What Is The Credit Score Range? Understanding the credit score scale is crucial for financial health. At WHAT.EDU.VN, we provide a clear overview of credit score ranges, their impact, and how to improve your credit rating. Discover your creditworthiness and unlock better financial opportunities today through creditworthiness insights and credit scoring tips.

1. Understanding the Credit Score Range

Credit scores play a vital role in your financial life, influencing everything from loan approvals to interest rates. But what exactly is the credit score range, and how does it impact you? Let’s break it down.

A credit score is a three-digit number that summarizes your credit history, providing lenders with an assessment of your creditworthiness. It’s a snapshot of how likely you are to repay debts, based on your past borrowing behavior. Understanding the credit score range is the first step toward managing your financial health.

1.1. FICO Score Range

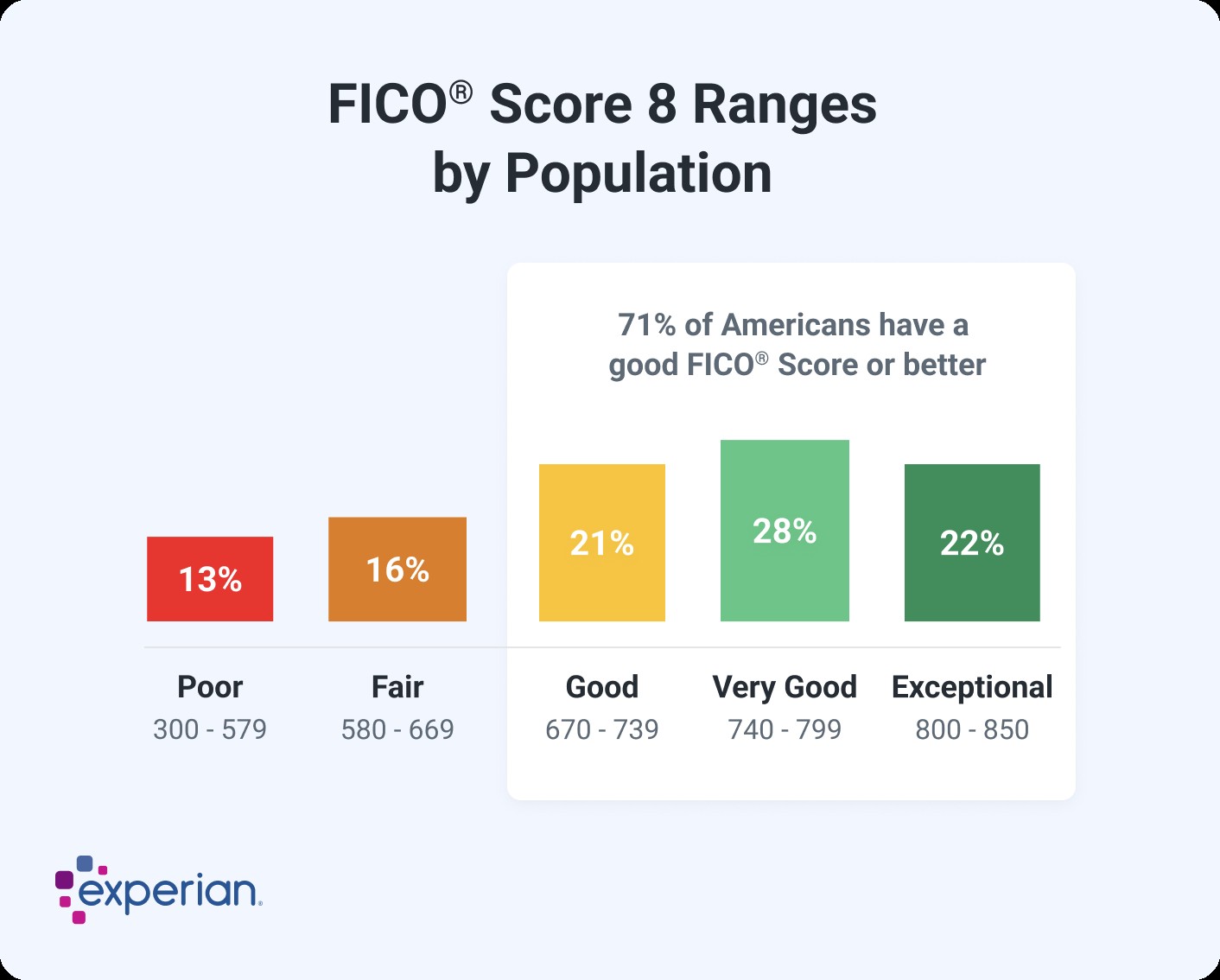

The FICO (Fair Isaac Corporation) Score is one of the most widely used credit scoring models. It ranges from 300 to 850, with higher scores indicating lower credit risk. Here’s a breakdown of the FICO score range:

- 300-579: Poor. Individuals in this range are considered high-risk borrowers. They may face difficulty obtaining credit or receive high interest rates.

