Are you curious about dynasty trusts and how they can benefit your family’s future? At WHAT.EDU.VN, we provide clear and concise answers to your financial questions. A dynasty trust is a powerful estate planning tool designed to preserve and grow wealth across multiple generations while minimizing estate taxes and generation-skipping transfer tax (GSTT). This guide will explore the ins and outs of dynasty trusts, their benefits, drawbacks, and how they can help you create a lasting legacy. Discover how dynasty trusts differ from legacy trusts and whether this strategy aligns with your long-term financial goals.

1. What Is A Dynasty Trust?

A dynasty trust is a specialized type of trust designed to hold and manage assets for multiple generations, minimizing estate taxes and the generation-skipping transfer tax (GSTT). It’s often referred to as a perpetual trust because it allows wealthy families to grow and distribute their wealth over time without incurring additional transfer taxes each time assets pass to a new generation. Dynasty trusts are a powerful tool for preserving family legacies and ensuring long-term financial security.

1.1. Key Features of a Dynasty Trust

- Long-Term Duration: Unlike traditional trusts, dynasty trusts are designed to last for multiple generations, sometimes indefinitely, depending on state laws.

- Estate Tax Minimization: One of the primary goals of a dynasty trust is to reduce or eliminate estate taxes as wealth is transferred across generations.

- GSTT Mitigation: Dynasty trusts can help mitigate the impact of the generation-skipping transfer tax (GSTT), which applies to transfers to beneficiaries who are at least two generations younger than the grantor.

- Asset Protection: Assets held within a dynasty trust are typically protected from creditors, lawsuits, and other potential financial risks.

- Flexibility: Dynasty trusts can be structured to provide beneficiaries with financial support for education, healthcare, and other needs, while also promoting financial responsibility.

