When considering the wealthiest nations on Earth, what images come to mind? Towering skyscrapers, bustling financial districts, or perhaps serene landscapes dotted with luxury resorts? It might surprise many to learn that the world’s richest countries are often also among its smallest.

Several of these nations, such as Luxembourg, Switzerland, Singapore, and San Marino, have cultivated prosperity through sophisticated financial sectors and strategic tax policies that attract international investment, skilled professionals, and substantial bank deposits. Others, like Qatar and the United Arab Emirates, are blessed with abundant reserves of oil and gas or other valuable natural resources. Even the allure of tourism and entertainment can play a significant role; Macao, despite recent global challenges, remains a powerhouse of affluence thanks to its renowned gambling industry.

However, defining a “rich country” requires careful consideration, especially in an age where economic disparities are increasingly pronounced. While Gross Domestic Product (GDP) provides a snapshot of a nation’s total economic output, a more insightful metric for gauging the relative wealth of a country’s population is GDP per capita. This figure is calculated by dividing the total GDP by the number of residents, offering a clearer picture of average economic well-being. This helps explain why smaller nations often appear “richer” – their economies are proportionally larger compared to their populations.

To gain an even more accurate understanding of living standards, we must factor in inflation and the local cost of goods and services. This leads us to Purchasing Power Parity (PPP), often expressed in international dollars, which allows for meaningful comparisons of economic well-being across different countries.

But does a high PPP automatically translate to a universally prosperous populace? Not necessarily. Averages can be misleading, and significant inequalities within a country can skew the perception of overall wealth, often favoring those already in privileged positions.

The COVID-19 pandemic brought these disparities into sharp focus. While wealthier nations generally possessed the resources to manage the health crisis, these resources were not always distributed equitably. The economic repercussions of lockdowns disproportionately affected lower-income workers, creating a new divide between those who could work remotely and those who faced job insecurity and health risks. Many individuals in industries severely impacted by shutdowns found themselves with inadequate safety nets, exposing vulnerabilities even in well-established welfare systems.

As the pandemic’s immediate threat receded, the global economy faced new challenges. Inflation surged, and the war in Ukraine exacerbated existing food and energy crises. Subsequent geopolitical events have further disrupted supply chains and commodity markets. These economic shocks invariably hit lower-income families hardest, as they allocate a larger portion of their income to essential goods and services like housing, food, and transportation, which are often subject to the most volatile price increases.

According to the International Monetary Fund (IMF), the gap between the world’s richest and poorest nations is stark. In the ten poorest countries, the average per-capita purchasing power is less than $1,500, while in the ten richest, it surpasses $110,000.

It’s crucial to interpret these statistics with caution. The IMF itself advises that certain figures should be viewed critically. Many of the countries high on the wealth ranking are considered tax havens. This means their apparent wealth is, in part, derived from financial activities originating elsewhere, artificially inflating their GDP. While over 130 governments signed a global deal in 2021 to ensure a minimum corporate tax rate of 15% for large companies, its implementation remains a challenge due to political and legislative hurdles in many countries. Critics also point out that this proposed minimum rate is only marginally higher than the existing rates in tax havens like Ireland, Qatar, and Macao. Estimates suggest that over 15% of global jurisdictions are tax havens, and the IMF projects that by the late 2020s, nearly 40% of global foreign direct investment flows could be linked to tax avoidance strategies, up from 30% in the 2010s. These investments often pass through shell corporations, contributing little real economic benefit to the host population.

THE TOP 10 RICHEST COUNTRIES IN THE WORLD:

10. Norway 🇳🇴

Current International Dollars: 82,832 | GDP & Economic Data

Norway’s economic prosperity has been largely driven by its vast offshore oil reserves discovered in the late 1960s. As Western Europe’s leading petroleum producer, the nation has reaped substantial benefits from consistently high oil prices for decades.

However, the early 2020s presented significant economic challenges. Oil prices plummeted, the global pandemic ensued, and the Norwegian krone experienced a sharp decline. In the second quarter of 2020, Norway’s GDP contracted by 6.3%, marking the most significant drop in half a century, possibly since World War II.

Despite this dramatic downturn, the long-term impact on Norwegians’ wealth was limited. The economy gradually recovered, offsetting initial losses.

Furthermore, Norway possesses a substantial financial safety net in its $1.4 trillion sovereign wealth fund, the largest globally. Crucially, unlike many other wealthy nations, Norway’s high GDP per capita figures accurately reflect the economic well-being of the average citizen. The country boasts one of the smallest income inequality gaps worldwide, indicating a more equitable distribution of wealth.

