What Is Echeck? If you’re asking this question, you’re in the right place. At WHAT.EDU.VN, we provide clear and concise answers to your queries, and this guide will demystify eChecks, electronic payment methods, and online banking. Whether you are dealing with digital checks, ACH payments or electronic fund transfers, we offer solutions. This guide will cover everything from processing fees to security measures, and even recurring payments.

1. Understanding eCheck: The Basics

An eCheck, short for electronic check, is the digital counterpart of a traditional paper check. Instead of physically writing and depositing a paper check, an eCheck allows for funds to be electronically transferred from the payer’s checking account to the payee’s account via the Automated Clearing House (ACH) network. This is the same network used for direct deposits and other electronic payments.

Think of it this way: an eCheck is like sending money directly from your bank account to someone else’s, but without the hassle of paper.

Electronic check next to a traditional paper check

Electronic check next to a traditional paper check

Alternative Text: Comparison of an eCheck and a traditional paper check, highlighting the convenience of electronic transactions.

1.1 How eChecks Differ from Traditional Checks

The main difference lies in the medium. Traditional checks are physical documents, while eChecks are entirely digital. This digital nature offers several advantages:

- Speed: eChecks process faster than traditional checks.

- Convenience: No need to physically mail or deposit checks.

- Security: eChecks offer enhanced security features to prevent fraud.

- Cost-Effectiveness: Lower processing fees compared to credit cards.

- Eco-Friendly: Reduces paper waste.

1.2 The Role of the ACH Network

The Automated Clearing House (ACH) network is the backbone of eCheck transactions in the United States. It’s an electronic network that connects financial institutions, allowing for the transfer of funds between bank accounts. When you use an eCheck, the ACH network facilitates the movement of money from the payer’s bank to the payee’s bank.

1.3 Key Components of an eCheck

An eCheck contains similar information to a paper check, but in a digital format. Key components include:

- Bank Name: The name of the payer’s bank.

- Account Number: The payer’s bank account number.

- Routing Number: A nine-digit code that identifies the payer’s bank.

- Check Number: A unique identifier for the eCheck.

- Amount: The amount of money being transferred.

- Payee: The name of the person or business receiving the payment.

- Date: The date the eCheck is issued.

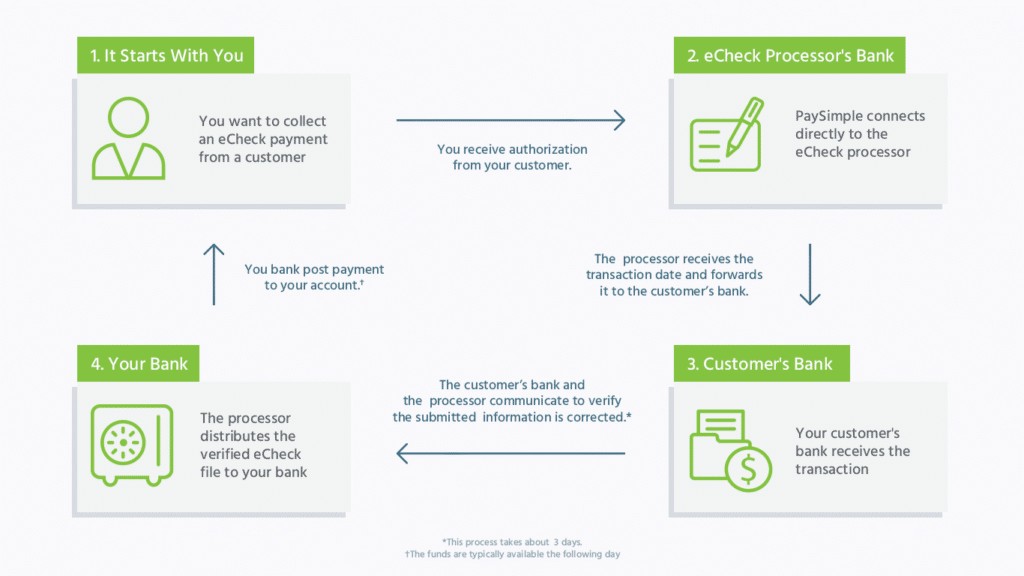

2. The Step-by-Step Process of How eChecks Work

Electronic check processing is a streamlined, efficient process that mirrors traditional check processing but with added speed and convenience. Here’s a detailed look at how it works:

2.1 Obtaining Authorization

The first step is obtaining authorization from the customer to process the eCheck. This is crucial for compliance and to prevent unauthorized transactions. Authorization can be obtained in several ways:

- Online Payment Form: Customers fill out an online form with their bank details and authorize the payment by clicking a “Submit” button.

