The purpose of a W-2 form, Wage and Tax Statement, is to report an employee’s annual wages and taxes withheld to the IRS. WHAT.EDU.VN offers guidance on understanding the W-2 form, its importance, and how it impacts your tax obligations and financial planning. Explore the essential role it plays in tax filing, income verification, and more with our comprehensive resources for tax preparation and financial literacy.

1. Understanding the W-2 Form

Form W-2, officially known as the Wage and Tax Statement, is a crucial IRS tax form. It summarizes an employee’s earnings and the taxes withheld from their paychecks throughout the year. Employers must file this form annually with the Social Security Administration (SSA) for most employees. The SSA then shares this data with the IRS. Employees also receive copies to complete their federal and state income tax returns.

2. The Importance of W-2 Forms

W-2 forms are more than just papers to collect during tax season. They serve multiple vital purposes:

2.1 Tax Return Preparation

W-2 forms are essential for accurate tax filing. They provide the necessary information about your earnings and tax withholdings, enabling you to calculate your tax liability. This determines whether you owe taxes or are entitled to a refund.

2.2 Employment and Income Verification

W-2 forms act as records of your employment and earnings. They verify your work and income history for non-tax purposes. This might include applying for loans or credit cards.

2.3 Personal Financial Planning

W-2 forms record your annual income, aiding budgeting and financial planning. They provide a snapshot of your tax withholdings, helping you decide whether to adjust your withholding for the following year. This adjustment can prevent owing taxes or receiving an excessively large refund.

2.4 Social Security and Medicare Benefits

The Social Security and Medicare taxes withheld from your paycheck are detailed on your W-2 form. Your eligibility for, and the amount of, Social Security and Medicare benefits are partly based on these taxes paid over the years. W-2 forms serve as a record of taxes withheld for any given year, which is helpful if there are future benefit issues.

2.5 Fraud Prevention

W-2 forms assist the IRS in detecting and preventing identity theft and tax fraud. The IRS compares the information on your tax return with the data on your W-2 form to ensure accuracy. Discrepancies could trigger investigations that catch fraudulent activity.

3. Who Receives a W-2 Form?

You should only receive a W-2 form if you are an employee. This encompasses full-time, part-time, and temporary or seasonal workers. Freelancers or independent contractors typically do not receive W-2 forms.

Generally, an employer must send you a W-2 form if you are an employee and if they:

- Paid you $600 or more in wages.

- Withheld any income, Social Security, or Medicare tax from your wages.

- Would have had to withhold income taxes from your wages if you had not claimed an exemption on Form W-4 or had claimed no more than one withholding allowance on a pre-2020 W-4 form.

You might receive multiple W-2s in a single tax year if you:

- Changed jobs.

- Worked more than one job where you were an employee.

- Worked for a company acquired by another company.

4. When Are W-2s Sent Out?

The IRS mandates that employers send W-2 forms to their employees no later than January 31 following the close of the tax year. This ensures that employees have the forms in time for tax season. For instance, W-2s for the 2024 tax year must be mailed by January 31, 2025. This does not necessarily mean employees must receive them by this date.

Employers must also file W-2 forms with the SSA by January 31. However, they can request a 30-day extension by submitting Form 8809, Application for Extension of Time to File Information Returns. The IRS typically grants extensions only in extraordinary circumstances, such as natural disasters or fires that destroy the records needed to file the W-2 forms.

Even with an extension to file W-2s with the SSA, employers must still provide copies of the W-2s to their employees by January 31, unless an extension is granted to provide W-2s to employees after the due date. You can request this extension by faxing Form 15397 to the IRS, including the reason why more time is needed. If approved, the extension is usually for no more than 15 days, unless a clear need for up to 30 days is shown.

5. What To Do If You Don’t Receive a W-2 Form

If you do not receive your W-2 by early February, contact your employer. They might provide an electronic version for use until you receive the paper version.

If you still don’t have a W-2 by the end of February, you can call the IRS at 800-829-1040. Ask them to contact your employer. If you do not receive your W-2 in time to file your income tax return, you can use Form 4852 as a substitute to file with your return.

6. Correcting Errors on Your W-2 Form

If you notice a mistake on your W-2 form—such as a misspelled name, an incorrect Social Security number, or an incorrect dollar amount—notify your employer and request a corrected W-2.

If you cannot obtain a corrected form from your employer, follow the steps for missing W-2 forms: contact the IRS for assistance, and use Form 4852 as a substitute if needed.

