What is responsible investing? It’s about incorporating environmental, social, and governance (ESG) factors into investment decisions alongside traditional financial analysis. At WHAT.EDU.VN, we believe in empowering everyone with access to clear, concise information, so you can make informed decisions. Discover sustainable finance, ethical investing, and impact investing with us.

Table of Contents

1. Understanding What Is Responsible Investment

- 1.1. Defining Responsible Investment

- 1.2. The Core of ESG Factors

- 1.2.1. Environmental Considerations

- 1.2.2. Social Considerations

- 1.2.3. Governance Considerations

- 1.3. Objectives of Responsible Investors

- 1.4. Historical Milestones in Responsible Investment

2. The Compelling Reasons: Why Invest Responsibly?

- 2.1. Financial Materiality: Linking ESG to Performance

- 2.2. Meeting Client Demand

- 2.3. The Role of Policy and Regulation

- 2.4. Upholding Fiduciary Duties

- 2.5. Achieving Sustainability Outcomes

- 2.6. Adhering to the Principles for Responsible Investment

3. Practical Guidance: How to Invest Responsibly

- 3.1. ESG Incorporation

- 3.1.1. Screening

- 3.1.2. ESG Integration

- 3.1.3. Thematic Investing

- 3.2. Stewardship

- 3.2.1. Influencing Investees

- 3.2.2. Influencing Other Stakeholders

- 3.3. Taking Action on Sustainability Outcomes

- 3.4. Responsible Investment Across Asset Classes

- 3.5. The Crucial Role of Asset Owners

- 3.6. The Importance of Reporting

- 3.7. Key ESG Issues

- 3.7.1. Climate Change

- 3.7.2. Human Rights

4. Debunking Myths: Addressing Common Misconceptions

- 4.1. Myth: Requires Specific Strategies or Products

- 4.2. Myth: Leads to Lower Returns

- 4.3. Myth: Limits the Investable Universe

- 4.4. Myth: Not Possible for Index Investors

- 4.5. Myth: Politically Motivated

- 4.6. Myth: Claims Can’t Be Substantiated

5. WHAT.EDU.VN: Your Partner in Understanding Responsible Investment

- 5.1. Free Answers: Getting Your Questions Answered

- 5.2. Community Support and Knowledge Sharing

- 5.3. Expert Guidance for Informed Decisions

6. FAQ: Frequently Asked Questions About Responsible Investment

7. Conclusion

1. Understanding What Is Responsible Investment

1.1. Defining Responsible Investment

Responsible investment is an approach that considers environmental, social, and governance (ESG) factors alongside traditional financial metrics when making investment decisions. It also involves actively influencing companies or assets through stewardship, also known as active ownership.

This approach aims to enhance long-term financial returns while creating positive impacts on society and the environment. Unlike traditional investment strategies that primarily focus on financial gains, responsible investment integrates ethical and sustainable considerations into the investment process.

1.2. The Core of ESG Factors

ESG factors are at the heart of responsible investment. They provide a framework for evaluating companies based on their environmental impact, social responsibility, and governance practices.

1.2.1. Environmental Considerations

Environmental factors assess a company’s impact on the natural world. This includes:

- Climate Change: Reducing carbon emissions and transitioning to renewable energy.

- Circular Economy: Promoting waste reduction and resource efficiency.

- Biodiversity: Protecting ecosystems and wildlife.

- Deforestation: Preventing the destruction of forests and promoting sustainable land use.

1.2.2. Social Considerations

Social factors examine a company’s relationships with its employees, customers, and the community. Key areas include:

- Human Rights: Ensuring fair labor practices and protecting human rights throughout the supply chain.

- Decent Work: Providing safe working conditions and fair wages.

- Diversity, Equity, and Inclusion: Promoting diversity in the workplace and ensuring equal opportunities for all.