- 580-669: Fair. This range is below average, and individuals may still encounter challenges securing loans with favorable terms.

- 670-739: Good. A score in this range is considered good and can lead to better loan terms and interest rates.

- 740-799: Very Good. Individuals with scores in this range are seen as reliable borrowers and can access even better rates and terms.

- 800-850: Exceptional. This is the highest credit score range, indicating excellent credit management. Individuals in this range receive the best possible loan terms and interest rates.

1.2. VantageScore Range

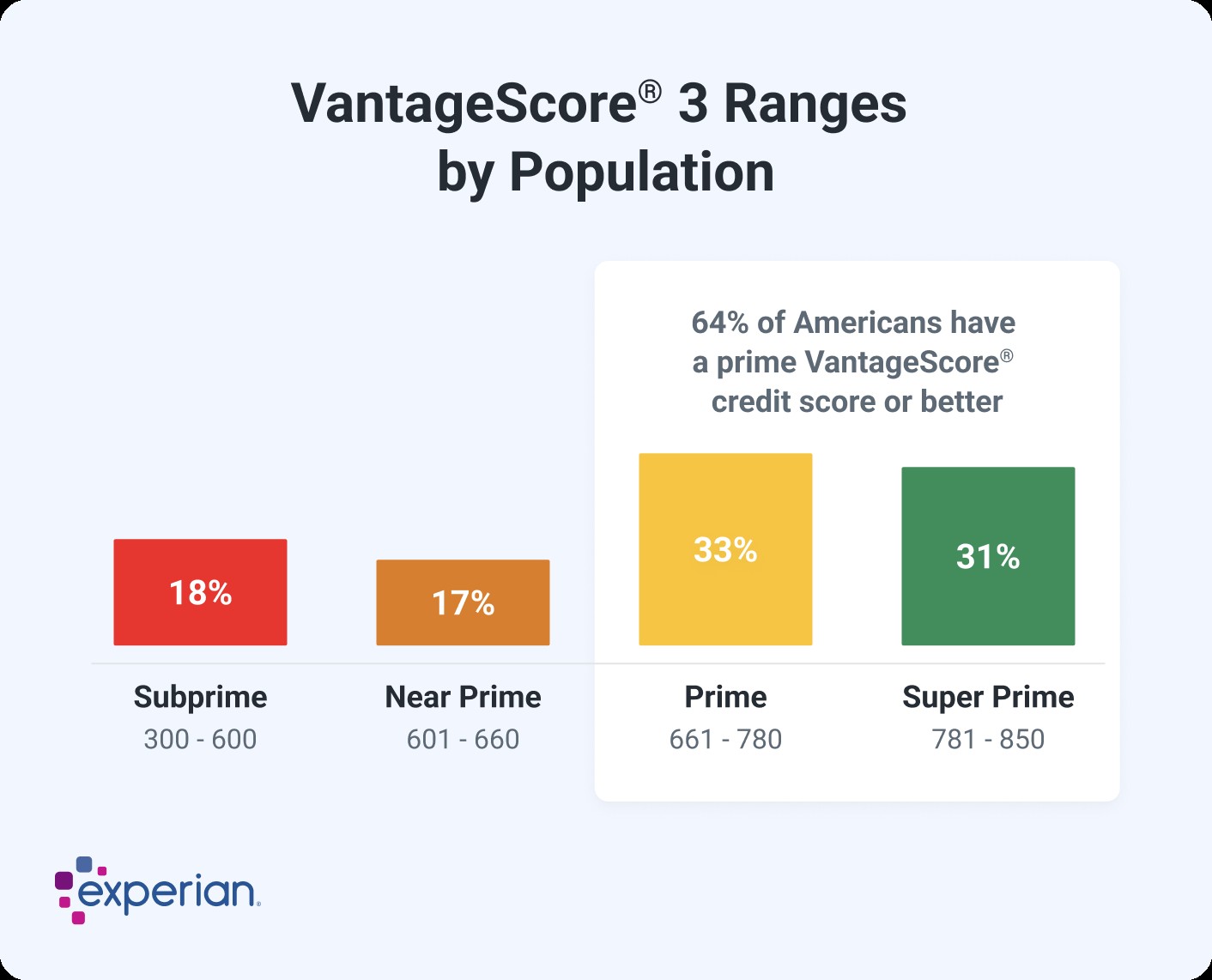

VantageScore is another popular credit scoring model, also using a range of 300 to 850. While it’s similar to the FICO score, there are some differences in how it’s calculated. Here’s the VantageScore breakdown:

- 300-499: Very Poor. This range indicates significant credit challenges.

- 500-600: Poor. Individuals in this range may struggle to get approved for credit.

- 601-660: Fair. This range is below average, and borrowers may face higher interest rates.

- 661-780: Good. A score in this range is considered good and can result in favorable loan terms.

- 781-850: Excellent. This top tier signifies excellent credit management and access to the best rates.

1.3. Industry-Specific Scores

In addition to the base FICO and VantageScore models, there are also industry-specific scores. These scores are tailored for specific types of lenders, such as auto lenders and credit card issuers. For example, FICO offers auto scores and bankcard scores that range from 250 to 900. These scores provide lenders with a more precise assessment of risk for their particular industry.

Understanding the different credit score ranges is essential for knowing where you stand and what steps you can take to improve your creditworthiness. Whether you’re aiming for a mortgage, a car loan, or a new credit card, knowing your score is the first step.

