Paze is a digital payment method designed to streamline online transactions, offering a unified digital wallet for your credit and debit cards; learn what is paze and how it simplifies online shopping with enhanced security features. WHAT.EDU.VN explains this modern solution, addressing your concerns and providing clarity on digital payments, mobile payment, and the convenience of online payment systems. Discover the meaning, uses, and advantages of Paze, so you can explore financial technology, digital wallet technology, and secure online transactions, ensuring you understand Paze.

1. Understanding What Paze Is

Paze represents a new approach to online payments. It consolidates your credit and debit cards from various participating banks and credit unions into one accessible digital wallet.

1.1. Defining Paze

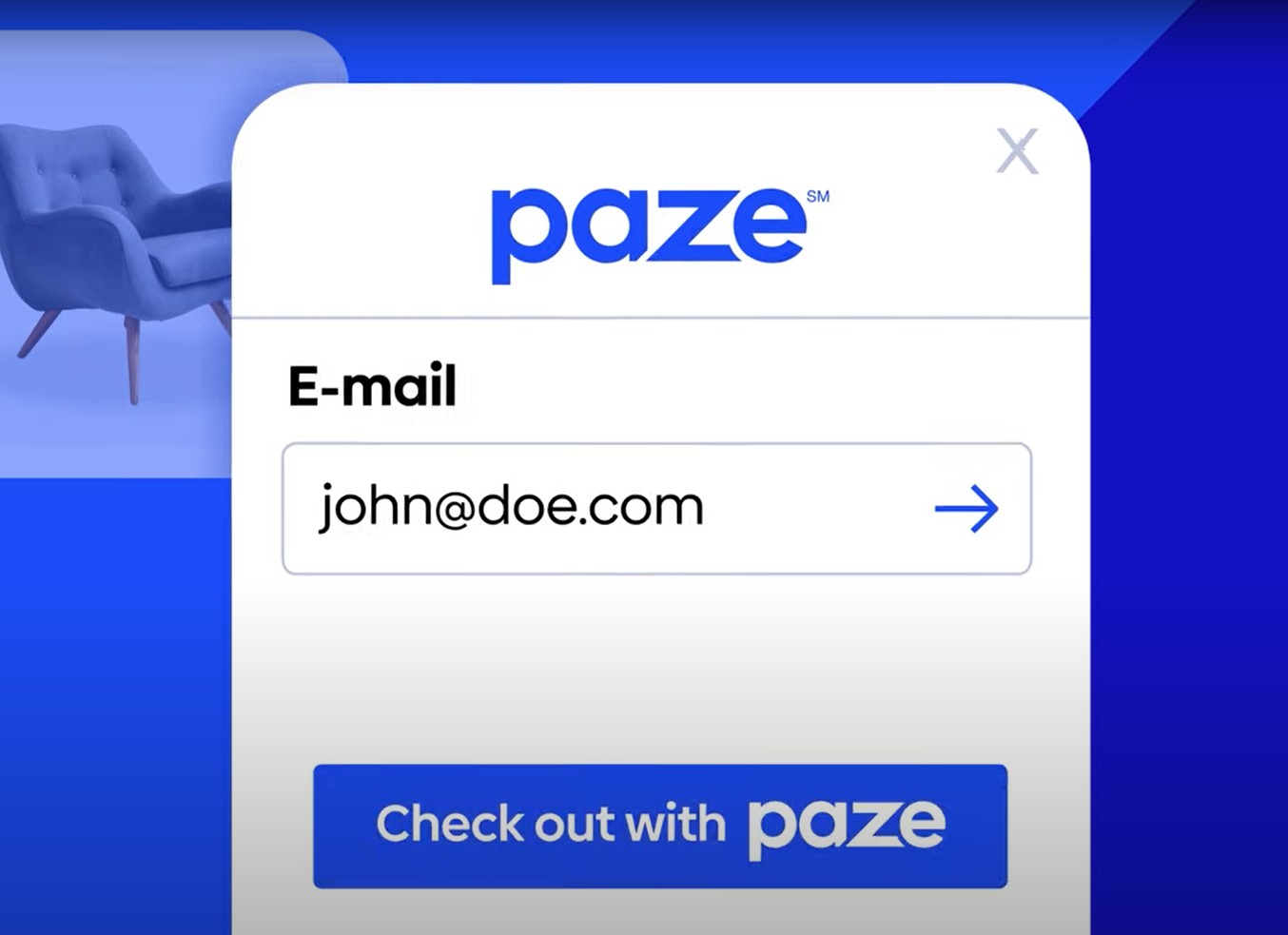

Paze is a digital payment solution designed to simplify the online checkout process. Instead of entering card details for every transaction, Paze allows users to pay using their email address, linked to their enrolled cards.

