In a landmark decision delivered on May 30, 2024, Donald J. Trump was found guilty on all 34 counts of falsifying business records in the first degree. The verdict, announced by Manhattan District Attorney Alvin L. Bragg, Jr., marks a significant moment in American legal and political history. This article delves into the specifics of the conviction, explaining what exactly Trump was convicted of and the context surrounding this unprecedented case.

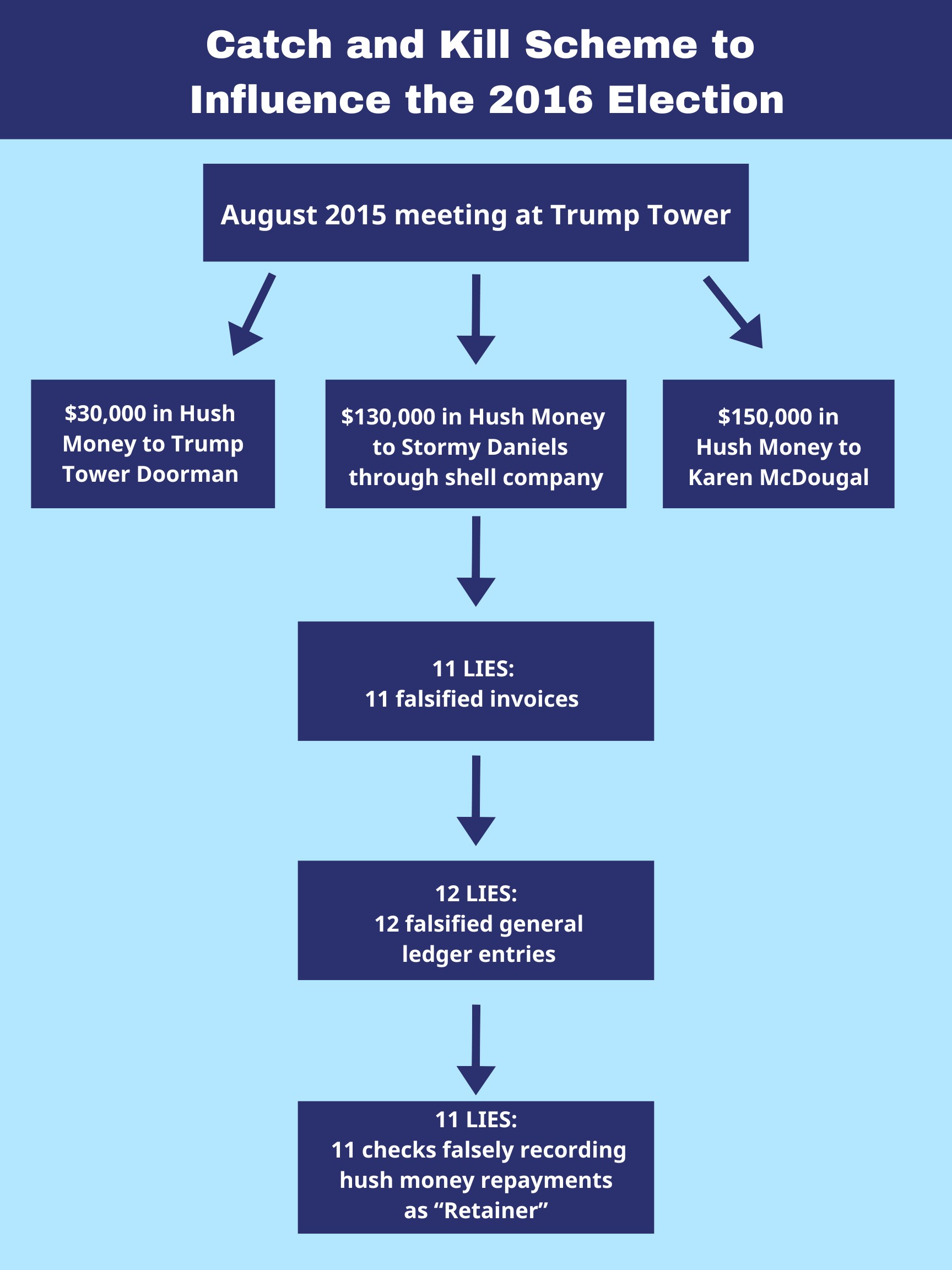

The charges stem from a scheme to conceal damaging information from voters during the 2016 presidential election. Prosecutors successfully argued that Trump and his associates engaged in an illegal “catch and kill” strategy to suppress negative stories that could have harmed his campaign. This strategy involved making payments to silence individuals with potentially damaging information and then disguising these payments as legitimate business expenses within the Trump Organization’s records.

