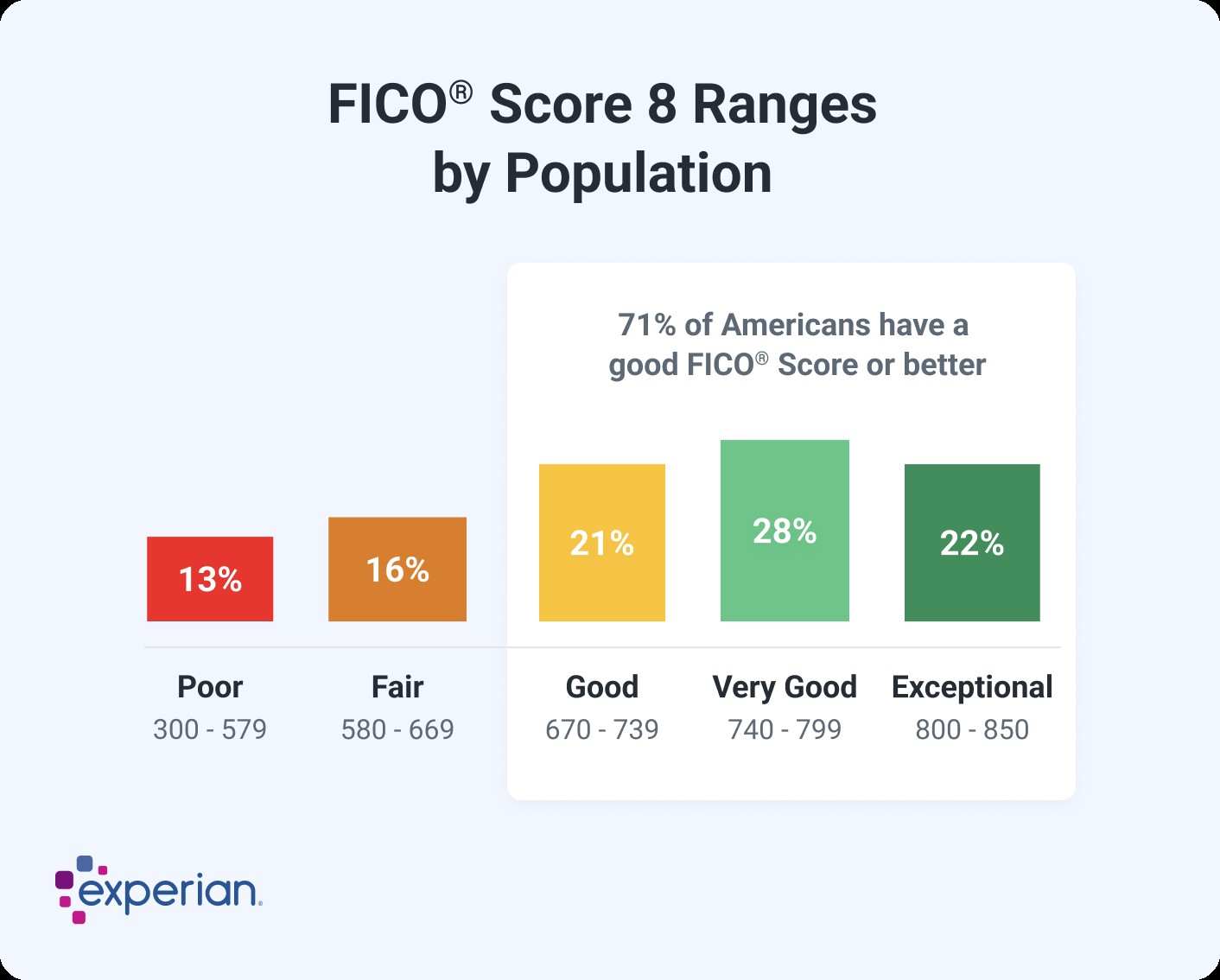

For many aspects of your financial life, your credit score is a critical number. Ranging from 300 to 850, this three-digit figure acts as a snapshot of your creditworthiness, influencing everything from loan approvals to interest rates. Generally, a credit score in the mid to high 600s or above is considered good, while scores in the high 700s and 800s are deemed excellent. In fact, a significant portion of Americans fall into these ranges, with about a third having FICO® Scores between 600 and 750, and an additional 48% scoring even higher. The average FICO® Score in the U.S. in 2023 was 715, highlighting a generally positive credit landscape for many.

