A great credit score unlocks better financial opportunities; “WHAT.EDU.VN” can guide you to achieve it. A strong credit history, reflected in your credit rating, can lead to lower interest rates and favorable loan terms. This article explores what constitutes a great credit score, its importance, and actionable steps to improve it, focusing on creditworthiness and financial health.

1. What Qualifies as a Great Credit Score?

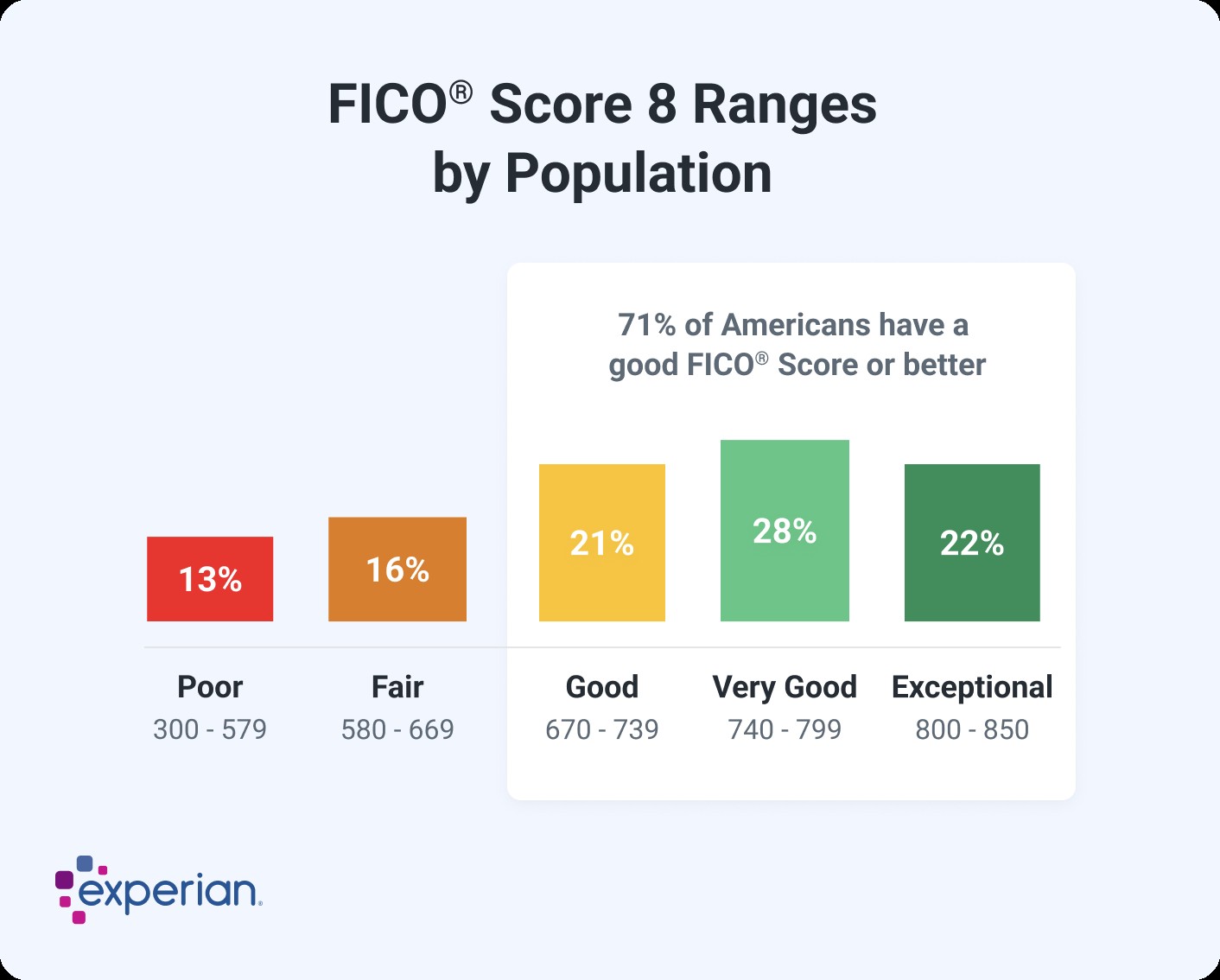

A great credit score typically falls within the upper ranges of both the FICO® and VantageScore® models. Let’s break down what constitutes a great score in each system:

-

FICO® Score: A FICO® Score ranges from 300 to 850. Generally:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

A score of 740 or higher is typically considered very good to excellent, opening doors to the best interest rates and loan terms.