Guilty on 34 Felony Counts: Falsifying Business Records

The New York State Supreme Court jury found Donald Trump guilty of 34 counts of Falsifying Business Records in the First Degree. This is a Class E felony in New York. Each count relates to a specific instance where a false entry was made in the business records of the Trump Organization. These entries were not simply accounting errors; they were, according to the prosecution, deliberate and fraudulent attempts to cover up illegal activity.

District Attorney Alvin Bragg emphasized the gravity of the situation, stating, “Donald Trump is guilty of repeatedly and fraudulently falsifying business records in a scheme to conceal damaging information from American voters during the 2016 presidential election.” The prosecution presented a range of evidence, including invoices, checks, bank statements, audio recordings, phone logs, text messages, and testimony from 22 witnesses, to demonstrate Trump’s involvement and intent.

The “Catch and Kill” Scheme: Election Interference in 2016

At the heart of the case was the allegation that Trump orchestrated a “catch and kill” scheme to influence the 2016 election. This scheme, as revealed in court, originated in a 2015 meeting at Trump Tower involving Trump, his then-attorney Michael Cohen, and David Pecker, the CEO of American Media Inc. (AMI), which owned the National Enquirer.

The agreement was that AMI would act to prevent damaging stories about Trump from becoming public. This involved AMI purchasing exclusive rights to stories, effectively burying them – the “catch and kill” tactic. Two key instances of this strategy were highlighted:

- The Trump Tower Doorman: AMI paid $30,000 to a former Trump Tower doorman who claimed to have information about a child Trump allegedly had out of wedlock.

- Karen McDougal: AMI paid $150,000 to model Karen McDougal, who alleged a sexual relationship with Trump.

These payments, while significant, were not the direct basis for the 34 felony counts. The charges specifically revolved around the subsequent cover-up of a payment to adult film actress Stormy Daniels.

The Stormy Daniels Payment and the Falsified Records

The situation with Stormy Daniels unfolded in the weeks leading up to the 2016 election, shortly after the infamous “Access Hollywood” tape surfaced. Concerned about the potential damage from Daniels’ story of a sexual encounter with Trump, Trump and Cohen allegedly acted to silence her.

Michael Cohen, with Trump’s approval, established a shell company, Essential Consultants, LLC, and paid $130,000 to Daniels’ attorney, Keith Davidson. This payment was intended to prevent Daniels from speaking publicly before the election.

Alt Text: Graphic illustrating the “Catch and Kill” scheme involving Trump, Cohen, and AMI to suppress negative stories.

After the election, Trump reimbursed Cohen. The prosecution argued, and the jury agreed, that these reimbursements were fraudulently recorded in the Trump Organization’s business records. Instead of being accurately documented as repayments for a campaign-related expense or a payment to silence Stormy Daniels, they were falsely labeled as “legal expenses” paid to Cohen for a non-existent retainer agreement.

Over a period of months, 11 checks were issued to Cohen, totaling $420,000. This inflated sum was designed to cover not only the $130,000 payment to Daniels but also to compensate Cohen for taxes he would incur by receiving the payment as income. Each of these checks, and the associated entries in the Trump Organization’s ledgers, constituted a count of falsifying business records. In total, 34 false entries were identified and formed the basis of the charges.

Alt Text: Visual representation of the election interference scheme, highlighting the flow of money and actions taken to conceal the Stormy Daniels payment.

Looking Ahead: Sentencing and Implications

Donald Trump is scheduled to be sentenced on July 11. Falsifying Business Records in the First Degree carries a potential sentence of up to four years in prison. However, legal experts have noted that, as a first-time felony offender, and given his age, it is not certain that Trump will receive a prison sentence. Other potential sentences could include probation, fines, or a combination thereof.

Alt Text: Evidence graphic showcasing key pieces of evidence presented during the Trump falsifying business records trial.

Regardless of the specific sentence, the conviction itself is historically significant. It marks the first time a former U.S. President has been convicted of felony crimes. The legal and political ramifications of this verdict are likely to be debated and analyzed for years to come.