A non-resident alien is a person who is not a U.S. citizen or a U.S. national and has not met the green card test or the substantial presence test, but at WHAT.EDU.VN, we’re here to simplify this definition and provide insights into tax implications. We offer a platform where you can ask any question and receive answers for free, covering topics like income tax return requirements, tax treaties, and effectively connected income. Explore our resources to understand your tax obligations better!

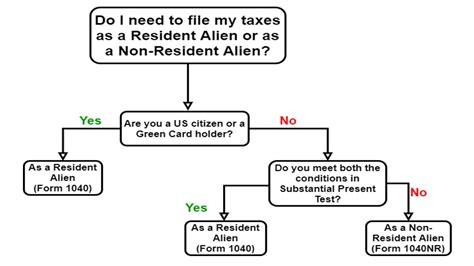

1. What Is a Non-Resident Alien?

A non-resident alien is an individual who is neither a U.S. citizen nor a U.S. national, and who has not met the requirements of either the green card test or the substantial presence test for U.S. residency for tax purposes. This classification is significant for determining how an individual is taxed in the United States. The IRS (Internal Revenue Service) uses specific criteria to determine whether an individual is a non-resident or a resident alien, as this affects their tax obligations. Non-resident aliens are generally taxed only on their income sourced within the U.S. or income effectively connected with a U.S. trade or business. Understanding this definition is crucial for anyone living or working in the U.S. who is not a citizen, ensuring they comply with U.S. tax laws. For further clarification or specific tax-related questions, consider using the free question-and-answer platform at WHAT.EDU.VN, where experts can provide tailored guidance.

1.1. What Constitutes “Not a U.S. Citizen or U.S. National?”

“Not a U.S. citizen or U.S. national” means the individual has not been born in the U.S., has not become a citizen through naturalization, and is not considered a U.S. national, usually someone born in American Samoa or Swains Island.

1.2. What Is the Green Card Test?

The green card test is one of two tests used to determine U.S. residency for tax purposes. An individual passes this test if they are a lawful permanent resident of the U.S. at any time during the calendar year. Lawful permanent residents are those who have been granted the privilege of residing permanently in the U.S. as an immigrant according to the immigration laws. This status is commonly evidenced by a green card (Permanent Resident Card). If an individual holds a green card at any point during the tax year, they are considered a resident alien for the entire year for tax purposes, regardless of how much time they spend in the U.S. Failing this test means proceeding to the substantial presence test to determine residency status.

1.3. What Is the Substantial Presence Test?

The substantial presence test is the second test used to determine U.S. residency for tax purposes. An individual meets this test if they are physically present in the U.S. for at least:

- 31 days during the current year, and

- 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

- All the days you were present in the current year,

- 1/3 of the days you were present in the first year before the current year, and

- 1/6 of the days you were present in the second year before the current year.

For example, if you were in the U.S. for 120 days in 2024, 300 days in 2023, and 180 days in 2022, the calculation would be:

- 2024: 120 days (full count)

- 2023: 300 days / 3 = 100 days

- 2022: 180 days / 6 = 30 days

Total: 120 + 100 + 30 = 250 days. Because the total is more than 183 days, you would meet the substantial presence test for 2024.

1.4. What Are the Exceptions to the Substantial Presence Test?

There are several exceptions to the substantial presence test. Here are the most common:

-

Exempt Individual: An exempt individual doesn’t count days of presence in the U.S. for the substantial presence test. Categories of exempt individuals include:

- Students: Individuals temporarily in the U.S. under an “F,” “J,” “M,” or “Q” visa, who substantially comply with the requirements of the visa.

- Teachers or Trainees: Individuals temporarily in the U.S. under a “J” or “Q” visa.

- Government-Related Individuals: Individuals temporarily in the U.S. as a foreign government-related individual (A or G visa).

- Professional Athletes: Temporarily in the U.S. to compete in a charitable sports event.

-

Medical Condition: If an individual is unable to leave the U.S. due to a medical condition that arose while in the U.S., they can apply for an exception. They must provide documentation from a licensed physician explaining their condition and why they were unable to leave.

