Discover the minimum wage in Colorado with this detailed guide, brought to you by WHAT.EDU.VN. Stay informed about Colorado’s wage laws, including exceptions, enforcement, and how they impact workers and employers. Find answers to all your questions about Colorado minimum wage, wage theft, and workers’ rights.

1. What Is the Current Minimum Wage in Colorado?

The current minimum wage in Colorado is $14.42 per hour as of January 1, 2024. This rate applies to most non-exempt employees working within the state. However, it’s crucial to note that some cities and counties, like Denver, have higher minimum wage rates. Understanding the state and local minimum wage laws is essential for both employees and employers. To stay up-to-date on minimum wage laws and workers’ rights, visit WHAT.EDU.VN for free answers and guidance.

1.1 Understanding Colorado’s Minimum Wage Laws

Colorado’s minimum wage laws are designed to protect workers and ensure they receive fair compensation for their labor. The laws are enforced by the Colorado Department of Labor and Employment.

Key Aspects of Colorado’s Minimum Wage Laws:

- Basic Rate: The standard minimum wage applies to most employees.

- Tip Credit: Employers can claim a tip credit for tipped employees, but specific conditions apply.

- Exemptions: Certain types of employees are exempt from minimum wage laws.

- Local Variations: Cities and counties can set higher minimum wages than the state.

1.2 How Does Colorado’s Minimum Wage Compare to the Federal Minimum Wage?

The federal minimum wage is currently $7.25 per hour, which is significantly lower than Colorado’s state minimum wage of $14.42 per hour. When a state minimum wage is higher than the federal minimum wage, employers must pay the higher state rate. This means that Colorado employers are required to pay at least $14.42 per hour, regardless of the federal rate.

1.3 The Impact of Minimum Wage on Colorado Workers

A higher minimum wage can have several positive impacts on Colorado workers, including:

- Increased Income: Workers earn more money, improving their financial stability.

- Reduced Poverty: Higher wages can lift families out of poverty.

- Economic Stimulus: Increased spending boosts the local economy.

- Improved Morale: Fair compensation leads to higher job satisfaction and productivity.