2. Factors Influencing Your Credit Score

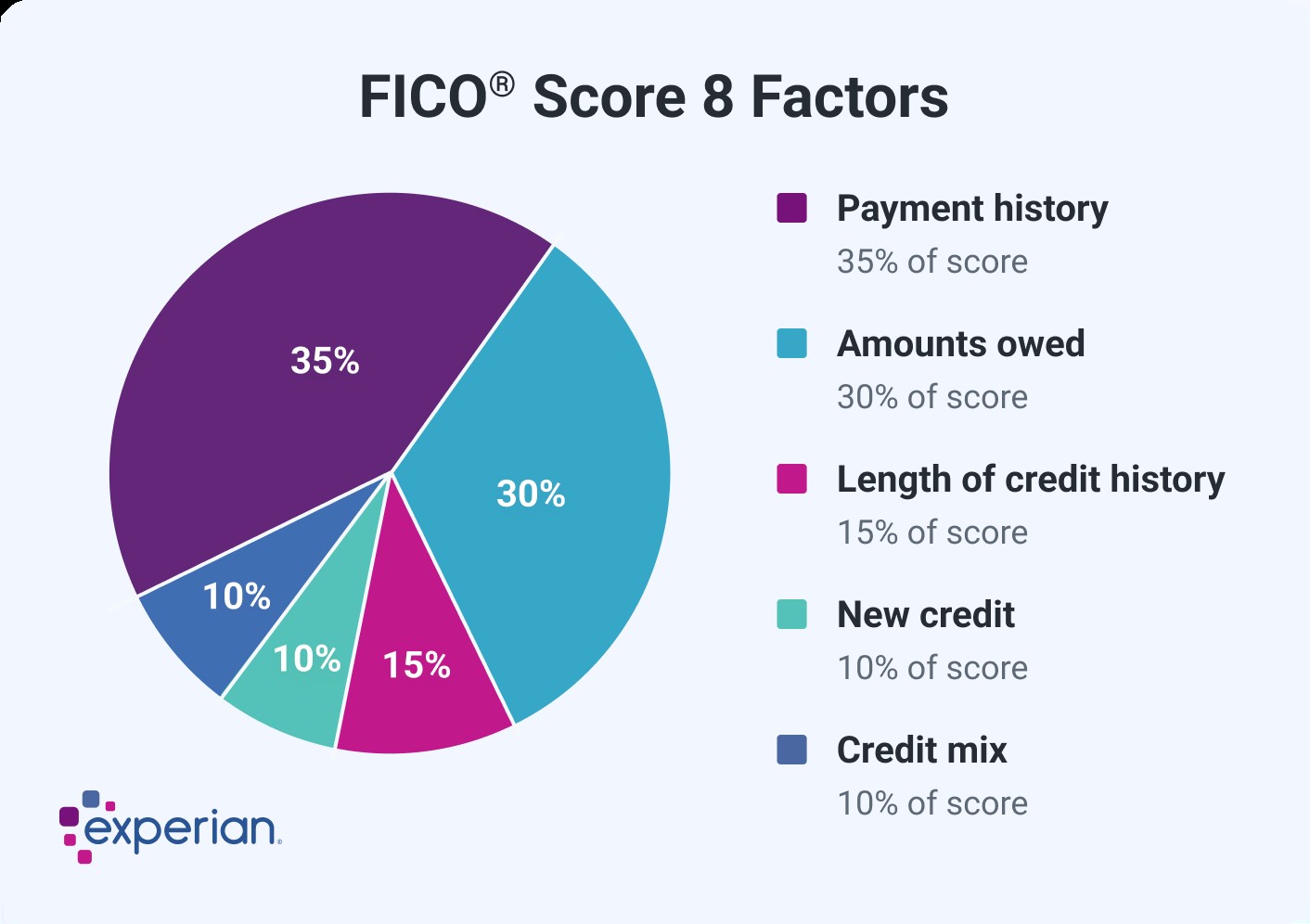

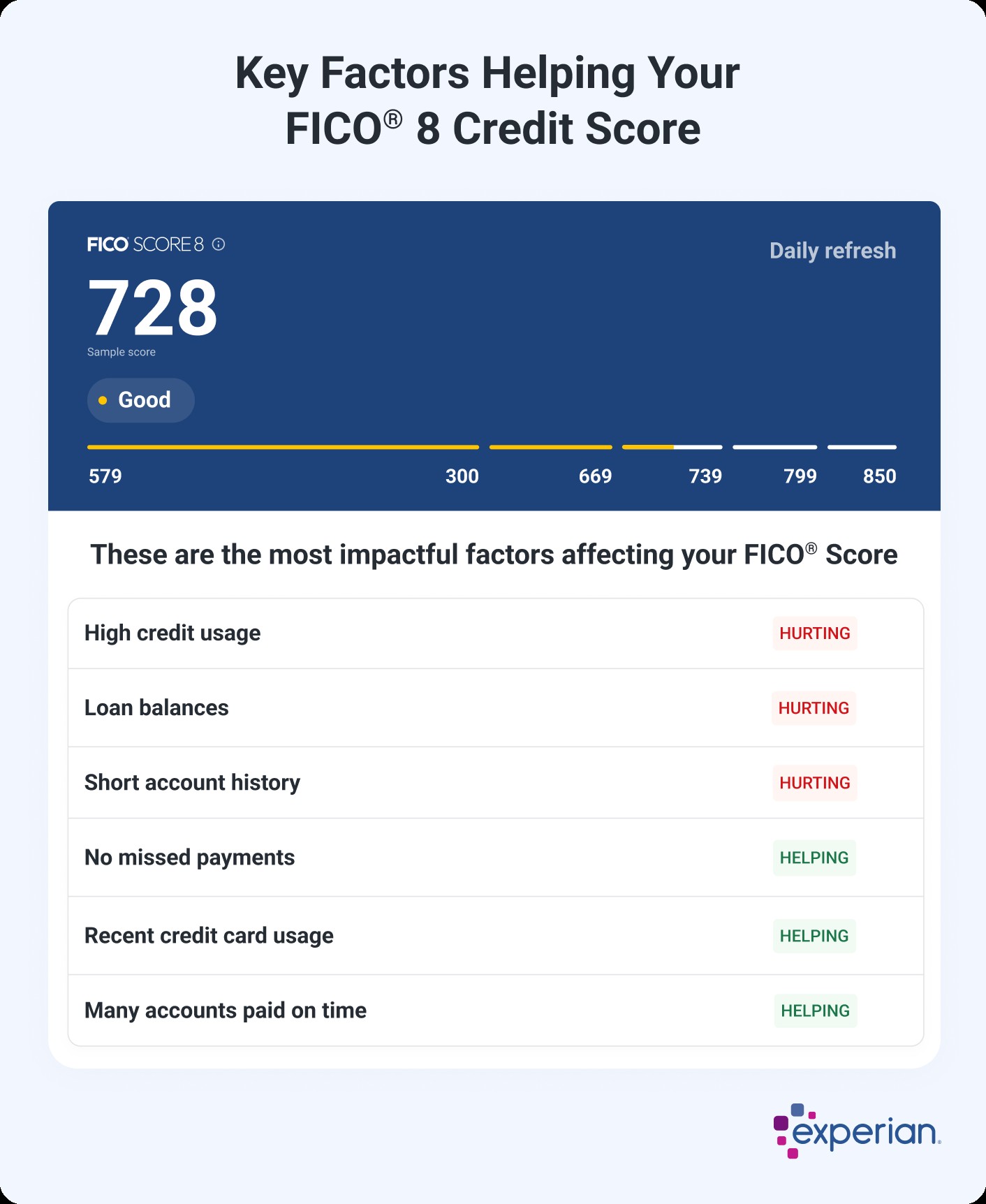

Several key factors influence your credit score, and understanding these can help you take control of your financial health. Both FICO and VantageScore consider similar factors, although they may weigh them differently. Let’s explore these factors in detail.

2.1. Payment History

Payment history is the most significant factor in determining your credit score. It reflects whether you’ve made past payments on time. Late payments, defaults, and bankruptcies can significantly lower your score.

- Importance: Extremely influential

- Impact: Consistently paying bills on time is crucial for building and maintaining a good credit score. Setting up payment reminders or automatic payments can help ensure you never miss a due date.

2.2. Amounts Owed

The amount of debt you owe, also known as credit utilization, is another critical factor. Credit utilization is the ratio of your outstanding credit balances to your total available credit.

- Importance: Highly influential

- Impact: Keeping your credit utilization low (ideally below 30%) demonstrates responsible credit management. Maxing out credit cards can negatively impact your score.

2.3. Length of Credit History

The length of time you’ve had credit accounts open also plays a role in your credit score. A longer credit history generally indicates a more predictable borrowing behavior.

- Importance: Moderately influential

- Impact: Avoid closing old credit accounts, even if you don’t use them regularly, as this can shorten your credit history and potentially lower your score.