- Signed Order Form: A physical or digital form where the customer provides their bank details and signs to authorize the payment.

- Recorded Phone Conversation: A verbal agreement recorded over the phone, where the customer provides their bank details and authorizes the payment.

2.2 Setting Up the Payment

Once authorization is obtained, the business inputs the customer’s payment information into their online payment processing software or virtual terminal. This includes:

- Bank Account Number: The customer’s checking account number.

- Routing Number: The nine-digit code identifying the customer’s bank.

- Payment Amount: The amount to be debited from the customer’s account.

- Recurring Schedule (if applicable): If it’s a recurring payment, the schedule details (e.g., monthly, weekly) are also entered.

2.3 Finalizing and Submitting the Transaction

After entering all the necessary information, the business finalizes the transaction and submits it through the payment processing software. This initiates the ACH transaction process.

2.4 Funds Transfer and Deposit

The payment processing software securely transmits the transaction information to the ACH network. The ACH network then debits the funds from the customer’s bank account and credits them to the business’s bank account. Typically, the funds are deposited into the business’s account within three to five business days.

2.5 Providing a Payment Receipt

As a final step, the online software sends a payment receipt to the customer, confirming that the payment has been successfully processed. This receipt includes details such as the payment amount, date, and transaction ID.

3. eCheck vs. ACH vs. EFT: Clarifying the Terminology

Understanding the nuances between eCheck, ACH, and EFT can be confusing. Let’s break down each term and clarify their relationships.

3.1 EFT: The Umbrella Term

EFT stands for “Electronic Funds Transfer.” It’s the broadest term, encompassing any transfer of funds that occurs electronically, rather than through physical means like cash or paper checks. EFT includes various types of financial transfers, such as:

- Wire Transfers: Electronic transfers between banks, often used for international transactions.

- Direct Deposits: Payments made directly into a bank account, such as payroll deposits.

- Electronic Benefits Payments: Government benefits distributed electronically.

- ACH Disbursements: Payments made through the ACH network, such as vendor payments.

3.2 ACH: The Network

ACH stands for “Automated Clearing House.” It’s the electronic network used by financial institutions in the United States to facilitate electronic fund transfers. The ACH network acts as a central hub, processing large volumes of credit and debit transfers.

3.3 eCheck: A Specific Type of EFT

An eCheck is a specific type of electronic funds transfer (EFT) that utilizes the Automated Clearing House (ACH) network to process the payment. It’s essentially a digital version of a paper check, processed electronically through the ACH network.

3.4 Visualizing the Relationship

Think of it like this: EFT is the big category, ACH is the road, and eCheck is a car driving on that road.

- EFT (Electronic Funds Transfer): The general concept of transferring funds electronically.

- ACH (Automated Clearing House): The specific network used to process eCheck payments.

- eCheck: The digital version of a paper check, processed through the ACH network.

4. Common Use Cases for eCheck Payments

eChecks are versatile and can be used for various types of payments. Here are some common use cases:

4.1 High-Cost Items and Services

Due to the lower processing fees compared to credit card payments, eChecks are commonly used for high-cost items and services, such as:

- Rent Payments: Landlords often accept eChecks for monthly rent payments.

- Mortgage Payments: Homeowners can use eChecks to pay their monthly mortgage.

- Car Payments: Auto lenders may allow eCheck payments for car loans.

- Legal Retainers: Law firms often accept eChecks for retainer fees.

4.2 Recurring Payments

eChecks are particularly well-suited for recurring payments, making them a popular choice for:

- Subscription Services: Companies offering subscription-based services often use eChecks for automated monthly payments.

- Membership Fees: Gyms, clubs, and other membership organizations may accept eChecks for recurring membership dues.