2. What Is Denver’s Minimum Wage?

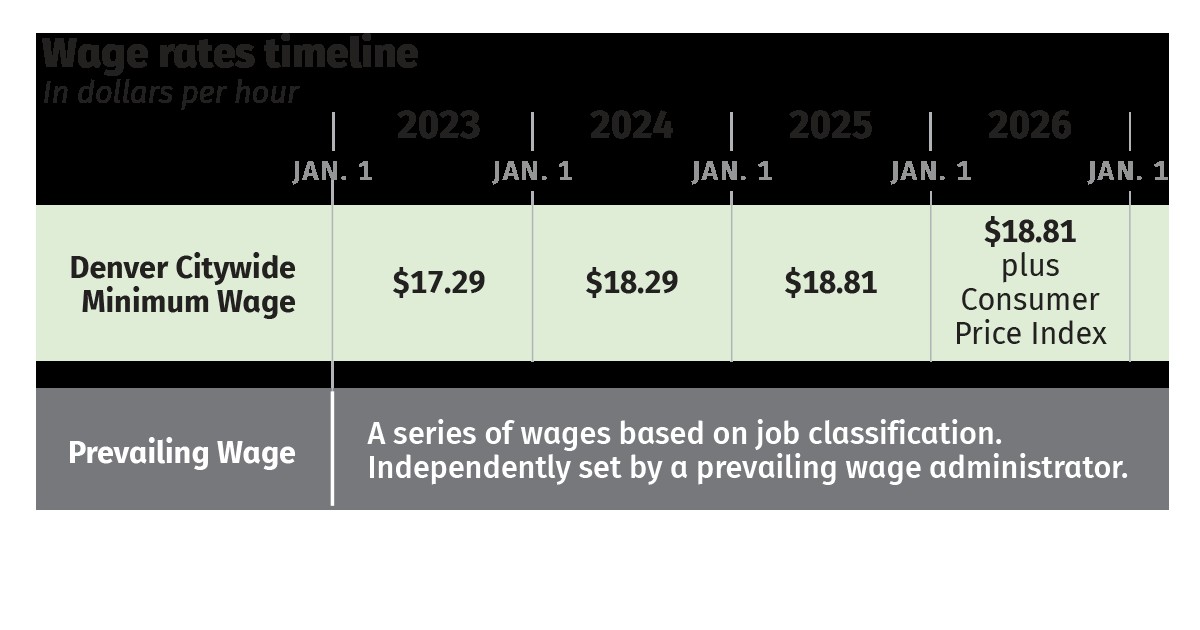

Denver has its own local minimum wage, which is higher than the state minimum wage. As of January 1, 2025, the minimum wage in Denver is $18.81 per hour. This rate applies to all employees working within the geographical limits of the City and County of Denver, regardless of whether their employer has a contractual relationship with the city. If you have more questions, remember that WHAT.EDU.VN offers a platform to ask any question and receive free answers from experts.

2.1 Denver’s Minimum Wage History

Denver has been proactive in raising its minimum wage to better support its workforce. Here’s a brief history:

- 2020: $12.85 per hour

- 2021: $14.77 per hour

- 2022: $15.87 per hour

- 2023: $17.29 per hour

- 2024: $18.29 per hour

- 2025: $18.81 per hour

2.2 Who Is Covered by Denver’s Minimum Wage?

Denver’s minimum wage ordinance covers all employees working within the city limits, including full-time, part-time, and temporary workers. The key factor is the location where the work is performed, not the location of the employer’s headquarters.

Coverage Details:

- Geographical Limits: The law applies to work performed within the City and County of Denver.

- No Contractual Requirement: Employers don’t need a contract with the city for the law to apply.

- All Employees: Full-time, part-time, and temporary workers are covered.

2.3 Tip Credit in Denver

In Denver, employers in the food and beverage industry can claim a maximum tip credit of $3.02 per hour. This means they can pay tipped employees $15.79 per hour, provided the employees receive at least $3.02 per hour in tips. If an employee’s tips don’t reach this amount, the employer must make up the difference to ensure they earn at least the full minimum wage of $18.81 per hour.

2.4 Interactive Map and Regional Address Finder

Denver Labor provides an interactive map to help determine whether a business or work location falls within the City and County of Denver. This tool assists in filing or responding to a complaint, ensuring that the correct jurisdiction is applied. However, Denver Labor makes the final determination regarding jurisdiction on all investigated complaints.

3. How Is the Minimum Wage Calculated in Denver?

The Denver Department of Finance calculates the annual minimum wage increase based on the Consumer Price Index (CPI). The methodology is similar to how the State of Colorado calculates its statewide minimum wage. The adjustment calculation compares the CPI for the first half of the previous year to the first half of the current year.

3.1 Understanding the Consumer Price Index (CPI)

The CPI measures the average change in prices over time for a basket of consumer goods and services commonly purchased by urban wage earners and clerical workers. It helps workers keep up with the cost of living in their area.

3.2 The Calculation Process

- Data Collection: The Department of Finance collects CPI data for the Denver-Aurora-Lakewood area.

- Comparison: The CPI from the first half of the prior year is compared to the first half of the current year.

- Adjustment: The minimum wage is adjusted based on the percentage change in the CPI.

3.3 Why Does Minimum Wage Matter?

Minimum wage laws are crucial for ensuring fair compensation for workers, reducing poverty, and stimulating the local economy. They also promote a sense of fairness and equity in the workplace.

4. What Are Workers’ Rights Regarding Minimum Wage in Colorado?

All workers in the City and County of Denver are protected by Denver’s wage ordinances, regardless of their immigration status. Denver Labor will not ask about the worker’s country of origin or immigration status during an investigation.

4.1 Protection Regardless of Immigration Status

Denver Labor will not ask about a worker’s immigration status during an investigation. Furthermore, Denver Labor will impose penalties for any unfair immigration-related actions or threats to workers.