2.4. Credit Mix

Having a mix of different types of credit accounts, such as credit cards, installment loans (e.g., auto loans, mortgages), and lines of credit, can positively influence your credit score.

- Importance: Less influential

- Impact: Diversifying your credit portfolio demonstrates that you can manage different types of credit responsibly.

2.5. New Credit

Opening too many new credit accounts in a short period can negatively impact your credit score. Each application for credit results in a hard inquiry on your credit report, which can lower your score slightly.

- Importance: Less influential

- Impact: Be mindful of how often you apply for new credit. Space out your applications to avoid appearing as a high-risk borrower.

2.6. Public Records and Collections

Public records, such as bankruptcies, and collection accounts can severely damage your credit score. These negative marks indicate a history of financial distress.

- Importance: Highly influential

- Impact: Avoid bankruptcies and work to resolve any collection accounts as quickly as possible. Negotiating a payment plan or settlement can help mitigate the damage.

2.7. What Credit Scores Do Not Consider

It’s also important to know what factors credit scores do not consider. Credit scores do not take into account:

- Age: Your age does not directly affect your credit score.

- Income: Your income is not a factor in calculating your credit score.

- Employment history: Your employment history is not considered.

- Savings: The amount of money you have in savings or investment accounts is not factored into your credit score.

By understanding the factors that influence your credit score, you can take proactive steps to improve your creditworthiness and achieve your financial goals.

3. Credit Scores and Key Financial Decisions

Your credit score is a critical factor in many important financial decisions. A good credit score can unlock opportunities and save you money, while a poor score can limit your options and increase your costs. Let’s examine how credit scores impact key financial decisions.

3.1. Buying a Home

Your credit score plays a significant role in determining whether you’ll be approved for a mortgage and the interest rate you’ll receive. Lenders view your credit score as an indicator of your ability to repay the loan.

- Impact: A higher credit score can qualify you for a lower interest rate, saving you thousands of dollars over the life of the loan. A lower score may result in denial or higher interest rates.

- Minimum Score: To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range or higher (FICO Score of at least 670).

- Government-Backed Mortgages:

- FHA Loans: May accept scores as low as 500 with a 10% down payment or 580+ with a 3.5% down payment.

- USDA Loans: Lenders may require a minimum score of 580-620, though there is no set minimum.

- VA Loans: Lenders generally require a score of 620+.

3.2. Buying a Car

Similar to mortgages, your credit score affects your ability to get approved for an auto loan and the interest rate you’ll pay. Auto lenders use your credit score to assess the risk of lending to you.

- Impact: A good credit score can lead to lower interest rates and better loan terms, while a poor score may result in higher rates or denial.