-

Closer Connection Exception: An individual who is present in the U.S. for more than 183 days may still qualify as a non-resident alien if they can demonstrate a closer connection to a foreign country. To qualify, they must:

- Be present in the U.S. for fewer than 183 days during the tax year.

- Maintain a tax home in a foreign country during the tax year.

- Have a closer connection to that foreign country than to the U.S.

1.5. How Does the Closer Connection Exception Work?

The closer connection exception allows someone who spends a significant amount of time in the U.S. to still be treated as a non-resident alien if they have stronger ties to another country. Factors considered include:

- Permanent Home: Where the individual maintains their primary residence.

- Family: Where the individual’s family resides.

- Personal Belongings: Where the individual keeps most of their personal belongings.

- Location of Business Activities: Where the individual conducts most of their business activities.

- Jurisdiction Issuing Driver’s License: The country that issued the individual’s driver’s license.

- Location of Bank Accounts: Where the individual holds their bank accounts.

- Country of Residence Designated on Forms and Documents: How the individual represents their country of residence on official forms.

1.6. What If My Spouse Is a Resident Alien?

If you are a non-resident alien at the end of the tax year and your spouse is a resident alien, your spouse can choose to treat you as a U.S. resident alien for tax purposes. This election allows you to file jointly as “Married Filing Jointly,” which can provide certain tax benefits. However, if your spouse makes this choice, all of your worldwide income becomes subject to U.S. tax. To make this election, you and your spouse must file a joint return and attach a statement indicating that you both agree to the election.

2. Why Is It Important to Determine Non-Resident Alien Status?

Determining non-resident alien status is crucial because it dictates the scope of U.S. taxation on an individual’s income. Non-resident aliens are generally taxed only on income that is either:

- Effectively connected with a U.S. trade or business (ECI), or

- Fixed, determinable, annual, or periodical (FDAP) income from U.S. sources that is not effectively connected with a U.S. trade or business.

This is different from U.S. citizens and resident aliens, who are taxed on their worldwide income, regardless of where it is earned. Understanding your status ensures compliance with U.S. tax laws and avoids potential penalties or legal issues.

2.1. How Does Non-Resident Alien Status Affect Tax Obligations?

Non-resident alien status primarily affects the scope of income that is subject to U.S. taxation. Unlike U.S. citizens and resident aliens who are taxed on their worldwide income, non-resident aliens are generally taxed only on:

- Income Effectively Connected with a U.S. Trade or Business (ECI): This includes income from services performed in the U.S. or from a business operated in the U.S. ECI is taxed at the same rates as U.S. citizens and residents, after allowable deductions.

- Fixed, Determinable, Annual, or Periodical (FDAP) Income: This includes income from U.S. sources that is not effectively connected with a U.S. trade or business, such as dividends, interest, rents, and royalties. FDAP income is typically taxed at a flat rate of 30%, although this may be reduced by a tax treaty.

Non-resident aliens cannot claim the standard deduction and may have limited eligibility for certain deductions and credits compared to U.S. citizens and resident aliens. Tax treaties between the U.S. and the individual’s country of residence may also affect the tax rates and exemptions.

2.2. What Is Effectively Connected Income (ECI)?

Effectively Connected Income (ECI) is income that is derived from a trade or business conducted within the United States. This includes income from services performed in the U.S. or from a business operated in the U.S. Examples of ECI include:

- Wages or salary earned for work performed in the U.S.

- Income from a business operated in the U.S.

- Profits from selling goods in the U.S.

- Certain rental income, if it is connected to a U.S. trade or business.

ECI is taxed at the same rates as U.S. citizens and residents, after allowable deductions. Non-resident aliens engaged in a U.S. trade or business must file a U.S. income tax return and report their ECI.

2.3. What Is Fixed, Determinable, Annual, or Periodical (FDAP) Income?

Fixed, Determinable, Annual, or Periodical (FDAP) income is a type of income from U.S. sources that is not effectively connected with a U.S. trade or business. This type of income is generally subject to a flat 30% tax rate, unless a tax treaty provides for a lower rate. Examples of FDAP income include:

- Dividends

- Interest

- Rents

- Royalties

- Pensions and annuities

- Scholarships and fellowships (to the extent they are taxable)

The tax on FDAP income is typically withheld at the source by the payer, meaning the individual receives the income net of taxes. Non-resident aliens are not allowed deductions against FDAP income.