1.2. How Does A Dynasty Trust Work?

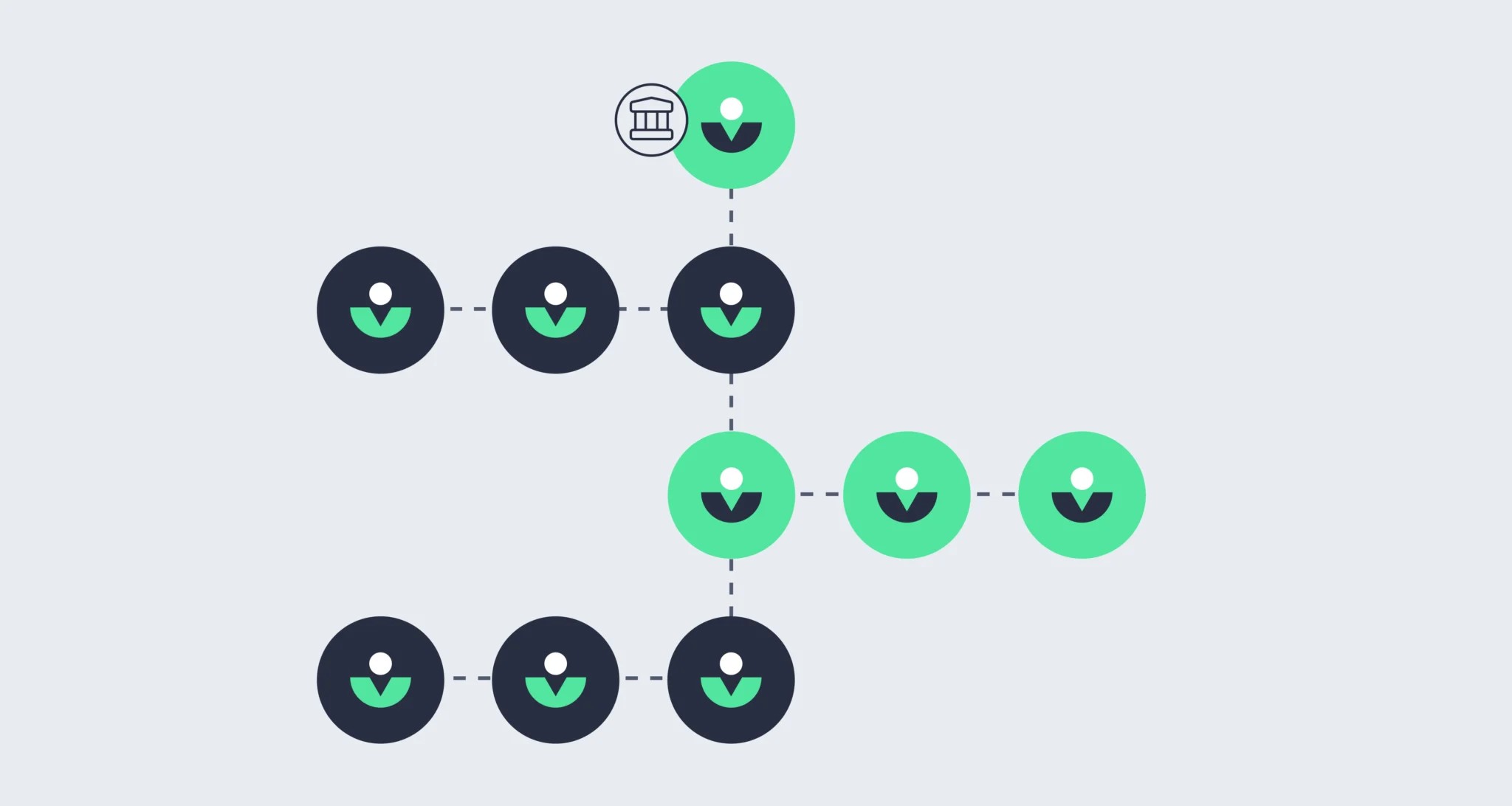

Dynasty trusts work by establishing a legal entity that holds assets for the benefit of multiple generations. The grantor (the person creating the trust) transfers assets into the trust, which are then managed by a trustee. The trustee is responsible for administering the trust according to its terms, including making distributions to beneficiaries and managing investments. Because the trust is designed to last for multiple generations, it can provide ongoing financial support and security for the grantor’s descendants.

1.3. The Purpose Of A Dynasty Trust

The main purpose of a dynasty trust is to preserve and grow wealth for future generations while minimizing estate taxes. By transferring assets into a dynasty trust, the grantor can remove those assets from their taxable estate, reducing or eliminating estate taxes when they die. Additionally, the trust can be structured to avoid the generation-skipping transfer tax (GSTT), which applies to transfers to grandchildren and other younger generations. Dynasty trusts are often used by high-net-worth families who want to create a lasting financial legacy for their descendants.

1.4. Historical Context Of Dynasty Trusts

Dynasty trusts emerged as a result of changes in estate tax laws and the desire of wealthy families to preserve their wealth for future generations. Historically, the rule against perpetuities limited the duration of trusts, preventing them from lasting for more than a certain period (typically 21 years after the death of the last living beneficiary). However, many states have abolished or modified the rule against perpetuities, allowing dynasty trusts to last for much longer periods, even indefinitely. This has made dynasty trusts an increasingly popular estate planning tool for high-net-worth individuals and families.

1.5. Dynasty Trust Vs. Other Types Of Trusts

| Feature | Dynasty Trust | Other Trusts |

|---|---|---|

| Duration | Designed to last for multiple generations, potentially indefinitely | Typically have a specific term or purpose |

| Estate Tax Minimization | Primary goal is to minimize estate taxes across generations | May or may not focus on estate tax minimization |

| GSTT Mitigation | Designed to avoid or minimize GSTT | May not address GSTT |

| Asset Protection | Offers strong asset protection benefits | Asset protection varies depending on the type of trust |

| Flexibility | Can be customized to meet the needs of multiple generations | Flexibility may be limited depending on the specific terms of the trust |

| Complexity | More complex to set up and administer | Simpler to set up and administer |

| Ideal For | High-net-worth families seeking to create a lasting legacy | Individuals with specific estate planning goals, such as providing for children |

| Need Free Answers? | Visit WHAT.EDU.VN | Visit WHAT.EDU.VN |

2. What Are The Key Benefits Of Establishing A Dynasty Trust?

Dynasty trusts offer numerous advantages, especially for high-net-worth individuals seeking to secure their family’s financial future for generations. These benefits include minimizing estate taxes, protecting assets from creditors, and providing long-term financial security for beneficiaries.

2.1. Minimizing Estate Taxes

One of the primary benefits of a dynasty trust is its ability to minimize estate taxes. By transferring assets into the trust, the grantor removes those assets from their taxable estate, reducing or eliminating estate taxes when they die. This can result in significant tax savings, especially for large estates.

- Federal Estate Tax Exemption: In 2024, the federal estate tax exemption is $13.61 million per individual, or $27.22 million per couple. By using a dynasty trust, a couple can protect up to $27.22 million from estate taxes.