Lenders use credit scores as a key factor in their decision-making process, evaluating risk and determining loan terms. A higher credit score often unlocks access to better financial products, including credit cards and loans with lower interest rates and more favorable terms. While specific scoring models can vary slightly, with FICO® Score and VantageScore® being the two primary types, the underlying principles and scoring factors remain largely consistent.

This article will delve deeper into what constitutes a good credit score, exploring the different scoring ranges for both FICO® Score and VantageScore®, the factors that impact your creditworthiness, and actionable steps you can take to improve your credit standing. Understanding these nuances is the first step towards achieving and maintaining a healthy credit score, paving the way for greater financial opportunities.

Decoding Good Credit Scores: FICO® Score Breakdown

The widely used base FICO® Scores operate on a scale of 300 to 850. Within this range, a good credit score is typically defined as falling between 670 and 739. This “good” range signifies to lenders that you are a reliable borrower with a history of responsible credit management.

It’s important to note that FICO® offers various types of credit scores tailored to different industries. In addition to the base scores, they also provide industry-specific scores for credit card issuers and auto lenders. These specialized scores utilize a slightly different range, from 250 to 900. However, the “good” credit score range of 670 to 739 remains consistent across both base and industry-specific FICO® Scores. Scores exceeding 739 are categorized as “very good” or “exceptional,” reflecting even stronger creditworthiness.

Understanding where your score falls within these ranges is crucial for gauging your financial health and anticipating lender perceptions. Aiming for a FICO® Score within the good range or higher can significantly improve your access to credit and favorable loan terms.

Learn more: What Is the Average Credit Score in the US?

