Are you looking for clear and concise answers to your financial questions? Look no further than WHAT.EDU.VN. In this article, we will explore What Is A Clo, what are their uses, benefits, and risks. We break down the complexities of Collateralized Loan Obligations (CLOs) in easy-to-understand terms. Stay informed, stay ahead, and ask all your questions on WHAT.EDU.VN to get free answers from experts. Let’s delve into CLO investments, structured credit, and fixed-income strategies.

1. What is a Collateralized Loan Obligation (CLO)?

A Collateralized Loan Obligation (CLO) is a type of structured credit product that pools together a portfolio of loans, typically corporate loans, and divides them into different tranches or slices, each with varying levels of risk and return. These tranches are then sold to investors. The cash flows from the underlying loan portfolio are used to pay interest and principal to the CLO investors based on a predetermined payment waterfall.

Think of it like this: imagine a basket filled with various types of loans. This basket is then sliced into different pieces, each representing a different level of risk and potential return. These slices are then sold to investors, with the cash generated from the loans in the basket used to pay them back.

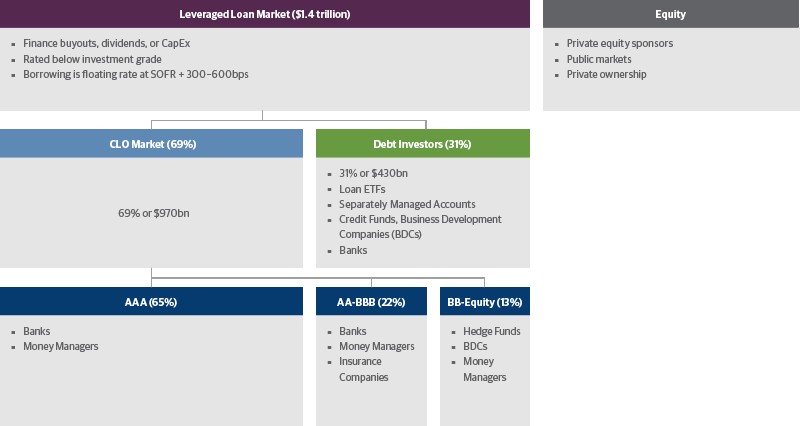

CLOs are a significant part of the structured credit market, offering investors exposure to a diversified pool of loans while allowing companies to access financing. To visualize how CLOs fit into the broader financial landscape, consider the following:

- CLO Market Size: CLOs represent a substantial portion of the structured credit fixed-income market.

- Underlying Assets: CLOs derive their value from a diversified pool of non-investment grade, senior-secured corporate loans.

- Risk and Return: Different tranches of CLOs offer varying risk/return profiles, catering to different investor preferences.

2. How Does a CLO Work?

To understand how a CLO works, it’s essential to break down its structure and lifecycle. Here’s a simplified explanation:

2.1. CLO Structure

- Loan Portfolio: A CLO starts with a portfolio of loans, usually corporate loans, which serve as the underlying assets.

- Tranches: The loan portfolio is divided into different tranches, each with a different level of seniority and risk.

- Cash Flow Waterfall: The cash flows generated from the loan portfolio are distributed to the tranches according to a predetermined waterfall structure.

2.2. CLO Lifecycle

- Warehouse Period: The CLO manager acquires leveraged loan assets, financed by a warehouse provider.

- Ramp-Up Period: The CLO manager uses the proceeds from the CLO issuance to purchase additional assets.

- Reinvestment Period: The collateral manager actively trades the underlying assets and uses principal cash flow to purchase new assets.

- Non-Call Period: The equity tranche owners cannot call or refinance the CLO debt tranches.

- Amortization Period: The cash flows from the CLO’s underlying assets are used to pay down outstanding CLO debt.

Understanding the structure and lifecycle of a CLO can help investors assess the potential risks and rewards associated with this type of investment.

3. What Are the Key Components of a CLO?

CLOs consist of several key components that work together to create a structured credit product. These components include:

- Collateral Manager: The collateral manager is responsible for selecting and managing the underlying loan portfolio. They actively trade the loans to optimize the portfolio’s value and mitigate losses from defaults.

- Trustee: The trustee oversees the CLO and ensures that it complies with the terms of the governing documents.

- Rating Agencies: Rating agencies assess the credit risk of the different tranches of the CLO and assign ratings accordingly.

- Investors: Investors purchase the different tranches of the CLO, each with varying levels of risk and return.

4. What Are the Different Tranches in a CLO?

CLOs are divided into different tranches, each with its own risk and return profile. The most common tranches include:

- AAA Tranche: This is the senior-most tranche and has the highest credit rating. It is the most protected from losses and offers the lowest yield.