-

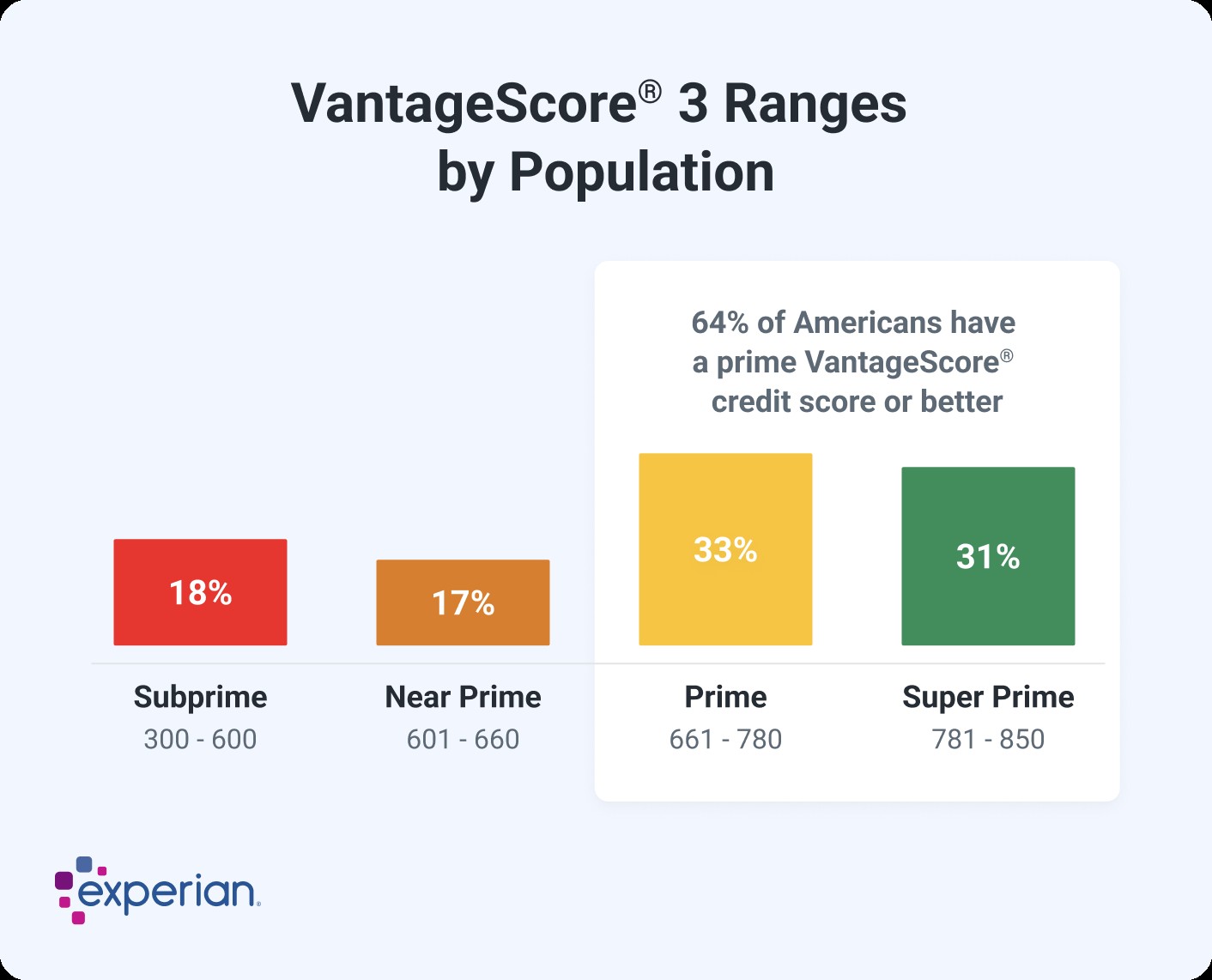

VantageScore®: VantageScore also uses a range of 300 to 850. Here’s the breakdown:

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 300-600

A VantageScore of 781 or higher is considered excellent.

1.1 FICO® Score Variations

FICO® offers different versions of its scoring models, including base scores and industry-specific scores (e.g., for auto lenders and credit card issuers). While the ranges may vary slightly (some industry-specific scores range from 250 to 900), the categorization remains similar: a score above 670 is generally considered good across all FICO® models.

1.2 VantageScore® Variations

Unlike FICO®, VantageScore® does not have industry-specific scores. However, it has released updated models over the years. The latest versions, VantageScore® 3.0 and 4.0, use the 300 to 850 range.