Navigating VantageScore: Defining a Good Score

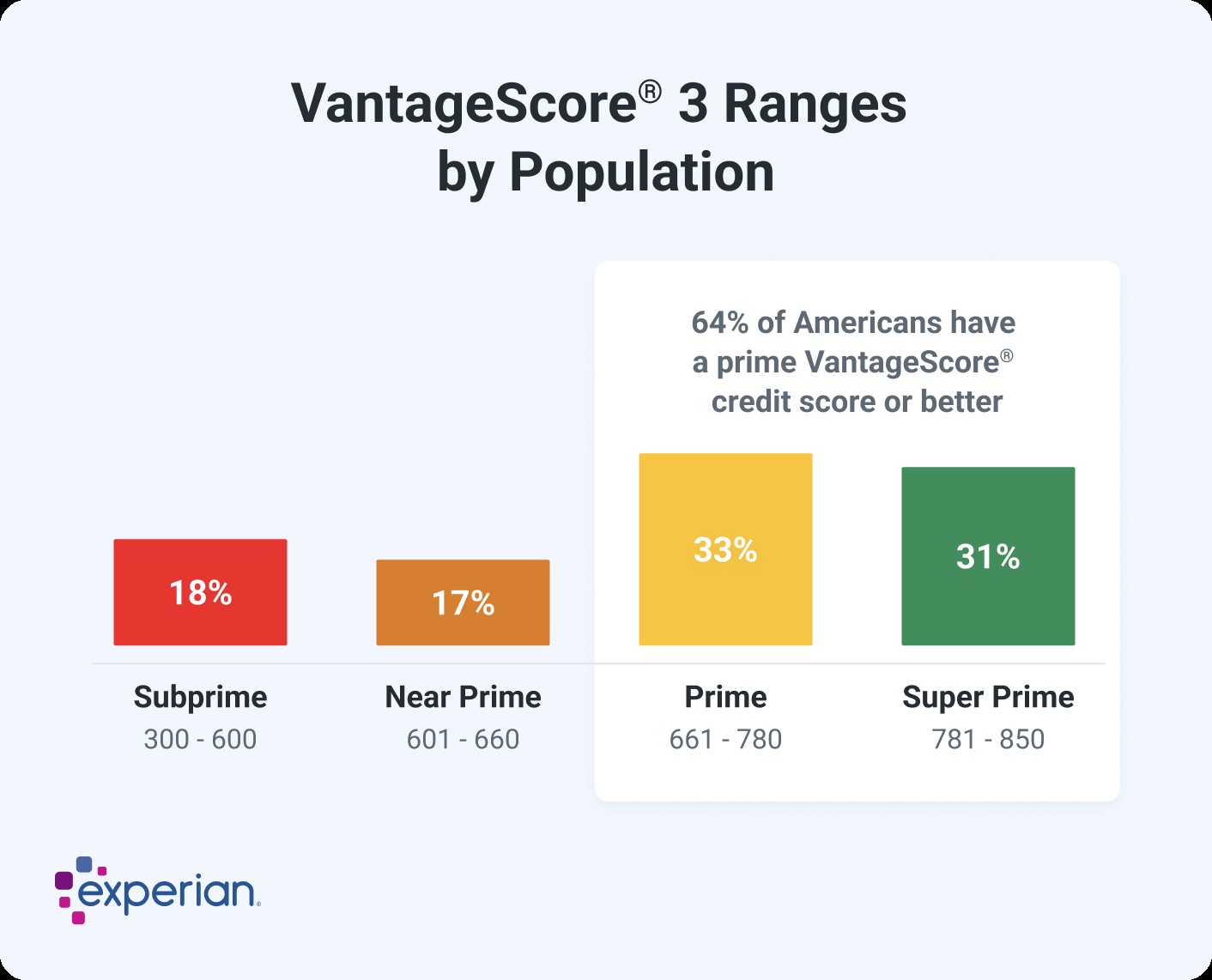

VantageScore, another prominent credit scoring model, also utilizes a score range of 300 to 850, aligning with the FICO® Score scale. For the latest VantageScore models, 3.0 and 4.0, a good credit score falls within the range of 661 to 780. This slightly broader “good” range compared to FICO® reflects the nuances in VantageScore’s scoring methodology.

While VantageScore doesn’t offer industry-specific scores like FICO®, it has evolved through various versions over the years. Earlier VantageScore models, such as 1.0 and 2.0, employed a different score range of 501 to 990. However, these older models are not widely used by lenders today. The current VantageScore 3.0 and 4.0 are the most relevant for consumers to understand and focus on.

Similar to FICO® Scores, achieving a VantageScore within the good range is indicative of responsible credit behavior and can lead to better financial opportunities. Monitoring your VantageScore, alongside your FICO® Score, provides a comprehensive view of your credit health.