- Mezzanine Tranches: These tranches have lower credit ratings than the AAA tranche and offer higher yields to compensate for the increased risk.

- Equity Tranche: This is the junior-most tranche and has the highest risk. It receives any excess cash flow after all the debt tranches have been paid.

The different tranches allow investors to choose the level of risk and return that aligns with their investment objectives.

5. What Are the Benefits of Investing in CLOs?

Investing in CLOs can offer several benefits, including:

- Diversification: CLOs provide exposure to a diversified pool of loans, reducing the risk associated with investing in individual loans.

- Higher Yields: CLOs can offer higher yields compared to other fixed-income investments with similar credit ratings.

- Floating Rate Coupons: CLOs typically have floating-rate coupons, which can help protect against rising interest rates.

- Active Management: CLOs are actively managed by experienced collateral managers, who can adjust the loan portfolio to optimize performance.

However, it’s important to note that investing in CLOs also involves risks, which we will discuss in the next section.

6. What Are the Risks of Investing in CLOs?

Investing in CLOs is not without risk. Some of the key risks include:

- Credit Risk: The risk that borrowers in the underlying loan portfolio will default on their loans.

- Liquidity Risk: The risk that CLO tranches may be difficult to sell in the secondary market, especially during times of market stress.

- Mark-to-Market Risk: The risk that the value of CLO tranches may decline due to changes in market conditions.

- Complexity: CLOs are complex financial instruments, and it can be difficult for investors to fully understand the risks involved.

Investors should carefully consider these risks before investing in CLOs and consult with a financial advisor if necessary.

7. How Are CLOs Rated?

CLOs are rated by credit rating agencies such as Standard & Poor’s, Moody’s, and Fitch. The rating agencies assess the credit risk of the different tranches of the CLO based on factors such as the quality of the underlying loan portfolio, the structure of the CLO, and the experience of the collateral manager.

The ratings assigned to CLO tranches can range from AAA (the highest rating) to below investment grade. The higher the rating, the lower the perceived risk of default.

8. What Is the Role of a Collateral Manager in a CLO?

The collateral manager plays a critical role in the success of a CLO. Their responsibilities include:

- Selecting Loans: The collateral manager is responsible for selecting the loans that will be included in the CLO’s portfolio. They look for loans that offer attractive yields and have a low risk of default.

- Managing the Portfolio: The collateral manager actively manages the loan portfolio, buying and selling loans to optimize its performance.

- Mitigating Losses: The collateral manager seeks to mitigate losses from loan defaults by actively monitoring the credit quality of the loans in the portfolio and taking action when necessary.

A skilled and experienced collateral manager can significantly enhance the performance of a CLO.

9. How Do CLOs Compare to Other Fixed-Income Investments?

CLOs are often compared to other fixed-income investments such as corporate bonds and asset-backed securities (ABS). Here’s a brief comparison:

- Corporate Bonds: Corporate bonds are debt securities issued by corporations. They typically offer lower yields than CLOs but also have lower credit risk.

- Asset-Backed Securities (ABS): ABS are securities backed by a pool of assets such as mortgages, auto loans, or credit card receivables. They can offer higher yields than corporate bonds but also have higher credit risk.

- CLOs: CLOs offer a unique combination of diversification, higher yields, and active management. However, they also have higher complexity and liquidity risk compared to corporate bonds and ABS.

The choice between these investments depends on an investor’s risk tolerance and investment objectives.

10. What Are Some Common Misconceptions About CLOs?

There are several common misconceptions about CLOs. Let’s debunk a few:

- CLOs Are Toxic Assets: This misconception stems from the role that collateralized debt obligations (CDOs) played in the 2008 financial crisis. However, CLOs are different from CDOs in several important ways, including their underlying assets and structure.

- CLOs Are All High-Risk Investments: While some CLO tranches are high-risk, others are relatively low-risk. The AAA tranche, for example, is considered to be one of the safest fixed-income investments available.

- CLOs Are Not Transparent: While CLOs are complex, they are subject to regulatory oversight and provide investors with detailed information about their underlying assets and performance.

Understanding the facts about CLOs can help investors make informed decisions about whether to invest in them.

11. What Is the Impact of Interest Rate Changes on CLOs?

Interest rate changes can have a significant impact on CLOs. Because CLOs typically have floating-rate coupons, their interest payments will adjust as interest rates change. This can make CLOs attractive to investors in a rising interest rate environment, as their yields will increase along with rates.

However, rising interest rates can also increase the risk of defaults in the underlying loan portfolio, as borrowers may struggle to make their loan payments. This is a risk that investors should carefully consider.

12. How Do Overcollateralization and Interest Coverage Tests Protect CLO Investors?

Overcollateralization (OC) and interest coverage (IC) tests are two important mechanisms that protect CLO investors from losses.