2. Key Factors That Impact Your Credit Scores

Your credit scores are influenced by several factors, each carrying different weights. Understanding these factors can help you focus on areas that need improvement.

2.1 FICO® Score Factors

FICO® uses percentages to represent the importance of each category, though the exact breakdown depends on your credit report.

- Payment History (35%): This is the most significant factor. Consistent on-time payments demonstrate reliability.

- Amounts Owed (30%): This looks at your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit.

- Length of Credit History (15%): A longer credit history generally indicates stability and responsible credit management.

- Credit Mix (10%): Having a mix of different types of credit accounts (e.g., credit cards, loans) can positively impact your score.

- New Credit (10%): Opening too many new accounts in a short period can lower your score.

2.2 VantageScore® Factors

VantageScore® also considers similar factors, but categorizes them by influence level:

| VantageScore Credit Scoring Factor | Importance |

|---|---|

| Payment history | Extremely influential |

| Total credit usage | Highly influential |

| Credit mix and experience | Highly influential |

| New accounts opened | Moderately influential |

| Balances and available credit | Less influential |

2.3 Information Not Considered

Both FICO® and VantageScore® do not consider factors like your race, religion, income, or employment status when calculating your credit scores.

3. What a Great Credit Score Enables You to Do

A great credit score unlocks numerous financial benefits and opportunities.

3.1 Buying a House

A credit score of 740 or higher can significantly improve your chances of getting approved for a mortgage with favorable interest rates. The minimum credit score required to buy a house varies depending on the type of loan:

| Minimum Credit Score for Government-Backed Mortgages |

|---|

| FHA home loans |

| USDA loans |

| VA loans |

A higher credit score can save you thousands of dollars in interest payments over the life of the loan.

3.2 Buying a Car

While there isn’t a strict minimum credit score to buy a car, a VantageScore® of 661 or higher can help you qualify for better auto loan terms. Lenders view low credit scores as a sign of risk, leading to higher interest rates and potentially lower loan limits.

3.3 Credit Card Approvals and Terms

A great credit score increases your chances of being approved for premium credit cards with attractive rewards, low interest rates, and other perks.

4. How Different Credit Scores Are Created

Multiple credit scores exist because credit scoring companies continually update and sell their models to lenders. Lenders use these scores to make decisions about lending and account management.

4.1 FICO® and VantageScore® Differences

FICO® and VantageScore® are the two main credit scoring companies. Both periodically release new versions of their scores to incorporate technological advances and changes in consumer behavior. Lenders can choose which model to use.

4.2 VantageScore®’s Evolution

VantageScore® creates a generic tri-bureau scoring model, meaning the score is designed for any type of lender and can evaluate credit reports from Experian, TransUnion, and Equifax.

Recent VantageScore® Credit Score Versions

| VS 3.0 | VS 4.0 | VS 4plus |

|---|---|---|

| Only considers data from credit report | X | X |

| Can consider additional data with your permission | X | |

| Considers trended data | X | X |

4.3 FICO®’s Diverse Models

FICO® was the first company to create credit scoring models based on consumer credit reports. There are three general types of consumer FICO® Scores:

- Base FICO® Scores: For any type of lender, ranging from 300 to 850.

- Industry-specific FICO® Scores: Auto scores and bankcard scores for auto lenders and card issuers, ranging from 250 to 900.

- FICO® Scores Using Alternative Data: Models incorporating alternative credit data like UltraFICO® and FICO® XD scores.

4.4 Lender Discretion

Lenders can choose which credit reports to request and which scores to receive. This choice often remains unknown to the consumer, and lenders may change their preferences or test different approaches.

4.5 Common Ground

Despite the variations, most FICO® and VantageScore® credit scores rely on the same underlying information from your credit reports. They aim to predict the likelihood of becoming 90 days past due on a bill within the next 24 months.

5. Why a Great Credit Score Is Crucial

Having a great credit score can simplify achieving financial goals. It can be the determining factor in qualifying for loans and securing favorable terms.

5.1 Financial Savings

A higher credit score translates to lower interest rates on loans, saving you significant amounts of money over time.

For example, consider a 30-year fixed-rate $350,000 mortgage:

| FICO® Score | Interest Rate, 30-Year Fixed-Rate Mortgage | Monthly Payment | Total Interest Cost |

|---|---|---|---|

| 620 | 7.71% | $2,806.11 | $549,199 |

| 700 | 7.13% | $2,667.53 | $499,310 |

| 840 | 6.69% | $2,564.49 | $462,214 |

Source: Curinos LLC, December 6, 2024; assumes a $350,000 mortgage and 30-day rate-lock period

5.2 Non-Lending Decisions

Credit scores can also influence non-lending decisions, such as a landlord’s willingness to rent you an apartment.