1.2. Core Features of Paze

The key features of Paze include:

- Consolidated Cards: Combines multiple cards into a single digital wallet.

- Simplified Checkout: Uses your email for quick transactions.

- Enhanced Security: A security code is sent to your phone for verification.

- Direct Bank Integration: No need for third-party apps.

1.3. Paze vs. Traditional Payment Methods

Unlike traditional payment methods that require entering card details repeatedly, Paze offers a streamlined approach. This not only saves time but also reduces the risk of exposing your card information to multiple merchants.

2. How Paze Works: A Step-by-Step Guide

Using Paze is straightforward. Here’s a step-by-step guide:

- Enrollment: Your bank will notify you if your card is eligible for Paze.

- Checkout: Select Paze as the payment option at participating online stores.

- Verification: Enter the email address associated with your card. A security code is sent to your phone.

- Confirmation: Verify the transaction using the security code.

- Payment: Payment is processed without sharing your card details with the merchant.

2.1. Enrolling in Paze

Enrollment is typically initiated by your bank. You’ll receive an email notification if your card is eligible. Follow the instructions provided by your bank to activate Paze.

2.2. Making a Purchase with Paze

When shopping online, select Paze as your payment method at checkout. Enter the email address associated with your enrolled card. A security code will be sent to your phone for verification.

2.3. Security Measures in Paze Transactions

Paze employs several security measures to protect your transactions:

- Email Verification: Transactions are verified through your registered email address.

- Security Codes: A one-time security code is sent to your phone for each transaction.

- Card Details Protection: Your card details are not shared with merchants.

3. Benefits of Using Paze for Online Payments

Paze offers numerous benefits that make it an attractive payment option:

- Convenience: Simplifies the checkout process by eliminating the need to enter card details.

- Security: Protects your card information by not sharing it with merchants.

- Efficiency: Speeds up online transactions, saving you time.

- Integration: Seamlessly integrates with your existing bank accounts.

3.1. Enhanced Security Features

One of the primary advantages of Paze is its enhanced security. By not sharing your card number with merchants, Paze reduces the risk of fraud and identity theft.

3.2. Streamlined Checkout Process

Paze streamlines the checkout process, allowing you to complete transactions quickly and easily. This is particularly beneficial for frequent online shoppers.

3.3. Integration with Existing Bank Accounts

Paze integrates seamlessly with your existing bank accounts, eliminating the need to create new usernames, passwords, or download additional apps.

4. Comparing Paze with Other Digital Wallets

While Paze shares similarities with other digital wallets like Apple Pay and Google Pay, there are key differences to consider:

| Feature | Paze | Apple Pay | Google Pay |

|---|---|---|---|

| Card Consolidation | Integrates cards from multiple banks | Primarily for Apple devices | Available on Android devices |

| Checkout Process | Email-based verification | Biometric authentication (Face ID) | Biometric authentication (Fingerprint) |

| Security | Card details not shared with merchants | Tokenization technology | Tokenization technology |

| App Requirement | No additional app needed | Requires Apple Wallet app | Requires Google Pay app |

4.1. Paze vs. Apple Pay

Apple Pay is primarily designed for Apple devices and uses biometric authentication for transactions. Paze, on the other hand, is email-based and doesn’t require a specific device.

4.2. Paze vs. Google Pay

Google Pay is similar to Apple Pay but is available on Android devices. Like Apple Pay, it uses tokenization technology for enhanced security. Paze distinguishes itself by not requiring a separate app.

4.3. Unique Advantages of Paze

The unique advantages of Paze include its direct bank integration and the elimination of the need for third-party apps. This makes it a convenient and secure option for online payments.

