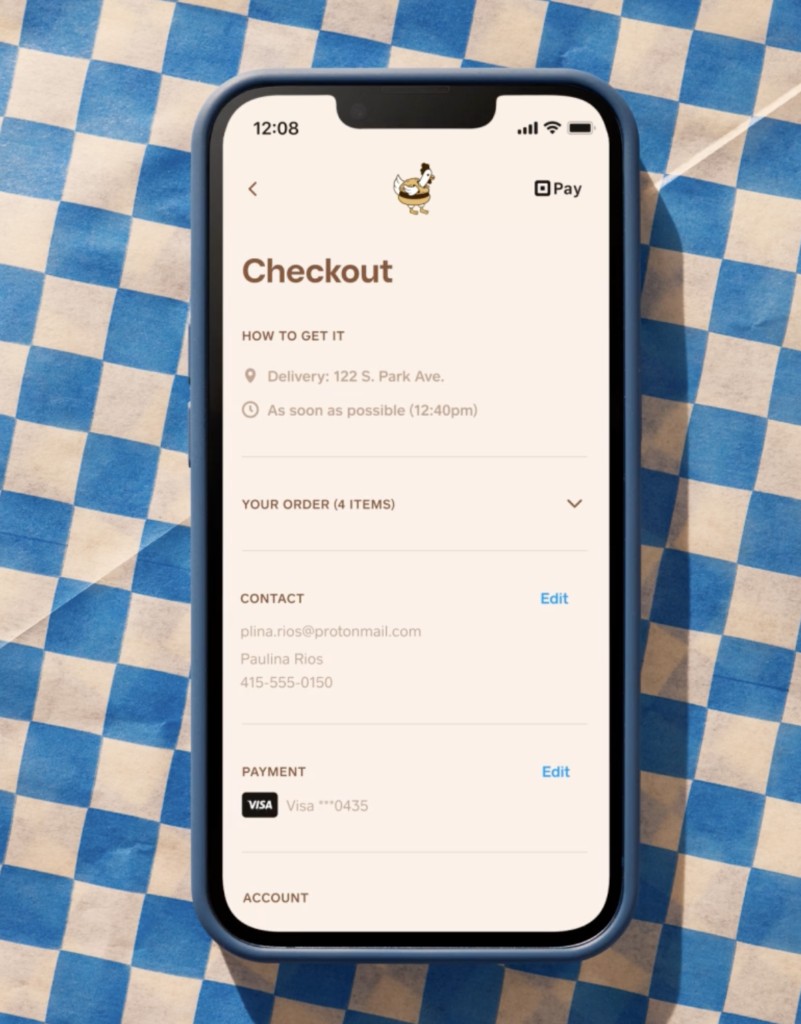

8.1.3. Online Ordering System

Square’s online ordering system provides restaurants with a mobile-friendly website where customers can place orders, along with QR codes for digital menus and embedded checkout links for social media platforms.

Alt: A mobile-first online menu from Square.

8.1.4. Payment Links and Buy Buttons

Square enables businesses to create payment links and buy buttons for various events and business types, facilitating online transactions and donations.

8.1.5. Gift Cards

Square’s gift cards are available in both physical and digital forms and can be sold in-store and online, providing businesses with a versatile marketing tool.

8.2. Square Customer Management Products

Square offers a range of customer management products designed to enhance customer engagement and loyalty.