5.3 Other Impacts

Credit reports can affect employment opportunities, as some employers may review them before making hiring or promotion decisions. Insurance companies may also use credit-based insurance scores to determine premiums for auto, home, and life insurance.

6. Steps to Elevate Your Credit Scores

Improving your credit scores involves focusing on the underlying factors that affect them.

6.1 Basic Strategies

- Pay Bills On Time: Consistent on-time payments are crucial.

- Lower Credit Utilization: Keep your credit utilization ratio below 30%.

- Monitor Credit Reports: Regularly check your credit reports for errors and inaccuracies.

- Avoid Opening Too Many New Accounts: Opening multiple new accounts in a short period can lower your score.

6.2 Additional Considerations

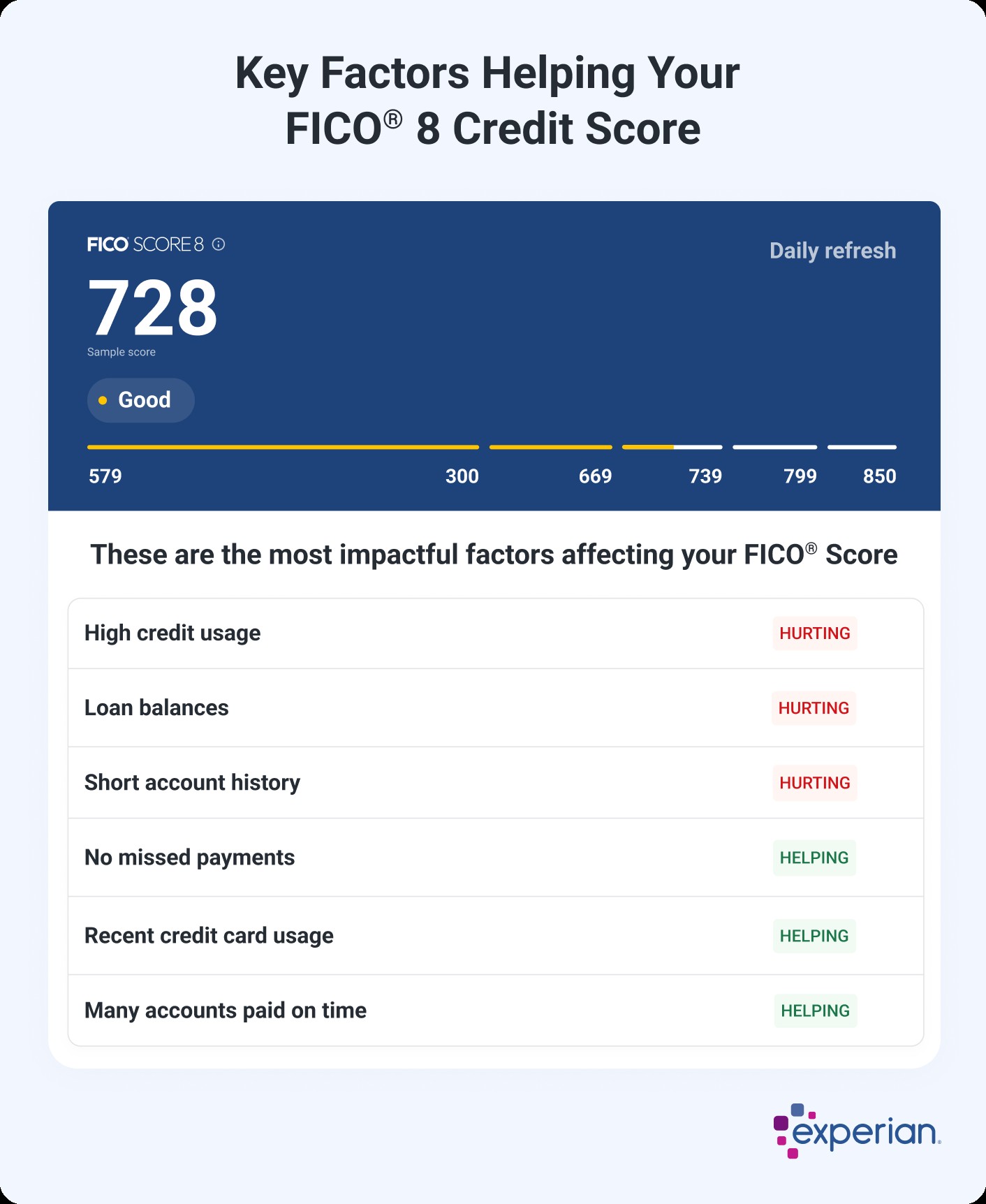

Increasing the average age of your accounts can help your scores, but this often requires time rather than immediate action. Checking your credit scores can provide insights into areas needing improvement.