2.4. How Do Tax Treaties Affect Non-Resident Aliens?

Tax treaties are agreements between the U.S. and other countries that can affect the tax treatment of non-resident aliens. These treaties may provide reduced tax rates or exemptions on certain types of income. For example, a tax treaty might reduce the 30% tax rate on FDAP income to a lower rate, such as 15% or 10%, or even exempt certain types of income from U.S. tax altogether. To benefit from a tax treaty, a non-resident alien must typically claim the treaty benefits on their U.S. income tax return and provide documentation establishing their eligibility for the treaty benefits. Tax treaties can vary significantly from country to country, so it’s essential to consult the specific treaty between the U.S. and the individual’s country of residence.

2.5. What Are the Common Types of Income for Non-Resident Aliens?

Common types of income for non-resident aliens include:

- Wages and Salaries: Compensation for work performed in the U.S.

- Scholarships and Fellowships: Payments to students and scholars for educational purposes.

- Dividends: Payments from U.S. corporations to shareholders.

- Interest: Income earned on U.S. bank accounts or investments.

- Royalties: Payments for the use of intellectual property, such as copyrights or patents.

- Rental Income: Income from renting out U.S. property.

- Business Income: Profits from a business operated in the U.S.

3. Who Must File a U.S. Tax Return as a Non-Resident Alien?

You must file a U.S. tax return if you are a non-resident alien and:

- You were engaged in a trade or business in the United States during the year, or

- You have U.S. source income on which the tax liability was not satisfied by withholding of tax at the source.

Even if you are not engaged in a trade or business, you must file a return if you want to claim a refund of excess withholding or want to claim the benefit of any deductions or credits (for example, if you have income from rental property that you choose to treat as income connected to a trade or business).

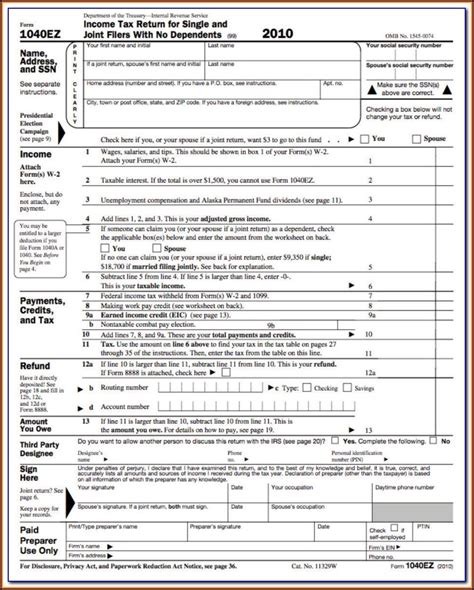

3.1. What Forms Do Non-Resident Aliens Need to File?

Non-resident aliens typically use Form 1040-NR, U.S. Nonresident Alien Income Tax Return, to file their U.S. income taxes. This form is specifically designed for non-resident aliens and differs from the standard Form 1040 used by U.S. citizens and resident aliens. Depending on the type of income and any applicable tax treaties, non-resident aliens may also need to file additional forms, such as:

- Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals): Used to claim treaty benefits or to establish foreign status for withholding purposes.

- Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual: Used to claim exemption from withholding under a tax treaty for compensation for personal services.

- Form 8833, Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b): Used to disclose treaty-based return positions.

3.2. When Is the Filing Deadline for Non-Resident Aliens?

The filing deadline for non-resident aliens depends on whether they receive wages subject to U.S. income tax withholding. If wages are subject to U.S. income tax withholding, the filing deadline is generally April 15th of the following year. If wages are not subject to U.S. income tax withholding, the filing deadline is generally June 15th of the following year. If these dates fall on a weekend or holiday, the deadline is extended to the next business day. Non-resident aliens can also request an extension of time to file by submitting Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form grants an automatic six-month extension, but it does not extend the time to pay any taxes owed.