- Generation-Skipping Transfer Tax (GSTT) Exemption: The GSTT exemption is also $13.61 million per individual in 2024. A dynasty trust can be structured to avoid the GSTT, which applies to transfers to grandchildren and other younger generations.

2.2. Asset Protection

Dynasty trusts offer strong asset protection benefits, shielding assets from creditors, lawsuits, and other potential financial risks. This can be particularly important for individuals in high-risk professions or those who want to protect their assets from potential future liabilities.

- Protection from Creditors: Assets held in a dynasty trust are generally protected from the grantor’s creditors, as well as the beneficiaries’ creditors.

- Divorce Protection: In many states, assets held in a dynasty trust are protected from being divided in a divorce settlement.

- Lawsuit Protection: Dynasty trusts can provide protection from lawsuits, as assets held in the trust are typically not subject to legal claims against the grantor or beneficiaries.

2.3. Long-Term Financial Security For Beneficiaries

Dynasty trusts can provide long-term financial security for beneficiaries, ensuring that they have the resources they need to meet their financial needs and pursue their goals. The trust can be structured to provide beneficiaries with income, pay for their education, or cover their healthcare expenses.

- Income Stream: The trust can generate income that is distributed to beneficiaries on a regular basis.

- Education Expenses: The trust can be used to pay for beneficiaries’ education expenses, such as tuition, books, and room and board.

- Healthcare Expenses: The trust can be used to cover beneficiaries’ healthcare expenses, such as medical bills, insurance premiums, and long-term care costs.

2.4. Flexibility In Distribution

Dynasty trusts offer flexibility in distribution, allowing the grantor to customize the terms of the trust to meet the specific needs and goals of their family. The grantor can specify how and when assets will be distributed to beneficiaries, as well as the conditions under which distributions will be made.

- Discretionary Distributions: The trustee can be given discretion to make distributions to beneficiaries based on their needs and circumstances.

- Mandatory Distributions: The trust can require the trustee to make specific distributions to beneficiaries on a regular basis.

- Milestone Distributions: The trust can specify that distributions will be made when beneficiaries reach certain milestones, such as graduating from college or getting married.

2.5. Preservation Of Family Values

Dynasty trusts can be used to preserve family values and traditions across generations. The grantor can include provisions in the trust that encourage beneficiaries to pursue education, engage in philanthropic activities, or uphold certain family traditions.

- Education Incentives: The trust can provide incentives for beneficiaries to pursue higher education.

- Philanthropic Giving: The trust can encourage beneficiaries to engage in philanthropic activities by matching their charitable donations.

- Family Traditions: The trust can include provisions that encourage beneficiaries to uphold certain family traditions, such as celebrating holidays together or passing down family heirlooms.

2.6. Potential Tax Advantages

- Gift Tax Exclusion: Contributions to the trust can be structured to qualify for the annual gift tax exclusion, allowing for tax-free transfers.

- Avoiding Future Estate Taxes: Assets held in the trust, along with their appreciation, are removed from future estate tax calculations.

- Income Tax Planning: Strategic management of the trust can also offer income tax benefits for the beneficiaries.

Looking for personalized advice? Contact us at WHAT.EDU.VN. Our experts at 888 Question City Plaza, Seattle, WA 98101, United States, or Whatsapp at +1 (206) 555-7890, are ready to assist.

3. What Are The Potential Downsides And Considerations Before Setting Up A Dynasty Trust?

While dynasty trusts offer significant benefits, it’s crucial to consider potential drawbacks and challenges before establishing one. These include the irrevocable nature of the trust, loss of control over assets, and potential complexities in administration.

3.1. Irrevocable Nature Of The Trust

One of the primary downsides of a dynasty trust is that it is irrevocable, meaning that once it is established, the grantor cannot change its terms or reclaim the assets held within the trust. This can be problematic if the grantor’s circumstances change or if they have a change of heart about the trust’s provisions.

- Loss Of Control: The grantor loses control over the assets held in the trust, as well as the ability to modify the trust’s terms.

- Inflexibility: The trust’s provisions cannot be changed, even if the grantor’s circumstances change or if they have a change of heart about the trust’s provisions.

- Unforeseen Circumstances: The irrevocable nature of the trust can be problematic if unforeseen circumstances arise, such as a financial crisis or a family dispute.

3.2. Loss Of Control Over Assets

As mentioned above, the grantor loses control over the assets held in the trust. This can be difficult for individuals who are accustomed to having complete control over their finances.