Unveiling the Factors Behind Your Credit Score

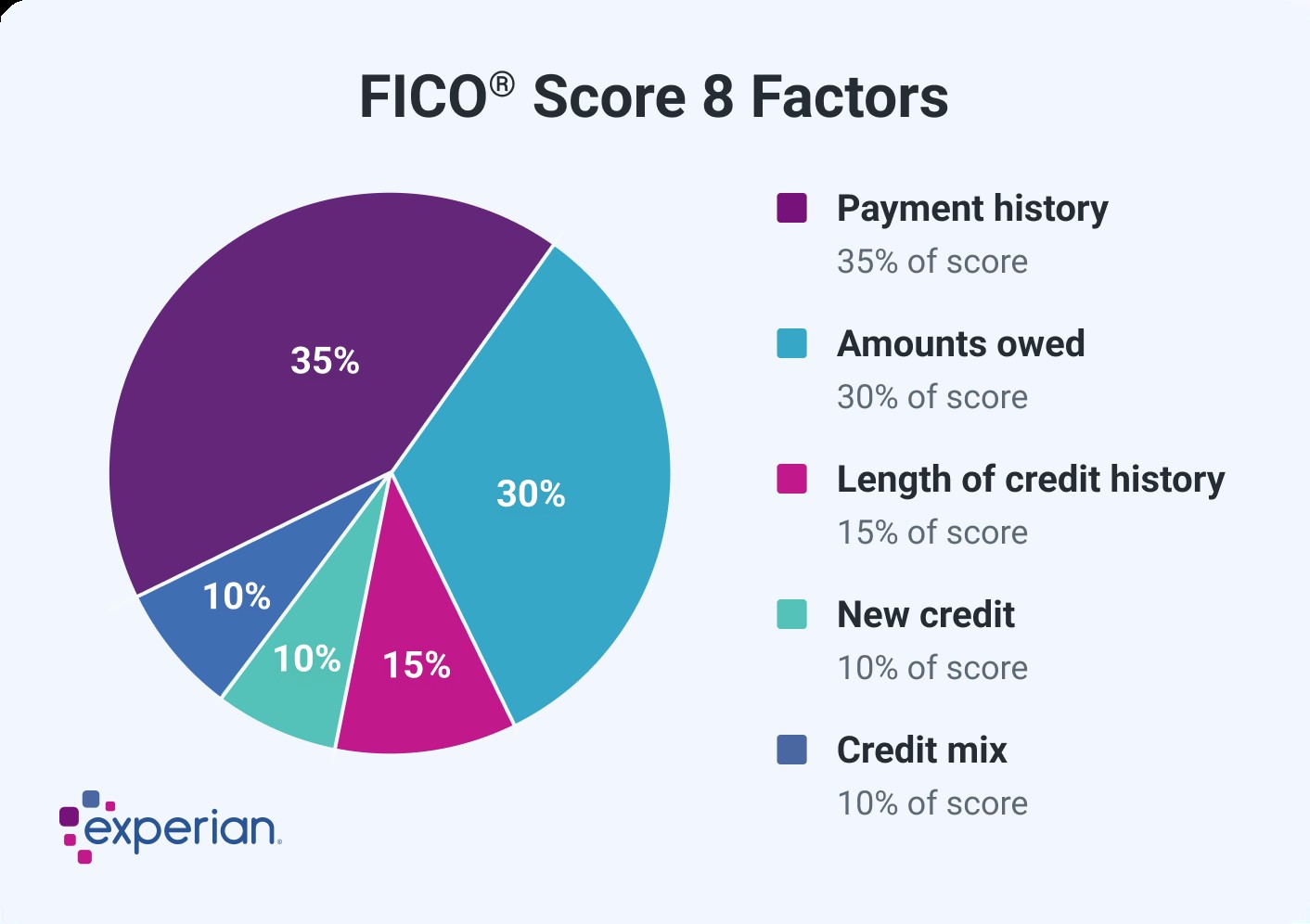

Both FICO® and VantageScore credit scores are calculated based on information contained in your credit reports. These reports, maintained by credit bureaus like Experian, TransUnion, and Equifax, detail your credit history, including payment history, amounts owed, length of credit history, credit mix, and new credit. While the specific weighting of these factors may differ slightly between FICO® and VantageScore, the core elements remain consistent.

Understanding these factors is key to managing and improving your credit score. By focusing on responsible credit behaviors that positively influence these factors, you can work towards achieving a good credit score.

Learn more: What Affects Your Credit Scores?

Delving into FICO® Score Factors

FICO® provides a percentage-based breakdown to illustrate the general importance of each scoring factor. However, it’s crucial to remember that the precise impact of each factor is personalized and depends on the unique details within your credit report. FICO® considers the following factors in order of their general influence:

Exploring VantageScore Credit Score Factors

VantageScore also outlines the factors influencing credit scores, ranking them by general influence. Similar to FICO®, the actual impact of each factor is individualized. VantageScore considers these factors in the following order of influence:

| VantageScore Credit Scoring Factor | Importance |

|---|---|

| Payment history | Extremely influential |

| Total credit usage | Highly influential |

| Credit mix and experience | Highly influential |

| New accounts opened | Moderately influential |

| Balances and available credit | Less influential |

Information Not Considered in Credit Scores

It’s equally important to understand what factors are not considered when calculating your credit scores. Both FICO® and VantageScore explicitly exclude the following types of information:

- Race, color, religion, national origin, sex, and marital status: Credit scoring is designed to be unbiased and does not consider these personal characteristics.

- Age: While length of credit history is a factor, your age itself is not directly considered.

- Where you live: Your geographical location does not directly impact your credit score.

- Income: Your income level is not a direct factor in credit score calculations. However, your debt-to-income ratio, which indirectly relates to income, can be considered by lenders separately.

- Employment history: Your current or past employers are not considered in credit scoring.

- Interest rates on accounts: The interest rates you pay on your credit accounts do not directly affect your credit score.

- Information not related to credit: This includes things like checking account balances, debit card usage, and social media activity.

Good Credit Scores for Major Purchases: Home and Car

Having a good credit score becomes especially crucial when making significant purchases like buying a house or a car. Lenders rely heavily on credit scores to assess risk and determine loan eligibility and terms for these major financial commitments.

What Constitutes a Good Credit Score to Buy a House?

For mortgage applications, a good credit score significantly increases your chances of approval and helps you secure a lower interest rate. Generally, aiming for a FICO® Score of at least 670, the beginning of the “good” range, is advisable when seeking a mortgage.