3.3. What Happens If a Non-Resident Alien Fails to File or Pay Taxes?

If a non-resident alien fails to file a U.S. tax return or pay taxes owed, they may be subject to penalties and interest. The penalties for failure to file and failure to pay can be significant, and interest accrues on any unpaid tax from the due date of the return until the date the tax is paid. Additionally, failure to comply with U.S. tax laws can have serious consequences for future immigration or visa applications. Non-compliance may result in the denial of a visa, deportation, or other adverse actions. It’s essential for non-resident aliens to meet their U.S. tax obligations to avoid these potential issues.

3.4. How Can Non-Resident Aliens Get Help with Their Taxes?

Non-resident aliens can get help with their U.S. taxes from several sources:

- Internal Revenue Service (IRS): The IRS provides information and resources on its website, including publications, forms, and instructions. The IRS also offers assistance through its Taxpayer Assistance Centers and toll-free phone lines.

- Tax Professionals: Enrolling in the services of a qualified tax professional can prove beneficial in ensuring precision and adherence to the legal requirements in your tax filings. Tax professionals are well-versed in non-resident alien tax rules and can provide personalized advice and assistance.

- Volunteer Income Tax Assistance (VITA): VITA sites offer free tax help to individuals who meet certain income requirements, including non-resident aliens.

- Tax Counseling for the Elderly (TCE): TCE sites provide free tax help to individuals age 60 and older, regardless of income.

- what.edu.vn: A platform where you can ask any question and receive answers for free, covering various tax-related topics and providing general guidance.

3.5. What Are Common Mistakes Non-Resident Aliens Make When Filing Taxes?

Common mistakes non-resident aliens make when filing taxes include:

- Using the Wrong Form: Using Form 1040 instead of Form 1040-NR.

- Failing to Claim Treaty Benefits: Not claiming tax treaty benefits to which they are entitled.

- Incorrectly Determining Residency Status: Misunderstanding the rules for determining residency status and incorrectly filing as a resident alien.

- Not Reporting All U.S. Source Income: Failing to report all income earned in the U.S.

- Claiming Incorrect Deductions or Credits: Claiming deductions or credits for which they are not eligible.

- Not Filing on Time: Missing the filing deadline and incurring penalties and interest.

- Not Including Required Documentation: Failing to include necessary forms or documentation, such as Form W-8BEN or Form 8233.

4. What Are Some Specific Tax Situations for Non-Resident Aliens?

Non-resident aliens may encounter various specific tax situations depending on their source of income and activities within the U.S. Understanding these scenarios can help ensure compliance with U.S. tax laws.

4.1. Non-Resident Aliens with Scholarship or Fellowship Grants

Non-resident aliens who receive scholarship or fellowship grants may be subject to U.S. tax on the portion of the grant used for expenses other than tuition and required fees. This taxable portion is generally treated as FDAP income and subject to a 14% or 30% tax rate, unless reduced by a tax treaty. However, if the scholarship or fellowship is connected to a U.S. trade or business (such as teaching or research), the income may be treated as ECI and taxed at the same rates as U.S. citizens and residents.

4.2. Non-Resident Aliens with Rental Income

Non-resident aliens who receive rental income from U.S. property have two options for how their rental income is taxed:

- Treating Rental Income as FDAP Income: In this case, the rental income is subject to a 30% tax rate (or lower treaty rate) on the gross rental income, and no deductions are allowed.

- Treating Rental Income as ECI: Non-resident aliens can elect to treat their rental income as income effectively connected with a U.S. trade or business. If they make this election, they can deduct expenses related to the rental property, such as mortgage interest, property taxes, and depreciation. The net rental income is then taxed at the same rates as U.S. citizens and residents. This election is made by filing Form 1040-NR and attaching a statement indicating that the individual elects to treat their rental income as ECI.

