Are you looking to understand what SDE is? WHAT.EDU.VN provides a clear explanation of Seller’s Discretionary Earnings, a crucial metric for valuing small businesses. This guide breaks down the definition, calculation, and benefits of SDE, offering insights into how it impacts business valuation. Learn about SDE and its role in financial assessments, empowering you to make informed decisions.

1. Defining SDE: What Is Seller’s Discretionary Earnings?

Seller’s Discretionary Earnings (SDE) is a financial metric used to determine the total financial benefit an owner derives from a small business. Think of it as a snapshot of the real earnings a potential buyer could pocket.

SDE encompasses the pre-tax net income of a business, adding back elements like the owner’s compensation, interest expense, depreciation, amortization, discretionary expenses (like auto, cell phone, meals), and adjustments for one-time or non-operational expenses.

What Does SDE Stand For, Exactly?

SDE stands for Seller’s Discretionary Earnings.

What’s the Purpose of SDE in Business Valuation?

The main purpose of SDE is to offer a standardized way to evaluate the profitability of small businesses, regardless of specific owner involvement or accounting practices. It provides a clearer picture of the business’s earning potential for prospective buyers.

Is Owner’s Salary Included in SDE?

Yes, absolutely! When calculating SDE, the owner’s salary is added back into the net income. This is because a new owner might choose to manage the business differently or draw a different salary.

2. Why Use SDE? The Core Reasons Explained

SDE is the go-to metric for valuing small businesses, but why is it so popular? Here’s a breakdown of its key benefits:

- Quick Comparison: SDE simplifies comparing the potential earnings of different businesses.

- Cash Flow Estimate: It serves as a decent estimate of the cash flow a new owner could expect to receive.

- Valuation Tool: SDE is a key component in various business valuation methods.

| Reason to Use SDE | Explanation |

|---|---|

| Rule of Thumb for Cash Flow | SDE provides an approximate measure of cash flow available to a buyer. It enables an “apples-to-apples” comparison between businesses, regardless of their industry. |

| Estimate of Free Cash Flow | SDE estimates the cash flow available for interest/debt repayment and the purchase of new equipment. Buyers investigate factors like growth rate, gross margins, and customer concentration after calculating SDE. |

| Measure of Earnings | SDE provides an approximate measure of earnings when evaluating a company as a target acquisition. |

| Used in Valuation Methods | SDE is used in income-based and market-based valuation methods and compares multiples among similar businesses that recently sold (comparable transactions). |

3. Calculating SDE: A Step-by-Step Example

Let’s walk through a straightforward example of how SDE is calculated:

Here’s the SDE Calculation Formula:

- Pre-tax Net Income

- + Owner’s Compensation

- + Interest

- + Depreciation

- + Amortization

- + Discretionary Expenses

- + Non-operating, Non-recurring Expenses

- = Seller’s Discretionary Earnings (SDE)

Example Breakdown:

| Item | Amount |

|---|---|

| Pre-tax Net Income | $300,000 |

| Owner’s Compensation | $150,000 |

| Interest | $50,000 |

| Depreciation | $50,000 |

| Amortization | $50,000 |

| Discretionary Expenses | $100,000 |

| Non-Operating/Non-Recurring Expenses | $50,000 |

| Total SDE | $750,000 |

4. The Benefits of Using SDE in Business Valuation

Why is SDE so widely embraced in the business world? Here are the key advantages:

- Common Usage: SDE is widely used among buyers, sellers, and brokers.

- Simplicity: The calculation is straightforward, reducing the chance of errors.

- Eliminates Variables: SDE removes variables that might not affect a buyer post-acquisition, like interest or taxes.

- Facilitates Comparison: Its common use enables easy comparisons between different business earnings.

5. The Downsides: What SDE Doesn’t Tell You

While SDE is valuable, it’s essential to understand its limitations:

- Doesn’t Account for Future Investments: SDE focuses on historical data, neglecting potential future investments or changes.

- Ignores Market Conditions: It doesn’t consider broader economic trends or specific industry conditions.

- Relies on Accurate Data: The accuracy of SDE hinges on the reliability of the financial data provided.

6. How To Increase the Value of Your Business

While you shouldn’t ignore other factors, one way to increase the value of your business is to increase SDE. Every dollar increase in SDE adds to the value of your business by its multiple.