While the minimum credit score requirements for mortgages can vary depending on the loan type and lender, a score in the good range provides a solid foundation. Conventional mortgages often require a minimum credit score of 620, while government-backed mortgages like FHA, USDA, and VA loans have varying minimums, sometimes lower, but often with other compensating factors or stricter terms.

| Minimum Credit Score for Government-Backed Mortgages |

|---|

| FHA home loans |

| USDA loans |

| VA loans |

Remember, even if you qualify with a lower score, improving your credit score before applying for a mortgage can lead to substantial savings over the life of the loan due to lower interest rates.

Learn more: Which Credit Scores Do Mortgage Lenders Use?

What Is a Good Credit Score to Buy a Car?

Similar to mortgages, a good credit score is beneficial when financing a car purchase. While there isn’t a strict minimum credit score to buy a car, a VantageScore of 661 or higher, reaching the “prime” range, can be considered a good benchmark.

A higher credit score generally translates to better auto loan terms, including lower interest rates and potentially higher loan amounts. Conversely, applicants with lower credit scores are often perceived as higher risk, resulting in higher interest rates and potentially less favorable loan terms. Improving your credit before seeking an auto loan can save you money in the long run.

Learn more: Average Car Loan Interest Rates by Credit Score

The Landscape of Credit Scores: Why So Many?

The existence of multiple credit scores stems from the dynamic nature of credit scoring and the competitive market of credit scoring companies. Companies like FICO® and VantageScore continually refine their scoring models and offer them to lenders.

Lenders utilize credit scores for various decisions, from loan approvals to managing existing accounts, such as adjusting credit limits. They have the flexibility to choose which scoring model best suits their needs and risk assessment strategies.

FICO® and VantageScore are the primary creators and sellers of credit scoring models, and both regularly release updated versions. These updates incorporate technological advancements, evolving consumer behavior patterns, and aim to improve the predictive accuracy of the scores. Lenders then decide whether to adopt these newer models or continue using older versions already integrated into their systems.

Learn more: Why Are My Credit Scores Different?

VantageScore’s Diverse Credit Score Versions

VantageScore focuses on creating generic, tri-bureau scoring models, meaning a single model can assess credit reports from all three major credit bureaus (Experian, TransUnion, and Equifax).

Since its inception, VantageScore has released several versions:

| Recent VantageScore Credit Score Versions | VS 3.0 | VS 4.0 | VS 4plus |

|---|---|---|---|

| Only considers data from a credit report | X | X | |

| Can consider additional data with your permission | X | ||

| Considers trended data | X | X |

- VantageScore 1.0 (No longer offered): The initial model launched in 2006.

- VantageScore 4.0 (Released in 2017): Introduced the use of trended data, analyzing changes in balances and credit utilization over time.

- VantageScore 4plus™ (Announced May 2024): Allows consumers to link bank accounts and share banking data for potential score recalculation, incorporating a broader view of financial behavior.

FICO®’s Range of Credit Score Versions

FICO® pioneered credit scoring based on consumer credit reports in 1989. While newer FICO® Score versions often share names (e.g., FICO® Score 8), FICO® develops distinct versions for each credit bureau.

FICO® offers three main types of consumer credit scores:

- Base FICO® Scores: Generic scores ranging from 300 to 850, predicting the likelihood of general credit obligation delinquency.

- Industry-Specific FICO® Scores: Tailored scores for auto lenders and credit card issuers (auto scores and bankcard scores), ranging from 250 to 900, predicting delinquency on specific account types.

- FICO® Scores Using Alternative Data: Models incorporating non-traditional data sources, such as UltraFICO® (linking deposit accounts) and FICO® XD (using telecom/utility payment history), both with a 300-850 range.

The FICO® Score 10 Suite, for example, includes base FICO® Score 10, FICO® Score 10 T (with trended data), and industry-specific scores, representing a comprehensive suite of scoring models.

Lender Discretion in Choosing Credit Scores

Lenders have the autonomy to select which credit reports they request and which credit scores they utilize. Consumers often aren’t informed about the specific report or score a lender will use, and lender preferences can change.

Despite the variety of scores, the good news is that most FICO® and VantageScore models rely on similar underlying credit report information. They also share a common goal: predicting the likelihood of a borrower becoming seriously delinquent (90 days past due) within a 24-month period.

Consequently, the same fundamental factors influence all your credit scores. While you might observe slight variations across different scores due to model differences and credit report variations, they generally trend in the same direction over time.