4.3. Non-Resident Aliens with Income from Personal Services

Non-resident aliens who perform personal services in the U.S., such as employment or independent contractor work, are generally subject to U.S. tax on the income earned for those services. The income is treated as ECI and taxed at the same rates as U.S. citizens and residents, after allowable deductions. Non-resident aliens may be able to claim certain deductions, such as business expenses, but they cannot claim the standard deduction. They may also be eligible for tax treaty benefits that reduce or eliminate U.S. tax on their personal services income.

4.4. Non-Resident Aliens Who Are Students or Trainees

Non-resident aliens who are students or trainees in the U.S. under an “F,” “J,” “M,” or “Q” visa may be exempt from counting days of presence in the U.S. for the substantial presence test. This means they may be able to maintain their non-resident alien status even if they spend a significant amount of time in the U.S. However, they are still subject to U.S. tax on any U.S. source income, such as scholarships, fellowships, or wages. Tax treaties may provide additional benefits, such as reduced tax rates or exemptions on certain types of income.

4.5. Non-Resident Aliens with Gambling Winnings

Non-resident aliens who have gambling winnings in the U.S. are generally subject to a 30% tax on those winnings. The tax is typically withheld at the source by the payer, such as the casino or lottery organization. However, certain types of gambling winnings, such as winnings from blackjack, craps, roulette, or baccarat, are exempt from U.S. tax. Non-resident aliens may be able to claim a refund of excess withholding if they are eligible for an exemption or a lower tax rate under a tax treaty.

5. What Are the Key Differences Between Resident and Non-Resident Aliens for Tax Purposes?

The key differences between resident and non-resident aliens for tax purposes lie in the scope of income that is subject to U.S. taxation and the deductions and credits that can be claimed. Here is a comparison:

| Feature | Resident Alien | Non-Resident Alien |

|---|---|---|

| Taxation of Income | Taxed on worldwide income, regardless of where it is earned. | Taxed only on: (1) Income effectively connected with a U.S. trade or business (ECI), and (2) Fixed, determinable, annual, or periodical (FDAP) income from U.S. sources that is not effectively connected with a U.S. trade or business. |

| Filing Status | Can use the same filing statuses as U.S. citizens, such as Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). | Generally limited to filing as Single or Married Filing Separately (unless an election is made to treat a non-resident alien spouse as a resident alien). |

| Standard Deduction | Eligible for the standard deduction. | Not eligible for the standard deduction. |

| Deductions | Can claim various deductions, such as itemized deductions (if they exceed the standard deduction) and deductions for certain expenses. | Limited deductions; can generally only deduct expenses related to effectively connected income. |

| Credits | Can claim various tax credits, such as the child tax credit, earned income tax credit, and education credits. | Limited eligibility for tax credits; may be able to claim credits related to effectively connected income. |

| Tax Treaties | Tax treaties may affect the taxation of specific items of income, but generally, resident aliens are subject to U.S. tax on their worldwide income. | Tax treaties can significantly affect the taxation of income, providing reduced tax rates or exemptions on certain types of income. |

| Tax Forms | Files Form 1040, U.S. Individual Income Tax Return. | Files Form 1040-NR, U.S. Nonresident Alien Income Tax Return. |

| Social Security and Medicare Taxes | Generally subject to Social Security and Medicare taxes on wages earned in the U.S. | May be exempt from Social Security and Medicare taxes under certain circumstances, such as if they are a student or work for a foreign government. |

| Gift and Estate Taxes | Subject to U.S. gift and estate taxes on worldwide assets. | Subject to U.S. gift and estate taxes only on assets located in the U.S. |

| Withholding | Generally subject to the same withholding rules as U.S. citizens. | Subject to specific withholding rules for non-resident aliens, such as withholding on FDAP income. |

6. How to Determine Your Residency Status for Tax Purposes?

Determining your residency status for tax purposes involves understanding the green card test and the substantial presence test.

6.1. Step-by-Step Guide to Determining Residency

- Check for U.S. Citizenship or Nationality: If you are a U.S. citizen or U.S. national, you are considered a U.S. resident for tax purposes, regardless of where you live.

- Green Card Test: Determine if you held a green card (lawful permanent resident status) at any time during the calendar year. If yes, you are considered a resident alien for the entire year.