9. United States 🇺🇸

Current International Dollars: 85,373 | GDP & Economic Data

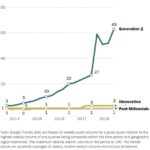

Breaking the trend of small, wealthy nations, the United States, a large and diverse economy, entered the top 10 richest countries in 2020. This marked its ascent after consistently ranking just outside the top tier for nearly two decades.

The initial surge was largely attributed to pandemic-era socioeconomic policies that boosted income and consumer spending, coupled with a decline in energy prices. This price drop negatively impacted petroleum-dependent economies like Qatar, Norway, and the UAE, causing them to slip in the rankings, while Brunei exited the top 10 altogether.

The United States has since solidified its position in the top tier, demonstrating remarkable economic resilience. The recession in early 2020 was the shortest on record, lasting only two months. The US economy has since experienced a strong rebound. The IMF in April revised its 2024 US economic growth forecast upwards to 2.7%, noting that the US economy is expected to be a significant driver of global growth this year.

8. San Marino 🇸🇲

Current International Dollars: 86,989 | GDP & Economic Data

San Marino, the oldest republic in Europe and the fifth smallest country globally, is a microstate with a population of just 34,000. Despite its size, it boasts one of the wealthiest citizenries in the world. Low income tax rates, approximately one-third of the EU average, contribute to its economic attractiveness. However, San Marino is actively working to align its fiscal laws and regulations with EU and international standards.

The nation demonstrated impressive resilience throughout the pandemic and subsequent energy crisis, with strong performances in both tourism and manufacturing sectors. Its diversified economy and stable political environment further contribute to its sustained prosperity.

7. Switzerland 🇨🇭

Current International Dollars: 91,932 | GDP & Economic Data

Switzerland, home to approximately 8.8 million people, has contributed numerous noteworthy inventions to the world, from white chocolate to the computer mouse. Its economic strength is rooted in its robust banking and insurance sectors, thriving tourism industry, and exports of high-value goods. These exports include pharmaceuticals, gems, precious metals, precision instruments like watches, and specialized machinery including medical devices and computers.

The 2023 Global Wealth Report by Credit Suisse again ranked Switzerland first in terms of average wealth per adult, reaching a remarkable $685,230. Furthermore, roughly one in six Swiss adults possesses assets exceeding one million US dollars, making Switzerland a global leader in millionaire density.

However, Switzerland is not immune to economic challenges. The pandemic significantly impacted its economy, and the war in Ukraine, due to Switzerland’s reliance on Russian oil and gas imports, led to energy price spikes and supply chain disruptions. The near-collapse of Credit Suisse in 2022, requiring a government-orchestrated rescue by UBS Group, damaged Switzerland’s reputation as an unshakeable global banking center.

In response to rising inflation, the Swiss National Bank (SNB) raised interest rates from -0.75% to 1.75% in 2023. This measure, while aimed at curbing inflation, has increased investment costs and slowed economic growth, compounding the effects of declining exports, particularly to Germany, a key trading partner also facing economic headwinds.

6. United Arab Emirates 🇦🇪

Current International Dollars: 96,846 | GDP & Economic Data

Historically, the United Arab Emirates (UAE) economy was based on agriculture, fishing, and pearl trading. The discovery of oil in the 1950s transformed the nation, ushering in an era of rapid modernization and wealth accumulation. Today, the UAE boasts a highly cosmopolitan population with a high standard of living. Modern architecture blends with traditional Islamic design, and the country attracts workers globally with tax-free salaries and a sunny climate. Interestingly, only about 20% of the UAE’s residents are native-born Emiratis.

The UAE’s economy is undergoing increasing diversification, moving beyond its traditional reliance on hydrocarbons. Tourism, construction, trade, and finance are now significant industries. The pandemic and the subsequent drop in oil prices did impact the UAE, briefly causing it to fall out of the IMF’s top 10 richest countries ranking for the first time in decades. However, with the recovery of energy prices, the UAE swiftly regained its position, reaffirming the enduring importance of its energy sector alongside its diversifying economy.

5. Qatar 🇶🇦

Current International Dollars: 112,283 | GDP & Economic Data

While oil prices have recovered somewhat, they remain below the peaks of the mid-2010s. In 2014, Qatar’s per capita GDP exceeded $143,222. However, it subsequently declined, falling below $100,000 for five years. Since then, it has shown a gradual upward trend, increasing by approximately $10,000 annually.