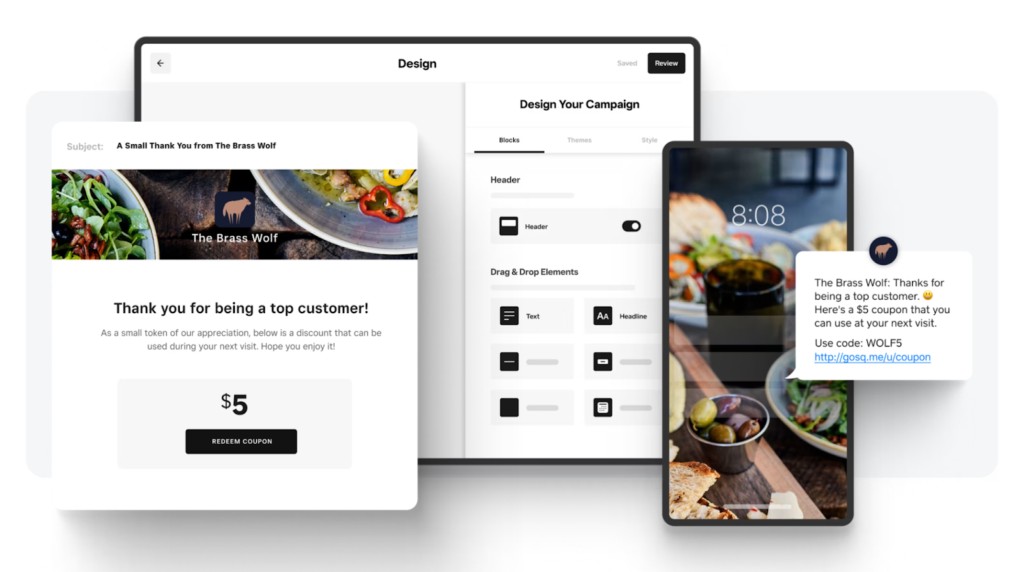

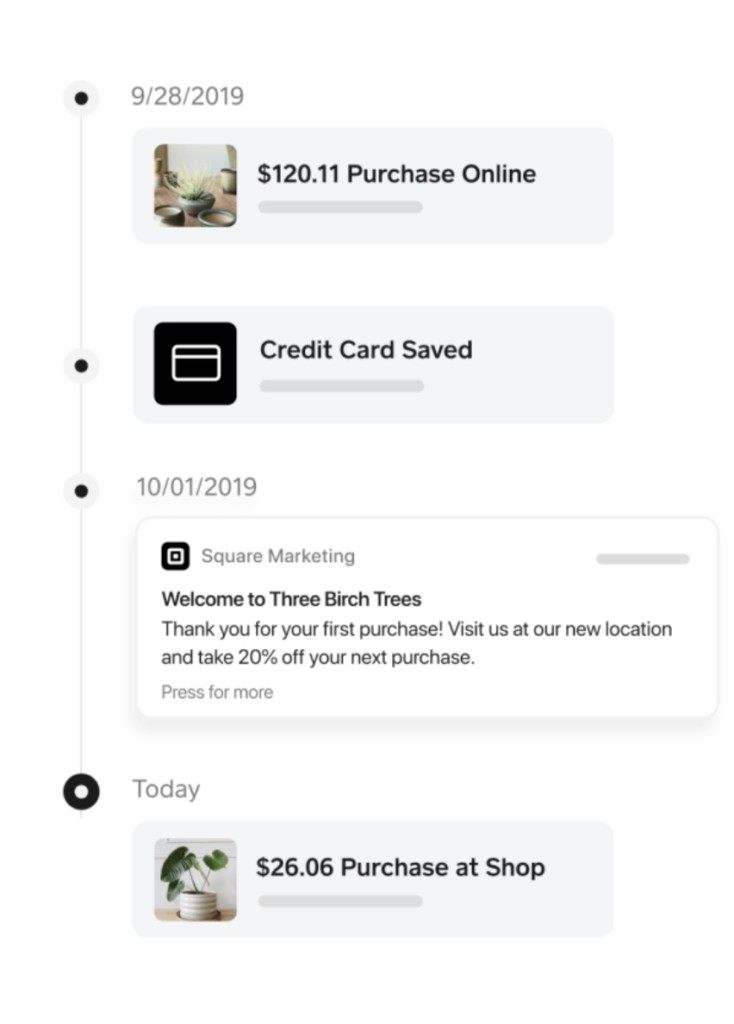

8.2.1. Email and Text Marketing

Square combines email and text marketing with CRM to nurture your customer base, offering customizable campaigns and automation features.

Alt: A Square marketing feature provides email and text marketing options.