- Substantial Presence Test: If you do not hold a green card, determine if you meet the substantial presence test. This involves counting the days you were present in the U.S. during the current year and the two preceding years.

- Count all the days you were present in the current year.

- Count 1/3 of the days you were present in the first year before the current year.

- Count 1/6 of the days you were present in the second year before the current year.

- If the total is 183 days or more, you meet the substantial presence test.

- Exceptions to the Substantial Presence Test: If you meet the substantial presence test, determine if you qualify for any exceptions, such as the exempt individual exception or the closer connection exception.

- Consult a Tax Professional: If you are unsure of your residency status, consult a tax professional for assistance.

6.2. Using Form 8843 to Claim Treaty Benefits or Exceptions

Form 8843, Statement for Exempt Individuals and Individuals With Medical Condition, is used by non-resident aliens to claim certain treaty benefits or exceptions to the substantial presence test. You may need to file this form if you are:

- An exempt individual (such as a student, teacher, or trainee) and you want to exclude days of presence in the U.S. for the substantial presence test.

- An individual with a medical condition that prevented you from leaving the U.S.

6.3. What Records Should You Keep to Prove Your Residency Status?

To prove your residency status, it is important to keep accurate records of your time spent in the U.S. and your ties to a foreign country. These records may include:

- Passport with entry and exit stamps

- Visa documents

- I-94 Arrival/Departure Record

- Lease agreements or property deeds

- Utility bills

- Bank statements

- Employment records

- School records

- Medical records

- Affidavits from individuals who can attest to your residency

7. Tax Planning Tips for Non-Resident Aliens

Effective tax planning can help non-resident aliens minimize their U.S. tax liabilities and ensure compliance with U.S. tax laws. Here are some tips:

7.1. Maximizing Tax Treaty Benefits

Tax treaties between the U.S. and other countries can provide reduced tax rates or exemptions on certain types of income. Review the tax treaty between the U.S. and your country of residence to identify any potential benefits. To claim treaty benefits, you must generally complete Form W-8BEN and provide it to the payer of the income. You may also need to file Form 8833 to disclose treaty-based return positions.

7.2. Properly Structuring Investments and Income

The way you structure your investments and income can affect your U.S. tax liabilities. For example, if you have rental income, you may be able to reduce your tax liability by electing to treat the income as ECI and deducting expenses related to the rental property. If you have investment income, you may be able to reduce your tax liability by investing in tax-advantaged accounts or by structuring your investments to generate income that is exempt from U.S. tax under a tax treaty.

7.3. Keeping Accurate Records of Income and Expenses

Keeping accurate records of your income and expenses is essential for preparing your U.S. tax return and supporting any deductions or credits you claim. Organize your records by income type and expense category, and keep all receipts, invoices, and other documentation.

7.4. Seeking Professional Tax Advice

Tax laws can be complex and may vary depending on your individual circumstances. Seek the advice of a qualified tax professional who specializes in non-resident alien taxation. A tax professional can help you understand your U.S. tax obligations, identify potential tax savings opportunities, and ensure that you comply with all applicable laws and regulations.

8. Common Misconceptions About Non-Resident Alien Taxation

There are several common misconceptions about non-resident alien taxation that can lead to errors and non-compliance.

8.1. “Non-Resident Aliens Don’t Have to File U.S. Taxes”

This is incorrect. Non-resident aliens are required to file a U.S. tax return if they have U.S. source income that is subject to U.S. tax, or if they want to claim a refund of excess withholding or claim the benefit of any deductions or credits.

8.2. “Non-Resident Aliens Are Only Taxed on Income Earned in the U.S.”

This is generally true, but it’s important to understand what constitutes U.S. source income. Non-resident aliens are taxed on income that is either effectively connected with a U.S. trade or business (ECI) or fixed, determinable, annual, or periodical (FDAP) income from U.S. sources that is not effectively connected with a U.S. trade or business.

8.3. “Tax Treaties Automatically Exempt Non-Resident Aliens from U.S. Taxes”

Tax treaties can provide reduced tax rates or exemptions on certain types of income, but they do not automatically exempt non-resident aliens from U.S. taxes. To claim treaty benefits, you must generally complete Form W-8BEN and provide it to the payer of the income.