- Trustee Management: The trustee is responsible for managing the assets held in the trust, and the grantor has no direct control over their investment decisions.

- Beneficiary Influence: The beneficiaries may have influence over the trustee’s decisions, which can create conflicts or disagreements.

- Legal Challenges: The trust can be subject to legal challenges, which can result in the grantor losing control over the assets.

3.3. Complexities In Administration

Dynasty trusts can be complex to administer, requiring the expertise of attorneys, accountants, and other professionals. This can add to the cost and burden of maintaining the trust.

- Legal Fees: The grantor will need to pay legal fees to establish the trust and to ensure that it complies with all applicable laws.

- Accounting Fees: The trustee will need to pay accounting fees to prepare the trust’s tax returns and to ensure that the trust’s finances are properly managed.

- Investment Management Fees: The trustee will need to pay investment management fees to manage the assets held in the trust.

3.4. Potential For Family Disputes

Dynasty trusts can create potential for family disputes, especially if the beneficiaries have different opinions about how the trust should be managed or how assets should be distributed.

- Disagreements Over Distributions: The beneficiaries may disagree about how assets should be distributed, which can lead to conflicts and resentment.

- Conflicts Of Interest: The trustee may have conflicts of interest, which can create tension among the beneficiaries.

- Legal Battles: The trust can be subject to legal battles, which can be costly and time-consuming.

3.5. State Laws And The Rule Against Perpetuities

The rule against perpetuities is a legal principle that limits the duration of trusts. Some states still have the rule against perpetuities in place, which can prevent dynasty trusts from lasting for more than a certain period.

- Limited Duration: In states that have the rule against perpetuities, dynasty trusts may not be able to last for more than a certain period, typically 21 years after the death of the last living beneficiary.

- State Law Variations: State laws regarding dynasty trusts vary widely, so it’s important to consult with an attorney in your state to determine whether a dynasty trust is a viable option.

- Changing Laws: State laws regarding dynasty trusts can change over time, so it’s important to stay informed about the latest legal developments.

3.6. Impact On Beneficiary Independence

- Dependency Concerns: Beneficiaries might become overly reliant on the trust, potentially hindering their motivation to achieve personal and professional success independently.

- Financial Responsibility: Steps should be taken to ensure beneficiaries understand financial management to avoid mismanagement of trust funds.

3.7. Tax Law Changes

- Future Legislation: Changes in tax laws could impact the effectiveness of the trust’s tax benefits, requiring adjustments to the trust structure.

3.8. Examples Of Potential Challenges

- Market Downturns: A significant market downturn can deplete the trust’s assets, affecting its ability to provide for future generations.

- Unexpected Expenses: Unforeseen healthcare costs or other significant expenses for beneficiaries can strain the trust’s resources.

- Beneficiary Mismanagement: A beneficiary’s mismanagement of distributed funds can lead to financial instability.

4. Which States Permit Dynasty Trusts?

The availability of dynasty trusts depends on state laws regarding the rule against perpetuities. Many states have abolished or modified this rule, allowing dynasty trusts to last for extended periods, even indefinitely.

4.1. States That Have Abolished The Rule Against Perpetuities

These states allow dynasty trusts to exist in perpetuity, meaning they can last indefinitely:

- Alaska

- Arizona

- Delaware

- Idaho

- Illinois

- Kentucky

- Maine

- Maryland

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- Ohio

- Pennsylvania

- Rhode Island

- South Dakota

- Tennessee

- Utah

- Virginia

- Washington

- Wisconsin

- Wyoming

4.2. States That Have Modified The Rule Against Perpetuities

These states have modified the rule against perpetuities, allowing dynasty trusts to last for a specific period, typically longer than the traditional rule:

- California

- Colorado

- Florida

- Georgia

- Hawaii

- Indiana

- Kansas

- Massachusetts

- Michigan

- Minnesota

- New York

- North Carolina

- North Dakota

- Oklahoma

- Oregon

- South Carolina

- Texas

- West Virginia

4.3. Importance Of Consulting With An Attorney

Because state laws regarding dynasty trusts can be complex and vary widely, it’s important to consult with an estate planning attorney in your state to determine whether a dynasty trust is a viable option and to ensure that it complies with all applicable laws.

4.4. Changing State Laws

State laws regarding dynasty trusts can change over time, so it’s important to stay informed about the latest legal developments. An experienced estate planning attorney can help you stay up-to-date on these changes and make any necessary adjustments to your trust.