5. Security Considerations When Using Paze

While Paze offers enhanced security features, it’s important to take precautions to protect your account:

- Secure Email: Keep your email account secure and up to date.

- Strong Passwords: Use strong, unique passwords for your email and bank accounts.

- Monitor Transactions: Regularly monitor your transactions for any unauthorized activity.

5.1. Protecting Your Email Account

Your email account is the key to accessing Paze, so it’s crucial to keep it secure. Use a strong password, enable two-factor authentication, and be cautious of phishing emails.

5.2. Monitoring Paze Transactions

Regularly monitor your Paze transactions to identify any suspicious activity. Report any unauthorized transactions to your bank immediately.

5.3. Staying Informed About Security Updates

Stay informed about security updates and best practices to protect your Paze account. Your bank will provide information on how to keep your account safe.

6. Retailers That Accept Paze

Paze is relatively new, so only a limited number of retailers currently accept it. The list of participating retailers is growing, so check the Paze website for the most up-to-date information.

6.1. Finding Participating Retailers

Visit the Paze website to find a directory of participating retailers. You can also look for the Paze logo at checkout when shopping online.

6.2. Encouraging More Retailers to Adopt Paze

As more consumers adopt Paze, more retailers are likely to offer it as a payment option. You can encourage your favorite retailers to accept Paze by contacting them directly.

6.3. Future Expansion of Paze Acceptance

The future expansion of Paze acceptance depends on its adoption rate among consumers and retailers. As more banks and credit unions participate, Paze is likely to become more widely accepted.

7. The Role of Banks and Credit Unions in Paze

Banks and credit unions play a crucial role in the Paze ecosystem. They are responsible for enrolling eligible cards and providing support to users.

7.1. Banks Offering Paze

Contact your bank to find out if they offer Paze. Many major banks and credit unions are participating in the Paze program.

7.2. How Banks Ensure Paze Security

Banks ensure Paze security through various measures, including email verification, security codes, and monitoring transactions for fraud.

7.3. Benefits for Banks Offering Paze

Offering Paze can benefit banks by enhancing customer satisfaction, reducing fraud, and streamlining the payment process.

8. Frequently Asked Questions About Paze

Here are some frequently asked questions about Paze:

| Question | Answer |

|---|---|

| Is Paze safe to use? | Yes, Paze is designed to be a secure payment method. It uses email verification and security codes to protect your transactions. |

| Do I need to download an app to use Paze? | No, you don’t need to download an app to use Paze. It integrates directly with your bank account. |

| Which retailers accept Paze? | A limited number of retailers currently accept Paze. Check the Paze website for a directory of participating retailers. |

| How do I enroll in Paze? | Your bank will notify you if your card is eligible for Paze. Follow the instructions provided by your bank to activate Paze. |

| What if I have issues with a Paze transaction? | Contact your bank or the retailer directly to resolve any issues with a Paze transaction. |

| What happens if my phone is lost or stolen? | Contact your bank immediately to disable Paze on your account. |

| Can I use Paze for in-store purchases? | No, Paze is currently only available for online transactions. |

| Is there a fee to use Paze? | No, there is typically no fee to use Paze. However, check with your bank to confirm any potential fees. |

| How does Paze protect my card details? | Paze protects your card details by not sharing them with merchants. |

| What should I do if I suspect fraud on my account? | Report any suspected fraud to your bank immediately. |

8.1. Addressing Common Concerns

Some common concerns about Paze include security, privacy, and acceptance. Paze addresses these concerns through its enhanced security features and direct bank integration.

8.2. Clearing Up Misconceptions

One common misconception is that Paze requires a separate app. In reality, Paze integrates directly with your bank account and doesn’t require any additional software.

8.3. Getting Support for Paze Users

If you have any issues with Paze, contact your bank or credit union for support. They can provide assistance with enrollment, transactions, and security.

9. The Future of Paze and Digital Payments

Paze represents a step towards the future of digital payments. As technology evolves, we can expect to see more innovative payment solutions that prioritize convenience, security, and efficiency.