1.2.3. Governance Considerations

Governance factors evaluate a company’s leadership, ethics, and internal controls. This includes:

- Board Structure: Ensuring an independent and effective board of directors.

- Executive Remuneration: Aligning executive pay with long-term performance and responsible behavior.

- Tax Fairness: Promoting transparent and equitable tax practices.

- Responsible Political Engagement: Ensuring that political activities are aligned with responsible business practices.

1.3. Objectives of Responsible Investors

Responsible investors have varied objectives. Some prioritize financial returns while considering ESG factors that may impact those returns. Others seek to generate both financial returns and positive outcomes for people and the planet, aiming to avoid negative impacts.

- Financial Performance: Enhancing long-term returns by integrating ESG factors into investment analysis.

- Positive Impact: Contributing to sustainable development goals and addressing social and environmental challenges.

- Risk Management: Identifying and mitigating ESG-related risks that could affect investment performance.

- Values Alignment: Aligning investments with personal or organizational values and ethical principles.

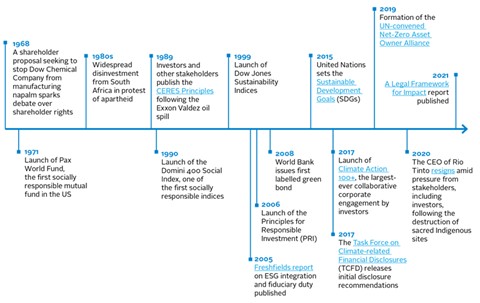

1.4. Historical Milestones in Responsible Investment

The evolution of responsible investment has been marked by significant milestones:

- 1960s: Emergence of socially responsible investing (SRI) focused on avoiding investments in companies involved in harmful activities like tobacco or weapons.

- 1990s: Growth of ethical investing and the integration of environmental and social factors into investment analysis.

- 2006: Launch of the Principles for Responsible Investment (PRI), providing a framework for investors to incorporate ESG factors into their practices.

- 2015: Adoption of the UN Sustainable Development Goals (SDGs), providing a global framework for sustainable development.

- Present: Increasing recognition of the financial materiality of ESG factors and the growth of impact investing.

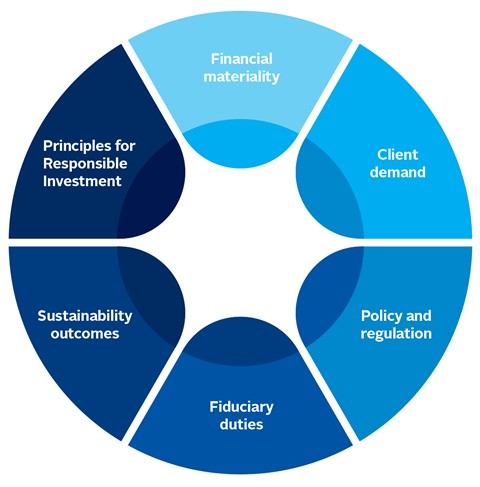

2. The Compelling Reasons: Why Invest Responsibly?

2.1. Financial Materiality: Linking ESG to Performance

Increasing research indicates a relationship between ESG issues and financial performance. Companies with strong ESG practices often exhibit better risk management, innovation, and operational efficiency, leading to improved financial outcomes.

- Better Risk Management: ESG factors help identify and mitigate risks related to environmental liabilities, social issues, and governance failures.

- Enhanced Innovation: Companies focused on sustainability often drive innovation and develop new products and services that meet evolving market demands.

- Operational Efficiency: ESG practices can lead to improved resource utilization, waste reduction, and cost savings.

- Long-Term Value Creation: Integrating ESG factors can contribute to long-term value creation and sustainable business practices.

Examples of Financially Material ESG Incidents and Sustainability Issues:

- 2019: The Vale dam collapse in Brazil resulted in significant financial losses and reputational damage for the mining company.

- 2020: The Wirecard scandal exposed accounting fraud linked to corporate governance failings, leading to the company’s insolvency.