4.5. Examples Of State-Specific Regulations

- Delaware: Known for its favorable trust laws, Delaware allows dynasty trusts to last in perpetuity and offers strong asset protection benefits.

- Alaska: Alaska also allows dynasty trusts to last in perpetuity and has no state income tax, making it an attractive option for wealthy families.

- Florida: Florida has modified the rule against perpetuities, allowing dynasty trusts to last for up to 360 years.

5. How Is A Dynasty Trust Established?

Establishing a dynasty trust involves several key steps, including working with an attorney, designating beneficiaries and trustees, funding the trust, and ensuring compliance with state laws.

5.1. Working With An Estate Planning Attorney

The first step in establishing a dynasty trust is to work with an experienced estate planning attorney who can help you understand the legal requirements and create a trust that meets your specific needs and goals.

- Legal Expertise: An attorney can provide legal expertise and guidance throughout the process.

- Customized Trust: An attorney can help you create a customized trust that meets your specific needs and goals.

- Compliance: An attorney can ensure that the trust complies with all applicable laws.

5.2. Designating Beneficiaries

The next step is to designate the beneficiaries of the trust. Beneficiaries can include your children, grandchildren, and future generations.

- Future Generations: Dynasty trusts can be designed to benefit future generations who are not yet born at the time the trust is created.

- Contingent Beneficiaries: It’s important to designate contingent beneficiaries in case the primary beneficiaries die before the trust terminates.

- Clear Definitions: The beneficiaries should be clearly defined in the trust document to avoid any confusion or disputes.

5.3. Naming A Trustee

The grantor must name a trustee to manage the assets held in the trust and to administer the trust according to its terms. The trustee can be an individual, such as a family member or friend, or a corporate trustee, such as a bank or trust company.

- Fiduciary Duty: The trustee has a fiduciary duty to act in the best interests of the beneficiaries.

- Experience And Expertise: The trustee should have experience and expertise in managing trusts and investments.

- Successor Trustees: It’s important to name successor trustees in case the primary trustee is unable or unwilling to serve.

5.4. Funding The Trust

The grantor must fund the trust by transferring assets into it. Assets that can be transferred into a dynasty trust include cash, stocks, bonds, real estate, and business interests.

- Gift Tax Implications: Transfers to the trust may be subject to gift tax, but the grantor can use their annual gift tax exclusion and lifetime gift tax exemption to minimize or eliminate gift tax.

- Appraisal: It’s important to obtain an appraisal of any assets that are transferred into the trust to determine their fair market value.

- Record Keeping: The grantor should keep detailed records of all assets that are transferred into the trust.

5.5. Drafting The Trust Document

- Custom Provisions: Include specific instructions for distributions, investment strategies, and the handling of unique family assets.

5.6. Ongoing Management

- Regular Reviews: Periodically review the trust document with legal and financial advisors to ensure it still meets the family’s goals and complies with current laws.

5.7. Consulting Relevant Professionals

- Financial Planners: They can help determine the best assets to place in the trust and manage them effectively.

- Accountants: Ensure the trust complies with tax regulations and handle filings.

- Trust Administrators: Manage the day-to-day operations and ensure distributions are made correctly.

For comprehensive support, reach out to WHAT.EDU.VN. Our experts at 888 Question City Plaza, Seattle, WA 98101, United States, or Whatsapp at +1 (206) 555-7890, are here to guide you.

6. What Is The Tax Impact Of Dynasty Trusts?

Dynasty trusts have significant tax implications, particularly regarding estate taxes, gift taxes, and generation-skipping transfer taxes (GSTT).

6.1. Estate Tax Implications

One of the primary goals of a dynasty trust is to minimize estate taxes. By transferring assets into the trust, the grantor removes those assets from their taxable estate, reducing or eliminating estate taxes when they die.

- Federal Estate Tax Exemption: In 2024, the federal estate tax exemption is $13.61 million per individual, or $27.22 million per couple.

- Estate Tax Rate: The federal estate tax rate is 40%.

6.2. Gift Tax Implications

Transfers to a dynasty trust may be subject to gift tax, but the grantor can use their annual gift tax exclusion and lifetime gift tax exemption to minimize or eliminate gift tax.

- Annual Gift Tax Exclusion: In 2024, the annual gift tax exclusion is $18,000 per recipient.