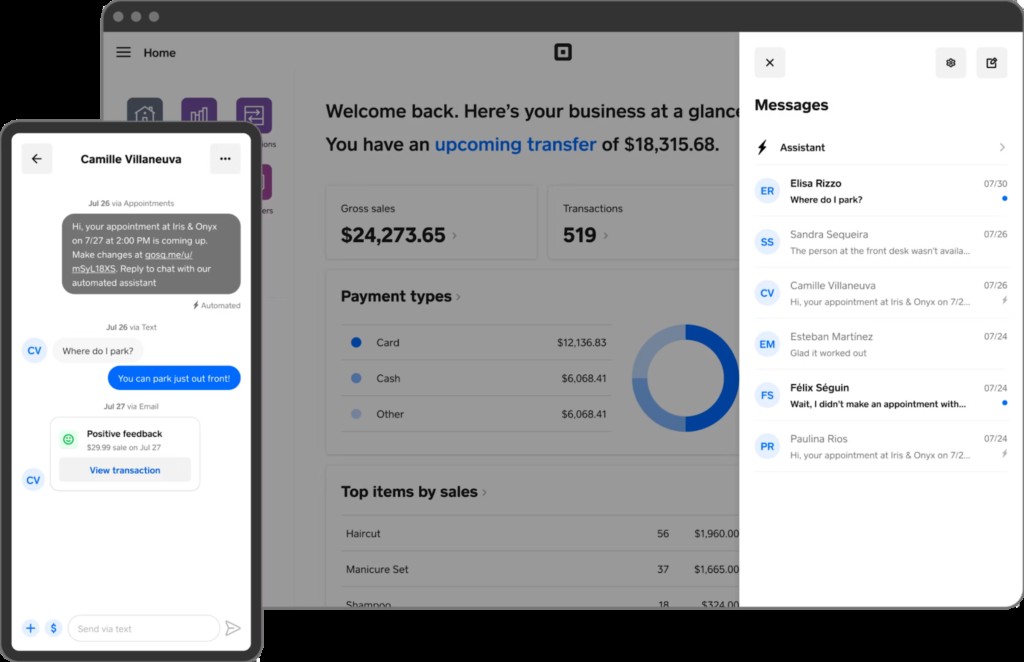

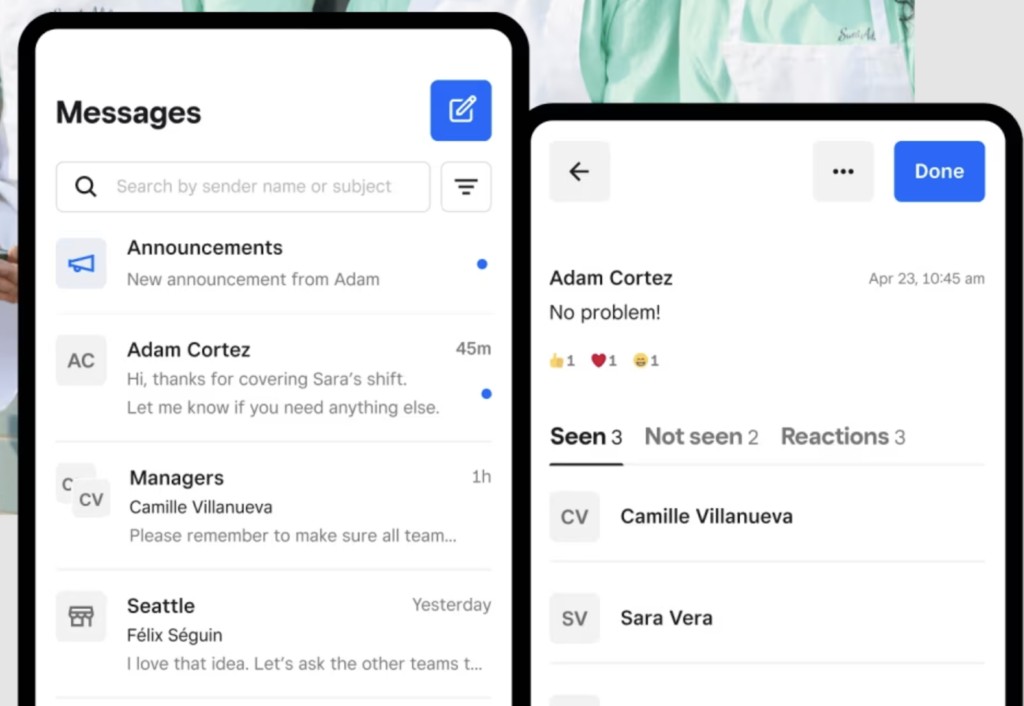

8.2.2. Square Messages

Square Messages help businesses efficiently manage customer communications from a single platform, streamlining interactions and enhancing customer service.

Alt: Square Messages shows SMS messaging options on both desktop and mobile.