- Minimum Score: While there isn’t a set minimum, a VantageScore credit score of 661 or higher could be a good score.

3.3. Credit Cards

Your credit score is a primary factor in whether you’ll be approved for a credit card and the terms you’ll receive, such as the credit limit and interest rate.

- Impact: A higher credit score can qualify you for credit cards with better rewards, lower interest rates, and higher credit limits. A lower score may limit your options to secured credit cards or those with high fees and interest rates.

- Benefits of Good Credit: Access to premium credit cards with travel rewards, cashback, and other perks.

3.4. Renting an Apartment

Landlords often check your credit score as part of the application process. A good credit score indicates responsible financial behavior and increases your chances of getting approved.

- Impact: A poor credit score may lead to denial or require you to pay a higher security deposit.

- Alternative Options: Consider providing references or offering to pay a larger deposit to offset a lower credit score.

3.5. Insurance Rates

In many states, insurance companies use credit-based insurance scores to help determine your premiums for auto, home, and life insurance.

- Impact: A good credit score can result in lower insurance premiums, while a poor score may lead to higher rates.

- Credit-Based Insurance Scores: These scores are different from traditional credit scores but are based on similar factors from your credit report.

Average Mortgage Rates Based on FICO® Score

| FICO® Score | Interest Rate, 30-Year Fixed-Rate Mortgage | Monthly Payment | Total Interest Cost |

|---|---|---|---|

| 620 | 7.71% | $2,806.11 | $549,199 |

| 700 | 7.13% | $2,667.53 | $499,310 |

| 840 | 6.69% | $2,564.49 | $462,214 |

Source: Curinos LLC, December 6, 2024; assumes a $350,000 mortgage and 30-day rate-lock period

3.6. Employment

Some employers may review your credit reports (but not your credit scores) before making a hiring or promotion decision.

- Impact: A negative credit report may raise concerns about your reliability and financial responsibility.

- Fair Credit Reporting Act (FCRA): Employers must obtain your permission before checking your credit report.

Understanding how your credit score impacts these key financial decisions can motivate you to take steps to improve and maintain a good credit rating.

4. Strategies to Improve Your Credit Score

Improving your credit score requires a consistent effort and a focus on responsible financial habits. Here are effective strategies to help you boost your credit rating:

4.1. Pay Bills On Time

Payment history is the most important factor in your credit score, so paying all your bills on time, every time, is crucial.

- Action Steps:

- Set up payment reminders or automatic payments to avoid missing due dates.

- Prioritize paying at least the minimum amount due on all credit accounts.

4.2. Reduce Credit Utilization

Keeping your credit utilization low demonstrates responsible credit management and can significantly improve your credit score.

- Action Steps:

- Aim to keep your credit utilization below 30% on each credit card.

- Pay down your credit card balances as much as possible each month.

- Consider requesting a credit limit increase (without increasing spending) to lower your utilization ratio.

4.3. Monitor Your Credit Report

Regularly checking your credit report allows you to identify and correct any errors or inaccuracies that could be negatively impacting your score.

- Action Steps:

- Obtain a free copy of your credit report from each of the three major credit bureaus (Experian, TransUnion, Equifax) at AnnualCreditReport.com.

- Review each report carefully and dispute any errors or inaccuracies with the credit bureau.

4.4. Avoid Opening Too Many New Accounts

Opening multiple new credit accounts in a short period can lower your credit score and make you appear as a higher-risk borrower.

- Action Steps:

- Limit the number of new credit applications you submit.

- Space out your applications to avoid multiple hard inquiries on your credit report.

4.5. Keep Old Accounts Open

The length of your credit history is a factor in your credit score, so keeping older accounts open (even if you don’t use them) can be beneficial.

- Action Steps:

- Avoid closing old credit card accounts, as this can shorten your credit history and potentially lower your score.

- Use older accounts occasionally to keep them active.

4.6. Diversify Your Credit Mix

Having a mix of different types of credit accounts (e.g., credit cards, installment loans) can positively influence your credit score.

- Action Steps:

- If you only have credit cards, consider taking out a small installment loan (e.g., a secured loan) and paying it off responsibly.

- Avoid taking on unnecessary debt just to diversify your credit mix.

4.7. Become an Authorized User

Becoming an authorized user on someone else’s credit card account can help you build credit, especially if you have a limited credit history.

- Action Steps:

- Ask a trusted friend or family member with a good credit history to add you as an authorized user on their credit card.