- Utility Bills: Some utility companies allow customers to pay their bills automatically via eCheck.

4.3 Business-to-Business (B2B) Transactions

eChecks are also used for B2B transactions, especially for:

- Vendor Payments: Businesses can use eChecks to pay their suppliers and vendors.

- Invoice Payments: Companies can accept eCheck payments for invoices.

5. Leveraging eChecks for Recurring Billing

One of the most significant advantages of eChecks is their suitability for recurring billing. Setting up recurring eCheck payments can streamline your billing process and improve cash flow.

5.1 Benefits of Recurring eCheck Payments

- Improved Cash Flow: Predictable, automated payments ensure consistent cash flow.

- Reduced Administrative Costs: Automating the billing process reduces manual tasks and paperwork.

- Increased Customer Retention: Convenient payment options can improve customer satisfaction and loyalty.

- Lower Transaction Fees: eCheck processing fees are typically lower than credit card fees, saving you money on each transaction.

5.2 Setting Up Recurring eCheck Payments

To set up recurring eCheck payments, you’ll need to:

- Obtain Authorization: Get written authorization from your customers to debit their bank accounts on a recurring basis.

- Use Payment Processing Software: Utilize a payment processing platform that supports recurring eCheck payments.

- Enter Customer Information: Input the customer’s bank account details and the recurring payment schedule into the payment processing software.

- Automate the Process: Configure the software to automatically debit the customer’s account according to the set schedule.

- Provide Payment Receipts: Send automated payment receipts to customers after each successful transaction.

5.3 Example: Rent Payments

Consider a property manager who wants to automate rent collection. They can ask tenants to fill out a recurring eCheck rent payment form. This form authorizes the property manager to automatically deduct rent from the tenant’s checking account on a specific day each month.

6. eCheck Clearing Times: What to Expect

Understanding eCheck clearing times is crucial for managing your cash flow. The clearing process involves verifying the availability of funds in the payer’s account and transferring the funds to the payee’s account.

6.1 Factors Affecting Clearing Times

Several factors can influence eCheck clearing times, including:

- Payment Processor: Different payment processors may have varying clearing times.

- Bank Policies: The policies of the payer’s and payee’s banks can affect the clearing process.

- Transaction Volume: High transaction volumes can sometimes slow down the clearing process.

- Risk Assessment: Transactions deemed high-risk may be subject to additional scrutiny, which can delay clearing.

6.2 Typical Clearing Timeframe

Generally, funds are verified within 24 to 48 hours of the transaction being initiated. If the payer has sufficient funds available in their checking account, the transaction is typically cleared within three to five business days, and the funds are moved to the payee’s account.

6.3 Expedited Clearing Options

Some payment processors offer expedited clearing options for an additional fee. These options can reduce the clearing time to as little as 24 hours.

7. Sending eCheck Payments: A User’s Guide

If you need to send an eCheck payment, here’s a step-by-step guide:

7.1 Confirming ACH Merchant Account

First, verify that the business or person you’re sending money to has an ACH merchant account. This type of account allows them to use the ACH network to accept payments via electronic funds transfer.

7.2 Filling Out an Online Payment Form

The payee may send you an online payment form. Fill in your checking account number and routing number, as well as the payment amount. By clicking “Submit,” you authorize the payee to withdraw the payment amount from your checking account.

7.3 Setting Up Payments by Phone

Alternatively, you can set up eCheck payments by phone. The payee will ask for your checking account and routing numbers during a recorded phone call. They input these numbers, as well as the payment amount, into an online payment terminal. Upon clicking “Process,” the payment is deducted from your bank account and deposited into the payee’s.

8. Weekend eCheck Processing: What You Need to Know

Since eChecks rely on financial institutions to process transactions, most are limited to business days. This means that eChecks typically do not process on weekends or bank holidays.

8.1 Impact on Processing Times

If you authorize an eCheck payment on a Friday, the funds may not show up in the business’s account until the following Wednesday. Similarly, if you make a payment on Monday, it could clear as early as Thursday.

8.2 Planning for Weekends and Holidays

When scheduling eCheck payments, it’s essential to factor in weekends and bank holidays to ensure timely processing. If you need a payment to clear by a specific date, it’s best to initiate the transaction several business days in advance.