- Lifetime Gift Tax Exemption: The lifetime gift tax exemption is $13.61 million per individual, or $27.22 million per couple.

6.3. Generation-Skipping Transfer Tax (GSTT) Implications

Dynasty trusts can be structured to avoid the generation-skipping transfer tax (GSTT), which applies to transfers to grandchildren and other younger generations.

- GSTT Exemption: The GSTT exemption is $13.61 million per individual in 2024.

- GSTT Rate: The GSTT rate is 40%.

6.4. Income Tax Implications

Dynasty trusts are typically structured as non-grantor trusts, meaning that the trust is a separate tax entity that is responsible for paying its own income taxes.

- Trust Income Tax Rates: Trust income tax rates are generally higher than individual income tax rates.

- Distribution Planning: Careful planning is needed to minimize the income tax impact on the beneficiaries.

- Grantor Trust Status: In some cases, it may be beneficial to structure the trust as a grantor trust, which means that the grantor is responsible for paying the income taxes on the trust’s income.

6.5. Examples Of Tax Planning Strategies

- Using the GSTT Exemption: Allocate the GSTT exemption to transfers to the trust to protect those assets from GSTT.

- Making Annual Exclusion Gifts: Make annual exclusion gifts to the trust to reduce the taxable value of the trust.

- Structuring the Trust as a Grantor Trust: Structure the trust as a grantor trust to shift the income tax burden to the grantor.

- Investing in Tax-Advantaged Assets: Invest in tax-advantaged assets, such as municipal bonds, to minimize the trust’s income tax liability.

6.6. Professional Tax Advice

Given the complexities of tax laws, seeking advice from a qualified tax professional is essential to optimize the tax benefits of a dynasty trust.

7. Legacy Trust Vs. Dynasty Trust: What Are The Key Differences?

While the terms “legacy trust” and “dynasty trust” are sometimes used interchangeably, there are key differences between the two that are important to understand.

7.1. Definition Of A Legacy Trust

A legacy trust is a type of trust that is designed to preserve and pass on a family’s values, traditions, and history, as well as their financial assets.

- Focus On Values: Legacy trusts focus on preserving and passing on a family’s values, traditions, and history.

- Financial Assets: Legacy trusts also involve the transfer of financial assets to future generations.

- Family History: Legacy trusts may include provisions for preserving and sharing a family’s history, such as photographs, letters, and stories.

7.2. Definition Of A Dynasty Trust

A dynasty trust is a type of trust that is designed to hold and manage assets for multiple generations, minimizing estate taxes and the generation-skipping transfer tax (GSTT).

- Tax Minimization: Dynasty trusts are primarily focused on minimizing estate taxes and the GSTT.

- Long-Term Duration: Dynasty trusts are designed to last for multiple generations, sometimes indefinitely.

- Asset Protection: Dynasty trusts offer strong asset protection benefits.

7.3. Key Differences

| Feature | Legacy Trust | Dynasty Trust |

|---|---|---|

| Focus | Preserving family values, traditions, and history | Minimizing estate taxes and the GSTT |

| Duration | May have a specific term or purpose | Designed to last for multiple generations, potentially indefinitely |

| Tax Implications | May have tax implications, but tax minimization is not the primary goal | Tax minimization is a primary goal |

| Asset Protection | May offer asset protection benefits, but it is not the primary focus | Offers strong asset protection benefits |

| Complexity | May be simpler to set up and administer | More complex to set up and administer |

| Have Questions? | Visit WHAT.EDU.VN | Visit WHAT.EDU.VN |

7.4. When To Choose A Legacy Trust

A legacy trust may be a good choice for families who are more concerned with preserving their values, traditions, and history than with minimizing taxes.

- Family Values: Families who want to pass on their values to future generations.

- Family Traditions: Families who want to preserve and share their traditions with future generations.

- Family History: Families who want to document and share their family history with future generations.

7.5. When To Choose A Dynasty Trust

A dynasty trust may be a good choice for high-net-worth families who are primarily concerned with minimizing estate taxes and the GSTT.

- High-Net-Worth Families: Families with significant assets who are concerned about estate taxes.

- Long-Term Planning: Families who want to create a lasting financial legacy for their descendants.

- Asset Protection: Families who want to protect their assets from creditors and lawsuits.

7.6. Blending Both Approaches

It is also possible to create a trust that combines elements of both a legacy trust and a dynasty trust. This type of trust can be used to preserve both a family’s values and their financial assets, while also minimizing taxes and providing asset protection.