- Ensure that the card issuer reports authorized user activity to the credit bureaus.

4.8. Consider a Secured Credit Card

If you have poor credit or a limited credit history, a secured credit card can be a good way to start building or rebuilding your credit.

- Action Steps:

- Apply for a secured credit card and make regular, on-time payments.

- Over time, your responsible use of the card can help improve your credit score.

Improving your credit score is a marathon, not a sprint. It takes time and consistent effort to build and maintain a good credit rating.

5. What to Do If You Don’t Have a Credit Score

If you’re new to credit or haven’t used credit in a while, you may not have a credit score. This can make it difficult to get approved for loans, credit cards, and other financial products. Here’s what you can do if you don’t have a credit score:

5.1. Understand the Requirements

Credit scoring models require a certain amount of information to generate a score. For FICO Scores, you generally need:

- An account that’s at least six months old.

- An account that has been active in the past six months.

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

5.2. Build Credit with a Secured Credit Card

A secured credit card is a great way to start building credit if you have no credit history. You’ll need to deposit a security deposit, which typically serves as your credit limit.

- Action Steps:

- Apply for a secured credit card and make regular, on-time payments.

- As you demonstrate responsible use, your credit score will begin to build.

5.3. Become an Authorized User

Becoming an authorized user on someone else’s credit card account can help you establish a credit history.

- Action Steps:

- Ask a trusted friend or family member with a good credit history to add you as an authorized user.

- Ensure that the card issuer reports authorized user activity to the credit bureaus.

5.4. Consider Credit-Builder Loans

Credit-builder loans are designed to help people with no credit or bad credit establish a positive credit history.

- Action Steps:

- Apply for a credit-builder loan from a credit union or community bank.

- Make regular, on-time payments, and the lender will report your payment activity to the credit bureaus.

5.5. Report Rent and Utility Payments

Some credit reporting services allow you to report your rent and utility payments, which can help you build credit.

- Action Steps:

- Sign up for a service that reports rent and utility payments to the credit bureaus.

- Ensure that you make consistent, on-time payments to get the most benefit.

5.6. Patience and Persistence

Building credit takes time, so be patient and persistent in your efforts. It may take several months or even years to establish a good credit history.

- Action Steps:

- Continue to practice responsible financial habits, such as paying bills on time and keeping your credit utilization low.

- Monitor your credit report regularly to track your progress.

Building a credit score from scratch can be challenging, but it’s essential for accessing credit and achieving your financial goals.

6. Understanding Changes in Your Credit Score

Your credit score can fluctuate over time due to various factors. Understanding why your score changes can help you manage your credit more effectively.

6.1. Factors That Can Increase Your Credit Score

- Paying off debt: Reducing your credit card balances and paying off loans can lower your credit utilization and improve your score.

- Making on-time payments: Consistently paying your bills on time adds positive payment history to your credit report.

- Negative items falling off: Negative items, such as late payments and collections, typically remain on your credit report for a limited time. When they fall off, your score may increase.

6.2. Factors That Can Decrease Your Credit Score

- Late payments: Even a single late payment can negatively impact your credit score.

- Increased credit utilization: Maxing out your credit cards or increasing your overall debt can lower your score.

- Applying for new credit: Each application for credit results in a hard inquiry on your credit report, which can lower your score slightly.

- Closing accounts: Closing old credit accounts can shorten your credit history and potentially lower your score.

6.3. Unexpected Impacts on Your Credit Score

Some actions may have an unexpected impact on your credit score. For example, paying off a loan could lead to a score drop because it was the only open installment account you had.

- Paying off a loan: While paying off a loan is generally a positive action, it can reduce the diversity of your credit mix and potentially lower your score.

- Closing a credit card: Closing a credit card can reduce your overall available credit and increase your credit utilization ratio, which can negatively impact your score.

6.4. Monitoring Your Credit Score

Regularly monitoring your credit score and report can help you stay informed about changes and take action to address any issues.

- Action Steps:

- Sign up for a credit monitoring service that provides alerts when your score changes or new activity is reported on your credit report.

- Review your credit report regularly to identify and correct any errors or inaccuracies.

Understanding the factors that can influence your credit score and monitoring your credit regularly can help you maintain a good credit rating and achieve your financial goals.