8.4. “Non-Resident Aliens Can Claim the Standard Deduction”

Non-resident aliens are not eligible for the standard deduction. They can generally only deduct expenses related to effectively connected income.

8.5. “All Gambling Winnings Are Tax-Exempt for Non-Resident Aliens”

This is incorrect. While certain types of gambling winnings, such as winnings from blackjack, craps, roulette, or baccarat, are exempt from U.S. tax, other types of gambling winnings, such as lottery winnings, are generally subject to a 30% tax.

9. Resources and Further Reading on Non-Resident Alien Taxation

There are numerous resources available to help non-resident aliens understand their U.S. tax obligations.

9.1. IRS Publications and Forms

The IRS website (www.irs.gov) offers a wealth of information on non-resident alien taxation, including publications, forms, and instructions. Some useful publications include:

- Publication 519, U.S. Tax Guide for Aliens

- Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities

- Form 1040-NR, U.S. Nonresident Alien Income Tax Return

- Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

- Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual

- Form 8843, Statement for Exempt Individuals and Individuals With Medical Condition

9.2. Tax Treaties and International Agreements

Tax treaties and international agreements between the U.S. and other countries can affect the tax treatment of non-resident aliens. Review the tax treaty between the U.S. and your country of residence to identify any potential benefits.

9.3. Online Forums and Communities

Online forums and communities can provide a valuable source of information and support for non-resident aliens. These forums can help you connect with other non-resident aliens, ask questions, and share experiences.

9.4. Tax Professionals and Advisors

Tax professionals and advisors can provide personalized advice and assistance to non-resident aliens. A qualified tax professional can help you understand your U.S. tax obligations, identify potential tax savings opportunities, and ensure that you comply with all applicable laws and regulations.

10. Frequently Asked Questions (FAQs) About Non-Resident Alien Status

Navigating the complexities of non-resident alien status can often lead to numerous questions. Here are some frequently asked questions to provide clarity and guidance.

10.1. What Happens If I Overstay My Visa in the U.S.?

Overstaying your visa in the U.S. can have serious consequences for your immigration status and future ability to enter the U.S. If you overstay your visa, you may be considered unlawfully present in the U.S., which can lead to deportation and bar you from re-entering the U.S. for a certain period. Additionally, overstaying your visa can affect your ability to adjust your status to become a lawful permanent resident. It is important to comply with the terms of your visa and depart the U.S. before your authorized stay expires.

10.2. Can I Claim Dependents on My U.S. Tax Return as a Non-Resident Alien?

Non-resident aliens can claim dependents on their U.S. tax return, but the rules for claiming dependents are different from those for U.S. citizens and resident aliens. To claim a dependent, the dependent must be a U.S. citizen, U.S. national, or a resident of the U.S., Canada, or Mexico. Additionally, the dependent must meet certain other requirements, such as the dependent’s gross income must be less than a certain amount, and the non-resident alien must provide more than half of the dependent’s support.

10.3. How Does Dual Residency Affect My U.S. Tax Obligations?

Dual residency occurs when an individual is considered a resident of both the U.S. and another country under the tax laws of each country. Dual residency can create complex tax issues, as the individual may be subject to tax in both countries. Tax treaties may provide tie-breaker rules to determine which country has the primary right to tax the individual. It is important to consult a tax professional to determine your residency status and your tax obligations in both countries.

10.4. What Is the Difference Between a Resident Alien and a Dual-Status Alien?

A resident alien is an individual who meets either the green card test or the substantial presence test and is considered a U.S. resident for the entire tax year. A dual-status alien is an individual who is considered a non-resident alien for part of the tax year and a resident alien for the other part of the tax year. Dual-status aliens may occur in the year an individual arrives in the U.S. and meets the substantial presence test, or in the year an individual departs the U.S. and no longer meets the substantial presence test.

10.5. How Do I Notify the IRS That I Have Changed My Address?

If you are a non-resident alien and you have changed your address, you should notify