9. Handling Bounced eChecks: What Happens When Things Go Wrong

Like traditional checks, eChecks can “bounce” if there are insufficient funds in the payer’s account. Here’s what happens when an eCheck bounces:

9.1 Insufficient Funds

If the payer doesn’t have enough money in their account to cover the eCheck, the transaction will be declined. The eCheck will “bounce,” and the payee will not receive the funds.

9.2 Fees and Penalties

The payer may be charged fees by their bank for the bounced eCheck. Additionally, the payee may charge the payer fees for the returned payment and any resulting late payment penalties.

9.3 Resolving the Issue

If your eCheck bounces, contact the business you paid to discuss alternative payment arrangements. You may need to set up a new payment method and pay any outstanding fees or penalties.

10. Cancelling an eCheck: A Step-by-Step Guide

If you need to cancel an eCheck, the process will depend on the payment system you’re using and the stage of the transaction.

10.1 Cancelling a Pending eCheck

If the eCheck is still pending (i.e., it hasn’t cleared yet), contact your payment processor as soon as possible. They may be able to cancel the transaction before it’s processed.

10.2 Cancelling a Cleared eCheck

If the eCheck has already cleared into your account, you can’t cancel the electronic check and will have to set up a refund. Issue a refund to the customer for the amount of the eCheck.

11. eCheck Processing Costs: Understanding the Fees

eCheck processing costs can vary depending on the provider of the eCheck merchant account. Understanding these fees is essential for budgeting and managing your expenses.

11.1 Per-Transaction Fees

Most eCheck processing companies charge a per-transaction fee for each eCheck processed. The average fee ranges from $0.30 to $1.50 per eCheck transaction.

11.2 Monthly Fees

Some providers also charge a monthly fee for using their eCheck processing services. This fee may be a flat rate or a variable amount based on your transaction volume.

11.3 Other Fees

In addition to per-transaction and monthly fees, you may encounter other fees, such as:

- Setup Fees: A one-time fee for setting up your eCheck merchant account.

- Chargeback Fees: Fees charged when a customer disputes an eCheck transaction.

- Statement Fees: Fees for receiving paper or electronic statements.

11.4 Comparing Providers

When choosing an eCheck processing provider, compare the fees and services offered by different companies to find the best fit for your business needs.

12. Obtaining an eCheck Merchant Account: Requirements and Process

To accept eCheck payments, you’ll need to obtain an eCheck merchant account. The process is similar to getting a credit card merchant account.

12.1 Required Information

You’ll typically need to provide information such as:

- Federal Tax Identification Number (EIN): Your business’s tax ID number.

- Years in Business: The number of years your business has been operating.

- Estimated Processing Volumes: Your estimated monthly eCheck transaction volume.

- Bank Account Information: Your business bank account details.

- Other Details: Additional information to confirm your business’s standing.

12.2 Approval Process

The payment processor or merchant account provider will review this information to determine acceptance. Approval can happen in a matter of days.

12.3 Choosing a Provider

When selecting an eCheck merchant account provider, consider factors such as:

- Fees: Compare the per-transaction fees, monthly fees, and other charges.

- Features: Look for features such as recurring billing, reporting, and fraud prevention.

- Customer Support: Choose a provider with responsive and helpful customer support.

- Integration: Ensure the provider integrates with your existing accounting and business software.

FAQ Section: Your Burning eCheck Questions Answered

To further clarify any lingering questions, here’s a comprehensive FAQ section:

13.1 What are the Benefits of Using eChecks?

Echecks come with lots of benefits, they include:

| Benefit | Description |

|---|---|

| Lower Transaction Fees | eCheck processing fees are typically lower than credit card fees. |

| Faster Processing Times | eChecks process faster than traditional paper checks. |

| Enhanced Security | eChecks offer enhanced security features to prevent fraud. |

| Convenience | eChecks eliminate the need for physical checks and manual processing. |

| Eco-Friendly | eChecks reduce paper waste, making them an environmentally friendly payment option. |

| Suitable for Recurring Payments | eChecks are ideal for setting up automated recurring payments. |

| Direct Bank-to-Bank Transfers | eChecks facilitate direct transfers from the payer’s bank account to the payee’s bank account. |

| Reduced Risk of Paper Check Fraud | By using eChecks, there is less risk of losses due to stolen or forged paper checks. |

13.2 Are eChecks Safe to Use?

Yes, eChecks are generally considered safe to use. They utilize encryption and other security measures to protect sensitive financial information. However, it’s essential to use reputable payment processors and follow best practices for online security.