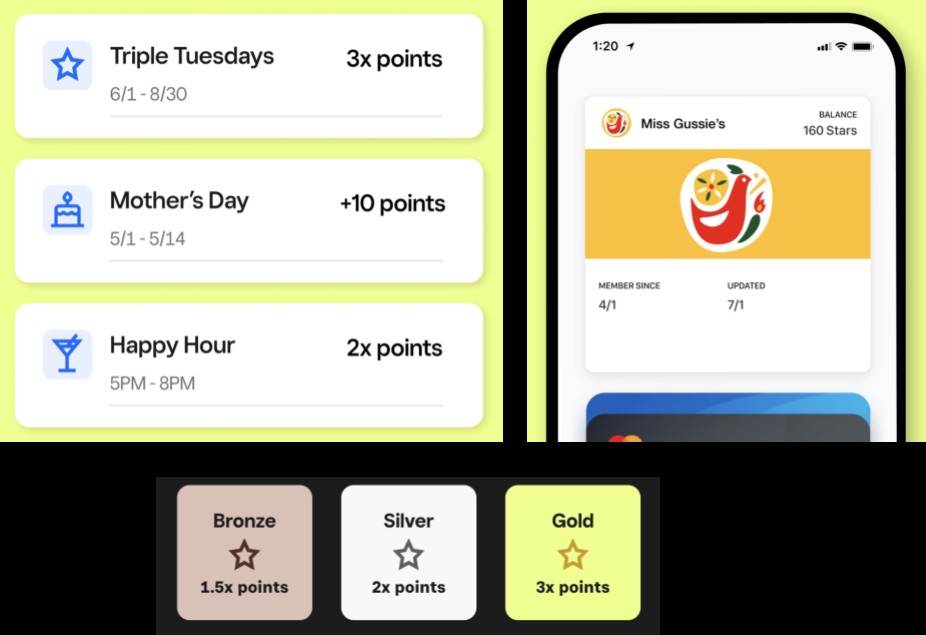

8.2.3. Loyalty Program Tools

Square’s loyalty program tools integrate with the customer directory, tracking purchase history and customer preferences to reward loyal customers.

Alt: A sample loyalty program from Square.

8.2.4. Customer Directory

Square’s customer directory integrates with other Square products, enabling businesses to analyze audience segments, understand customer behavior, and create timely reports.

Alt: A Square customer directory is integrated with loyalty and rewards programs.

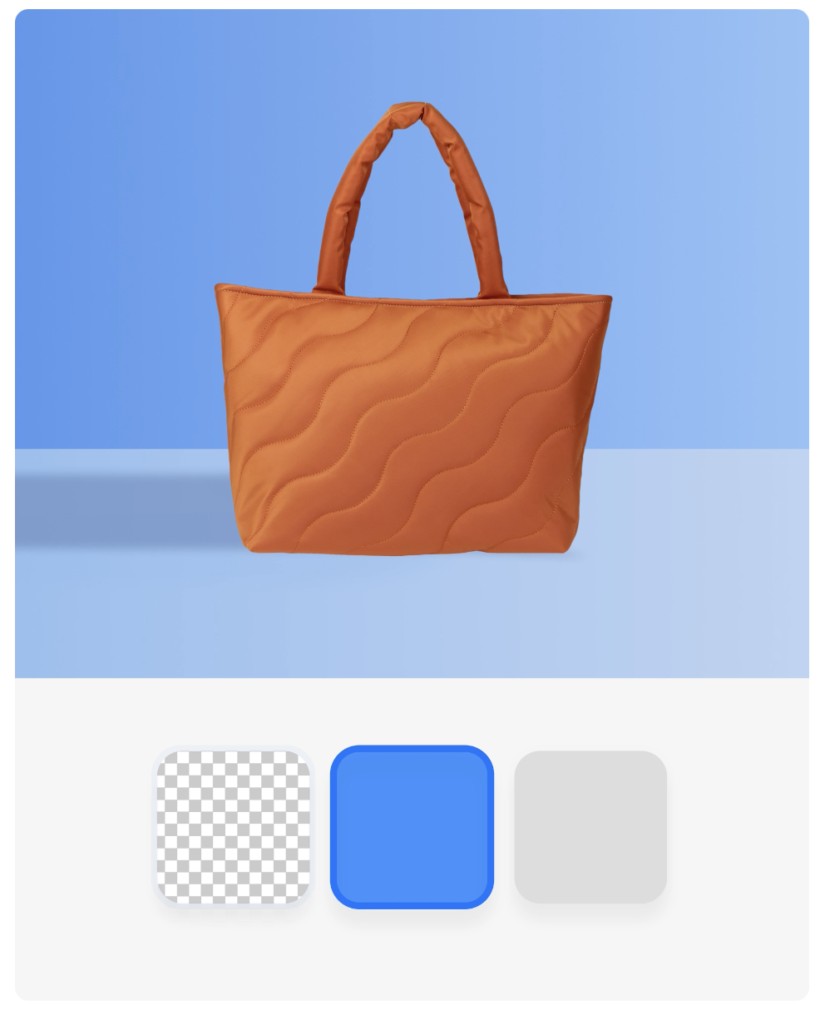

8.2.5. Photo Studio

The Square Photo Studio helps users capture and create professional product images, enhancing online sales and marketing efforts.

Alt: A Square Photo Studio provides AI-enhanced product images.

