If you’ve recently received an unexpected text or chat message from an attractive stranger, you’re not alone. This seemingly innocent “Hi” or mistaken identity message could be the bait in a sophisticated online fraud known as “pig butchering.” These scams are designed to lure you into fake online investments, ultimately leaving you with significant financial losses.

“Pig butchering,” a term that evokes the image of fattening a hog before slaughter, originated in China and has exploded globally, especially during the pandemic. Criminal organizations now target individuals worldwide, often forcing victims of human trafficking in Southeast Asia to carry out these deceptive schemes against their will. ProPublica’s recent investigation delves deep into this cybercrime, drawing from extensive interviews with scam victims, former scam workers, advocates, law enforcement, and a wealth of documentary evidence, including scam training manuals and victim-scammer chat logs.

Andrew Frey, a financial investigator with the Secret Service, highlights the widespread impact: “We’ve had people from all walks of life that have been victimized in these cases and the paydays have been huge.” The Secret Service is at the forefront of combating online crime and assisting victims in recovering stolen funds.

These scams are meticulously planned and executed. Here’s a breakdown of the typical pig butchering process, complete with visuals, real scammer-victim text excerpts, fraudster training advice, and insights from police investigations.

1. Crafting a Deceptive Online Persona

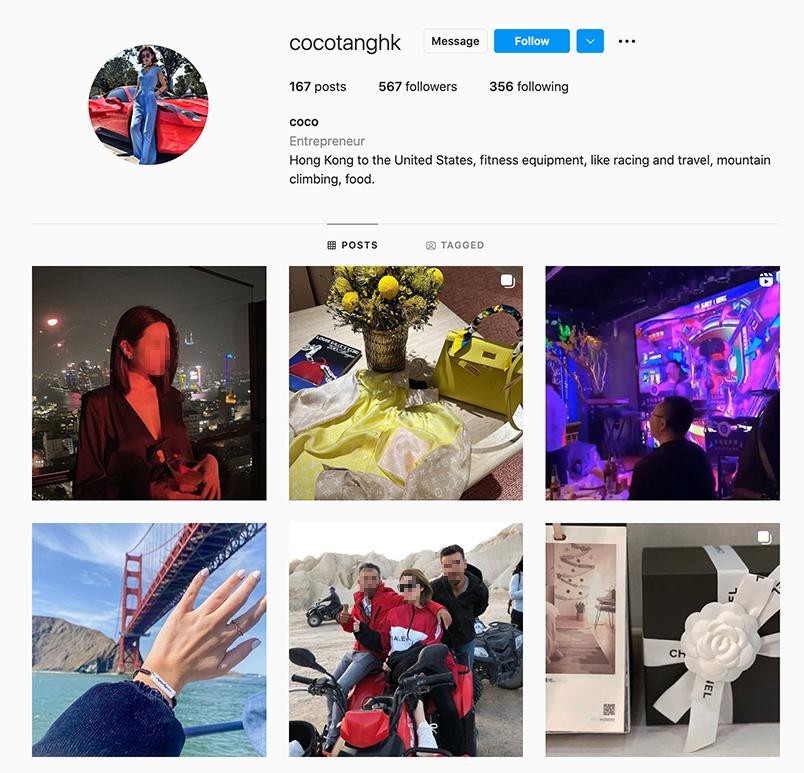

Pig butchers begin by constructing a false online identity, typically featuring a captivating profile picture (often stolen) and images that portray an affluent and desirable lifestyle.

Alt text: Example Instagram profile used in a pig butchering scam, reported to the FTC after victim lost $89,000.

Alt text: Example Instagram profile used in a pig butchering scam, reported to the FTC after victim lost $89,000.

This Instagram profile, reported to the Federal Trade Commission by a Florida resident who lost $89,000 to this scam, exemplifies the alluring facade. (Meta, Instagram’s parent company, is investigating the account, and the profile owner did not respond to requests for comment.)

2. Initiating Contact: The Hook

With a compelling online profile established, scammers start sending messages on dating apps or social media. Alternatively, they might use platforms like WhatsApp, feigning a “wrong number” to initiate contact. (Meta, which also owns WhatsApp, has stated they are investing heavily to combat pig butchering scams on their platforms.)

In December 2020, a Connecticut resident received these seemingly innocuous messages on WhatsApp from a stranger. Responding to this initial contact led him into two scams, resulting in a staggering $180,000 loss.

3. Building Trust: The “Romance” Phase

The crucial next step involves cultivating trust with the potential victim. Scammers engage in casual conversations about everyday topics like life, family, and work. This seemingly innocent interaction serves to extract personal details that can later be used to manipulate the victim. They fabricate similar life experiences to create a false sense of connection, leveraging the principle that people are drawn to those who appear similar to themselves.