- Overcollateralization Test: This test ensures that the principal value of the bank loan collateral pool exceeds the outstanding principal of the CLO debt tranches. If the collateral’s value declines below a certain level, cash that would have been distributed to equity and junior tranches is instead used to pay down senior debt.

- Interest Coverage Test: This test ensures that the cash collected from the bank loan collateral is sufficient to pay the interest on the CLO tranches. If collections decline below a certain level, cash is diverted from equity and junior tranches to pay senior debt interest.

These tests provide an additional layer of protection for CLO investors.

13. What is CLO 1.0 vs CLO 2.0?

CLO 1.0 refers to CLOs issued before the Global Financial Crisis (GFC), while CLO 2.0 refers to those issued after. CLO 2.0 structures have several enhancements compared to CLO 1.0, including:

- Higher overcollateralization requirements

- Restrictions on investments in subordinated bonds

- More investor-friendly documentation

These improvements have led to better performance for CLO 2.0 structures compared to their pre-crisis counterparts.

14. How Have CLOs Performed Historically?

CLOs have generally performed well historically, particularly CLO 2.0 structures. According to Standard & Poor’s, CLO 1.0s exhibited strong credit performance during the GFC, and CLO 2.0s have performed even better due to their enhanced collateral and structural improvements.

CLOs have also had historically low default rates compared to corporate debt.

15. Who Invests in CLOs?

The investor base for CLOs has evolved since the GFC. Prior to the crisis, investors were largely hedge funds and structured investment vehicles. Today, the CLO investor base is primarily composed of large institutional asset managers, banks, and insurance companies.

These investors tend to be less prone to forced selling during times of market volatility, which can help to stabilize the CLO market.

16. What is the Role of Leveraged Loans in CLOs?

Leveraged loans form the collateral base of most CLOs. These loans are typically senior secured loans, meaning they have a priority claim on the company’s assets in the event of bankruptcy. Leveraged loans carry floating-rate coupons, which can help to protect CLO investors from rising interest rates.

The senior secured position of leveraged loans has historically led to lower default rates and higher recoveries compared to high-yield bonds.

17. How Does Active Management Impact CLO Performance?

Active management is a key feature of CLOs. The collateral manager actively trades the loans in the portfolio to optimize its value and mitigate losses from defaults.

Active management can help to improve CLO performance by:

- Identifying and selecting loans with attractive yields and low default risk

- Selling loans that are deteriorating in credit quality

- Taking advantage of opportunities in the market to find value

18. What Are the Regulatory Considerations for CLOs?

CLOs are subject to a variety of regulatory requirements, including those imposed by the Securities and Exchange Commission (SEC) and other regulatory bodies. These regulations are designed to protect investors and ensure the stability of the financial system.

Regulatory considerations include:

- Disclosure requirements

- Capital requirements

- Risk retention rules

19. How Do CLOs Fit Into a Fixed-Income Portfolio?

CLOs can be a valuable addition to a fixed-income portfolio, offering diversification, higher yields, and protection against rising interest rates. However, they also have higher complexity and liquidity risk compared to other fixed-income investments.

Investors should carefully consider their risk tolerance and investment objectives before adding CLOs to their portfolio.

20. What Are the Current Trends in the CLO Market?

The CLO market is constantly evolving. Some current trends include:

- Growth in the market due to strong historical credit performance and floating-rate coupons.

- Increased investor demand for CLOs

- Innovation in CLO structures

Staying informed about these trends can help investors make better decisions about investing in CLOs.

21. What Is The Difference Between CLOs And CDOs?

Collateralized Loan Obligations (CLOs) and Collateralized Debt Obligations (CDOs) are both structured financial products, but they differ significantly in their underlying assets and risk profiles. CLOs primarily hold senior secured corporate loans, which generally have lower default rates and higher recovery rates compared to other types of debt. CDOs, on the other hand, can hold a wider range of debt instruments, including mortgage-backed securities, corporate bonds, and other asset-backed securities.

The structure of CLOs is designed to prioritize the repayment of senior tranches, providing them with greater protection against losses. Additionally, CLOs are actively managed by experienced collateral managers who can adjust the loan portfolio to optimize performance and mitigate risks. In contrast, CDOs may have less active management and may be exposed to more volatile and higher-risk assets.

22. What Are the Key Factors Affecting CLO Pricing?

Several key factors influence the pricing of Collateralized Loan Obligations (CLOs). Credit quality of the underlying loans is a primary driver, as higher-quality loans reduce default risk. Market interest rates play a significant role; rising rates can decrease the value of fixed-rate tranches but may increase the attractiveness of floating-rate tranches.