Despite these fluctuations, Qatar’s vast reserves of oil, gas, and petrochemicals, combined with a small population of around 3 million, have allowed this nation of ultramodern cities, luxury shopping, and fine dining to consistently rank among the world’s richest for two decades.

However, even wealthy nations face challenges. With Qatari nationals constituting only about 12% of the population, the initial phase of the pandemic saw rapid COVID-19 spread among low-income migrant workers living in dense housing, leading to one of the region’s highest infection rates. Falling energy prices also reduced government and private sector revenues. As an export-oriented economy, Qatar was further affected by disruptions to global trade caused by the war in Ukraine. More recently, regional conflicts have introduced renewed uncertainty. Despite these challenges, Qatar’s economy has demonstrated considerable resilience and is projected to grow by around 2% in both 2024 and 2025.

4. Singapore 🇸🇬

Current International Dollars: 133,737 | GDP & Economic Data

Singapore is a magnet for high-net-worth individuals. Eduardo Saverin, co-founder of Facebook and the wealthiest person in Singapore with assets around $16 billion, became a permanent resident in 2011, drawn by the city-state’s attractive fiscal environment. Singapore is a renowned tax haven where capital gains and dividends are tax-free.

Singapore’s economic success story is remarkable. Upon gaining independence in 1965, half its population was illiterate and the nation possessed virtually no natural resources. Through strategic policies and a strong work ethic, Singapore transformed itself into one of the most business-friendly countries globally. Today, it is a thriving hub for trade, manufacturing, and finance, with a 98% adult literacy rate.

Despite its economic prowess, Singapore was not immune to the pandemic-induced global recession. In 2020, its economy contracted by 3.9%, marking its first recession in over a decade. While Singapore rebounded with 8.8% growth in 2021, the economic slowdown in China, a major trading partner, hampered continued recovery. China’s economic challenges particularly impacted Singapore’s manufacturing sector, which accounts for approximately 20% of its GDP. Singapore’s economy grew by just 1% in 2023 and is projected to grow modestly in the coming years.

3. Ireland 🇮🇪

Current International Dollars: 133,895 | GDP & Economic Data

Ireland, with a population of about 5.3 million, experienced a severe economic downturn during the 2008-09 financial crisis. Following politically challenging reforms, including significant public sector wage cuts and banking industry restructuring, Ireland achieved a remarkable fiscal recovery. Employment rates rebounded, and its per capita GDP experienced substantial growth.

However, Ireland’s economic picture is nuanced. It is a major global corporate tax haven, a factor that benefits multinational corporations more than the average Irish citizen. From the mid-2010s onwards, numerous large US firms, including Apple, Google, Microsoft, Meta, and Pfizer, relocated their fiscal residences to Ireland to take advantage of its low 12.5% corporate tax rate, among the lowest in the developed world. In 2023, these multinationals contributed over 50% of the total value added to the Irish economy. The potential adoption of a 15% minimum corporate tax rate, as proposed by the OECD and implemented by many countries, could diminish Ireland’s competitive advantage.

Furthermore, while Irish households are generally better off than in the past, the national household per-capita disposable income remains slightly below the EU average, according to OECD data. Significant income inequality persists, with the top 20% of earners making almost five times as much as the bottom 20%. Therefore, many Irish citizens may not perceive themselves as being among the world’s wealthiest.

2. Macao SAR 🇲🇴

Current International Dollars: 134,141 | GDP & Economic Data

Just a few years ago, Macao, often called the “Las Vegas of Asia,” was projected by some to become the world’s richest nation. Formerly a Portuguese colony, this Special Administrative Region (SAR) of China liberalized its gaming industry in 2001, leading to astounding economic growth. With a population of approximately 700,000 and over 40 casinos within a compact 30 square kilometer area, Macao became a highly lucrative gambling and tourism hub.

However, the COVID-19 pandemic brought significant disruptions. Global travel restrictions brought Macao’s economy to a near standstill, and it temporarily fell out of the top 10 richest nations ranking. Since then, Macao’s economy has rebounded strongly. Its per-capita purchasing power, which was around $125,000 in 2019, is even higher today, driven by the resurgence of tourism and gaming revenues.