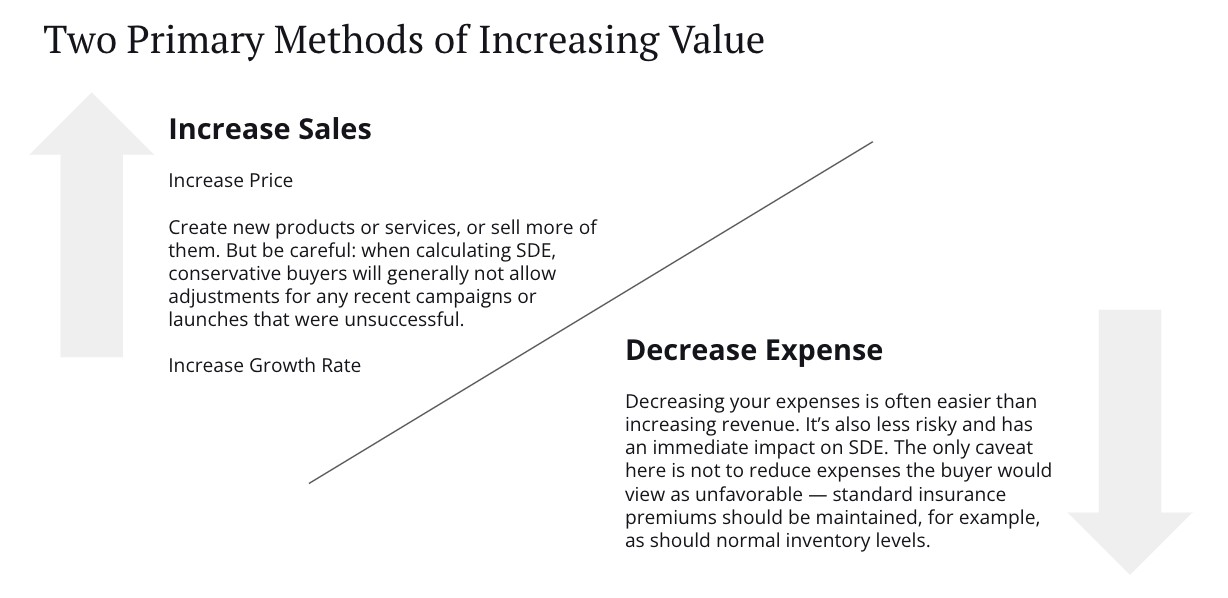

Two Primary Methods for Increasing Value

There are only two ways to increase SDE:

- Increase Sales

The easiest way to increase sales is to increase your prices since 100% of your price increase will fall to the bottom line (less merchant fees, generally speaking).

If your company currently generates $2 million per year in revenue and you increase pricing by 5%, your SDE will increase by $100,000 per year ($2 million x 5% = $100,000). If your current SDE is $400,000, your SDE will increase by 25% (from $400,000 to $500,000). So, a 5% rise in prices increases your SDE by 25%.

Other methods for increasing sales include creating new products or services or selling more of them. But be careful – when calculating SDE, conservative buyers will generally not allow adjustments for any recent campaigns or launches that were unsuccessful.

You can increase the value of your business by increasing SDE. Every dollar increase in SDE adds to the value of your business by its multiple.

If you plan on selling in the next three years, stick to low-risk methods of increasing your sales, such as predictable marketing with measurable returns. Avoid high-risk strategies such as hiring a new sales manager or launching new campaigns outside of your expertise. These can drain cash flow, which decreases SDE and, therefore, the value of your business.

- Decrease Expenses

Decreasing your expenses is often easier than increasing revenue. It’s also less risky and has an immediate impact on SDE. The only caveat here is that you don’t want to reduce expenses the buyer would view as favorable – standard insurance premiums should be maintained, for example, as should normal inventory levels.

Image of a person analyzing financial charts, symbolizing the need to decrease expenses and increase sales to improve SDE.

Image of a person analyzing financial charts, symbolizing the need to decrease expenses and increase sales to improve SDE.

Other Ways To Increase the Value of Your Business

Another alternative for increasing the value of your business is to increase its growth rate.

The value of your business is normally based on its most recent 12-month SDE, which is called the trailing twelve months (TTM). But, if you’ve demonstrated strong and consistent growth, you may be able to negotiate a price based on some measure of “projected SDE” rather than the current year’s SDE.

7. SDE FAQs: Answers to Common Questions

Let’s tackle some frequently asked questions about SDE:

| Question | Answer |

|---|---|

| What are metrics similar to SDE? | LTM (last twelve months SDE), TTM (trailing twelve months SDE), EBITDA (earnings before interest, taxes, depreciation, and amortization), and EBIT (earnings before interest and taxes, also called Operating Profit). |

| Which year’s SDE should a valuation be based on? | A valuation is normally based on the last full year’s SDE or trailing twelve months (TTM). A weighted average may be used if results are inconsistent from year to year and business cycles are longer and predictable. In some cases, value may be placed on the projected current-year SDE if the growth rate is consistent and predictable. Buyers may use an average of the last three years’ SDE. |

| Is SDE the same as cash flow? | No, they’re entirely different concepts. The term “cash flow” is used loosely, sometimes referring to EBITDA. Your cash flow is determined by your cash flow statement. |

How Does SDE Relate to EBITDA?

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is another common metric. While SDE is tailored for small businesses, EBITDA is more frequently used for larger companies.

What Does TTM Mean in Relation to SDE?

TTM stands for Trailing Twelve Months. When discussing SDE, TTM SDE refers to the SDE calculated over the previous 12 months.

Is a Higher SDE Always Better?

Generally, yes. A higher SDE indicates greater profitability and can positively impact the valuation of a business.

8. Navigating Business Valuation: Beyond SDE

SDE is a valuable tool, but it’s not the only factor in determining a business’s worth. Factors like market trends, customer base, and competitive landscape also play a significant role.

9. Conclusion

SDE is a cornerstone of small business valuation. Understanding its definition, calculation, and limitations empowers you to make informed decisions when buying or selling a business. Remember, it’s essential to consider SDE alongside other financial and market factors for a comprehensive assessment.

If you have any questions or need expert advice on business valuation, don’t hesitate to reach out. Visit WHAT.EDU.VN for free answers to your questions. Our address is 888 Question City Plaza, Seattle, WA 98101, United States. You can also contact us via WhatsApp at +1 (206) 555-7890.

10. Seeking Answers? Ask WHAT.EDU.VN!

Still have questions about SDE or other business topics?

At WHAT.EDU.VN, we understand the challenges of finding reliable, free answers to your questions. That’s why we’ve created a platform where you can ask anything and receive helpful responses from knowledgeable individuals.

Why Choose WHAT.EDU.VN?

- It’s Free: Ask as many questions as you like without any cost.

- Quick Answers: Get responses to your questions promptly.

- Expert Insights: Connect with a community of experts who can provide valuable guidance.

- Easy to Use: Our platform is designed for simplicity and ease of navigation.

Ready to get started?

Visit what.edu.vn today and ask your question! Let us help you find the answers you need.