- 2020: The COVID-19 pandemic highlighted the importance of investing in pandemic preparedness and public health infrastructure.

- 2022: Charges of complicity in crimes against humanity against Lafarge demonstrated the legal and reputational risks associated with unethical business practices.

2.2. Meeting Client Demand

Many asset owners and beneficiaries recognize the financial materiality of ESG factors and seek to align their investments with their values and broader environmental and social objectives. They expect their investment managers to do the same.

- Values-Based Investing: Aligning investments with personal or organizational values and ethical principles.

- Impact Investing: Investing in companies and projects that generate positive social and environmental outcomes alongside financial returns.

- Sustainable Development Goals: Supporting the achievement of the UN Sustainable Development Goals through investment activities.

2.3. The Role of Policy and Regulation

Corporate and investor regulations and policies relating to ESG issues and disclosures have increased significantly in recent years, reflecting the financial sector’s role in addressing global challenges.

- Corporate ESG Disclosure Regulations: Requiring companies to disclose information about their environmental, social, and governance performance.

- Stewardship Regulations: Encouraging active ownership and engagement with companies on ESG issues.

- Investor Duties and Disclosure Regulations: Clarifying investors’ fiduciary duties to consider ESG factors and disclose their responsible investment practices.

- Taxonomies of Sustainable Economic Activities: Defining and classifying economic activities that contribute to environmental and social objectives.

2.4. Upholding Fiduciary Duties

Fiduciary duties require investors to consider all factors relevant to investment returns, including ESG issues, and to act in the best interests of their clients or beneficiaries.

- Considering ESG Factors: Integrating ESG factors into investment analysis and decision-making processes.

- Acting in the Best Interests: Prioritizing the long-term financial interests of clients and beneficiaries while considering ESG impacts.

- Pursuing Sustainability Outcomes: Considering sustainability outcomes where they can help achieve financial objectives.

2.5. Achieving Sustainability Outcomes

All investment activities can result in positive and negative sustainability outcomes to people and the planet. Stakeholders expect investors to manage these outcomes and align their activities with global frameworks such as the SDGs and the Paris Agreement.

- Sustainable Development Goals: Aligning investments with the UN Sustainable Development Goals to address global challenges.

- Paris Agreement: Reducing greenhouse gas emissions and supporting the transition to a low-carbon economy.

- Convention on Biological Diversity: Protecting ecosystems and biodiversity through responsible investment practices.

2.6. Adhering to the Principles for Responsible Investment

The Principles for Responsible Investment (PRI) provide a framework for investors to incorporate ESG factors into their practices and contribute to a more sustainable global financial system.

- Principle 1: Incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: Be active owners and incorporate ESG issues into ownership policies and practices.

- Principle 3: Seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: Promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: Work together to enhance our effectiveness in implementing the Principles.

- Principle 6: Report on our activities and progress towards implementing the Principles.

3. Practical Guidance: How to Invest Responsibly

3.1. ESG Incorporation

ESG incorporation involves assessing, reviewing, and considering ESG issues in existing investment practices through integration, screening, and thematic investing.

3.1.1. Screening

Screening involves applying filters to a universe of securities, issuers, sectors, or other financial instruments to decide whether to consider them for investment, based on criteria set out in an investment process or that reflect a client or fund mandate.

- Positive Screening: Selecting companies with strong ESG performance.

- Negative Screening: Avoiding companies involved in harmful activities.

- Norms-Based Screening: Aligning investments with international norms and standards.

3.1.2. ESG Integration

ESG integration involves considering ESG issues in investment analysis and decisions to better manage risks and improve returns.

- Analyzing ESG Data: Incorporating ESG data into financial models and investment research.

- Assessing ESG Risks and Opportunities: Identifying ESG-related risks and opportunities that could affect investment performance.

- Integrating ESG into Investment Decisions: Using ESG information to inform investment decisions and portfolio construction.