The Importance of a Good Credit Score: Opening Financial Doors

Cultivating a good credit score is not just about numbers; it’s about unlocking financial opportunities and achieving your financial goals more easily. A good credit score can be the deciding factor in loan approvals, particularly for major loans like mortgages and car loans. Furthermore, it directly impacts the cost of borrowing, determining the interest rates and fees you’ll pay.

Consider a 30-year, fixed-rate $350,000 mortgage. The difference in monthly payments and total interest paid between a FICO® Score of 620 and 700 can be substantial. A better score could save you hundreds of dollars per month and tens of thousands of dollars in interest over the loan’s lifetime.

Beyond lending, credit scores can also influence non-lending decisions. Landlords may review credit scores when considering rental applications, and in some states, employers and insurance companies may use credit information for employment and premium decisions, respectively.

Average Mortgage Rates Based on FICO® Score

| FICO® Score | Interest Rate, 30-Year Fixed-Rate Mortgage | Monthly Payment | Total Interest Cost |

|—|—|—|—|

| 620 | 7.71% | $2,806.11 | $549,199 |

| 700 | 7.13% | $2,667.53 | $499,310 |

| 840 | 6.69% | $2,564.49 | $462,214 |

Source: Curinos LLC, December 6, 2024; assumes a $350,000 mortgage and 30-day rate-lock period

Learn more: Facts About Credit You May Not Know

Strategies to Improve Your Credit Scores

Improving your credit score is an achievable goal that requires focusing on the underlying factors that influence your score. The fundamental steps are relatively straightforward:

- Pay Bills on Time, Every Time: Payment history is the most significant factor. Consistent on-time payments are crucial.

- Manage Credit Card Balances Wisely: Keep credit utilization low (ideally below 30% of your credit limit). High credit utilization can negatively impact your score.

- Don’t Close Old Credit Cards: Length of credit history matters. Keeping older, unused credit cards open (if there are no fees) can benefit your score.

- Limit New Credit Applications: Avoid applying for too much new credit in a short period, as it can lower your score.

- Maintain a Healthy Credit Mix: Having a mix of different credit types (e.g., credit cards, installment loans) can be beneficial, but don’t open accounts you don’t need.

- Regularly Check Your Credit Reports for Errors: Dispute and correct any inaccuracies you find, as errors can negatively impact your score.

While some factors, like the age of your credit accounts, improve naturally over time, actively managing the factors within your control is key to credit score improvement.