9.1. Trends in Digital Payment Technology

Some key trends in digital payment technology include:

- Biometric Authentication: Using fingerprints, facial recognition, and other biometric methods to verify transactions.

- Blockchain Technology: Leveraging blockchain for secure and transparent payments.

- Contactless Payments: Expanding the use of contactless payment methods like NFC.

9.2. Potential Enhancements to Paze

Potential enhancements to Paze include:

- Integration with More Retailers: Expanding the number of retailers that accept Paze.

- Support for In-Store Purchases: Allowing users to use Paze for in-store transactions.

- Enhanced Security Features: Implementing additional security measures to protect against fraud.

9.3. The Role of Paze in the Future of E-Commerce

Paze has the potential to play a significant role in the future of e-commerce by simplifying the online checkout process and enhancing security. As more consumers and retailers adopt Paze, it could become a standard payment option for online transactions.

10. How to Get Started with Paze Today

Getting started with Paze is easy. Here’s how:

- Check Eligibility: Contact your bank to see if your card is eligible for Paze.

- Enroll: Follow the instructions provided by your bank to activate Paze.

- Shop Online: Look for the Paze logo at checkout when shopping online.

- Enjoy Secure Payments: Experience the convenience and security of Paze for your online transactions.

10.1. Checking Your Card’s Eligibility

Contact your bank or credit union to check if your card is eligible for Paze. Many major banks are participating in the Paze program.

10.2. Activating Paze Through Your Bank

Follow the instructions provided by your bank to activate Paze. This typically involves verifying your email address and setting up security preferences.

10.3. Exploring Online Retailers That Accept Paze

Visit the Paze website to find a directory of online retailers that accept Paze. Look for the Paze logo at checkout when shopping online.

11. Expert Opinions on Paze

Industry experts have mixed opinions on Paze. Some praise its convenience and security, while others are skeptical about its adoption rate and potential for widespread use.

11.1. Insights from Financial Analysts

Financial analysts note that Paze has the potential to disrupt the digital payment landscape by offering a streamlined and secure alternative to traditional payment methods.

11.2. Views from Cybersecurity Experts

Cybersecurity experts emphasize the importance of keeping your email account secure when using Paze. They also recommend monitoring transactions for any suspicious activity.

11.3. Predictions for Paze’s Adoption Rate

Predictions for Paze’s adoption rate vary. Some experts believe that it could become a popular payment option, while others are more cautious, citing the limited number of retailers that currently accept it.

12. The Environmental Impact of Digital Payments Like Paze

Digital payment methods like Paze can have a positive impact on the environment by reducing the need for paper transactions.

12.1. Reducing Paper Waste

Digital payments eliminate the need for paper checks and receipts, reducing paper waste and conserving natural resources.

12.2. Energy Consumption of Digital Transactions

While digital transactions consume energy, they are generally more energy-efficient than traditional paper-based transactions.

12.3. Promoting Sustainable Payment Practices

By using digital payment methods like Paze, consumers can promote sustainable payment practices and reduce their environmental footprint.

13. How Paze is Changing the Landscape of Online Banking

Paze is changing the landscape of online banking by offering a more integrated and streamlined payment experience.

13.1. Integration with Banking Apps

Paze integrates seamlessly with banking apps, allowing users to manage their payments and track their transactions in one place.

13.2. Enhanced Customer Experience

Paze enhances the customer experience by simplifying the online checkout process and providing a more secure payment option.

13.3. The Future of Banking and Digital Payments

The future of banking and digital payments is likely to be characterized by greater integration, personalization, and security. Paze represents a step in this direction.

14. Paze for Businesses: Accepting Paze as a Payment Method

For businesses, accepting Paze as a payment method can offer several benefits, including increased sales, reduced fraud, and enhanced customer satisfaction.

14.1. Benefits of Accepting Paze

The benefits of accepting Paze include:

- Increased Sales: Paze can attract more customers by offering a convenient and secure payment option.

- Reduced Fraud: Paze’s enhanced security features can help reduce fraud and chargebacks.

- Enhanced Customer Satisfaction: Paze can improve customer satisfaction by simplifying the checkout process.