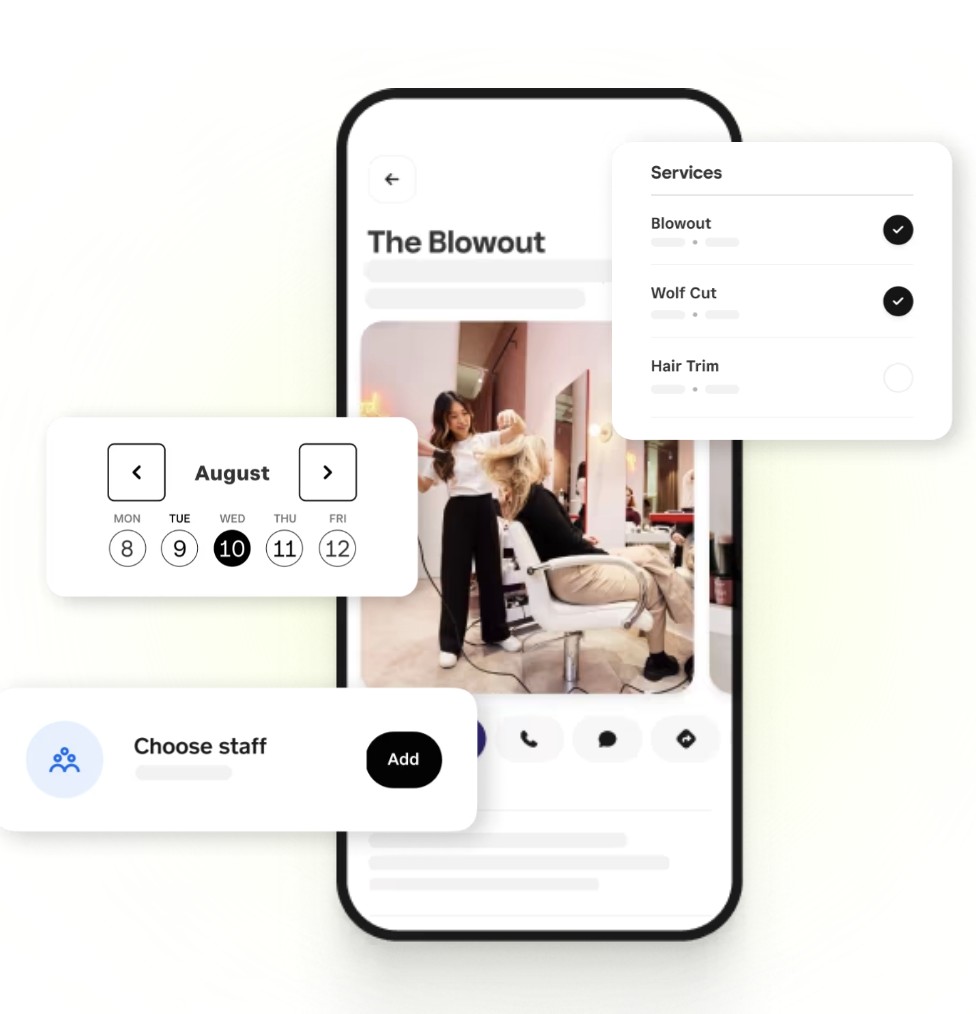

8.2.6. Square Go

Square Go lets customers manage their appointments from a mobile app, providing convenience and accessibility for both businesses and customers.

Alt: Square Go allows customers to manage appointments via a mobile app.

8.3. Square Staff Products

Square offers staff management products designed to streamline scheduling, communication, and payroll processing.