You’ll also get an overview of your score profile, with an explanation of what’s helping and hurting your score the most.

7. Building Credit from Scratch

Credit scoring models cannot score credit reports that lack sufficient information.

7.1 FICO® Requirements

For FICO® Scores, you need:

- An account that’s at least six months old.

- An account that has been active in the past six months.

7.2 VantageScore®’s Flexibility

VantageScore® can score your credit report if it has at least one active account, even if the account is only a month old.

7.3 Starting Points

If you aren’t scoreable, consider:

- Becoming an authorized user on someone else’s credit card.

- Securing a secured credit card.

- Applying for a credit-builder loan.

8. Understanding Credit Score Changes

Your credit score can fluctuate due to various reasons. It’s normal for scores to move up or down as new information is added to your credit reports.

8.1 Factors That Can Boost Your Score

- Negative items falling off your credit report.

- Lowering your credit utilization rate.

- Paying off or settling collection accounts.

- Adding new on-time payments to your credit report.

8.2 Factors That Can Lower Your Score

- A credit card or loan payment becoming 30 days past due.

- An increase in your credit utilization rate.

- Applying for or opening a new credit account.

- Filing for bankruptcy.

8.3 Unexpected Impacts

Some actions, like paying off a loan, can unexpectedly lower your score if it was the only open installment account you had.

8.4 Complex Calculations

Credit scoring models use complex calculations. A single event’s impact depends on your entire credit report. A late payment can lead to a significant point drop for someone with a clean payment history but a smaller drop for someone with a history of missed payments.

9. Continuous Monitoring for Financial Health

Regularly checking your credit score helps you understand your chances of approval for new loans or credit cards and allows you to improve your scores over time, potentially saving money.

9.1 Experian’s Free Services

Experian offers a free FICO® Score and credit report with daily updates and real-time alerts for suspicious changes. A free account provides credit-building features like Experian Boost and insights into your credit history and score.

10. FAQs About Credit Scores

10.1 What is a credit score?

A credit score is a three-digit number that reflects your creditworthiness based on your credit history. It helps lenders assess the risk of lending you money.

10.2 How are credit scores calculated?

Credit scores are calculated using complex algorithms that consider various factors, including payment history, amounts owed, length of credit history, credit mix, and new credit.

10.3 What is a good credit utilization ratio?

A good credit utilization ratio is typically below 30%. This means you should aim to use no more than 30% of your available credit on each credit card.

10.4 How often should I check my credit report?

You should check your credit report at least once a year to ensure there are no errors or fraudulent activity.

10.5 What is the difference between a credit report and a credit score?

A credit report is a detailed record of your credit history, including your payment history, credit accounts, and any public records. A credit score is a numerical representation of your creditworthiness based on the information in your credit report.

10.6 How long does it take to improve my credit score?

The time it takes to improve your credit score depends on your specific situation and the steps you take to improve it. Some actions, like paying down debt, can have a relatively quick impact, while others, like building a long credit history, take time.

10.7 Can I get a loan with bad credit?

Yes, it is possible to get a loan with bad credit, but you will likely pay a higher interest rate and have less favorable terms.

10.8 How can I establish credit if I have no credit history?

You can establish credit by becoming an authorized user on someone else’s credit card, securing a secured credit card, or applying for a credit-builder loan.

10.9 What should I do if I find an error on my credit report?

If you find an error on your credit report, you should dispute it with the credit bureau that issued the report. The credit bureau is required to investigate the dispute and correct any errors.

10.10 Does closing a credit card account hurt my credit score?

Closing a credit card account can potentially hurt your credit score, especially if it lowers your overall available credit or reduces the length of your credit history.

Achieving a great credit score is within reach with the right knowledge and strategies. By understanding the factors that influence your credit scores and taking proactive steps to improve them, you can unlock better financial opportunities and achieve your financial goals.

Do you have more questions about credit scores or need personalized advice? Visit WHAT.EDU.VN today to ask your questions and receive free, expert guidance. Our team is ready to assist you with any queries related to credit, finances, and more. Contact us at 888 Question City Plaza, Seattle, WA 98101, United States, or reach out via Whatsapp at +1 (206) 555-7890. Let what.edu.vn be your trusted partner in achieving financial success.