14.2. How to Integrate Paze into Your Business

Contact your payment processor to find out how to integrate Paze into your business. The integration process typically involves adding Paze as a payment option on your website or in your app.

14.3. Marketing Your Business as a Paze-Accepting Merchant

Promote your business as a Paze-accepting merchant to attract more customers. You can display the Paze logo on your website and in your marketing materials.

15. Real-Life Examples of Paze Usage

Real-life examples of Paze usage demonstrate its convenience and security.

15.1. Case Studies of Successful Paze Transactions

Case studies of successful Paze transactions highlight its efficiency and ease of use.

15.2. User Testimonials on Paze

User testimonials on Paze praise its convenience, security, and integration with existing bank accounts.

15.3. How Paze Has Simplified Online Shopping

Paze has simplified online shopping by streamlining the checkout process and reducing the risk of fraud.

16. Disadvantages of Using Paze

Despite its advantages, Paze also has some disadvantages that users should be aware of.

16.1. Limited Acceptance

One of the main disadvantages of Paze is its limited acceptance. Only a relatively small number of retailers currently accept Paze as a payment method.

16.2. Security Concerns

While Paze offers enhanced security features, it is not immune to security threats. Users should take precautions to protect their email accounts and monitor their transactions for any suspicious activity.

16.3. Dependence on Bank Participation

Paze’s availability depends on bank participation. If your bank does not offer Paze, you will not be able to use it.

17. Paze and Data Privacy: What You Need to Know

Data privacy is a key concern for users of digital payment methods like Paze.

17.1. How Paze Handles User Data

Paze handles user data in accordance with its privacy policy. It collects information about your transactions, but it does not share your card details with merchants.

17.2. Paze’s Privacy Policy

Review Paze’s privacy policy to understand how your data is collected, used, and protected.

17.3. Tips for Protecting Your Data on Paze

Protect your data on Paze by using a strong password, enabling two-factor authentication, and monitoring your transactions for any suspicious activity.

18. Alternatives to Paze: Exploring Other Digital Payment Options

If Paze is not the right fit for you, there are several alternative digital payment options to consider.

18.1. Apple Pay

Apple Pay is a popular digital wallet that is available on Apple devices. It uses biometric authentication for secure transactions.

18.2. Google Pay

Google Pay is similar to Apple Pay but is available on Android devices. It also uses biometric authentication for secure transactions.

18.3. PayPal

PayPal is a widely used online payment platform that allows you to send and receive money securely.

19. The Legal and Regulatory Landscape of Paze

The legal and regulatory landscape of Paze is evolving.

19.1. Regulations Governing Digital Payments

Digital payments are governed by various regulations, including consumer protection laws and data privacy laws.

19.2. How Paze Complies with Regulations

Paze complies with all applicable regulations to ensure the security and privacy of its users.

19.3. Future Regulatory Changes Affecting Paze

Future regulatory changes could affect Paze. Stay informed about these changes to understand how they may impact your use of Paze.

20. Keeping Up with the Latest Paze Updates and News

Stay informed about the latest Paze updates and news to get the most out of this digital payment method.

20.1. Following Paze on Social Media

Follow Paze on social media to get the latest updates and news.

20.2. Subscribing to Paze Newsletters

Subscribe to Paze newsletters to receive updates and news directly in your inbox.

20.3. Visiting the Paze Website

Visit the Paze website regularly to get the latest information about Paze.

Are you struggling to find quick, reliable answers to your questions? Do you feel lost in the sea of information and unsure where to turn? WHAT.EDU.VN is here to help You can ask any question on WHAT.EDU.VN and receive answers quickly and completely free. Our platform is designed to connect you with knowledgeable individuals who can provide the insights you need. Don’t hesitate—visit WHAT.EDU.VN today and get the answers you’re looking for Whether you need help with homework, understanding a complex topic, or just satisfying your curiosity, WHAT.EDU.VN is your go-to resource.

Email with Paze

Email with Paze

Are you ready to experience the convenience and ease of getting your questions answered quickly and for free? Visit WHAT.EDU.VN now and ask away!

Address: 888 Question City Plaza, Seattle, WA 98101, United States. Whatsapp: +1 (206) 555-7890. Website: what.edu.vn