7. Understanding Your W-2 Form: A Detailed Guide

Your W-2 form includes vital information for completing your tax return. It displays your total wages from your employer and the total taxes withheld from your paycheck during the year. This form may also include details about:

- Tips

- Contributions to a 401(k)

- Contributions to a health savings account

- Health coverage premiums paid by your employer

- Other employee benefits

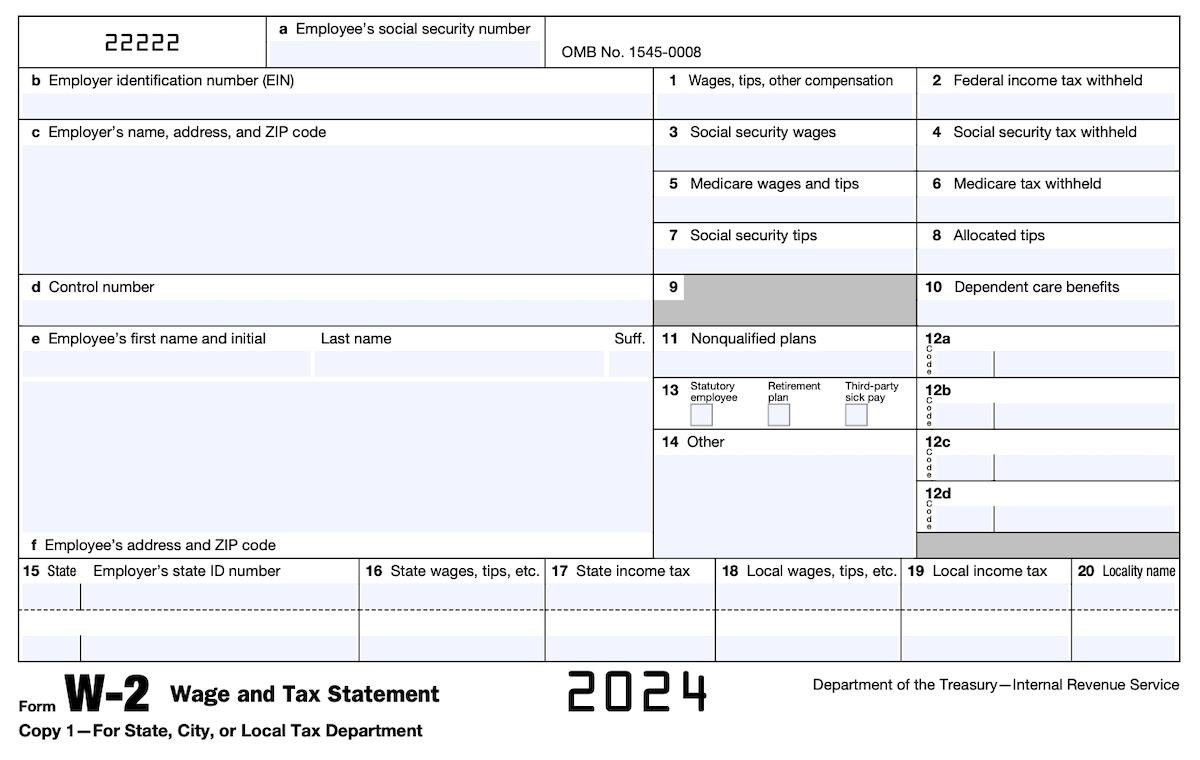

7.1 Boxes A to F – Identifying Information

Boxes A to F on the W-2 form contain identifying information about you and your employer. This includes your Social Security number (Box A), your name (Box E), and your address (Box F). Your employer’s Employer Identification Number (EIN) (Box B), name, and address (Box C), and control number (Box D), if any, are also included.

7.2 Boxes 1 and 2 – Compensation and Federal Income Tax Withholding

Box 1 shows the total taxable income paid to you by your employer during the year. This includes wages, salary, tips, bonuses, prizes, and various other types of taxable compensation. Box 2 shows the total amount of federal income tax withheld by your employer on your behalf.

7.3 Boxes 3 to 6 – Social Security and Medicare Wages and Tax Withholding

Boxes 3 and 5 show the amount of your earnings subject to Social Security and Medicare taxes. Boxes 4 and 6 show the amount of Social Security and Medicare taxes withheld from your pay during the year. The amounts in Boxes 3 and 5 might differ from the amount in Box 1. This often happens when taxes on some of your income are deferred, such as when you contribute to a traditional 401(k) or similar plan.

7.4 Boxes 7 and 8 – Tips

If you earned money through tips, Box 7 shows how much you reported in tips, and Box 8 shows how much money your employer allocated to you in tips.

7.5 Box 9 – Reserved

This box once reported an employer benefit that no longer exists (advance earned income credit payments). The box is now grayed out.

7.6 Box 10 – Dependent Care Benefits

If your employer provided or paid for dependent care benefits, Box 10 reports this amount.