4.2 Confidentiality and Protection

Denver Labor makes every effort to keep the complainant’s information confidential. Employers may not take adverse action against a worker for their involvement in an investigation.

4.3 Submitting a Wage Complaint

If you think you are being underpaid, you can submit a wage complaint to Denver Labor. Complaints must be submitted in writing, providing as much information as possible to aid the investigation.

5. What Should Employers Do To Comply With Denver’s Local Minimum Wage Requirements?

To comply with Denver’s local minimum wage requirements, employers must pay their employees the appropriate wage and maintain payroll records for three years. There is no additional reporting requirement. Make sure your business is compliant by staying informed, and if you have questions, WHAT.EDU.VN offers a free platform to get them answered.

5.1 Record-Keeping Requirements

Denver law requires employers conducting business in Denver to retain records demonstrating compliance with Denver’s minimum wage law. These records must be kept for at least three years, dating back to January 1, 2020.

5.2 Required Payroll Information

When Denver Labor conducts an investigation, employers must provide payroll records in a timely manner. These records must include:

- The number of hours worked by each worker.

- The hourly wage paid to each worker.

- Any deductions made from worker wages, including any taxes withheld.

- The net amount of wages received by each worker.

5.3 Penalties for Non-Compliance

Failing to comply with Denver’s minimum wage requirements can result in significant penalties. The Denver Auditor may impose fines for each employee paid less than the minimum wage. The amount of the fine depends on the number of violations and whether the error was made in good faith.

6. What Is “Active Enforcement” Of Minimum Wage Laws in Denver?

Starting in 2022, Denver Labor has used data and thoughtful analysis to improve the reach of their education and enforcement work within industries where workers are at the highest risk of receiving less than the wages required according to law.

6.1 Proactive Wage Investigations

Denver Labor may begin more proactive wage investigations without receiving a complaint of potential underpayment, using data to identify at-risk industries and employers.

6.2 Strategic Onsite Visits

Active wage enforcement includes strategic onsite visits to speak with at-risk workers, ensuring they are aware of their rights and that employers are complying with the law.

6.3 Criteria for Proactive Investigations

City ordinance lists criteria that must be met to trigger a proactive investigation, including:

- Prior violations by an owner.

- A pattern of noncompliance within an industry.

- Credible information from a state or federal agency.

- Data indicating an employer is likely to be in violation of the minimum wage.

7. What Happens If an Employer Does Not Comply with Minimum Wage Laws?

If an employer fails to comply with minimum wage laws, several actions can be taken, including filing a wage complaint and potential penalties for the employer.

7.1 Filing a Wage Complaint

If you believe you are being underpaid, you can submit a wage complaint to Denver Labor. The complaint should include as much information as possible, such as pay stubs, hours worked, and the name of the employer.

7.2 Investigation Process

The Denver Auditor’s Office will investigate all credible complaints submitted. They will inform the employer of the investigation and request documentation demonstrating compliance with minimum wage requirements.

7.3 Penalties for Non-Compliance

For an employer’s first violation, the Auditor may impose a fine of as much as $50 a day for each employee paid less than minimum wage, unless the Auditor finds the error was made in good faith and corrected within 30 days. Subsequent violations can result in higher fines and penalties.

8. Minimum Wage Restitution Stories in Denver

Denver Labor has successfully recovered unpaid wages for numerous workers. Here are a few examples:

8.1 Valet Workers Recover $70,531

Denver Labor initiated an active enforcement investigation for a valet company and recovered $70,531.53 in restitution for 60 workers who were improperly denied tip credit.

8.2 Janitorial Worker Recovers $23,215

A worker contacted Denver Labor because their employer, JMC Cleaning Services, was not paying Denver’s minimum wage. Denver Labor helped recover $23,215.01 for 3,760 hours worked.

8.3 Remote Workers Recover $334,211

Denver Labor recovered $334,211.23 for 161 remote employees of 24-7 Intouch who were not being paid the correct minimum wage.