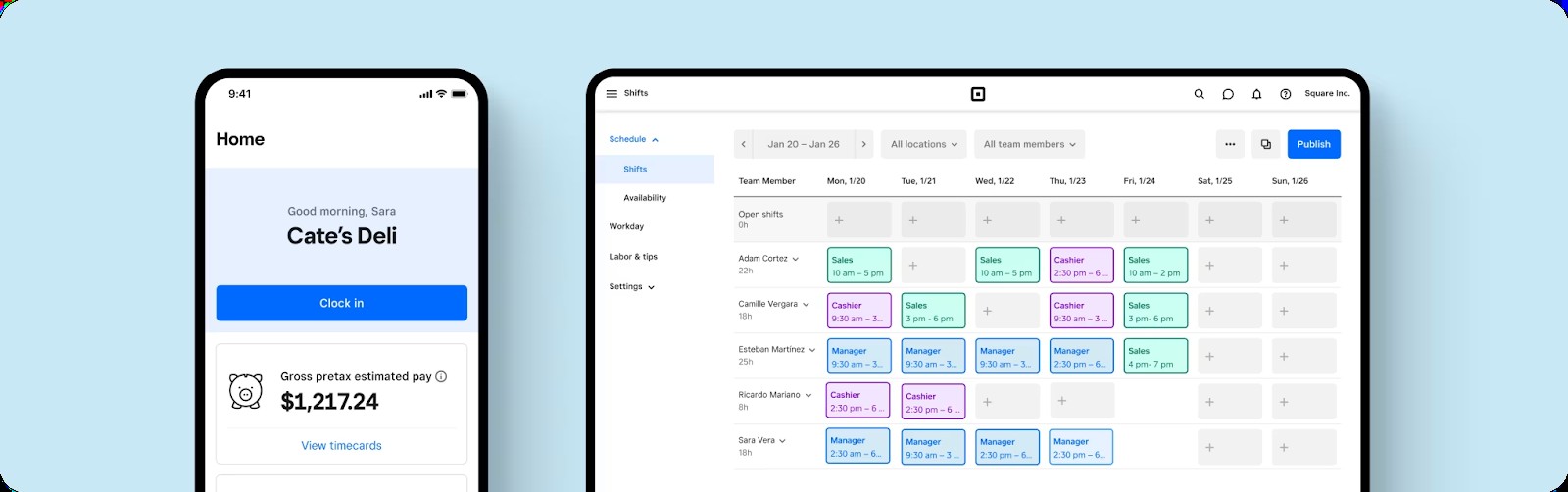

8.3.1. Square Shifts

Square Shifts integrates with the POS system to handle scheduling, time tracking, and attendance, enabling businesses to prepare payroll and analyze labor costs.

Alt: Square Shifts offers automated time cards to track attendance and time off.

8.3.2. Square Teams

The Square Teams app is a communication platform between employers and employees, facilitating announcements, file sharing, and private messaging.

Alt: The Square Teams app manages shift swapping and time off requests.

8.3.3. Square Payroll

With Square Payroll, businesses can run payroll in minutes, pulling information from team management tools and automating onboarding and tax filing.

8.4. Square Banking Products

Square offers banking products designed to provide businesses with fast access to funds and streamlined financial management.

8.4.1. Square Business Checking

Square Business Checking offers a fast way to set up a business checking account with no opening deposits or balance requirements.

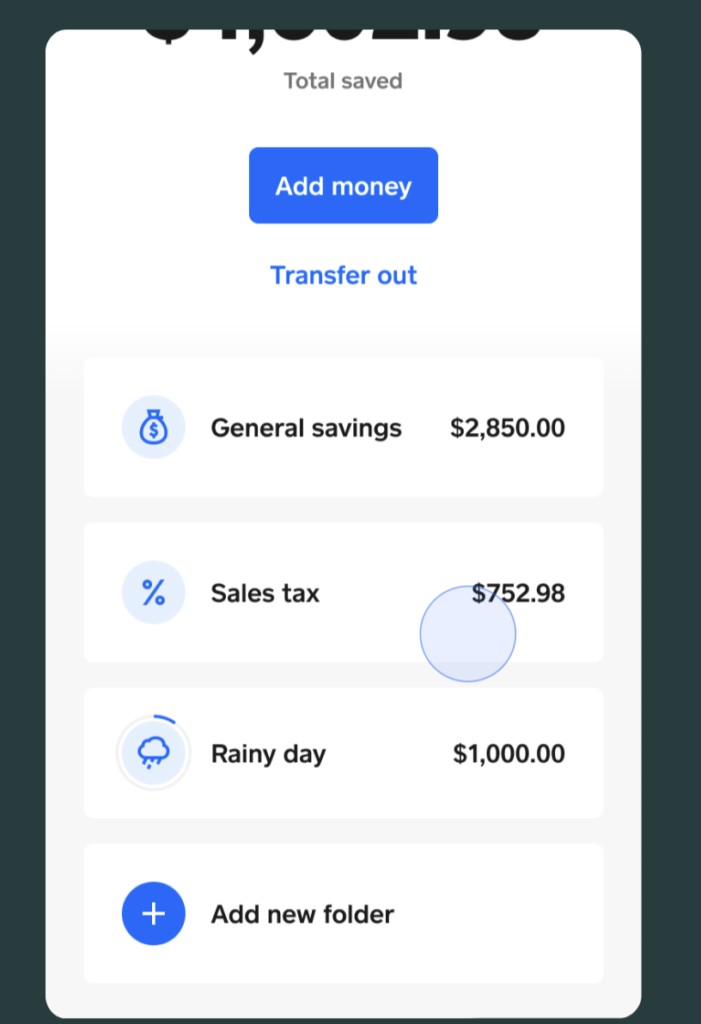

8.4.2. Square Business Savings

A Square Business Savings account allows companies to automatically set aside a portion of their sales proceeds for different goals, earning interest from Square’s APY.