8. What Are Some Common Misconceptions About Dynasty Trusts?

There are several common misconceptions about dynasty trusts that can lead to confusion and misunderstandings.

8.1. Dynasty Trusts Are Only For The Super-Rich

While dynasty trusts are often used by high-net-worth families, they can also be beneficial for individuals with more modest estates who want to minimize taxes and provide for future generations.

- Tax Benefits: Dynasty trusts can offer tax benefits for individuals with estates of all sizes.

- Estate Planning: Dynasty trusts can be a valuable tool for estate planning, regardless of the size of the estate.

- Financial Security: Dynasty trusts can provide financial security for future generations.

8.2. Dynasty Trusts Are Too Complicated

While dynasty trusts can be complex, they can be structured to be relatively simple to administer.

- Professional Assistance: Working with an experienced estate planning attorney can help simplify the process of setting up and administering a dynasty trust.

- Clear Instructions: The trust document can be drafted to provide clear instructions for the trustee.

- Regular Reviews: The trust can be reviewed regularly to ensure that it continues to meet the needs of the family.

8.3. Dynasty Trusts Are Set And Forget

While dynasty trusts are designed to last for multiple generations, they require ongoing management and attention.

- Trustee Oversight: The trustee must be monitored to ensure that they are acting in the best interests of the beneficiaries.

- Investment Management: The trust’s investments must be managed carefully to ensure that they are generating sufficient returns.

- Tax Planning: The trust’s tax planning must be reviewed regularly to ensure that it is minimizing taxes.

8.4. Dynasty Trusts Guarantee Wealth Forever

While dynasty trusts can help preserve wealth for future generations, they cannot guarantee that wealth will last forever.

- Market Risk: The trust’s investments are subject to market risk, which can cause the value of the trust to decline.

- Beneficiary Mismanagement: Beneficiaries can mismanage the trust’s assets, which can lead to the depletion of the trust.

- Economic Changes: Economic changes can affect the value of the trust and its ability to provide for future generations.

8.5. Dynasty Trusts Are A One-Size-Fits-All Solution

Dynasty trusts are not a one-size-fits-all solution. They must be customized to meet the specific needs and goals of each family.

- Individualized Planning: Dynasty trusts should be tailored to the specific circumstances of each family.

- Family Values: Dynasty trusts should reflect the family’s values and priorities.

- Long-Term Goals: Dynasty trusts should be designed to achieve the family’s long-term goals.

8.6. Examples Illustrating Misconceptions

- Misconception: “Setting up a dynasty trust means I’ll never pay taxes again.” Reality: While dynasty trusts can minimize estate taxes and the GSTT, they do not eliminate all taxes. The trust may still be subject to income tax, and transfers to the trust may be subject to gift tax.

- Misconception: “Once a dynasty trust is set up, it can’t be changed.” Reality: While dynasty trusts are irrevocable, there may be ways to modify the trust if necessary, such as through court order or decanting.

- Misconception: “My children will automatically be financially secure if I set up a dynasty trust.” Reality: While dynasty trusts can provide financial security for future generations, they cannot guarantee that beneficiaries will be financially responsible or successful.

9. Real-World Examples Of Dynasty Trusts In Action

Examining real-world examples of dynasty trusts can provide valuable insights into how they work and the benefits they can offer.

9.1. The Rockefeller Family

The Rockefeller family is one of the most well-known examples of a family that has used dynasty trusts to preserve their wealth for multiple generations.

- Early Use Of Trusts: John D. Rockefeller established trusts in the early 20th century to manage and protect his vast fortune.

- Generational Wealth: These trusts have allowed the Rockefeller family to maintain their wealth and influence for over a century.

- Philanthropic Giving: The Rockefeller family has also used their trusts to support philanthropic causes.

9.2. The Walton Family

The Walton family, founders of Walmart, has also used dynasty trusts to manage their wealth and minimize taxes.

- Family Business: The Walton family’s dynasty trusts hold a significant portion of Walmart stock.

- Tax Planning: These trusts have helped the Walton family minimize estate taxes and the GSTT.

- Charitable Giving: The Walton family has also used their trusts to support charitable giving.

9.3. Case Studies Of Smaller Estates

While dynasty trusts are often associated with large estates, they can also be beneficial for individuals with more modest estates.

- Family Farm: A family farm can be transferred into a dynasty trust to ensure that it remains in the family for future generations.

- Small Business: A small business can be transferred into a dynasty trust to provide for the owner’s children and grandchildren.