When a woman from Houston shared that her brother had cerebral palsy, the scammer fabricated a strikingly similar story to build rapport:

4. Introducing the Investment Ploy

Fairly quickly, the conversation shifts towards investment opportunities. Scammers boast about their supposed investment successes, often sharing fabricated screenshots of brokerage accounts displaying inflated gains. They then persuade victims to open accounts on “their” online brokerage platform. Unbeknownst to the victim, this brokerage is a complete fabrication, and any funds deposited go directly to the scammer. This critical deception often remains hidden until it’s too late.

Scammer guides frequently recommend promoting MetaTrader, a legitimate trading app misused for fraudulent purposes. They emphasize its availability on the Apple App Store as proof of its legitimacy. (MetaTrader did not respond to requests for comment. Apple has reported sharing complaints with MetaTrader’s parent company and claims the parent company has taken action.)

5. Injecting Real Money into the Fake Account

Once victims are convinced to explore investing, scammers offer “guidance” through the investment process. They meticulously explain how to transfer funds from personal bank accounts to cryptocurrency wallets and subsequently into the fraudulent brokerage. Typically, scammers suggest a small initial investment, which predictably shows a profit, further solidifying the illusion of legitimacy.

A woman in Michigan, intrigued by her online “boyfriend’s” claims of profitable gold trading, agreed to become his student. Just two days later, he was instructing her on how to begin investing through a fake brokerage accessible via MetaTrader:

6. “Proof” of Legitimacy: The Initial Withdrawal

To dispel any lingering doubts, scammers often allow victims to make small withdrawals early on. This seemingly successful transaction reinforces the belief that the investment is genuine and trustworthy. For instance, a Canadian man, Sajid Ikram, was permitted to withdraw 33,000 Canadian dollars, according to his statement to the Royal Canadian Mounted Police. This returned money solidified his trust, ultimately leading to a reported loss of nearly $400,000, including borrowed funds.

7. Escalating Investment: Pressure Tactics

This initial “success” is merely the beginning. Pig butchering guides detail methods to exploit victims’ emotional and financial vulnerabilities, manipulating them into depositing increasingly larger sums. The process starts with assurances of risk-free investments, then escalates to pressuring victims to take out loans, liquidate retirement savings, and even mortgage their homes.

Over just nine days, one scammer, identifying as “Jessica,” intensified pressure on a California man, progressively urging him to use his available cash, then tap into retirement funds, and finally, borrow money. This relentless pressure is a hallmark of the pig butchering scam.

8. The Cut-Off: Investment Frozen

Once victims reach their financial limits or become hesitant to deposit more funds, the illusion of investment success abruptly ends. Withdrawals become impossible, or victims experience a sudden, catastrophic “loss” that wipes out their entire investment.

The California man was devastated to discover that the $440,000 he had deposited had vanished. Exploiting his desperation, the scammer then convinced him to invest an additional $600,000, which also disappeared into the scammer’s account.

9. Exploiting Desperation: The “Recovery” Lie

Scammers then amplify their manipulation by presenting a false solution: depositing more money to recover the lost funds. Sometimes, they claim the investment is highly profitable but that a “tax issue” requires upfront payment, often around 20% of the account value. If the victim complies, new obstacles and fees are fabricated, creating a never-ending cycle of demands for more money.

No matter how much victims pay, it is never enough. An FTC complaint from a Maryland victim illustrates this point. This individual lost nearly $1.4 million, continually giving in to scammers’ demands for taxes and fees to supposedly recover their money:

“Once the trading has ended, I applied to withdrawal my money and profit from the website. The broker asked me to pay a tax on the profit of 88,587.90 usd on 8162021, this amount was wired again through Bank of America into a foreign account in Hong Kong. Another request for me to pay security deposit on my profits which was 83,950.00 usd wired out to a different foreign account in Hong Kong once again. The broker asked for a bank and withdrawal processing fee of 27,983.34 usd again was wired out to a different foreign account in Hong Kong. The very last wire was for expediting the withdrawal and the platform asked for 55,966.60 usd wired out to Hong Kong. At this point I already had to much money in the platform so I kept giving in.”

10. Taunting and Disappearance: The Final Blow

Once victims realize they’ve been defrauded, scammers often resort to insults and taunts before abruptly cutting off all communication. The fake brokerage websites become inaccessible. Subsequently, they relaunch under new URLs and initiate the cycle anew with fresh targets.

After nearly four months of communication and a $30,000 loss for the Michigan victim, her scammer revealed the cruel deception, reveling in both the financial and emotional damage inflicted:

What to Do If You’re a Pig Butchering Scam Victim

If you have fallen victim to a pig butchering scam, immediate action is crucial. Report the crime to your bank and law enforcement authorities—the FBI, the Secret Service, and your local police department—as quickly as possible. Delaying the report makes it significantly harder for banks to reverse fraudulent transactions and for law enforcement to trace, freeze, or recover stolen funds. Erin West, Deputy District Attorney at the Santa Clara County District Attorney’s office, emphasizes the importance of prompt reporting: “We are definitely going to be more successful if you immediately report.” Early reporting is key to maximizing the chances of recovering your funds and holding perpetrators accountable.