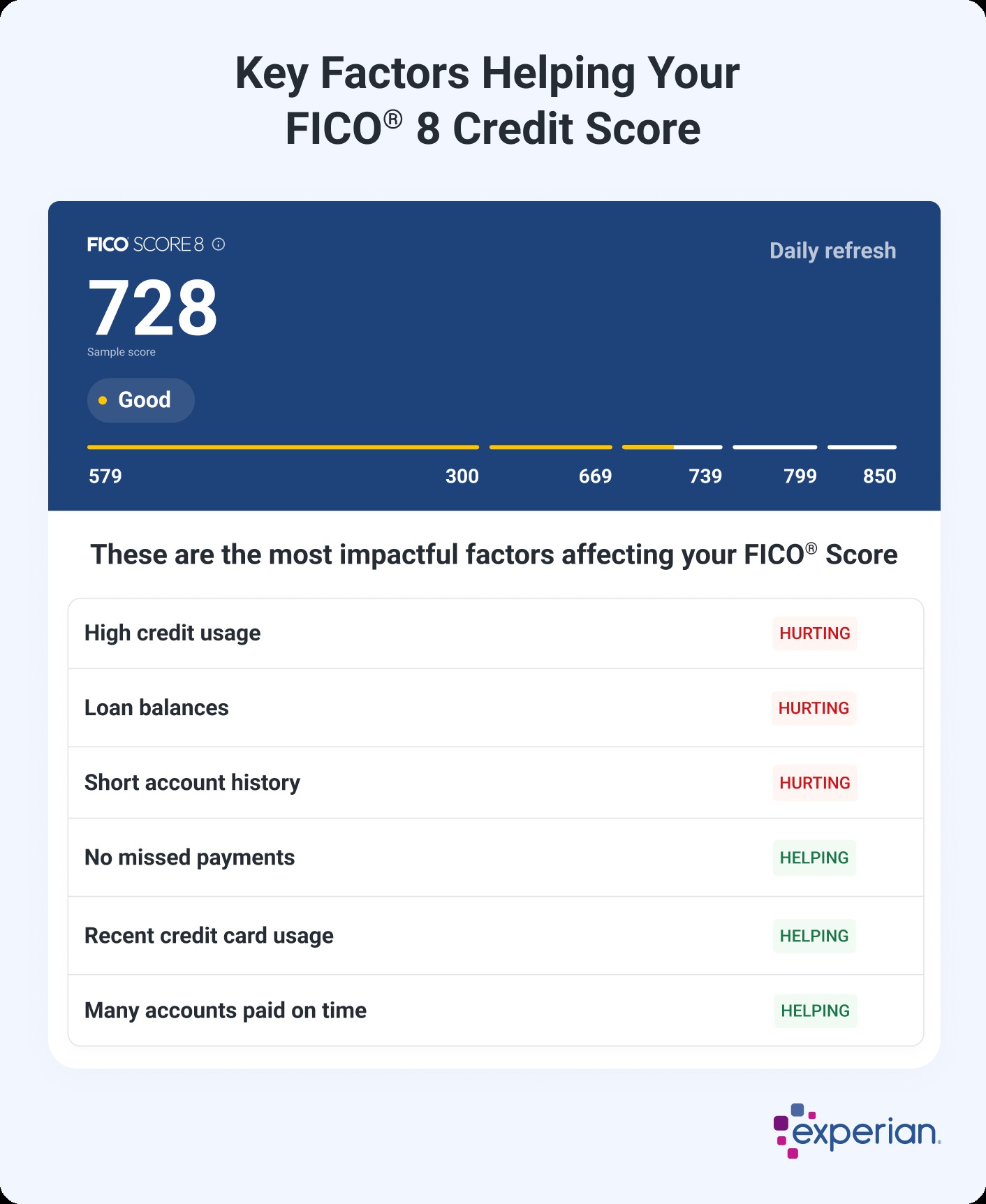

Checking your credit score and report can provide valuable insights into areas for improvement. Services like Experian CreditWorks offer free FICO® Score 8 access and personalized analysis of your credit profile, highlighting factors that are helping and hurting your score.

Establishing Credit: What If You Don’t Have a Credit Score?

Credit scoring models require sufficient information to generate a score. If you have a limited credit history, you may not have a credit score.

For FICO® Scores, the minimum requirements are:

- At least one account open for six months or longer.

- At least one account with recent activity within the past six months.

VantageScore is more lenient, potentially scoring credit reports with at least one active account, even if it’s only a month old.

If you are “unscoreable,” you can take steps to build credit:

- Become an authorized user on a credit card: Piggybacking on someone else’s responsible credit card use can help you establish credit.

- Apply for a secured credit card: These cards require a security deposit and are designed for individuals with limited or no credit history.

- Consider a credit-builder loan: These loans are specifically designed to help build credit by reporting your payments to credit bureaus.

Learn more: Ways to Build Credit if You Have No Credit History

Understanding Credit Score Fluctuations

Credit scores are not static; they can change over time as new information is reported to credit bureaus. It’s normal to see your score fluctuate.

Factors that can lead to an increase in your credit score:

- Removal of negative items from your credit report (e.g., late payments, collections after 7 years).

- Lowering your credit utilization rate.

- Paying off or settling collection accounts.

- Adding consistent on-time payments.

Factors that can lead to a decrease in your credit score:

- Late payments (even one 30-day late payment can have a significant impact).

- Increased credit utilization.

- Applying for or opening new credit accounts.

- Filing for bankruptcy.

Interestingly, even positive financial actions, like paying off a loan, can sometimes cause a temporary dip in your score. This could be due to changes in your credit mix or the closure of an account that contributed positively to your score. Credit scoring models are complex, and the impact of any single action depends on your overall credit profile.

Proactive Credit Monitoring: Stay Informed and in Control

Monitoring your credit report and score regularly is a proactive step towards financial well-being. Checking your score before applying for new credit is beneficial, but ongoing monitoring allows you to identify potential issues early and take corrective action to improve your score over time.

Experian CreditWorks offers free credit monitoring, providing access to your FICO® Score and credit report with daily updates and alerts for suspicious activity. These tools empower you to stay informed, track your progress, and maintain a good credit score, ultimately paving the way for greater financial success.