8.4 Wage Theft and Retaliation Settlement of $7,500

A worker received $7,500 as a result of a settlement negotiated by Denver Labor for wage theft and retaliation after an organization rescinded a job offer.

8.5 Hotel Workers Recover $56,019

Denver Labor recovered $56,019.40 for 52 underpaid valets, porters, and bellhops at seven hotels in Denver.

8.6 Home Improvement Sales Employees Compensated

Nearly $16,000 was recovered for 194 home improvement sales employees, and all employees’ base wage rates were raised to prevent future underpayments.

9. Frequently Asked Questions (FAQs) About Colorado and Denver Minimum Wage

This section addresses common questions about minimum wage in Colorado and Denver, providing clear and concise answers.

9.1 What is the minimum wage in Colorado for 2024?

The minimum wage in Colorado is $14.42 per hour as of January 1, 2024.

9.2 What is the minimum wage in Denver for 2025?

The minimum wage in Denver is $18.81 per hour as of January 1, 2025.

9.3 Does Denver’s minimum wage apply to all workers?

Yes, Denver’s minimum wage applies to all workers within the geographical boundaries of the City and County of Denver, regardless of immigration status.

9.4 Can employers claim a tip credit in Denver?

Yes, employers in the food and beverage industry can claim a maximum tip credit of $3.02 per hour.

9.5 How can I file a wage complaint in Denver?

You can file a wage complaint by e-mailing the Denver Auditor’s Office at [email protected] or calling 720-913-5039.

9.6 Are undocumented workers protected by Denver’s minimum wage?

Yes, all workers in the City and County of Denver are protected by Denver’s wage ordinances, regardless of their immigration status.

9.7 What should employers do to comply with Denver’s minimum wage requirements?

Employers must pay their employees the appropriate wage and maintain payroll records for three years.

9.8 What is active enforcement of minimum wage laws in Denver?

Active enforcement involves proactive wage investigations and strategic onsite visits to ensure compliance with minimum wage laws.

9.9 What happens if an employer does not comply with minimum wage laws?

Employers may face fines, penalties, and be required to provide restitution to underpaid employees.

9.10 Where can I find more information about Colorado and Denver minimum wage laws?

You can find more information on the Denver government website or by contacting Denver Labor. Alternatively, you can ask any question and receive free answers on WHAT.EDU.VN.

10. Additional Resources and Contacts

This section provides resources and contact information for those seeking more information about minimum wage laws in Colorado and Denver.

10.1 Denver Labor Contact Information

- Call: 720-913-WAGE (9243)

- Email: [email protected]

10.2 Denver Auditor’s Office

- Address: 201 W. Colfax Ave. #705 Denver, CO 80202

- Email: [email protected]

- Call: 720-913-5000

10.3 Useful Links

- Denver’s Minimum Wage

- Small Business Resources

If you have any questions or concerns about minimum wage laws in Colorado or Denver, don’t hesitate to reach out to the resources listed above. And remember, for quick and free answers to any question, visit WHAT.EDU.VN.

Understanding your rights and obligations regarding minimum wage is crucial for both employees and employers. By staying informed and utilizing available resources, you can ensure fair labor practices and a thriving community.

Have More Questions? Ask on WHAT.EDU.VN!

Do you still have unanswered questions about minimum wage, wage theft, or workers’ rights in Colorado? Don’t hesitate to ask on WHAT.EDU.VN, where you can get free answers from knowledgeable experts. Whether you’re an employee seeking clarification or an employer striving for compliance, WHAT.EDU.VN is your go-to resource for reliable information.

Call to Action:

Visit WHAT.EDU.VN today to ask your questions and get the answers you need. Our community of experts is ready to help you navigate the complexities of minimum wage laws and ensure fair treatment for all. Your voice matters, and your questions deserve answers. Join WHAT.EDU.VN and let us help you stay informed and empowered.

Contact Information for WHAT.EDU.VN:

- Address: 888 Question City Plaza, Seattle, WA 98101, United States

- WhatsApp: +1 (206) 555-7890

- Website: what.edu.vn