Alt: Square Savings helps set aside funds for sales tax and other goals.

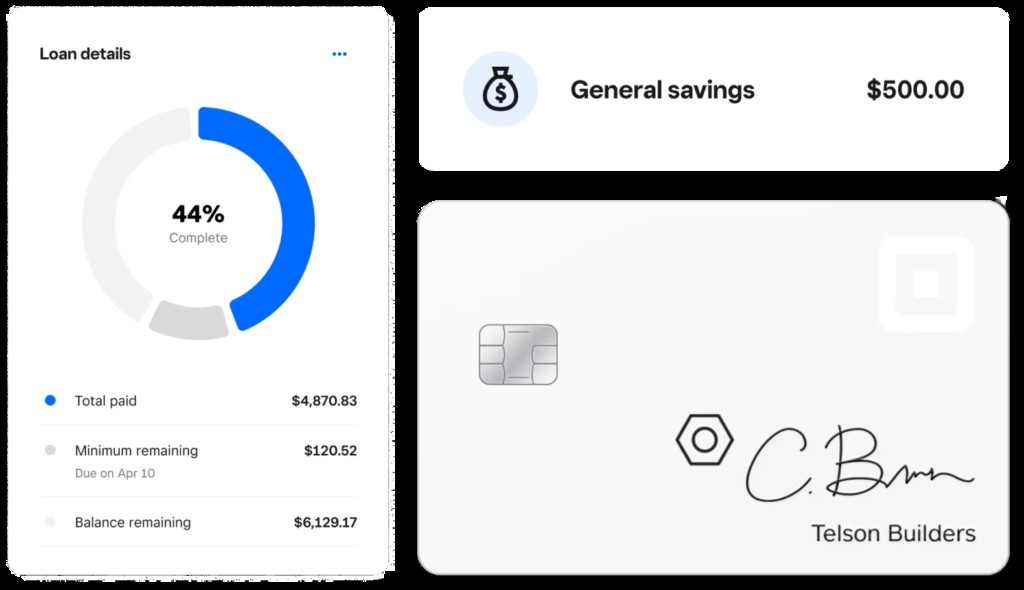

8.4.3. Square Business Credit Card

The Square Business Credit Card is linked to your Square Business Checking account, providing a credit line and incentives such as points that can be applied against credit card processing fees.

8.4.4. Square Loans

Square offers small business loans from $100-$350,000, with automated repayments based on daily earnings.

Alt: A loan application and savings balance in Square.

9. Key Benefits of Using Square

Square offers a range of benefits for businesses of all sizes, including an all-in-one business solution, a feature-rich free plan, ease of use, multichannel and omnichannel sales platform, and a seamless ecosystem.

9.1. All-in-One Business Solution

Square provides a complete business ecosystem with integrated payment processing, e-commerce platforms, and proprietary hardware, along with industry-specific software and business integration tools.

9.2. Feature-Rich Free Plan

Square’s popular free plan allows merchants to launch their business with zero upfront costs, providing essential tools and functionalities.

9.3. Ease of Use

Square is renowned for its user-friendly interface, allowing first-time users to quickly sign up, set up their account, and begin managing their business operations.

9.4. Multichannel and Omnichannel Sales Platform

Square supports multiple sales channels, enabling businesses to conduct sales and accept payments from mobile devices, storefronts, and online platforms.

9.5. Seamless Ecosystem

Square’s fully integrated business management tools ensure real-time updates across all sales channels, providing timely low-stock alerts and enhancing customer experience.

10. Examining Square’s Competitors and Alternatives

Square faces competition from other payment processing and POS providers, including PayPal, Stripe, and Helcim. Each offers unique features and benefits, catering to different business needs.