- Real Estate: Real estate can be transferred into a dynasty trust to provide a source of income for future generations.

9.4. Challenges And Successes

- Navigating Legal Changes: Dynasty trusts must adapt to changing tax laws and regulations to remain effective.

- Maintaining Family Harmony: Clear communication and well-defined distribution guidelines are essential to prevent disputes among beneficiaries.

- Ensuring Competent Management: Selecting experienced and trustworthy trustees is crucial for the long-term success of the trust.

9.5. Examples Of Distribution Strategies

- Education Funds: Trusts can be structured to provide funds for beneficiaries’ education expenses.

- Healthcare Coverage: Trusts can be used to cover beneficiaries’ healthcare costs.

- Business Ventures: Trusts can provide capital for beneficiaries to start their own businesses.

10. Frequently Asked Questions (FAQs) About Dynasty Trusts

10.1. What Happens If A Beneficiary Mismanages Their Inheritance From A Dynasty Trust?

Dynasty trusts can be structured to protect against beneficiary mismanagement.

- Spendthrift Provisions: Trusts can include spendthrift provisions that prevent beneficiaries from selling or assigning their interest in the trust.

- Discretionary Distributions: The trustee can be given discretion to make distributions to beneficiaries based on their needs and circumstances.

- Professional Management: The trustee can hire professional investment managers to manage the trust’s assets.

10.2. Can Creditors Seize Assets Held In A Dynasty Trust?

Dynasty trusts offer strong asset protection benefits, but they are not foolproof.

- State Law Variations: State laws regarding asset protection vary, so it’s important to consult with an attorney in your state.

- Fraudulent Transfers: Transfers to a dynasty trust can be challenged if they are made with the intent to defraud creditors.

- Beneficiary Creditors: In some cases, creditors of the beneficiaries may be able to seize assets held in the trust.

10.3. What Are The Alternatives To A Dynasty Trust?

There are several alternatives to a dynasty trust that can be used to minimize taxes and provide for future generations.

- Irrevocable Life Insurance Trust (ILIT): An ILIT can be used to hold life insurance policies and provide tax-free death benefits to beneficiaries.

- Qualified Personal Residence Trust (QPRT): A QPRT can be used to transfer a personal residence to beneficiaries while minimizing gift tax.

- Grantor Retained Annuity Trust (GRAT): A GRAT can be used to transfer assets to beneficiaries while minimizing gift tax.

10.4. How Often Should A Dynasty Trust Be Reviewed?

A dynasty trust should be reviewed regularly to ensure that it continues to meet the needs of the family and that it complies with all applicable laws.

- Annual Review: The trust should be reviewed at least annually by the trustee and the beneficiaries.

- Significant Life Events: The trust should be reviewed whenever there is a significant life event, such as a birth, death, marriage, or divorce.

- Law Changes: The trust should be reviewed whenever there are changes in the law that could affect the trust.

10.5. What Role Does A Financial Advisor Play In Managing A Dynasty Trust?

A financial advisor can play a key role in managing a dynasty trust.

- Investment Management: A financial advisor can help the trustee manage the trust’s investments.

- Financial Planning: A financial advisor can help the beneficiaries with their financial planning.

- Tax Planning: A financial advisor can help the trustee with the trust’s tax planning.

10.6. How Can I Learn More About Setting Up A Dynasty Trust?

- Consult With Professionals: Estate planning attorneys, financial advisors, and tax professionals can provide personalized guidance.

- Attend Seminars: Look for estate planning seminars in your area to learn more about dynasty trusts and other estate planning strategies.

- Read Books And Articles: There are many books and articles available on dynasty trusts and estate planning.

Have more questions? Contact the experts at WHAT.EDU.VN. We’re located at 888 Question City Plaza, Seattle, WA 98101, United States, or reach us on Whatsapp at +1 (206) 555-7890.

Call to Action

Ready to secure your family’s financial future with a dynasty trust? Don’t let complex estate planning challenges overwhelm you. At WHAT.EDU.VN, we make it easy to get the answers you need. Ask your questions now and connect with our network of knowledgeable experts who can provide clear, personalized guidance tailored to your unique situation.

Whether you’re curious about minimizing estate taxes, protecting your assets, or ensuring long-term financial security for your loved ones, we’re here to help. Visit what.edu.vn today and experience the convenience of free, reliable answers at your fingertips. Contact us at 888 Question City Plaza, Seattle, WA 9