7. Credit Score FAQs

Here are some frequently asked questions about credit scores:

| Question | Answer |

|---|---|

| What is a good credit score? | A good credit score is generally considered to be in the 670-739 range for FICO scores and 661-780 for VantageScore. |

| How often do credit scores update? | Credit scores can update as often as daily, but typically update monthly as lenders report new information to the credit bureaus. |

| Does checking my own credit score hurt it? | No, checking your own credit score is considered a soft inquiry and does not impact your credit score. |

| How can I improve my credit score quickly? | The fastest way to improve your credit score is to pay down your credit card balances to lower your credit utilization ratio. |

| What is the difference between FICO and VantageScore? | FICO and VantageScore are both credit scoring models, but they use different algorithms and may weigh factors differently. |

| How long does it take to build good credit? | It can take several months to years to build good credit, depending on your starting point and how consistently you practice responsible financial habits. |

| Can I get a loan with a bad credit score? | Yes, but you may face higher interest rates and less favorable terms. Consider improving your credit score before applying for a loan. |

| What is a credit report? | A credit report is a detailed record of your credit history, including your payment history, credit accounts, and any negative items such as bankruptcies or collections. |

| How can I get a free copy of my credit report? | You can get a free copy of your credit report from each of the three major credit bureaus at AnnualCreditReport.com. |

| What should I do if I find an error on my credit report? | Dispute the error with the credit bureau and provide supporting documentation to correct the inaccuracy. |

8. Credit Score Myths Debunked

There are many misconceptions about credit scores. Let’s debunk some common myths:

- Myth: Checking your credit score will lower it.

- Fact: Checking your own credit score is a soft inquiry and does not impact your credit score.

- Myth: Closing credit card accounts will improve your credit score.

- Fact: Closing credit card accounts can shorten your credit history and increase your credit utilization ratio, which can negatively impact your score.

- Myth: You need to carry a balance on your credit cards to build credit.

- Fact: You don’t need to carry a balance to build credit. Simply use your credit cards responsibly and pay off the full balance each month.

- Myth: Income affects your credit score.

- Fact: Income is not a factor in calculating your credit score.

- Myth: Age affects your credit score.

- Fact: Age does not directly affect your credit score.

- Myth: Credit scores are the same across all credit bureaus.

- Fact: Your credit scores may vary across the three major credit bureaus because lenders may not report to all three, and the credit bureaus use different scoring models.

9. The Future of Credit Scoring

The credit scoring landscape is constantly evolving, with new technologies and data sources being incorporated into scoring models.

9.1. Trended Data

Trended data, which tracks how your balances and credit utilization change over time, is becoming increasingly important in credit scoring.

- Impact: Trended data provides a more detailed picture of your credit behavior and can help lenders assess your risk more accurately.

9.2. Alternative Data

Alternative data, such as rent payments, utility payments, and bank account information, is being used to supplement traditional credit data.

- Impact: Alternative data can help people with limited credit histories build credit and access financial products.

9.3. AI and Machine Learning

Artificial intelligence (AI) and machine learning are being used to develop more sophisticated credit scoring models that can better predict credit risk.

- Impact: AI and machine learning can improve the accuracy and fairness of credit scoring, but also raise concerns about transparency and bias.

The future of credit scoring is likely to be more data-driven, personalized, and inclusive.

10. Need More Answers? Ask WHAT.EDU.VN!

Navigating the world of credit scores can be complex. If you have any lingering questions or need personalized advice, don’t hesitate to reach out to WHAT.EDU.VN!

At WHAT.EDU.VN, we understand that finding answers to your questions should be quick, easy, and free. Whether you’re curious about improving your credit score, understanding loan options, or simply seeking financial guidance, our platform is designed to provide you with the information you need.

10.1. Why Choose WHAT.EDU.VN?

- Free Answers: Get the information you need without any cost.

- Fast Responses: Our community of experts is ready to provide quick and accurate answers.

- Easy-to-Use Platform: Simply ask your question and receive helpful responses in no time.

- Expert Advice: Connect with knowledgeable individuals who can provide valuable insights.

10.2. How to Get Started

- Visit our website: WHAT.EDU.VN

- Ask your question in the search bar.

- Receive answers from our community of experts.

Don’t let your questions go unanswered. Visit WHAT.EDU.VN today and get the answers you need to achieve your financial goals!

10.3. Contact Us

For more information or assistance, feel free to contact us:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- WhatsApp: +1 (206) 555-7890

- Website: WHAT.EDU.VN

Take control of your financial future with what.edu.vn. We’re here to help you every step of the way.