3.1.3. Thematic Investing

Thematic investing involves looking for opportunities created by long-term ESG trends, such as the move towards renewable energy or circular economies.

- Renewable Energy: Investing in companies that develop and deploy renewable energy technologies.

- Circular Economy: Supporting companies that promote waste reduction and resource efficiency.

- Sustainable Agriculture: Investing in companies that promote sustainable farming practices.

3.2. Stewardship

Stewardship means using influence to maximize overall long-term value – including of common economic, social, and environmental assets – that client and beneficiary returns and interests depend on. Engagement is a key way investors can fulfill their stewardship obligations.

3.2.1. Influencing Investees

- Engaging with current or potential investees across all asset classes

- Voting at shareholder meetings

- Filing shareholder resolutions/proposals

- Fulfilling direct roles on investee boards and committees

- Litigating

3.2.2. Influencing Other Stakeholders

- Engaging with policy makers and standard setters

- Contributing to public goods (such as research)

- Publicly reporting engagement results and disclosing voting activity

- Negotiating with, and monitoring, others in the investment chain

3.3. Taking Action on Sustainability Outcomes

Investors can act to improve the sustainability outcomes associated with their investments through their investment decisions and stewardship of investees, policy makers, and other stakeholders.

- Aligning Investments with Global Goals: Making investments consistent with global sustainability goals and thresholds.

- Increasing Positive Outcomes: Aiming to increase positive outcomes for people and the planet.

- Decreasing Negative Outcomes: Reducing negative impacts on the environment and society.

3.4. Responsible Investment Across Asset Classes

It is possible to invest responsibly across all asset classes, but the tools that can be used to achieve responsible investment objectives vary between private and public markets, and different security types.

- Fixed Income: Embedding ESG provisions into bond covenants.

- Listed Equity: Using voting rights to communicate views and expectations about a company’s ESG performance.

- Private Equity: Taking board seats to help develop a company’s ESG strategy and influence its impact.

3.5. The Crucial Role of Asset Owners

Heading the investment chain, asset owners set the direction for markets globally. They are increasingly focused on managing their assets sustainably, as they often have long-term liabilities and investment horizons.

- Setting Responsible Investment Policies: Establishing clear policies for responsible investment and ESG integration.

- Selecting Responsible Investment Managers: Choosing investment managers with strong ESG capabilities and track records.

- Monitoring Investment Manager Performance: Assessing the ESG performance of investment managers and holding them accountable for meeting responsible investment objectives.

3.6. The Importance of Reporting

Reporting by investors usually involves providing public or private information to stakeholders, such as regulators and clients. Asset owners can use the information in these disclosures to assess the ESG incorporation and stewardship practices, and actions on sustainability outcomes, taken by their investment managers.

- Providing Transparent Disclosures: Disclosing information about responsible investment practices and ESG performance.

- Assessing ESG Performance: Evaluating the ESG performance of investments and investment managers.

- Aligning with Regulations: Meeting regulatory requirements for ESG reporting and disclosure.

3.7. Key ESG Issues

Responsible investors can consider a wide range of ESG issues in their analysis, giving greater weight to those with higher potential impact on people, the planet, and financial returns.

3.7.1. Climate Change

Climate change is a high-priority ESG issue for investors, particularly asset owners.

- Reducing Greenhouse Gas Emissions: Investing in companies that are reducing their carbon footprint and transitioning to renewable energy.

- Supporting Climate Adaptation: Investing in companies and projects that are helping communities adapt to the impacts of climate change.

- Setting Net-Zero Targets: Committing to achieving net-zero greenhouse gas emissions by 2050.

3.7.2. Human Rights

Institutional investors have a responsibility to respect human rights.

- Ensuring Fair Labor Practices: Investing in companies that provide safe working conditions and fair wages.