13.3 What are the Security Measures in Place for eChecks?

eChecks incorporate several security measures, including:

- Encryption: Encrypting sensitive data during transmission.

- Tokenization: Replacing sensitive data with non-sensitive tokens.

- Fraud Detection: Using fraud detection systems to identify and prevent suspicious transactions.

- Authentication: Verifying the identity of the payer and payee.

13.4 How Can I Prevent eCheck Fraud?

To minimize the risk of eCheck fraud, follow these tips:

- Use Reputable Payment Processors: Choose payment processors with strong security measures.

- Verify Customer Information: Verify the identity and bank details of your customers.

- Monitor Transactions: Regularly monitor your eCheck transactions for any suspicious activity.

- Implement Fraud Detection Tools: Use fraud detection tools to identify and prevent fraudulent transactions.

- Educate Employees: Train your employees on how to identify and prevent eCheck fraud.

- Use Secure Networks: Ensure that all payment processing activities are conducted over secure network connections.

13.5 What if I Suspect eCheck Fraud?

If you suspect eCheck fraud, take the following steps:

- Contact Your Bank: Notify your bank immediately and report the suspected fraud.

- Contact the Payment Processor: Contact your payment processor and report the incident.

- File a Police Report: File a police report with your local law enforcement agency.

- Monitor Your Accounts: Closely monitor your bank accounts for any unauthorized activity.

13.6 How Do eCheck Chargebacks Work?

An eCheck chargeback occurs when a customer disputes an eCheck transaction and requests a refund from their bank. The chargeback process typically involves the following steps:

- Customer Dispute: The customer files a dispute with their bank.

- Bank Investigation: The bank investigates the dispute and requests information from the merchant.

- Merchant Response: The merchant provides evidence to support the validity of the transaction.

- Resolution: The bank makes a decision based on the evidence presented.

13.7 What is the Difference Between a Void and a Refund?

- Void: A void is used to cancel a transaction before it has been processed. The funds are never transferred from the payer’s account.

- Refund: A refund is used to return funds to the payer after the transaction has been processed.

13.8 Can I Use eChecks for International Payments?

While eChecks are primarily used within the United States, some payment processors may offer international eCheck processing services. However, these services may be subject to additional fees and regulations.

13.9 What are the Legal Considerations for Using eChecks?

When using eChecks, it’s essential to comply with all applicable laws and regulations, including the Electronic Funds Transfer Act (EFTA) and the rules of the National Automated Clearing House Association (NACHA).

13.10 How do I reconcile eCheck payments in my accounting system?

To reconcile eCheck payments in your accounting system, follow these steps:

- Record eCheck Transactions: Accurately record all eCheck payments in your accounting system, including the date, amount, payer, and transaction ID.

- Match Bank Statements: Compare your eCheck transactions to your bank statements to ensure they match.

- Investigate Discrepancies: Investigate any discrepancies and resolve them promptly.

- Use Accounting Software: Utilize accounting software that supports eCheck payments and reconciliation.

14. Embrace the Future of Payments with eChecks

eChecks are a convenient, secure, and cost-effective payment method for businesses and individuals alike. By understanding how eChecks work and following best practices for security and compliance, you can take advantage of this versatile payment option.

Alternative Text: A happy person using a laptop to make an eCheck payment, showcasing the ease of electronic transactions.

If you have more questions or need further assistance, don’t hesitate to reach out to us at WHAT.EDU.VN. We’re here to provide you with the answers you need to navigate the world of electronic payments with confidence.

Address: 888 Question City Plaza, Seattle, WA 98101, United States

Whatsapp: +1 (206) 555-7890

Website: WHAT.EDU.VN

Do you have any questions? Visit what.edu.vn and ask us anything for free. We’re here to help you find the answers you need quickly and easily.