10.1. Square vs. PayPal

PayPal, a pioneer in online payment processing, offers a wide range of payment solutions and is particularly unique for its proprietary payment methods. While both are easy to set up, PayPal is a better option for occasional sellers.

| Square | PayPal | |

|---|---|---|

| Best for | Small business | Occasional sellers and e-commerce businesses |

| Merchant account type | Aggregate | Aggregate |

| Fee structure | Flat rate | Flat rate |

| Monthly software fee | $0-$89 (POS+payments) | $0-$30 (virtual terminal) |

| Chargeback fee | Waived up to $250/mo | $20 |

| Volume discounts | Sales volume > $250,000/year | Upgrade to Braintree for interchange plus rates |

| Scalability | Integrations, Square large business solutions | PayPal for Enterprise + upgrade to Braintree |

10.2. Square vs. Stripe

Stripe, a developer-first platform, offers nearly unlimited customization options via APIs and SDKs. Unlike Square, Stripe has no native POS software, requiring custom integration to use the system with a business platform.

| Square | Stripe | |

|---|---|---|

| Best for | In-person sales | Online sales |

| Merchant account type | Aggregate | Aggregate |

| Fee structure | Flat rate | Flat rate |

| Monthly software fee | $0-$89 (POS+payments) | $0-$10 (Custom domain) |

| Chargeback fee | Waived up to $250/mo | $15 |

| Volume discounts | Sales volume > $250,000/year | Custom interchange plus rates quote for large-volume sales |

| Scalability | Integrations, Square large business solutions | Coding-based customizations |

10.3. Square vs. Helcim

Helcim offers a variety of payment methods and services, including free POS, invoicing, and e-commerce software. Unlike Square, Helcim supports additional cost-saving features, such as built-in volume discounts and free credit card processing.

| Square | Helcim | |

|---|---|---|

| Best for | Small and new businesses | Fast-growing businesses & B2Bs |

| Merchant account type | Aggregate | Traditional/dedicated |

| Fee structure | Flat rate | Interchange plus |

| Monthly software fee | $0-$89 (POS+payments) | $0 |

| Chargeback fee | Waived up to $250/mo | $15 refundable |

| Volume discounts | Sales volume > $250,000/year | Built-in volume-based discounts |

| Scalability | Integrations, Square large business solutions | Developer tools and APIs |

11. Frequently Asked Questions (FAQs) About Square

Here are some frequently asked questions about Square and its functionalities:

| Question | Answer |

|---|---|

| What is the major benefit of using Square? | The major benefit of using Square is the access to a complete suite of business software solutions to customize and grow a POS system based on your business needs. Square is a one-stop-shop, which makes for an easy set up. |

| How does Square work? | Square works by integrating its core POS software with its in-house payments, ecommerce, and other business management tools. It runs sales and manages inventory across multiple channels from a single POS dashboard and supports real-time inventory and sales information. |

| Does Square provide a free plan? | Yes. Square provides one of the most feature-rich free plans in the market that includes payment processing, website builder & management, mobile POS app, virtual terminal, and a free magstripe mobile card reader. |

| Is Square a good POS system? | Yes, Square is a great POS system that offers the best value-for-money especially for small and new businesses. Square also offers great potential for building a custom POS solution for large businesses. |

| Do I need to link a business bank account to Square? | Yes, you will need to link a business bank account when you sign up for a Square account. Square will send the proceeds of your sales (net of transaction fees) to your business bank account. |

| Is Square used by large businesses? | Yes, Square is used by many large businesses such as Shake Shack, SoFi Stadium, and Ben & Jerry’s. It utilizes a combination of advanced developer tools and various third-party partnerships to provide tailored solutions. |

| Is Square’s POS software HIPAA compliant? | Square’s POS software is HIPAA compliant. It signs business associate agreements (BAA) with healthcare providers, making handling patient information in the Square POS system legal. |

12. Need Answers? Ask WHAT.EDU.VN!

Are you struggling to find quick, free answers to your questions? Do you find yourself unsure of where to turn for reliable information? Are you concerned about the cost of expert advice?

12.1. WHAT.EDU.VN: Your Free Question-Answering Platform

WHAT.EDU.VN offers a free platform where you can ask any question and receive prompt, accurate answers. We provide easy-to-understand, helpful information and connect you with a knowledgeable community for insightful discussions.

12.2. Why Choose WHAT.EDU.VN?

- Free to Use: Ask unlimited questions without any hidden costs.

- Fast and Accurate Answers: Receive quick, precise responses from experts.

- Easy-to-Understand Information: Get clear, concise explanations.

- Community Support: Connect with others for valuable knowledge exchange.

12.3. Call to Action

Don’t remain in the dark! Visit WHAT.EDU.VN today and ask your question to get the answers you need. Our dedicated team is ready to help you find solutions and information.

Contact Us:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- WhatsApp: +1 (206) 555-7890

- Website: WHAT.EDU.VN

12.4. Experience the Convenience

Experience the ease and convenience of having your questions answered quickly and easily with what.edu.vn. We are committed to providing you with the knowledge and support you need.