1. Luxembourg 🇱🇺

Current International Dollars: 143,743 | GDP & Economic Data

Luxembourg, located in the heart of Europe, offers a blend of historical castles, scenic countryside, cultural festivals, and gastronomic delights. It is also a major international financial center, attracting those seeking offshore banking and financial services. However, visiting Luxembourg reveals a nation of approximately 670,000 people that leverages its wealth to provide high-quality housing, healthcare, and education to its citizens, who enjoy the highest standard of living in the Eurozone.

While the global financial crisis and international pressure to reduce banking secrecy have had some impact, Luxembourg’s economy has proven remarkably resilient. The COVID-19 pandemic did force business closures and job losses, but Luxembourg weathered the economic storm better than many European neighbors. Its economy rebounded from a -0.9% contraction in 2020 to over 7% growth in 2021. However, subsequent economic headwinds, including high interest rates, the war in Ukraine, and broader Eurozone economic challenges, have slowed growth. The economy grew by just 1.3% in 2022 and contracted by 1% in 2023, although a projected growth of 1.2% is anticipated for this year.

Despite recent economic fluctuations, Luxembourg’s exceptionally high living standards remain unchallenged. It surpassed the $100,000 mark in per capita GDP in 2014 and has consistently held its position as the world’s richest country ever since.

World’s Richest Countries 2024

| Rank | Country/Territory | GDP-PPP per capita ($) |

|---|---|---|

| 1 | 🇱🇺Luxembourg | 143,743 |

| 2 | 🇲🇴Macao SAR | 134,141 |

| 3 | 🇮🇪Ireland | 133,895 |

| 4 | 🇸🇬Singapore | 133,737 |

| 5 | 🇶🇦Qatar | 112,283 |

| 6 | 🇦🇪United Arab Emirates | 96,846 |

| 7 | 🇨🇭Switzerland | 91,932 |

| 8 | 🇸🇲San Marino | 86,989 |

| 9 | 🇺🇸United States | 85,373 |

| 10 | 🇳🇴Norway | 82,832 |

| 11 | 🇬🇾Guyana | 80,137 |

| 12 | 🇩🇰Denmark | 77,641 |

| 13 | 🇧🇳Brunei Darussalam | 77,534 |

| 14 | 🇹🇼Taiwan | 76,858 |

| 15 | 🇭🇰Hong Kong SAR | 75,128 |

| 16 | 🇳🇱Netherlands | 74,158 |

| 17 | 🇮🇸Iceland | 73,784 |

| 18 | 🇸🇦Saudi Arabia | 70,333 |

| 19 | 🇦🇹Austria | 69,460 |

| 20 | 🇸🇪Sweden | 69,177 |

| 21 | 🇦🇩Andorra | 69,146 |

| 22 | 🇧🇪Belgium | 68,079 |

| 23 | 🇲🇹Malta | 67,682 |

| 24 | 🇩🇪Germany | 67,245 |

| 25 | 🇦🇺Australia | 66,627 |

| 26 | 🇧🇭Bahrain | 62,671 |

| 27 | 🇫🇮Finland | 60,851 |

| 28 | 🇨🇦Canada | 60,495 |

| 29 | 🇫🇷France | 60,339 |

| 30 | 🇰🇷South Korea | 59,330 |

| 31 | 🇬🇧United Kingdom | 58,880 |

| 32 | 🇨🇾Cyprus | 58,733 |

| 33 | 🇮🇹Italy | 56,905 |

| 34 | 🇮🇱Israel | 55,533 |

| 35 | 🇦🇼Aruba | 54,716 |

| 36 | 🇯🇵Japan | 54,184 |

| 37 | 🇳🇿New Zealand | 53,797 |

| 38 | 🇸🇮Slovenia | 53,287 |

| 39 | 🇰🇼Kuwait | 52,274 |

| 40 | 🇪🇸Spain | 52,012 |

| 41 | 🇱🇹Lithuania | 50,600 |

| 42 | 🇨🇿Czech Republic | 50,475 |

| 43 | 🇵🇱Poland | 49,060 |

| 44 | 🇵🇹Portugal | 47,070 |

| 45 | 🇧🇸The Bahamas | 46,524 |

| 46 | 🇭🇷Croatia | 45,702 |

| 47 | 🇭🇺Hungary | 45,692 |

| 48 | 🇪🇪Estonia | 45,122 |

| 49 | 🇵🇦Panama | 44,797 |

| 50 | 🇸🇰Slovak Republic | 44,081 |

Source: International Monetary Fund, World Economic Outlook April 2024.