7.7 Box 11 – Nonqualified Plans

If you received distributions from a non-qualified deferred compensation plan, this information is reported in Box 11.

7.8 Box 12 – Codes

If you received other types of compensation or reductions to your taxable income, the amount will be reported in Box 12 along with the appropriate one- or two-letter code. Items reported in Box 12 include contributions to a 401(k) plan, employer contributions to a health savings account, nontaxable sick pay, adoption benefits, and the taxable cost of group-term life insurance over $50,000.

7.9 Box 13 – Statutory Employee, Retirement Plan, and Third-Party Sick Pay

Box 13 indicates whether you worked as a statutory employee not subject to federal income tax withholding, participated in an employer-sponsored retirement plan (such as a 401(k) plan), or received sick pay through a third party (like an insurance company).

7.10 Box 14 – Other Information

Box 14 may include other federal tax information your employer wants to provide that doesn’t fit into any other W-2 boxes. This could include state disability insurance taxes withheld, union dues, payments for uniforms, health insurance premiums deducted from your pay, educational assistance payments, and more.

7.11 Boxes 15 to 20 – State and Local Information

Boxes 15 to 20 are used to report state and local income tax information, including your employer’s state ID number (assigned by the state), state and local wages, and withholding of state and local income taxes.

The W-2 form allows for reporting information for two states and/or localities. If your employer needs to report information for more than two states or localities, they must prepare a second W-2 form for you.

8. Frequently Asked Questions About W-2 Forms

Below are answers to some frequently asked questions about the W-2 form:

| Question | Answer |

|---|---|

| What is the difference between a 1099-NEC form and a W-2 form? | Both W-2 and 1099-NEC forms report income received from work and taxes withheld. The main difference lies in the employment status. Employees receive W-2 forms, while freelancers and independent contractors receive 1099-NEC forms if paid at least $600 during the tax year. Employers withhold federal income, Social Security, and Medicare taxes from employee pay, reported on the W-2. Independent contractors are generally responsible for paying their own income taxes via estimated tax payments, which do not appear on Form 1099-NEC. |

| What is the difference between a W-4 form and a W-2 form? | A W-4 form is completed by the employee and given to the employer to determine how much federal income tax to withhold from paychecks. A W-2 form is prepared by the employer after the tax year, reporting how much was earned and how much income, Social Security, and Medicare tax was withheld. Reviewing your income tax withholding annually is a good practice to ensure the correct amount of tax is being withheld. |

| How much money do I need to make to get a W-2 form? | If you’re an employee and are paid at least $600 during the year, your employer is required to send you a W-2 form for the year. However, you can still be issued a W-2 form if you earn less than $600 for the year if your employer withheld income, Social Security, or Medicare tax from your paycheck. |

| What is “Cafe 125” on a W-2 tax form? | Cafe 125 refers to a “cafeteria plan” under Section 125 of the U.S. tax code. These plans allow employees to choose from various benefits options and pay for them with pre-tax dollars, reducing taxable income. This includes 401(k) plans, health insurance, and health savings accounts. Seeing “Cafe 125” on your W-2 form typically in Box 14, should not affect how you prepare your tax return, as these amounts are already subtracted from your total compensation in Box 1. |

| What is Form W-2G? | Form W-2G is used to report gambling winnings that need to be included in taxable income. A casino or gambling establishment provides this form if you win a certain amount. You must report all gambling winnings on your tax return, even if you don’t receive a W-2G. Gambling losses can be deducted up to the amount of your winnings. |

| Can I file taxes without my W-2 forms? | Yes, you can file your federal income tax return even if you don’t have your W-2 forms. If you don’t receive a W-2 form, or you get an incorrect one, you might eventually have to complete Form 4852 and use it as a substitute W-2 form to file your return. |

| Do I have to attach my W-2 to my tax return? | If filing electronically using tax software, you do not need to send your W-2 forms separately. The information from your W-2 is sent electronically to the IRS. However, if filing a paper tax return by mail, you must attach Copy B of each W-2 form you receive to the front of your federal tax return. |

Navigating the complexities of W-2 forms and tax preparation can be challenging. At WHAT.EDU.VN, we understand the difficulties in finding quick, reliable answers to your questions. That’s why we offer a free platform to ask any question and receive expert responses.

Are you struggling to understand your W-2? Do you have questions about tax withholdings, deductions, or any other financial topic? Don’t hesitate to reach out. Visit WHAT.EDU.VN today to ask your question and get the clarity you need. Our community of experts is here to provide the guidance you deserve. Contact us at 888 Question City Plaza, Seattle, WA 98101, United States, or via WhatsApp at +1 (206) 555-7890. Your questions are welcome at what.edu.vn!