- Protecting Human Rights in the Supply Chain: Ensuring that suppliers respect human rights and adhere to ethical labor practices.

- Engaging with Companies on Human Rights Issues: Working with companies to address human rights risks and improve their performance.

4. Debunking Myths: Addressing Common Misconceptions

4.1. Myth: Requires Specific Strategies or Products

There are many ways to invest responsibly, and investors can use ESG information in investment and stewardship decisions to consider all relevant issues when assessing risk and return.

- Focusing on the Entire Portfolio: Integrating ESG factors into investment decisions across all asset classes and strategies.

- Considering Specific Asset Classes: Targeting responsible investment strategies to specific asset classes or sectors.

- Using Specific Products: Investing in thematic funds or ESG-screened indices.

4.2. Myth: Leads to Lower Returns

Responsible investment does not need to require sacrificing returns and can enhance risk and return characteristics.

- Identifying Risks and Opportunities: Using ESG data and trends to identify risks and opportunities that might remain undiscovered without analyzing ESG data and trends.

- Enhancing Risk Management: Mitigating ESG-related risks that could affect investment performance.

- Driving Innovation: Investing in companies that are developing innovative solutions to environmental and social challenges.

4.3. Myth: Limits the Investable Universe

Responsible investment involves incorporating ESG issues in investment decisions and stewardship; screening is common but not required.

- Integrating ESG Factors: Considering ESG factors alongside financial metrics in investment analysis.

- Engaging with Companies: Working with companies to improve their ESG performance and address sustainability challenges.

- Expanding the Investment Universe: Identifying new investment opportunities in companies that are leading the way on ESG issues.

4.4. Myth: Not Possible for Index Investors

ESG factors can be incorporated into index-investment strategies in different ways.

- Selecting ESG Indices: Choosing indices whose constituents have been screened or which have a thematic focus.

- Engaging with Index Constituents: Using stewardship to influence the behavior of current and potential index constituents.

- Driving Industry Reforms: Engaging with regulators and industry bodies to drive reforms that enable responsible investment.

4.5. Myth: Politically Motivated

Responsible investment does not mean promoting a particular political agenda.

- Making Informed Decisions: Using ESG factors and considering sustainability outcomes to make more informed investment decisions.

- Aligning with Beneficiaries’ Objectives: Better aligning investments with beneficiaries’ objectives and pursuing risk-adjusted returns.

- Focusing on Financial Materiality: Prioritizing ESG issues that are financially material and can affect investment performance.

4.6. Myth: Claims Can’t Be Substantiated

Many regulations and initiatives have been developed to counter greenwashing, and sustainable finance taxonomies allow investors to objectively report on how much of their portfolios are invested in activities that meet ESG or sustainability goals.

- Using Sustainable Finance Taxonomies: Reporting on how much of their portfolios are invested in activities that meet ESG or sustainability goals

- Providing Transparent Disclosures: Disclosing information about responsible investment practices and ESG performance.

- Adhering to Regulations: Complying with regulations and guidelines for responsible investment and ESG reporting.

5. WHAT.EDU.VN: Your Partner in Understanding Responsible Investment

At WHAT.EDU.VN, we understand that navigating the world of responsible investment can be complex. That’s why we’re dedicated to providing you with the resources and support you need to make informed decisions.

5.1. Free Answers: Getting Your Questions Answered

Do you have questions about ESG factors, sustainable investing, or how to align your investments with your values? Our platform allows you to ask any question and receive free answers from our community of experts and knowledgeable users.

5.2. Community Support and Knowledge Sharing

Join our community to connect with other investors, share insights, and learn from each other’s experiences. Our forums and discussion boards provide a space for collaborative learning and knowledge sharing.

5.3. Expert Guidance for Informed Decisions

We also offer access to expert guidance and resources to help you make informed decisions about responsible investment. Our team of experienced professionals can provide personalized advice and support to help you achieve your financial and sustainability goals.