Supply and demand dynamics in the CLO market also impact pricing, with higher demand typically leading to increased prices. The structure of the CLO, including the seniority and credit enhancement of different tranches, affects their relative value. Macroeconomic conditions, such as economic growth and inflation, can influence investor sentiment and CLO valuations. Lastly, the expertise and track record of the collateral manager can impact investor confidence and pricing, as skilled managers are expected to better navigate market conditions and manage risks.

23. How Do CLOs Perform During Economic Downturns?

CLOs have generally demonstrated resilience during economic downturns, particularly those issued post-Global Financial Crisis (GFC). The senior secured nature of the underlying loans provides a degree of protection, and active management allows collateral managers to adapt to changing market conditions. Overcollateralization and interest coverage tests further safeguard senior tranches by diverting cash flows to pay down debt.

While some defaults may occur in the underlying loan portfolio, the diversified nature of CLOs helps mitigate the impact of individual loan losses. Historical data indicates that CLOs have lower default rates compared to corporate bonds, and recovery rates on defaulted loans tend to be higher due to their senior secured status. The performance of CLOs during economic downturns depends on the severity and duration of the downturn, as well as the specific characteristics of the CLO structure and the skill of the collateral manager.

24. What Are The Ethical Considerations Involving CLOs?

Ethical considerations surrounding Collateralized Loan Obligations (CLOs) encompass transparency, risk management, and potential conflicts of interest. Transparency is crucial, as investors need comprehensive information about the underlying assets, structure, and performance of CLOs to make informed decisions. Ethical risk management involves accurately assessing and mitigating the risks associated with CLOs, ensuring that investors are not exposed to undue harm.

Conflicts of interest can arise when collateral managers have incentives that are not aligned with the best interests of CLO investors, such as prioritizing short-term gains over long-term stability. Responsible investing practices, which consider environmental, social, and governance (ESG) factors, are also relevant, as CLOs may indirectly support companies with questionable ethical practices. Balancing the pursuit of financial returns with ethical responsibilities is essential for maintaining trust and integrity in the CLO market.

25. What Resources Are Available For Further CLO Research?

Several resources are available for conducting further research on Collateralized Loan Obligations (CLOs). Credit rating agencies like Standard & Poor’s, Moody’s, and Fitch provide detailed ratings and analysis on CLOs, including reports on their structure, performance, and underlying assets. Investment banks and financial institutions publish research reports and market commentary on the CLO market, offering insights into current trends and investment opportunities.

Industry associations such as the Loan Syndications and Trading Association (LSTA) provide educational materials and data on leveraged loans and CLOs. Academic journals and financial publications often feature articles on CLOs, exploring various aspects of their structure, performance, and risk characteristics. Regulatory filings with the Securities and Exchange Commission (SEC) can provide detailed information on specific CLOs. Finally, financial data providers like Bloomberg and Refinitiv offer comprehensive data and analytics on CLOs, enabling investors to monitor market trends and assess investment opportunities.

Do you still have questions about CLOs or other financial topics? Don’t hesitate to ask on WHAT.EDU.VN, where you can get free answers from experts.

In conclusion, Collateralized Loan Obligations (CLOs) are complex but potentially rewarding investments. Understanding their structure, benefits, and risks is essential for making informed investment decisions.

Still have questions? At WHAT.EDU.VN, we’re here to provide you with the answers you need. Whether you’re a student, a professional, or simply curious, our platform offers a wealth of information and expert insights.

Your Questions, Answered Free on WHAT.EDU.VN

Are you struggling to find reliable answers to your questions? Do you need expert advice without the hefty price tag? WHAT.EDU.VN is your solution. We offer a free platform where you can ask any question and receive timely, accurate responses from knowledgeable professionals.

Why Choose WHAT.EDU.VN?

- Free Access: Ask unlimited questions without any subscription fees.

- Expert Answers: Get responses from experienced professionals in various fields.

- Quick Turnaround: Receive answers promptly, so you can stay informed.

- Easy to Use: Our platform is simple and intuitive, making it easy to ask and find answers.

How to Get Started

- Visit WHAT.EDU.VN: Go to our website.

- Ask Your Question: Type your question into the search bar.

- Get Your Answer: Receive a detailed, accurate response from our experts.

Don’t let your questions go unanswered. Join WHAT.EDU.VN today and start getting the answers you need, completely free.

We Are Here To Help

At WHAT.EDU.VN, our mission is to make information accessible to everyone. We believe that everyone should have the opportunity to learn and grow, regardless of their background or financial situation. That’s why we offer our services completely free of charge.

Contact Us

Have questions or need assistance? Reach out to us:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- WhatsApp: +1 (206) 555-7890

- Website: WHAT.EDU.VN

Join our community today and experience the convenience of having your questions answered quickly and accurately. what.edu.vn – where knowledge is free.