Contact Us:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- WhatsApp: +1 (206) 555-7890

- Website: WHAT.EDU.VN

Don’t hesitate to reach out and ask your questions!

6. FAQ: Frequently Asked Questions About Responsible Investment

| Question | Answer |

|---|---|

| What are the main benefits of responsible investing? | Responsible investing can lead to better risk management, enhanced innovation, and alignment with values. It also contributes to positive social and environmental outcomes. |

| How can I get started with responsible investing? | Start by educating yourself about ESG factors and different responsible investment strategies. Consider aligning your investments with your values and seeking advice from a financial advisor. |

| What is the difference between ESG investing and impact investing? | ESG investing focuses on integrating environmental, social, and governance factors into investment decisions to improve financial performance and manage risks. Impact investing aims to generate positive social and environmental outcomes alongside financial returns. |

| Is responsible investing only for large institutions? | No, responsible investing is for everyone. Individual investors can also incorporate ESG factors into their investment decisions and support companies that are making a positive impact. |

| How do I measure the impact of my responsible investments? | Measuring the impact of responsible investments can be complex, but there are several tools and frameworks available. These include impact reporting standards, sustainability ratings, and third-party assessments. |

| What are some common challenges of responsible investing? | Some common challenges include a lack of standardized ESG data, greenwashing, and difficulty measuring impact. However, these challenges are being addressed through improved regulations, reporting standards, and investor education. |

| Does responsible investing require sacrificing financial returns? | No, responsible investing does not necessarily require sacrificing financial returns. In fact, many studies have shown that companies with strong ESG practices can outperform their peers over the long term. |

| How can I avoid greenwashing in responsible investing? | To avoid greenwashing, do your research and choose investments that are transparent and have credible ESG credentials. Look for funds that are independently certified and follow recognized reporting standards. |

| What role does shareholder engagement play in responsible investing? | Shareholder engagement is a key tool for responsible investors to influence companies and promote better ESG practices. By engaging with companies, investors can encourage them to address environmental and social challenges and improve their governance. |

| Where can I find more information about responsible investing? | You can find more information about responsible investing on WHAT.EDU.VN, as well as from industry organizations like the Principles for Responsible Investment (PRI) and the Global Impact Investing Network (GIIN). |

| What are the risks of ignoring ESG factors in investing? | Ignoring ESG factors can lead to increased financial risks, such as regulatory fines, reputational damage, and stranded assets. It can also result in missed opportunities to invest in innovative and sustainable companies that are driving long-term growth. |

| How can I assess a company’s commitment to human rights? | Look for companies that have strong human rights policies and practices, conduct human rights due diligence, and engage with stakeholders to address human rights risks. You can also consult with organizations that monitor and assess corporate human rights performance. |

| What is the role of government in promoting responsible investing? | Governments can play a key role in promoting responsible investing by setting regulations, providing incentives, and supporting investor education. They can also encourage companies to disclose ESG information and promote sustainable business practices. |

| Can responsible investing help address global challenges? | Yes, responsible investing can play a key role in addressing global challenges such as climate change, poverty, and inequality. By directing capital towards sustainable and responsible companies, investors can support the transition to a more sustainable and equitable economy. |

| What are the different types of sustainable investment funds available? | There are various types of sustainable investment funds, including ESG integration funds, thematic funds, impact funds, and exclusion funds. Each type has a different approach to incorporating sustainability factors into investment decisions. |

7. Conclusion

Understanding what is responsible investment is crucial for investors who want to align their financial goals with their values. By incorporating ESG factors into investment decisions, investors can contribute to a more sustainable and equitable future while potentially enhancing their long-term returns. At WHAT.EDU.VN, we’re committed to providing you with the knowledge and resources you need to navigate the world of responsible investment and make informed decisions that benefit both your portfolio and the planet.

Ready to start your responsible investing journey? Have more questions? Visit what.edu.vn today and ask us anything!